Guy on Rocks: Searching for a cheap uranium stock with something to sell?

Via Getty

‘Guy on Rocks’ is a Stockhead series looking at the significant happenings of the resources market each week. Former geologist and experienced stockbroker Guy Le Page, director, and responsible executive at Perth-based financial services provider RM Corporate Finance, shares his high conviction views on the market and his “hot stocks to watch”.

Market Ructions:

Gold has traded more or less sideways since hitting a recent high of US$2,030 back in May of this year closing the week at up US$12 to US$1,960/ounce.

In a recent Kitco article, JP Morgan noted that China purchased around 16 tonnes of gold last month and represents the seventh consecutive month China’s central bank has bought gold.

Chinese gold reserves have increased by 144 tonnes since November.

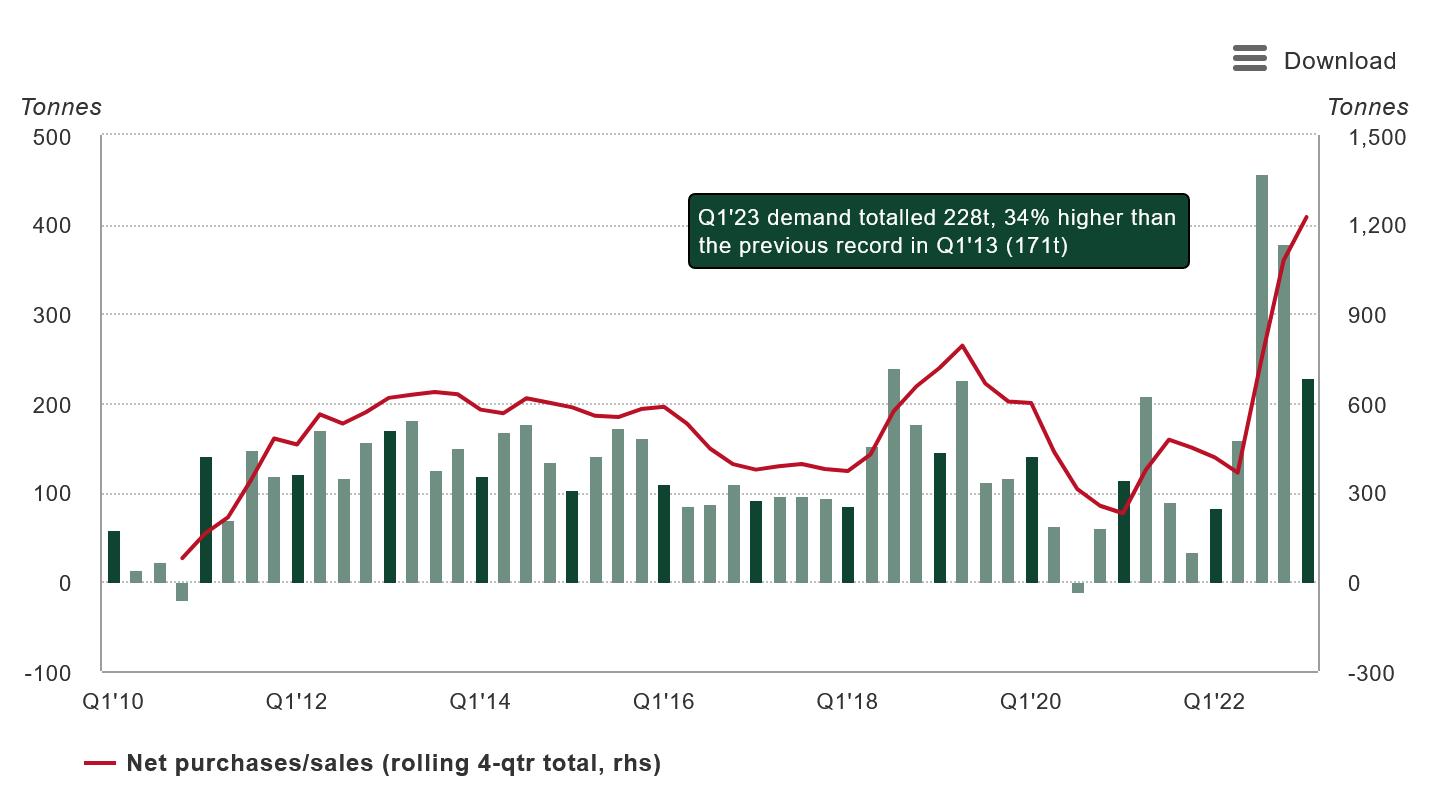

Net buying by central banks has picked up significantly in recent years (figure 1)

In the same article, JP Morgan highlighted that the US dollar’s share in global FX reserves has fallen to a record low of 58%, with gold now accounting for 15% of global reserves, up from 11% five years ago.

Figure 1: Central bank gold purchases 2010 to 2023 (Source: www.gold.org/goldhub/research/gold-demand-trends/gold-demand-trends-q1-2023/Central-banks).

Silver was up 2.8% for the week closing at US$24.25/oz while platinum closed down US$3 to US$1,008/ounce and Palladium fell a whopping 7.4% to US$1,296/ounce with losses amounting to just over 13% in the preceding three weeks.

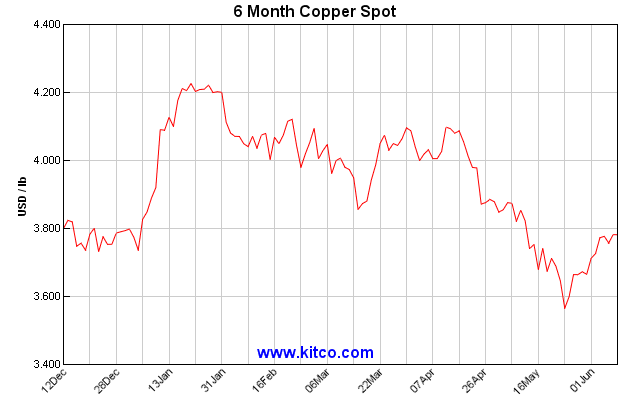

Copper rose 6 cents to US$3.79/lb (figure 2) last week bouncing off a 6-month low of just under US$3.60/lb on the back of low inventories (figure 3) and China announcing the introduction of more stimulus measures. No doubt we are heading for a medium to longer term supply “crunch” in copper as Robert Gottliebson rightly pointed out in the Australian with S&P Global suggesting that the world will need to double production to around 50 million tonnes to satisfy the demand from electrification.

And what about the fossil fuel demand to make lithium batteries? Well, that should increase substantially if China keeps on expanding its coal fired power stations. That makes sense because it is not economic to use renewable energy to make lithium batteries.

Figure 2: 6-month copper spot price (Source: www.kitcometals.com).

Figure 3: 5-year LME copper warehouse stock levels (Source: www.kitcometals.com).

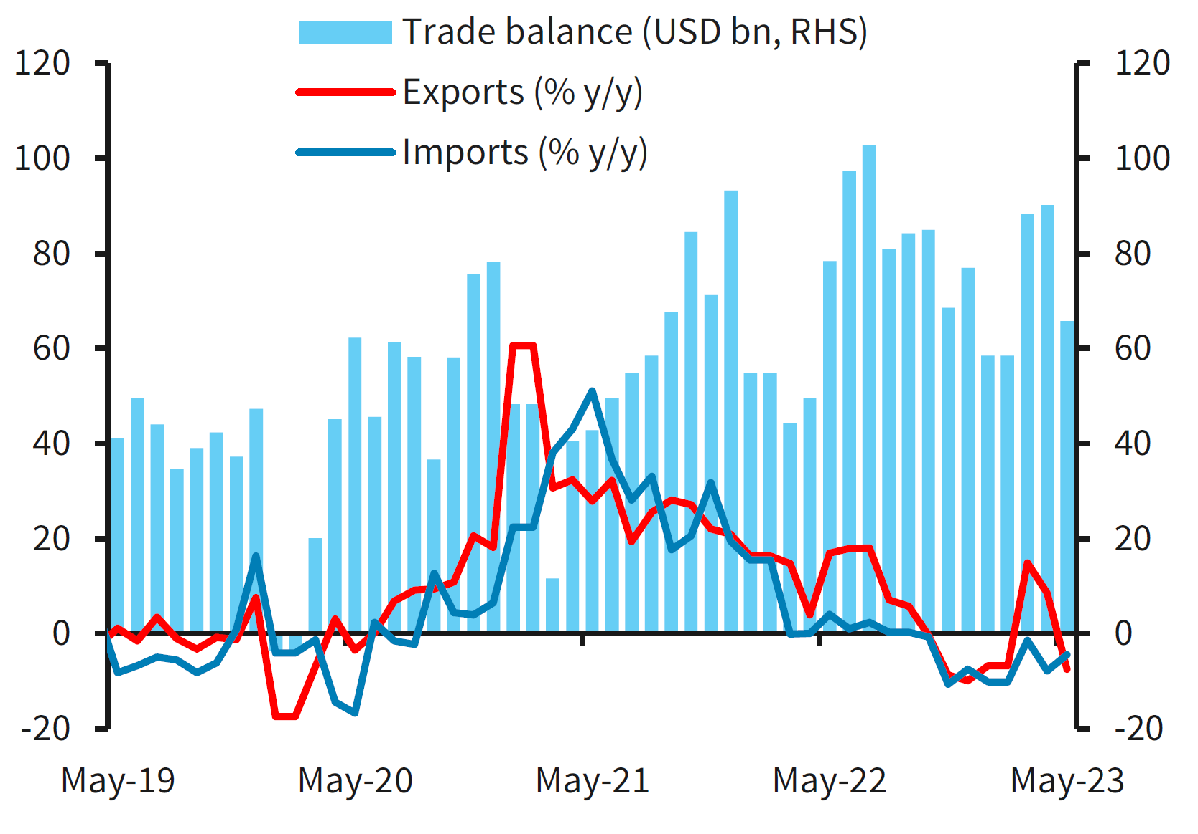

Economic news out of China has been soft in May with exports falling 7.5% year-on year compared to growth of 8.5% in the corresponding period last year.

Imports however fared slightly better, off -4.5% year-on-year compared to -7.9% over the same period last year. The trade surplus narrowed to US$65.8trn compared with consensus expectations of US$95.5trn (figure 4).

Chinese exports to the US were also down -18.2% year-on-year in May compared to -6.5% in April. European exports fell 7.0% compared to +3.9% over the corresponding period last year.

The ASEAN region was also soft with -15.9% year-on-year.

Figure 4: Chinese import-export and trade balance May 2019 to May 2023 (Source: Barclays Economic Research, 7 June 2023)

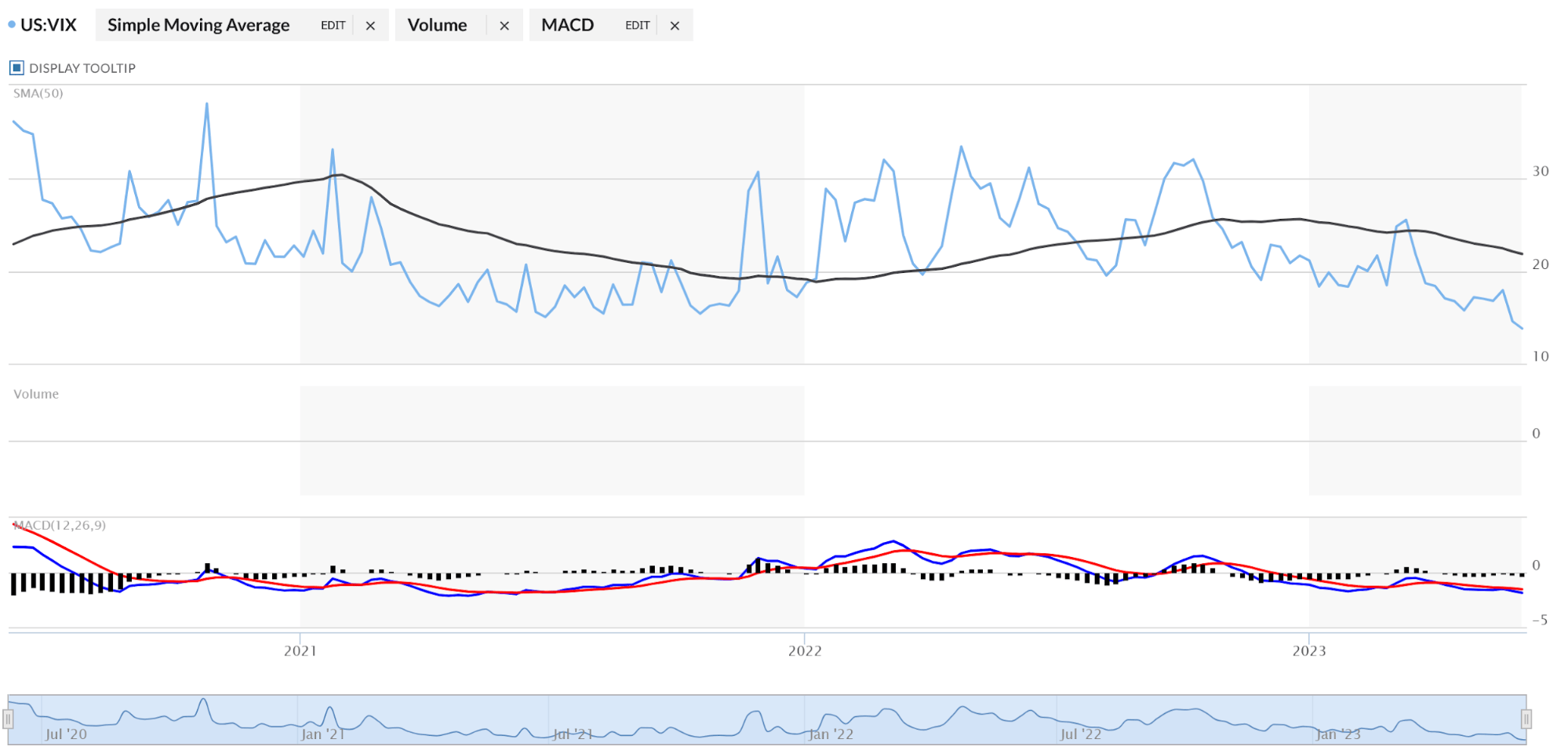

The US dollar index closed down 46 basis points to 103.58 with the inversion between 3- and 10-year US treasuries now widening to 80 basis points, a trend we have seen for the last 21 months. Together with low volatility levels (figure 5), all the signs are pointing to an impending recession according to a large number of the doomsday preppers out there.

Certainly, our north American cousins continue to do it tough with the TSX-V, home to many junior mining companies, seeing its volumes dwindle to a mere 7 million shares last Memorial Day.

Figure 5: VIX volatility index (Source: www.marketwatch.com/investing/index/vix/charts).

Apparently COSTCO are seeing changes in buying behaviour at their stores with consumers opting for cheaper alternatives. The Stockhead faithful would equate this to opting for the Mercedes E300 over the AMG model; not that many of you would have ever been faced with that sort of life changing decision before.

Uranium continues to move against the trend with the spot price closing the week up almost 3% to US$57.25/lb.

Uranium equities both in Australia and Canada (with a few exceptions) remain depressed despite uranium’s strong performance this year. Energy prices were weaker but closed at US$70.36/bbl with weaker demand from the US offset by announcements of Saudi production cuts.

So how have the larger cap miners performed around the globe this year?

According to S&P Global commodity insights it is a bit of a mixed bag with analysis of over 2,300 metals and mining companies showing a 25.2% decline on average year over year, falling 8.4% over the month in May.

The 25 largest miners with a market capitalisation of $984.37 billion as of the end of May, fell 12.1% from $1.12 trillion at the end of April. Nineteen of the largest miners lost market value year over year, with 14 companies posting falling by at least 10%.

Among stocks under pressure included diversified miner Anglo American PLC down 42.9% while gold producer Newmont Corp’s valuation fell over 40%. The lithium sector wasn’t spared either with Sociedad Química y Minera de Chile SA and Albemarle Corp dropping 39.1% and 25.5%, respectively.

This occurred after Chile’s announcement of a desire to expand state control over lithium resources.

Glencore PLC also fell 25.2% year-over- year as of the end of May.

On a brighter side coal miner PT Bayan Resources Tbk increased 178.9% year over year while royalty and streaming companies Wheaton Precious Metals Corp. and Franco-Nevada Corp were up 18.1% and 10.5%, respectively.

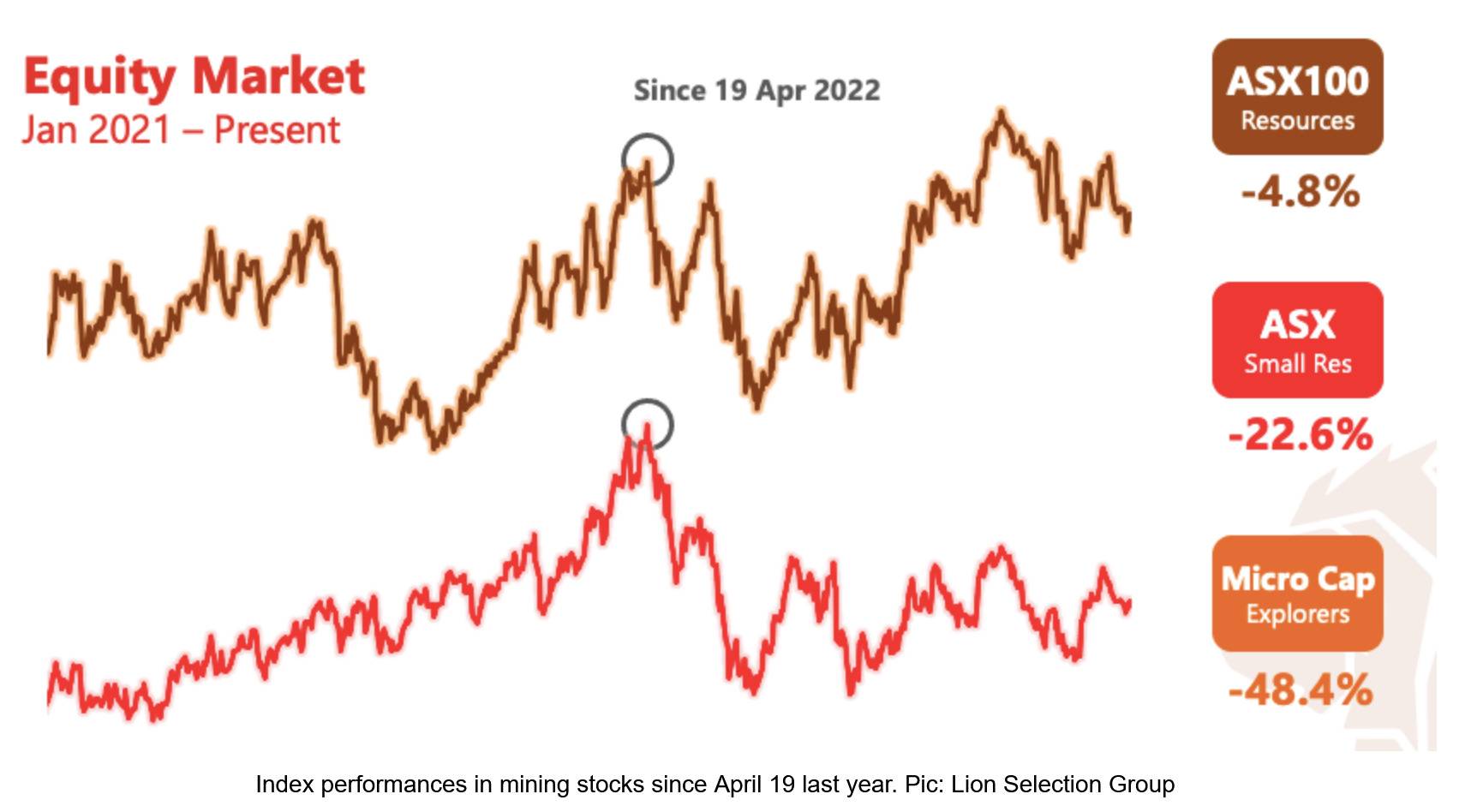

Index performance since 19 April 2022 (Source: Stockhead, 18 May 2023 ).

According to an April Stockhead interview with Hedley Widdup from Lion Selection Group (ASX: LSX) April 19, 2022, represented the top of the mining cycle with small resources down 22.6% and micro caps under $200 million market cap down 48% since that date.

So, looks like there could be a little more pain to come before we see an uptick in the cycle.

Plenty of economic news out next week including the Federal Reserve meeting on Wednesday, CPI Tuesday and European Central Bank rate announcement on Thursday and the University of Michigan consumer sentiment on Friday.

New Ideas: Uranium production on the horizon

Figure 7: PEN 2-year price chart (source: CMC Markets, 12 June 2023).

I first brought this uranium developer to the attention of the Stockhead faithful back in March 2022 when it was trading around 12 cents and the performance, given the recent downturn in junior resources, has been impressive.

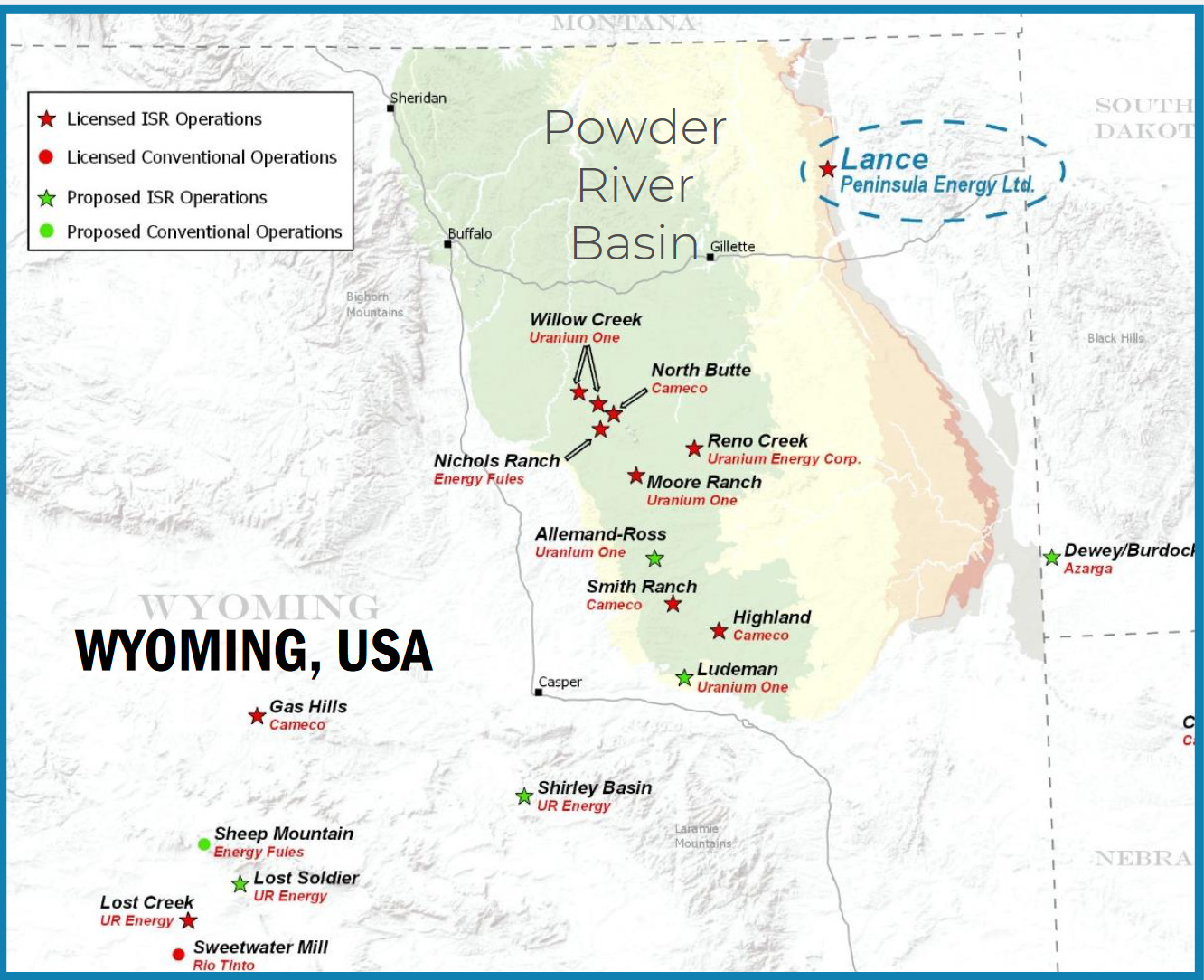

Peninsula Energy (ASX: PEN) (figure 7) is on track to restart production at its 100% owned Lane Project, a low Ph in-situ leach (“ISR”) operation in the Powder River Basin area of Wyoming, USA (figure 8).

Figure 8: Lance Project, Wyoming, USA (source: PEN Presentation, May 2023).

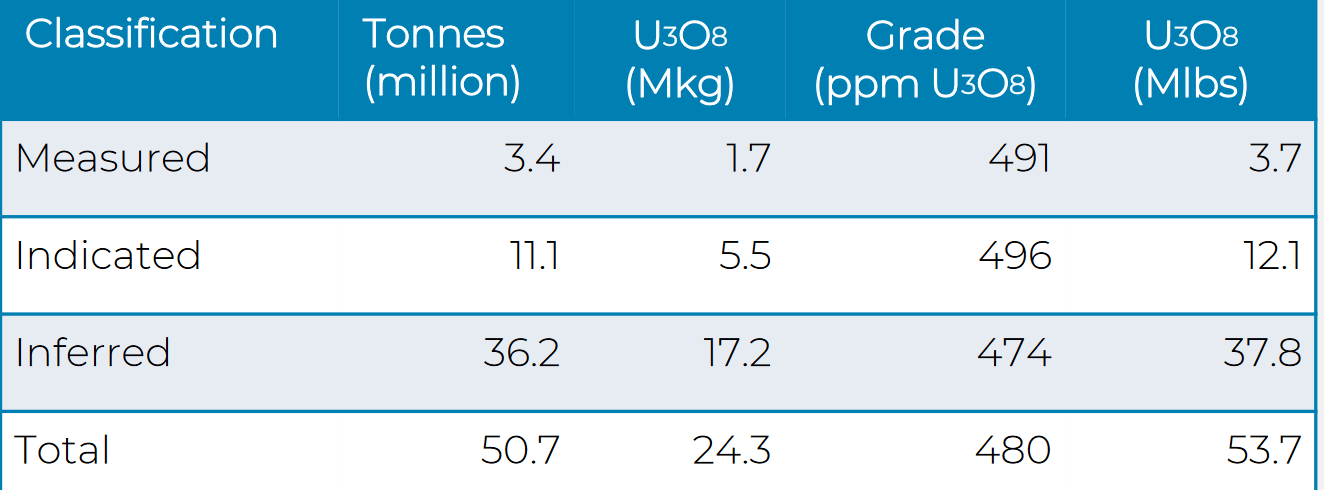

Lance has a Mineral Resource Estimate of 50M lbs @ 480ppm U3O8 for 24.3M lbs of U3O8 (table 1) with an exploration target in excess of 100m lbs U3O8.

Figure 9: New installation of a high-volume acid storage tank at the Lance Project (source: PEN Presentation, May 2023).

Plant construction (figure 9) is expected to be completed later this month with well patterns being pre-acidified and readied for production.

Table 1: Lance Mineral Resource Estimate (PEN, Presentation, May 2023).

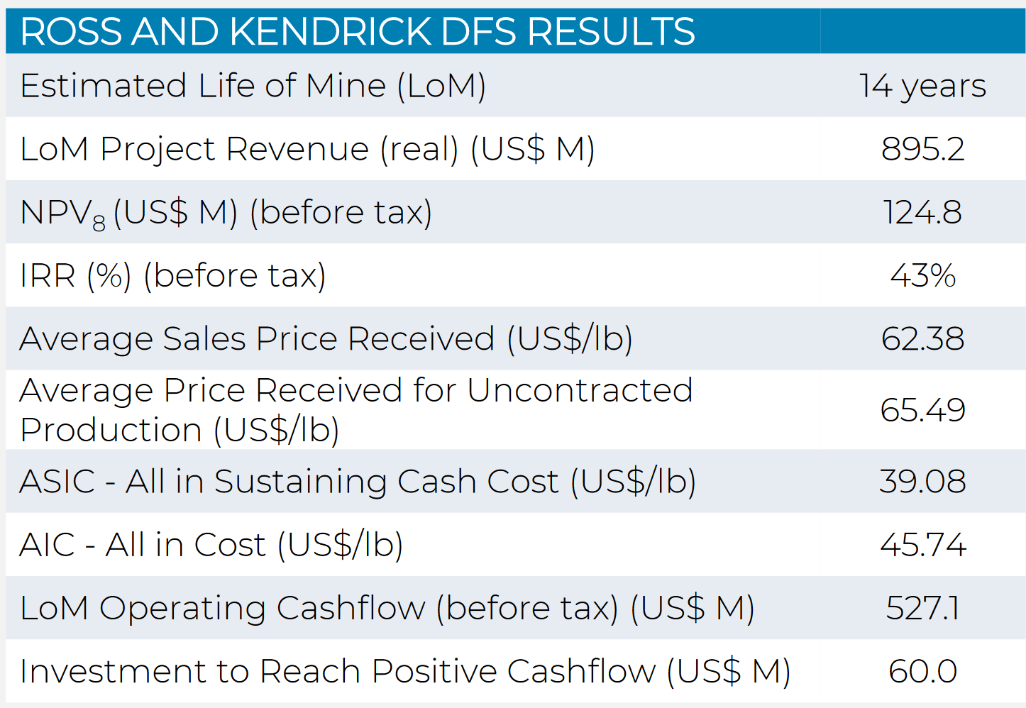

The Company is well funded with in excess of $20 million in cash and has an enterprise value of just over $200 million which is not far off the pre-tax NPV of US$125 million (A$185 million) (table 2).

From a valuation perspective I wouldn’t say it’s cheap, however it does provide leverage to increases in uranium prices given that 5.25m of the 14.4Mlbs of life of mine production has been contracted and comprises of a mixture of base escalated (projected to be ~US$60/lb U3O8) and market based (with floors down to US$45/lb and ceilings up to US$80/lb U3O8).

There is excellent potential to extend mine life if the 100Mlb exploration target has any substance so I anticipate the production profile, and the project economics, could be significantly enhanced.

The big challenge for uranium developers is permitting, particularly in Australia, so any near-term uranium developers like Peninsula are almost certainly going to attract a premium.

That time is coming soon given the momentum behind the uranium price.

At RM Corporate Finance, Guy Le Page is involved in a range of corporate initiatives from mergers and acquisitions, initial public offerings to valuations, consulting, and corporate advisory roles.

He was head of research at Morgan Stockbroking Limited (Perth) prior to joining Tolhurst Noall as a Corporate Advisor in July 1998. Prior to entering the stockbroking industry, he spent 10 years as an exploration and mining geologist in Australia, Canada, and the United States.

The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed, or otherwise assumed responsibility for any financial product advice contained in this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.