Guy on Rocks: Has iron ore hit the ceiling?

Pic: Stevica Mrdja / EyeEm / EyeEm via Getty Images

Guy on Rocks’ is a Stockhead series looking at the significant happenings of the resources market each week.

Former geologist and experienced stockbroker Guy Le Page, director and responsible executive at Perth-based financial services provider RM Corporate Finance, shares his high conviction views on the market and his “hot stocks to watch”.

Market ructions

China’s iron ore imports continue to hit records as the Asian heavyweight restarts blast furnaces and ramps up steel production.

However, the resulting very high iron ore prices are putting a clamp on steelmakers’ profit margins, Guy Le Page says.

“It looks like with the increase in iron ore, the steel margins have been eroded quite rapidly,” he said.

By Le Page’s numbers, hot-rolled coil (HRC) margins have slipped from $US60 ($82) a tonne to around $US26 a tonne.

“So I would have thought we’re seeing a topping out of the iron ore price,” Le Page said. “I don’t think we’ve got much room to move over $US130, certainly not longer term.”

Meanwhile, the volatility in gold is still high and Le Page sees investors backing off a little bit in the coming months.

“Over the past 12 months we’ve had a huge increase in investors with gold exposure, but you could probably see that start to flatten off over the next couple of months,” he noted.

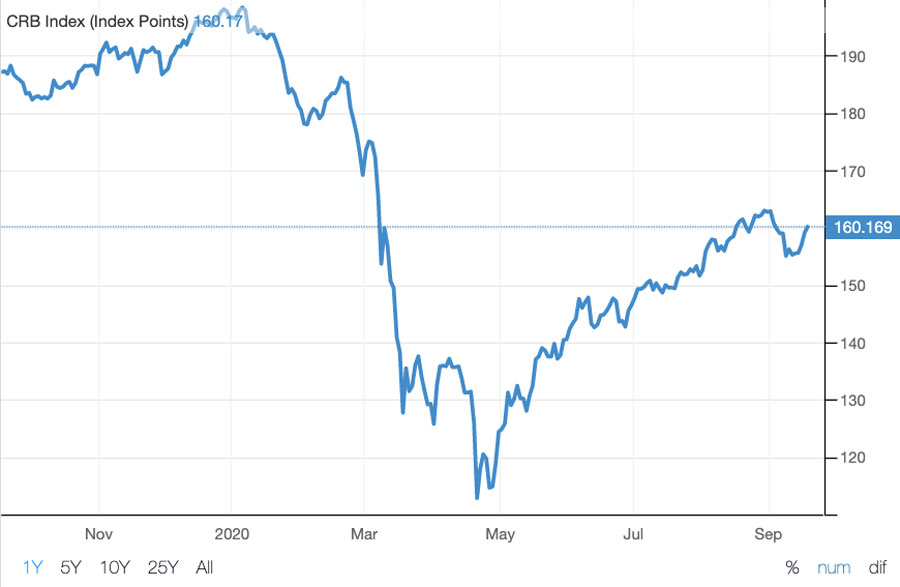

The CRB Commodity Index, which comprises 19 commodities, has also started to “flatten off”, according to Le Page.

The index has edged down about 1.7 per cent since the start of September.

“There’s been a very strong run up in predominantly precious metals, which probably account for about 80 per cent of the cumulative inflows, with the balance being about 10-15 per cent energy and an overall reduction in base metals and agriculture inflows,” he explained.

“So that’s sort of consistent with the run up in the resource stocks that we’ve seen. Of that amount, the precious metals offered $75bn inflows. This calendar year $61bn has been precious metals, so a very heavy weighting towards precious metals compared to historical numbers.”

After a long hiatus cobalt is also starting to make some moves.

“We’re starting to see a bit of a lift in cobalt which we haven’t seen for about 12/18 months,” Le Page said.

The price has had a bit of a breakout since the end of July, jumping over 19 per cent to around $US34,000 a tonne on the London Metal Exchange.

“We’re starting to see a few entities starting to stockpile cobalt, which is interesting, in particular China,” Le Page said.

“That’s been probably the least transparent of any of the commodities to follow, and there was a huge investment back in 2016-17 and into 2018, but that just fell off a cliff. So we’d expect that price to continue to recover.”

Movers and shakers

There was a bit happening on the resources front this week.

De Grey Mining (ASX:DEG) raised $100m in a placement that was done at premium and more than three times overbid.

Meanwhile, Caeneus Minerals (ASX:CAD) has ground to the north of De Grey’s company making Hemi discovery in Western Australia’s Pilbara region and witnessed a further move in its share price this week.

“We’ve seen a very strong run up in Caeneus,” Le Page said.

The company was up another 21.4 per cent on Friday to 1.7c as it gears up for a “fairly aggressive exploration campaign over the next six months”.

Fenix Resources (ASX:FEX) is ticking the boxes and getting closer to production after this week locking in key mining approvals for its Iron Ridge direct shipping ore (DSO) project in WA.

“They’re commencing development works this month and should have their first shipment out early 2021,” Le Page said.

“I think it might be a little bit earlier than that even. So that’s continuing to track pretty well.”

CAD and FEX share price charts

Hot stocks to watch

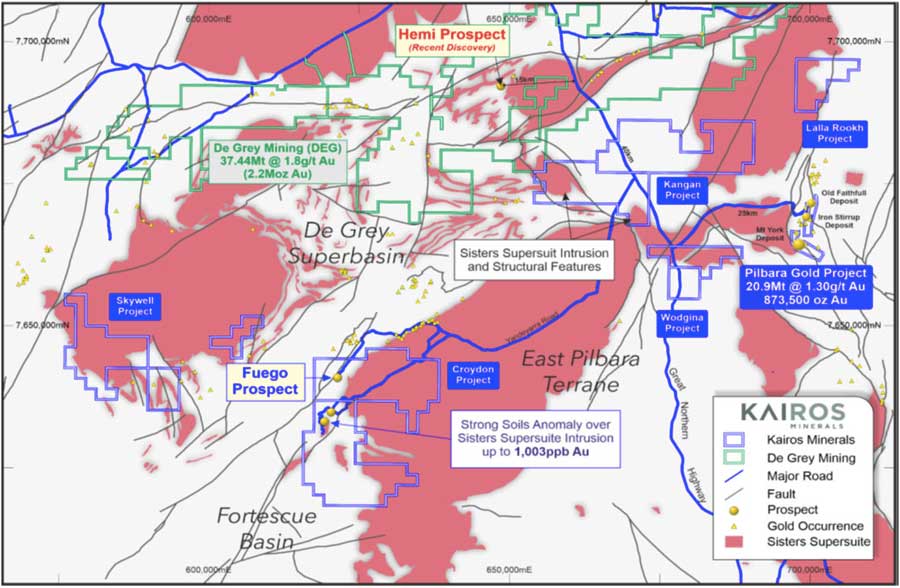

A new company on Le Page’s radar this week is Eric Sprott-backed Kairos Minerals (ASX:KAI), which has a market cap of just under $100m at a share price of 6.5c.

Kairos also has several gold prospects in the Pilbara surrounding De Grey’s Hemi that make up the broader Pilbara gold project.

The Pilbara project currently hosts 20.9 million tonnes at 1.3 grams per tonne (g/t) for 873,500 contained gold ounces.

“Not a huge resource compared to what De Grey have got, but reasonable grade and there’s reasonable potential to find satellite deposits in that area,” Le Page said.

Kairos this week revealed it had uncovered a large gold target just 20km from Hemi at the Kangan project.

“It seems to be coincident with these large regional structures picked up by the aeromagnetics,” Le Page explained.

“Striking in a somewhat different orientation to Hemi, but seem to be tracking those big regional targets.

“They’ve got four targets and they’ve got a 5000m aircore program coming up in October/November. They’ve also got some results coming out on Fuego, just south of Kangan.”

Kairos is also undertaking drilling at its Mt York project as well as completing a sub-audio magnetics survey at the Tierra prospect, part of the Croydon project. Both projects are in the Pilbara.

“They’ve got a pretty good board and a very strong position in the Pilbara,” Le Page said.

“They recently raised some money, so they’re cashed up. I think there’s going to be a lot of interest in them over the next six months.”

Kairos Minerals (ASX:KAI) share price chart

At RM Corporate Finance, Guy Le Page is involved in a range of corporate initiatives from mergers and acquisitions, initial public offerings to valuations, consulting and corporate advisory roles.

He was head of research at Morgan Stockbroking Limited (Perth) prior to joining Tolhurst Noall as a Corporate Advisor in July 1998. Prior to entering the stockbroking industry, he spent 10 years as an exploration and mining geologist in Australia, Canada and the United States.

The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.