Guy on Rocks: Gold on the rebound after ‘flash crash’

Pic via Getty

Guy on Rocks is a Stockhead series looking at the significant happenings of the resources market each week.

Former geologist and experienced stockbroker Guy Le Page, director and responsible executive at Perth-based financial services provider RM Corporate Finance, shares his high conviction views on the market and his “hot stocks to watch”.

Market Ructions

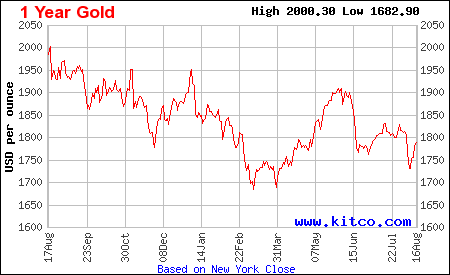

US job numbers came in high last week (943,000 versus consensus figures of 845,000), with gold dropping around US$70 in the first 30 minutes of trading on Tuesday morning (looks like a short?), before staging a strong recovery 2.5% (figure 1).

Gold finally finished the week up 1% after this flash crash on Tuesday morning.

Platinum fell below US$1,000 for the first time this year before closing up 5% for the week to US$1,023/ounce, while palladium closed up US$16 to close at US$2,579/ounce. Uranium lost US$1.75 down 3.5% to US$30.75/lb.

Platinum looks like it had been a little oversold while palladium (which is primarily used in automobile catalysts, notably petrol motors) remains as strong as ever.

Copper was flat to down slightly to US$4.31- super spreader environment with a negative forward curve going out four months.

Looks like a strike was averted at BHP, with workers signing a deal at the Company’s Escondida mine in Chile while Codelco was not so lucky with two unions voting 82% in favour of a strike at the giant copper producer Andina that produces 184,000 tonnes of copper per annum.

Iron ore has come off to around US$165/tonne (62% fines) on the back of failing steel production in China which is sitting at a 15-month low to 86.79Mt in July (off 8.4% from June’s figure of 93.36Mt).

According to Bloomberg, the steel industry appears to be complying with the request for reduced output.

Apparently Beijing has dispatched inspection teams around the country to check that steel capacity and output cuts have been adhered to. Furthermore, a number of outdated blast furnaces have been shut down.

While the believers here in Perth are lamenting the fall in the iron ore price (which has led some to buy Moet as opposed to Perrier Jouet or Crystal), we have to bear in mind that China produced around 649 million tonnes of steel in the first seven months of 2021, up 8% from the same period last year, so the party is not over yet!

According to Tommy Xie We from Greater China research the reduction in steel output is due to China’s de-carbonisation efforts and uncertainty around COVID and global chip shortages.

An alternative view is that China is talking down steel demand and output in an effort to soften the iron ore price so margins can recover. I am sure this is highly unlikely however…

Company News

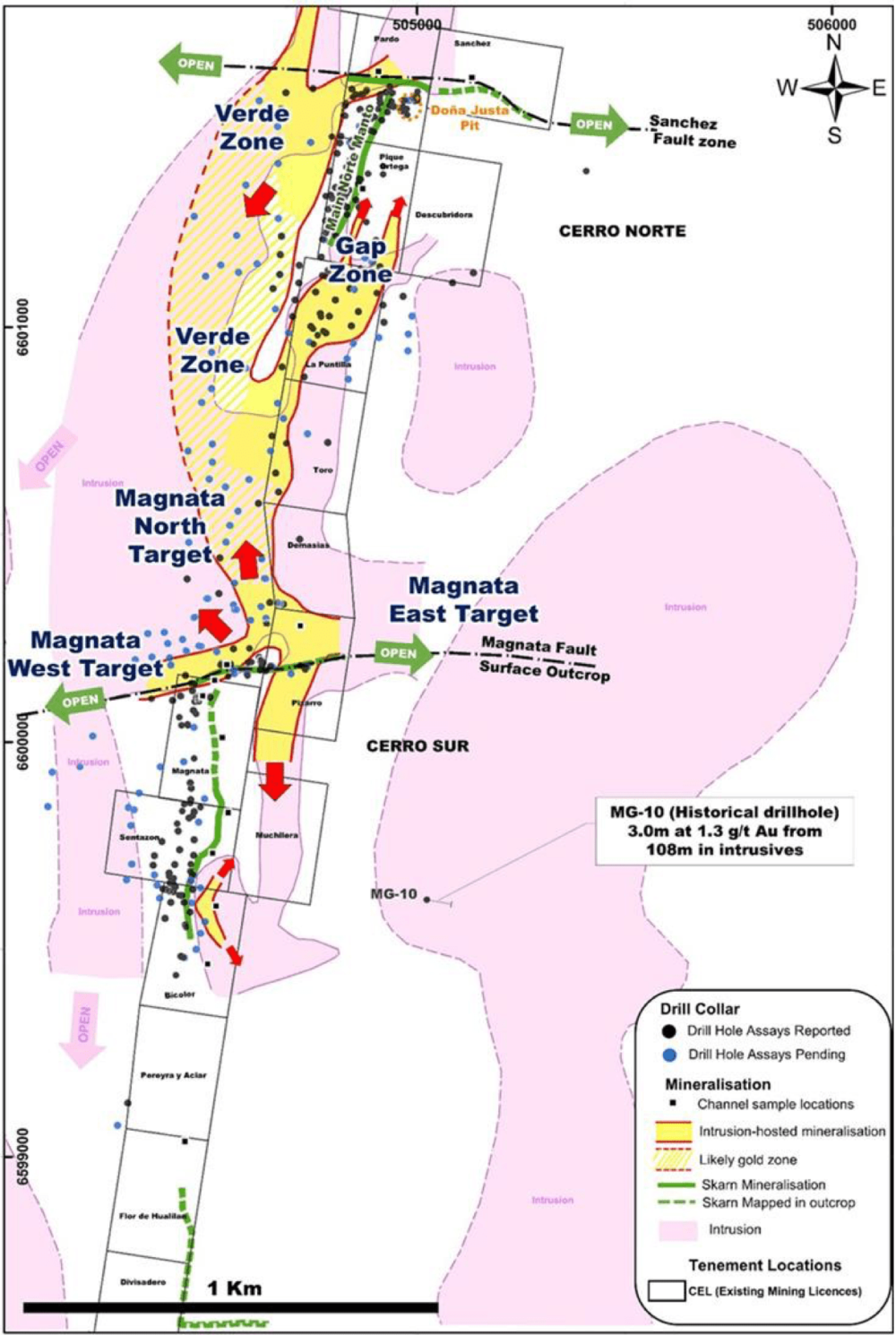

More good news from Challenger Exploration (ASX:CEL) (figure 4) as drilling at Sentazon (San Juan Province, Argentina-figure 3) continues to deliver high grade results including confirmation of a second zone of mineralisation. Better results included:

- GNDD-296 with 9m at 16.9 g/t AuEq2 – 14.1 g/t Au, 18.3 g/t Ag, 5.8% Zn from 193.0m downhole, and

- GNDD-253 with 0m at 1.9g/t AuEq2 – 1.8g/t Au, 1.0g/t Ag, 0.1% Zn from 133.0m downhole.

This recent round of drilling has also extended down dip mineralisation to around 200 metres (from 100 metres), with mineralisation remaining open along strike and at depth.

The drilling confirms mineralisation identified in GNDD-142 is a new zone of mineralisation 50 metres below the existing mineralisation in the footwall.

As mentioned earlier, we are expecting a substantial maiden JORC Resource later in CY 2021/early CY 2022 for CEL.

GWR Group (ASX:GWR) (figure 5) haulage rates have come in just ahead of target at its flagship C4 Iron deposit (GWR 70%: PRG 30%, JORC Resource of 21.6Mt @ 60.7% Fe) near Wiluna (Western Australia) with 125,060 tonnes hauled in the month of July and 130,000 tonnes scheduled for this month (figure 6).

The first cargo ship left Geraldton on 6th of August 2021 with 56,400 wet metric tonnes of lump ore with GWR and its Alliance Partners Pilbara Resource Group (PRG) working on further optimising infrastructure, logistics and port options to reduce C1 costs that are sitting at a very respectable $130/tonne.

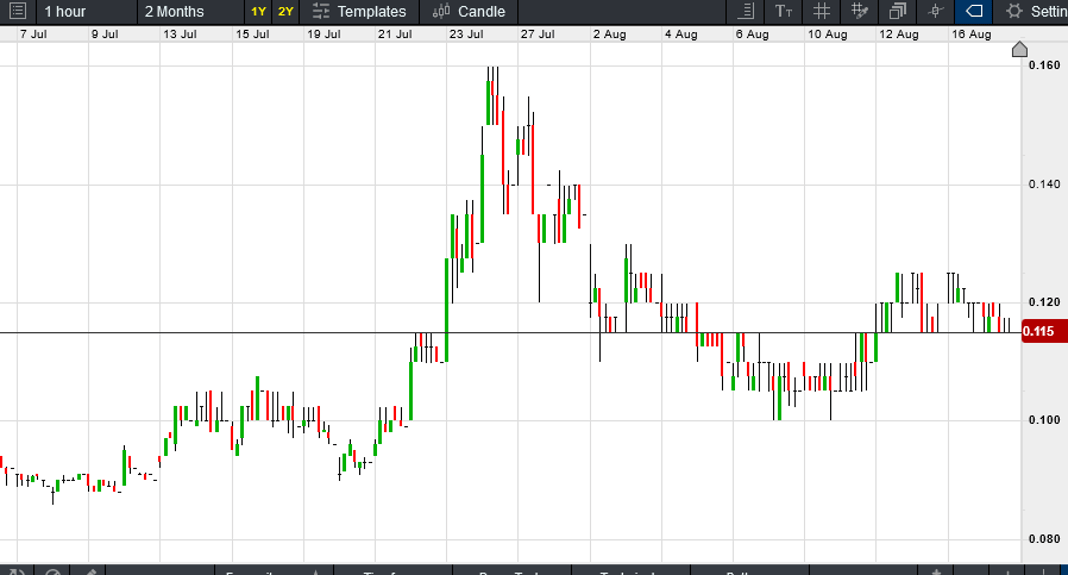

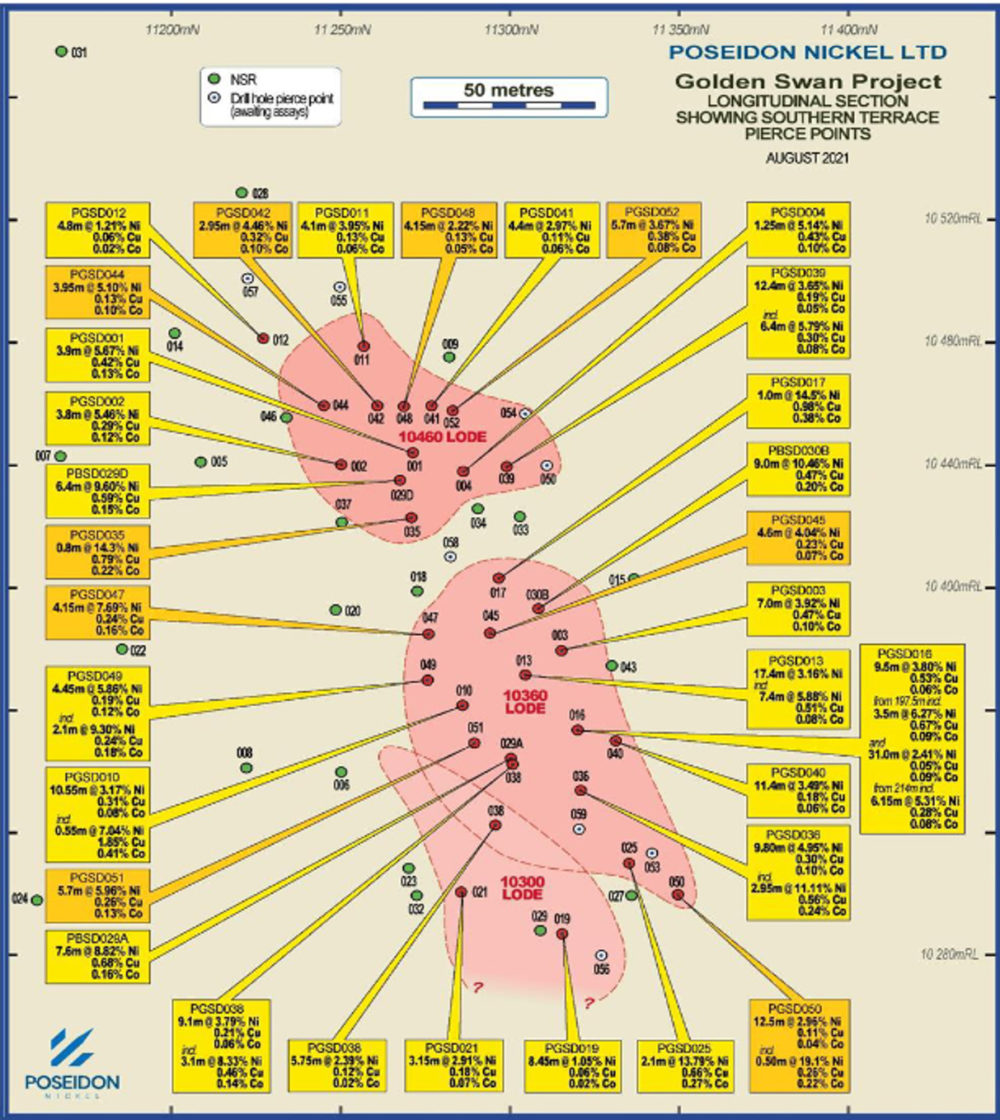

Poseidon Nickel (ASX:POS) (figure 7) delivered a serious of high-grade hits from nine holes as part of its 60 hole, 16,000 metre resource definition program that commenced in April 2021 at its high-grade Golden Swan Nickel project in Western Australia (figure 8).

Better results included;

- PGSD035: 0.8m at 14.3% Ni from 178.85m

- PGSD042: 2.95m at 4.46% Ni from 166.85m

- PGSD044: 3.95m at 5.1% Ni from 168m

- PGSD045: 4.6m at 4.04% Ni from 178.45

- PGSD047: 4.15m at 7.69% Ni from 174.8m.

An impressive series of results lying adjacent to the old Black Swan – Silver Swan deposits with a maiden JORC Resource due in the September Quarter. Drilling is also ongoing on the Southern Terrace in the search for a mirror of the Golden Swan mineralisation mineralised zones.

New Ideas

Antilles Gold (ASX:AAU) (figure 9) has continued to deliver impressive results from its 15,000-metre drill program at its La Demajagua gold-silver project in Cuba.

Better results included:

- P-076 5.0m at 5.37 g/t Au & 79.38 g/t Ag from 6.5m downhole

- P-008 6.0m at 13.25 g/t Au & 39.88 g/t Ag from 177.0m downhole

- P-009 15.0m at 4.76 g/t Au & 85.95 g/t Ag from 102.0m downhole

- P-074 4.0m at 9.23 g/t Au & 49.93 g/t Ag from 138.0m downhole.

These results represent the third batch of assays received from its 15,000-metre drill program with plans now being made to bring forward the planned 10,000 metre program in early 2022 with a view to finalising a JORC Resource later in mid CY 2022.

Analysis of Figure 10 shows that the mineralised zone is hanging together pretty well with some decent grades.

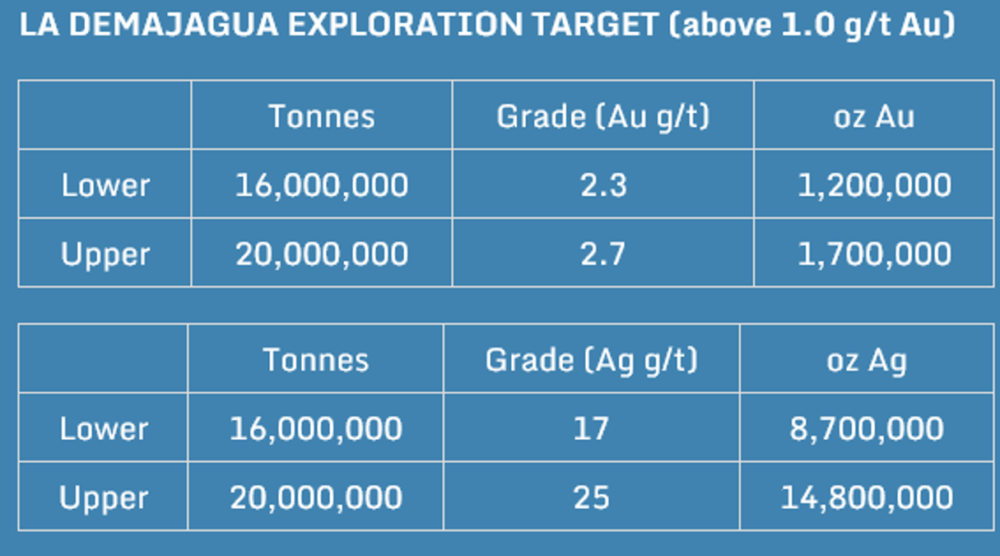

A DFS likely to be finished late next year ahead of a proposed re-start in CY 2023. Cube Consulting Pty Ltd have also signed off on an impressive exploration target as set out in table 1.

While the ores are refractory the company is proposing to use the Albion Oxidation Process, a relatively low-cost technology that employs ultrafine grinding and oxidative leaching at atmospheric pressure to oxidise the concentrate and allow metal extraction utilising CIL technology.

With the processing of refractory ores gaining greater acceptance in the Australian market (e.g., Aphrodite Gold Project: Bardoc Gold (ASX: BDC)), I am quietly confident of a rerating of AAU (capped around $20 million) as it moves towards its maiden JORC Resource and hopefully a positive DFS.

At RM Corporate Finance, Guy Le Page is involved in a range of corporate initiatives from mergers and acquisitions, initial public offerings to valuations, consulting, and corporate advisory roles.

He was head of research at Morgan Stockbroking Limited (Perth) prior to joining Tolhurst Noall as a Corporate Advisor in July 1998. Prior to entering the stockbroking industry, he spent 10 years as an exploration and mining geologist in Australia, Canada, and the United States. The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed, or otherwise assumed responsibility for any financial product advice contained in this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.