Guy on Rocks: Can junior iron ore producers rise like the Fenix?

Experts

‘Guy on Rocks’ is a Stockhead series looking at the significant happenings of the resources market each week. Former geologist and experienced stockbroker Guy Le Page, director, and responsible executive at Perth-based financial services provider RM Corporate Finance, shares his high conviction views on the market and his “hot stocks to watch”.

Gold bulls will be pleased to see the US yield curve which has recently inverted, a strong signal in my view for higher gold prices (figure 1).

The two-year US treasury yield has moved above the 10-year yield which according to Morgan Stanley has been an historic indicator for an oncoming recession.

The last time this took place was 2006-07, which was then followed by a strong gold market for a number of years. This combined with rampant inflation and political instability should see a move above US$2,000/oz in the near term.

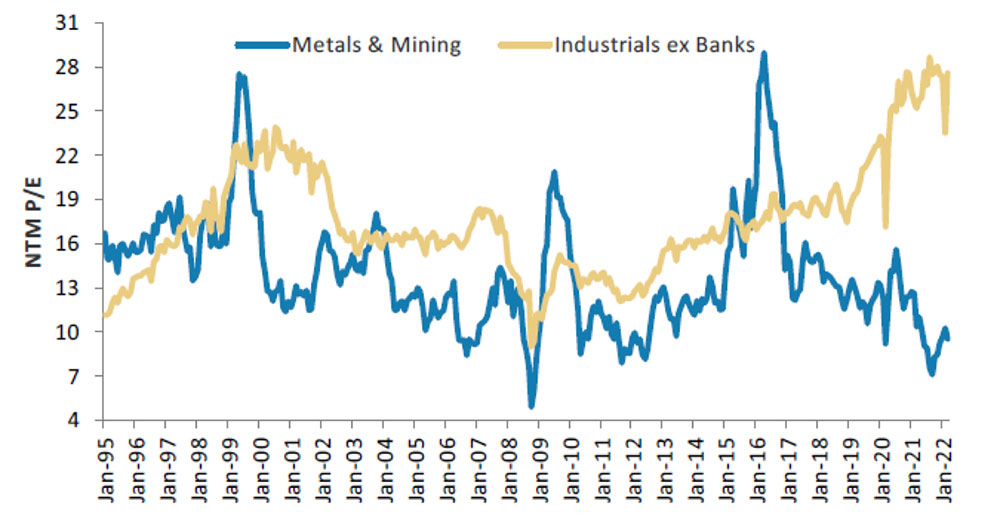

Looking at relative valuations it still looks like the large mining companies represent reasonable value compared to the industry sector (figure 2).

As figure 3 demonstrates, mining companies are making “super profits” across a broad range of commodities.

Some relief on the copper front as Peru appears to be targeting excess profits rather than higher royalties, a bit of a blow for newly elected President Pedro Castillo who faced a hostile mining sector and a fractured Congress.

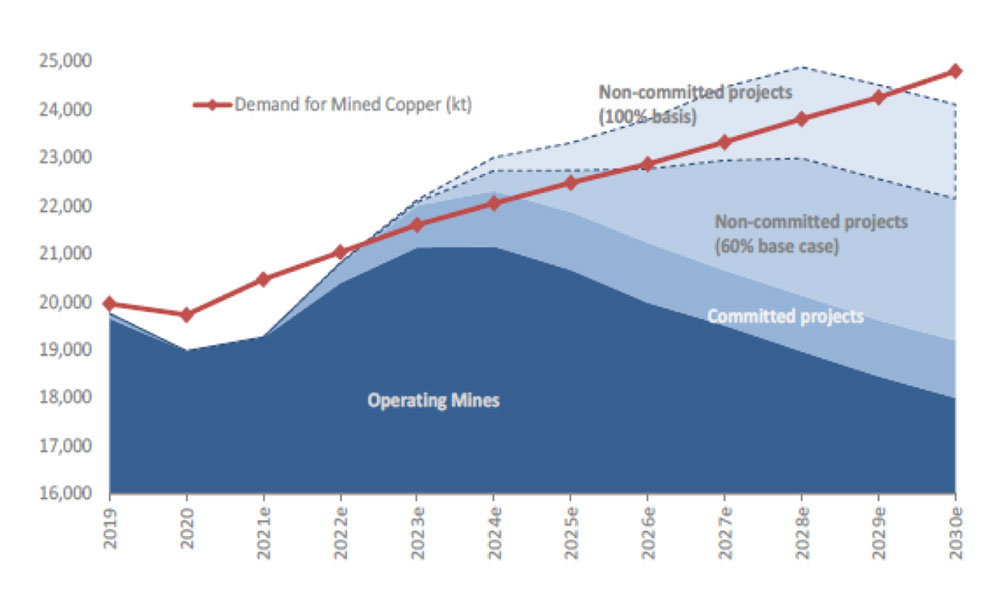

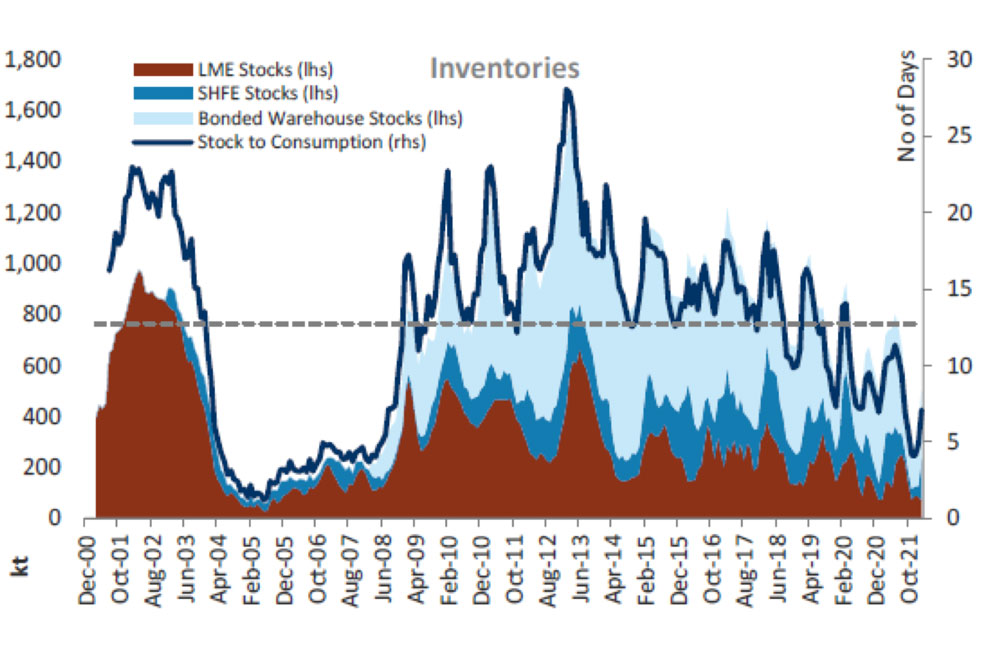

Good thing as the supply-demand situation for copper remains “tight” (figure 4) with excess demand and low inventories (figure 5).

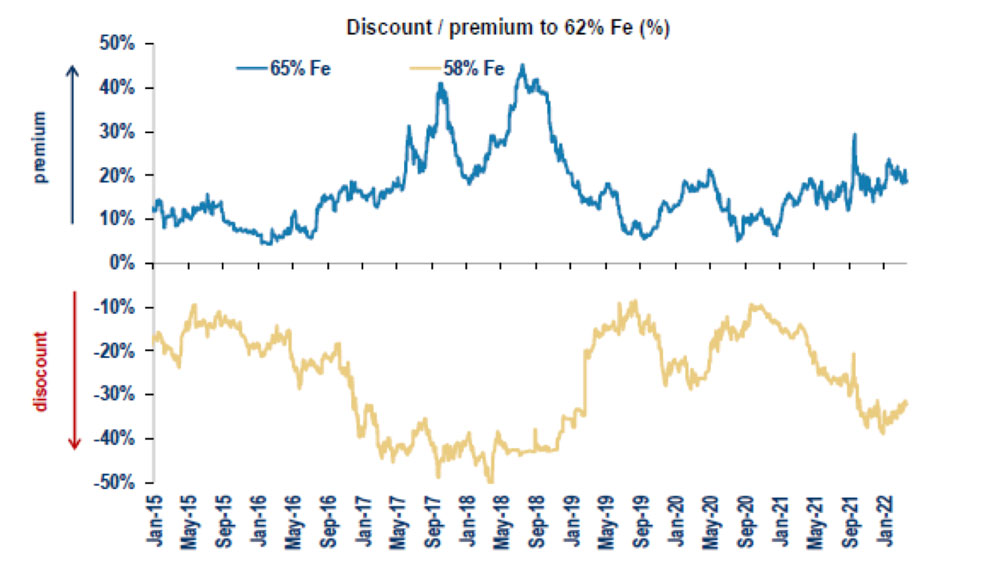

In other news iron ore has had a strong comeback this year after dipping below US$100/tonne in CY 2021 with premiums for high (65%) and low grade (58%) iron ore slowly picking up.

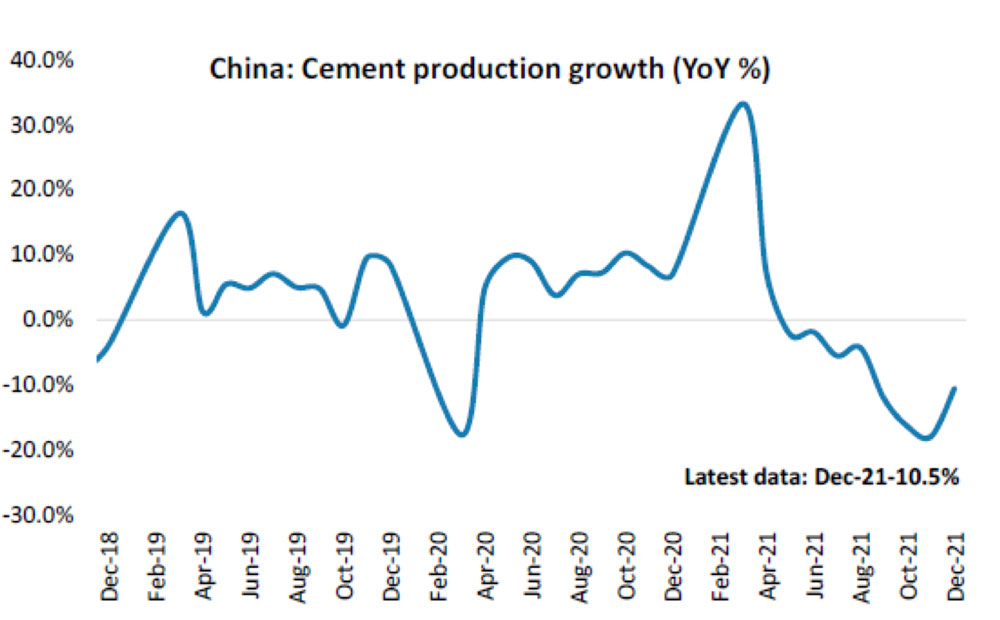

Overall, the performance of iron ore has been surprising given many of the economic indicators in China have been tepid (figure 7).

We first picked up GWR Group Limited (ASX:GWR) in the low 20s in late 2020 after which it went for a fairly solid run (figure 8) on the back of the restart of the Wiluna West Iron Ore Project in early 2021.

Iron ore prices were strong at the time (figure 2) however production was halted on 22nd September in the face of declining iron ore prices and escalating shipping costs.

The 31 December 2021 Half Yearly report showed a modest loss of around $330,000 with a lost of $5.6 million attributable to the iron ore operations, offset by the spin-out of Western Gold Resources for $6.5 million.

Late October 2021 however saw a resumption of operations with the C4 Mining production for February moving a record 330,000 tonnes with Stage 2 of the C4 project well advanced with the cutback of the C4 ore body taking shape (Figure 10).

Furthermore, 55,000 tonnes of +63% ore were shipped in late February.

The company has managed to fix forward deliveries (August- US$129/t, September US$121/t and October US$131/t) on an FOB basis therefore taking away the risk of volatile shipping charges.

GWR also announced the acquisition of a 70% interest in the Ridge Magnesite project (situated 55km from the port of Burnie in northwest Tasmania) in early March from ASX listed Jindalee Resources Ltd (ASX:JRL).

The next stage is the commencement of Desktop and Transport Studies together with preliminary discussions with offtake partners. The objective is to establish a low-cost DSO Magnesite operation from a JORC Resource of 25Mt @ 42.4% MgO, 4.8% Si, 1.4% Fe203 and 2.6% CaO to a depth of approximately 100m.

The market is a little sceptical of junior iron ore producers, however the likes of Fenix Resources Ltd (ASX:FEX) have shown that large transport distances can be overcome providing the mining and logistics in particular are well managed.

Not an easy task in the face of rising fuel costs and labour shortages, with the rebuilding of the haulage fleet delivering ore 711km away to the Geraldton storage shed a major focus of GWR over recent months.

One to watch with a market capitalisation around $54 million and Ridge Magnesite providing a further development option for GWR.

At RM Corporate Finance, Guy Le Page is involved in a range of corporate initiatives from mergers and acquisitions, initial public offerings to valuations, consulting, and corporate advisory roles.

He was head of research at Morgan Stockbroking Limited (Perth) prior to joining Tolhurst Noall as a Corporate Advisor in July 1998. Prior to entering the stockbroking industry, he spent 10 years as an exploration and mining geologist in Australia, Canada, and the United States.

The content of this article was not selected, modified or otherwise controlled by Stockhead. Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in this article.