Guy on Rocks: Gold, lithium, uranium, copper … all these resources stocks are undervalued, and due a correction

pic: Via Getty

‘Guy on Rocks’ is a Stockhead series looking at the significant happenings of the resources market each week. Former geologist and experienced stockbroker Guy Le Page, director, and responsible executive at Perth-based financial services provider RM Corporate Finance, shares his high conviction views on the market and his “hot stocks to watch”.

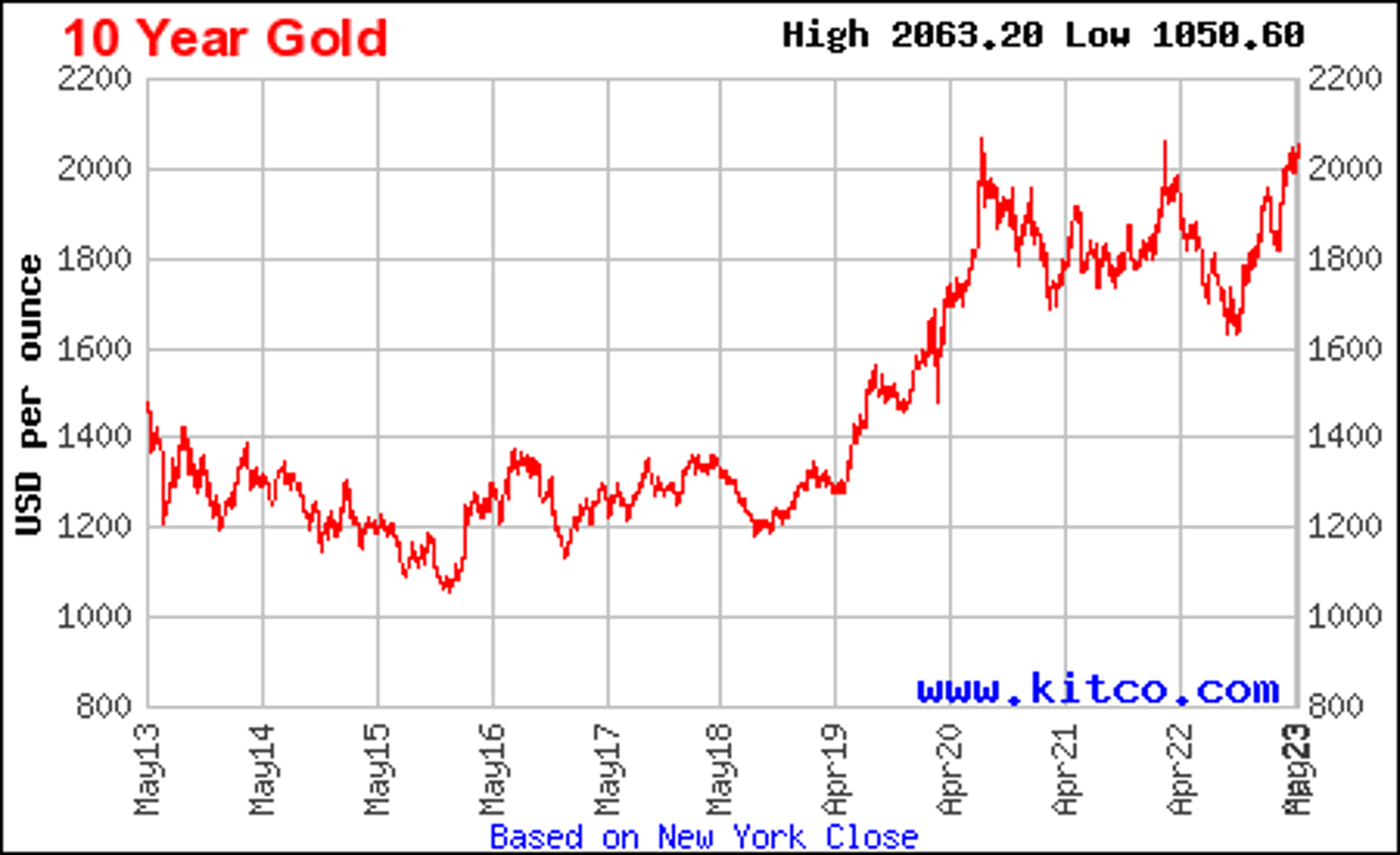

Market Ructions: Gold tests record highs

Last week was gold’s second highest close at US$2,050/oz finishing at US$2,018/oz, still up 1.5% in a volatile week for markets (figure 1).

Silver closed at US$25.66/oz up 2.5% while PGMs moved in the other direction driven by fears of recession with platinum down 1.4% to US$1,059/oz and palladium off almost 7% to close the week at US$1,421/oz

Copper had a slight loss closing down 1 cent to $3.87/lb but remains in a 1.5% contango for the three-month forward contract.

The oil market was also volatile with WTI touching US$67/bbl before finishing the week at US$71.35 for a 7% loss. Notably Saudi Arabia needs around US$81/bbl to break even on their balance of payments so more production cuts could be on the horizon.

The WA State Government announced last week that Albemarle intends to double capacity at its lithium hydroxide plant in Western Australia to 100,000 tonnes by 2026 and is spending in excess of $1 billion to build two more trains.

No doubt further acquisitions of near term/producing lithium companies is highly likely.

The USD saw a slight loss with the DXY trading around 101.27 down 4/10 per cent on the week. 10-year treasuries were flat at 3.44% while the EU added 0.50% to 3.25%, a whopping 2% lower than US rates.

On the domestic front the RBA has revised GDP growth down a further 0.6% to 1.7% for FY 2023 with the CPI expected to be slightly lower by the end of the year at 4.5%, down from earlier forecasts of 4.8%.

Last week unemployment fell to 3.4% from 3.5% with the stronger equities performance last week due to a better-than-expected quarterly earnings result from Apple.

Plenty of news to follow later this week in the US with CPI on Wednesday followed by consumer sentiment on Friday.

If the Stockhead faithful weren’t convinced the world is going mad, you will be pleased to know that the State of New York is proposing to ban all natural gas in the state from 2025.

Suggest you bring some warm clothing if you are proposing to travel there from 2025 onwards…

The elephant in the room is of course the approaching US debt ceiling (currently US$31 trillion) that will need to be dealt with by June 1 after which the US Government will have an empty closet.

While this has been raised 78 times since 1960 there are currently 43 Republican senators opposing an increase without further spending cuts.

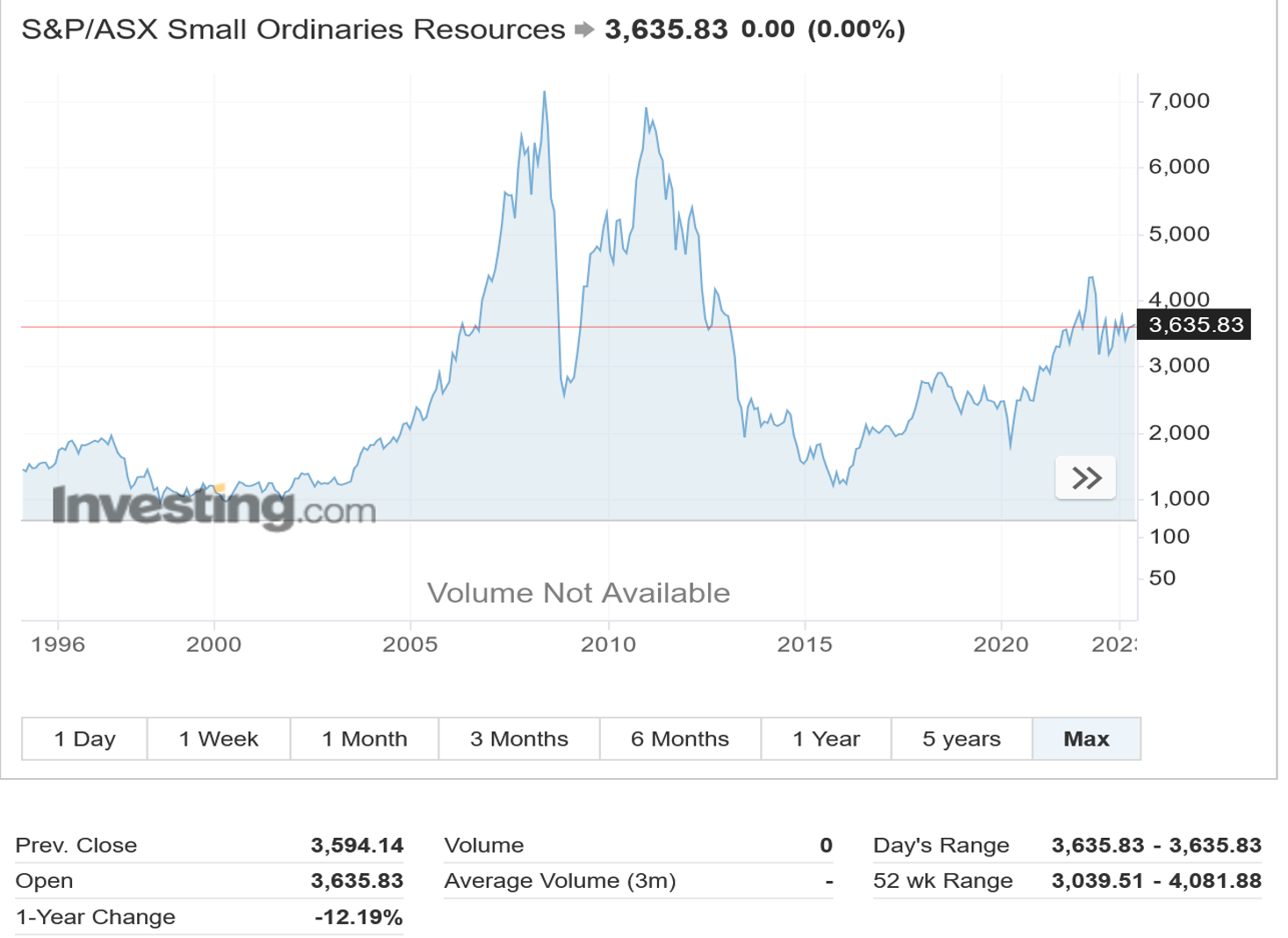

The S&P/ASX Small Ordinaries Resources Index (figure 2) is yet to retest its highs over 2007 however its performance since 2015/2016 has been far superior to our poor cousins in Canada who have been doing it tough.

The TSX-V (figure 3) is flat as a pancake on low volumes less than 20 million shares per day. The index is down almost 75% since it started in 2004.

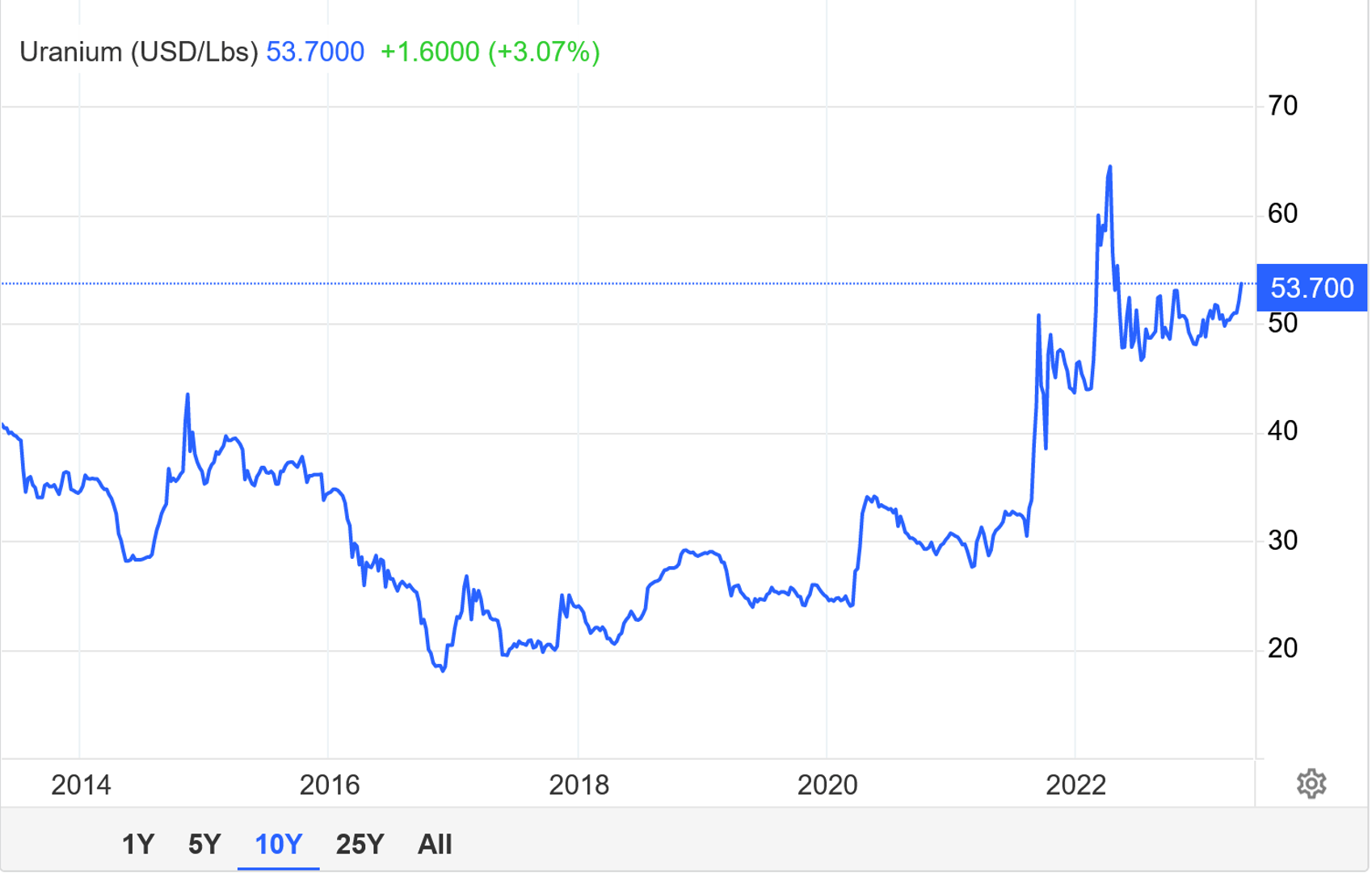

The uranium spot price (figure 4) continued its solid performance, rising just over 6% in April (over 11% year-to-date) and closing the month at US$53.74/lb.

Sprott believes that the spot price has reacted favourably to China’s bullish comments about its plans to expand its nuclear energy capacity and supply 18% of its electricity requirements by 2060. Nuclear power currently contributes 5% of its electricity needs.

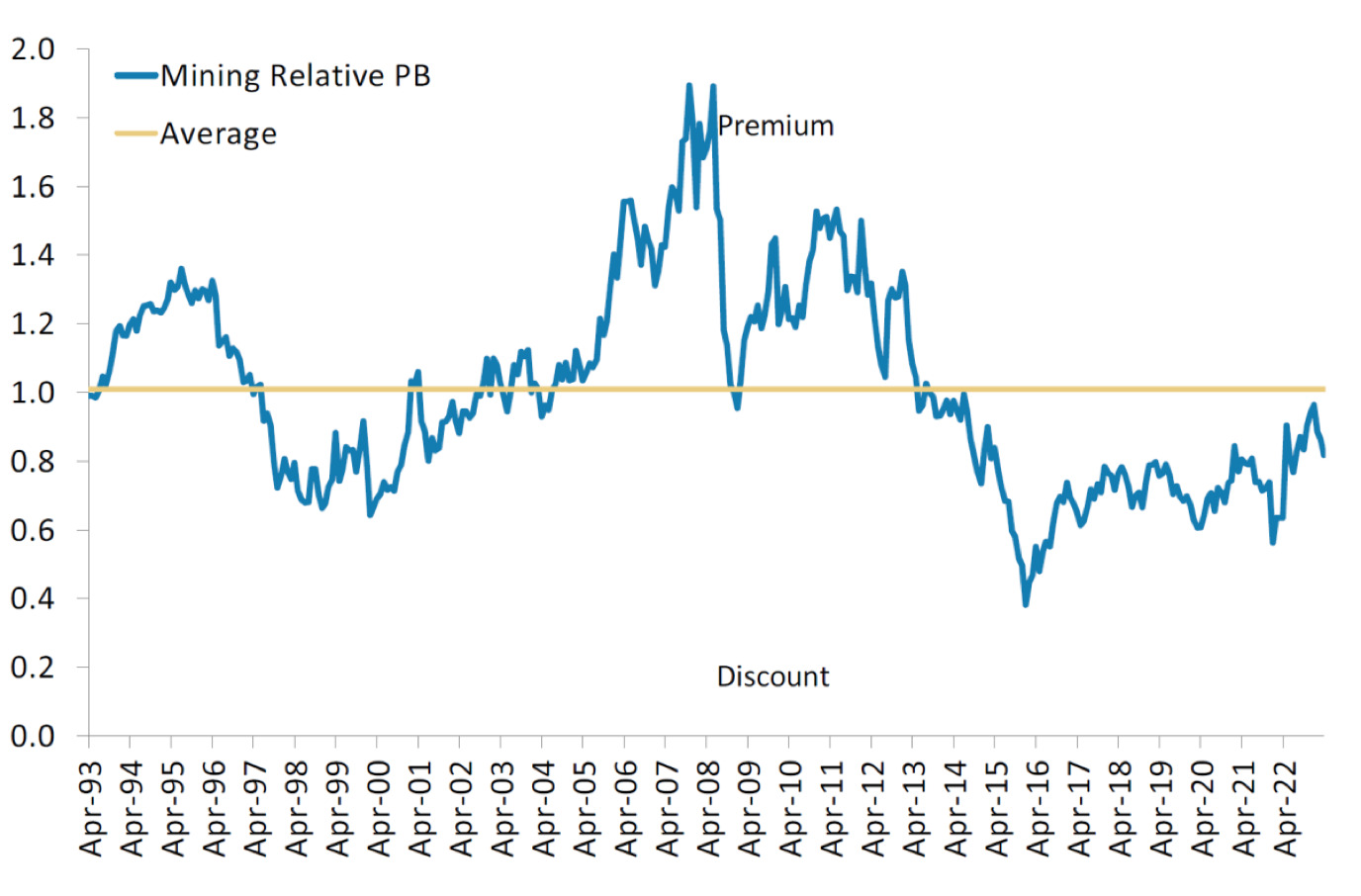

Global mining stocks (as measured by Price to Book ratios) remain undervalued compared to industrials and have taken a hit over 2023 but appear overdue for a correction which should pull the valuations of junior resources up after we move on from the risk off environment of 1H CY 2023.

Stock of the Week: American West Metals

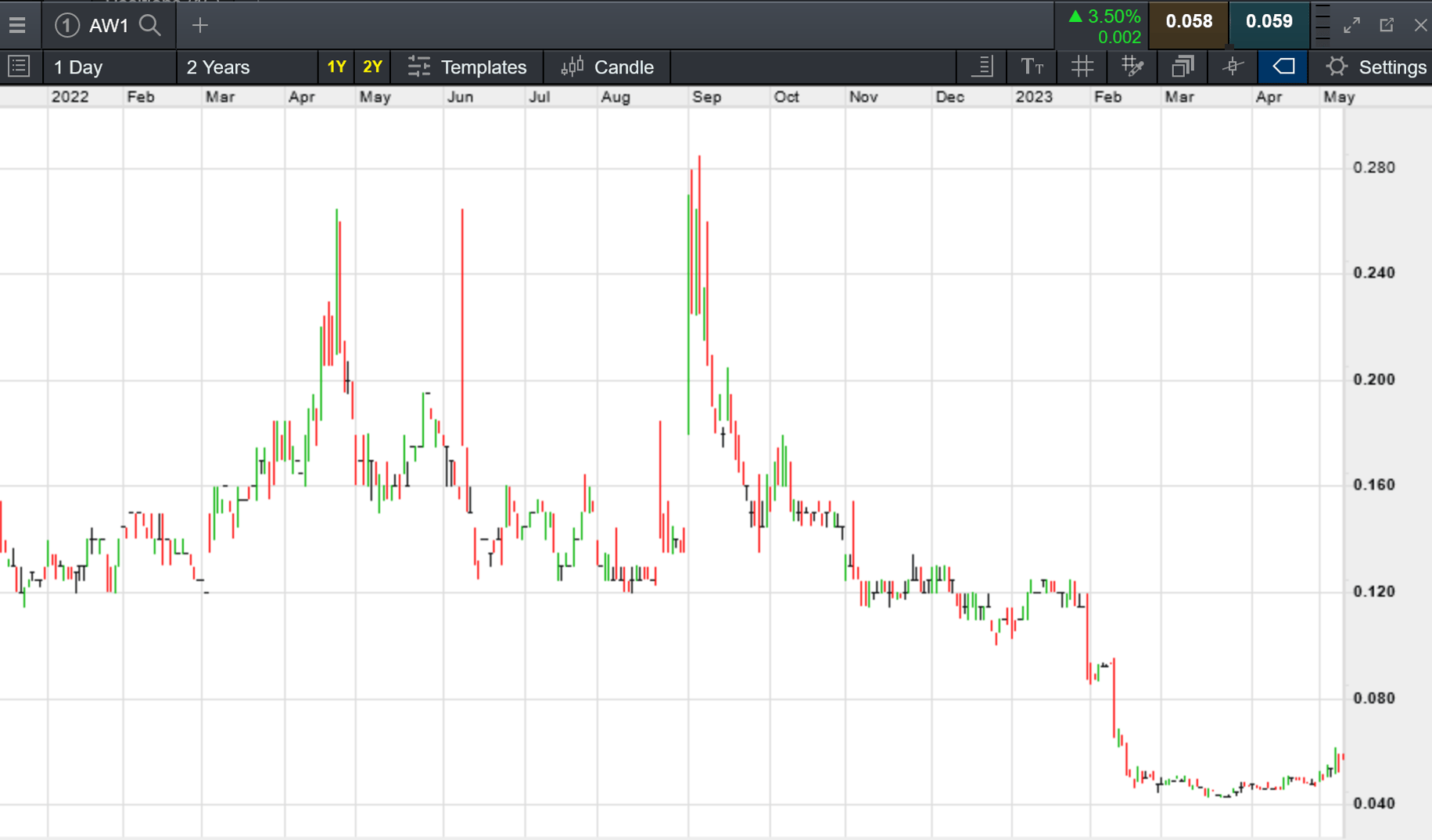

It has been anything but smooth sailing for American West Metals (ASX: AW1) (figure 6) since their ASX listing in the middle of last year. However the next 4-5 months are set to transform the company if today’s announcement is anything to go by as exploration activities ramp up at its Storm Project (earning 80%) in northern Canada (figure 7).

RM Corporate Finance (of which I am a director and shareholder) acted as lead manager for the recent placement ($2.6 million) and underwriter for the Rights Issue ($2.6 million) at 5 cents per share (and one for two free attaching options exercisable at 10 cents each on or before 30 November 2026).

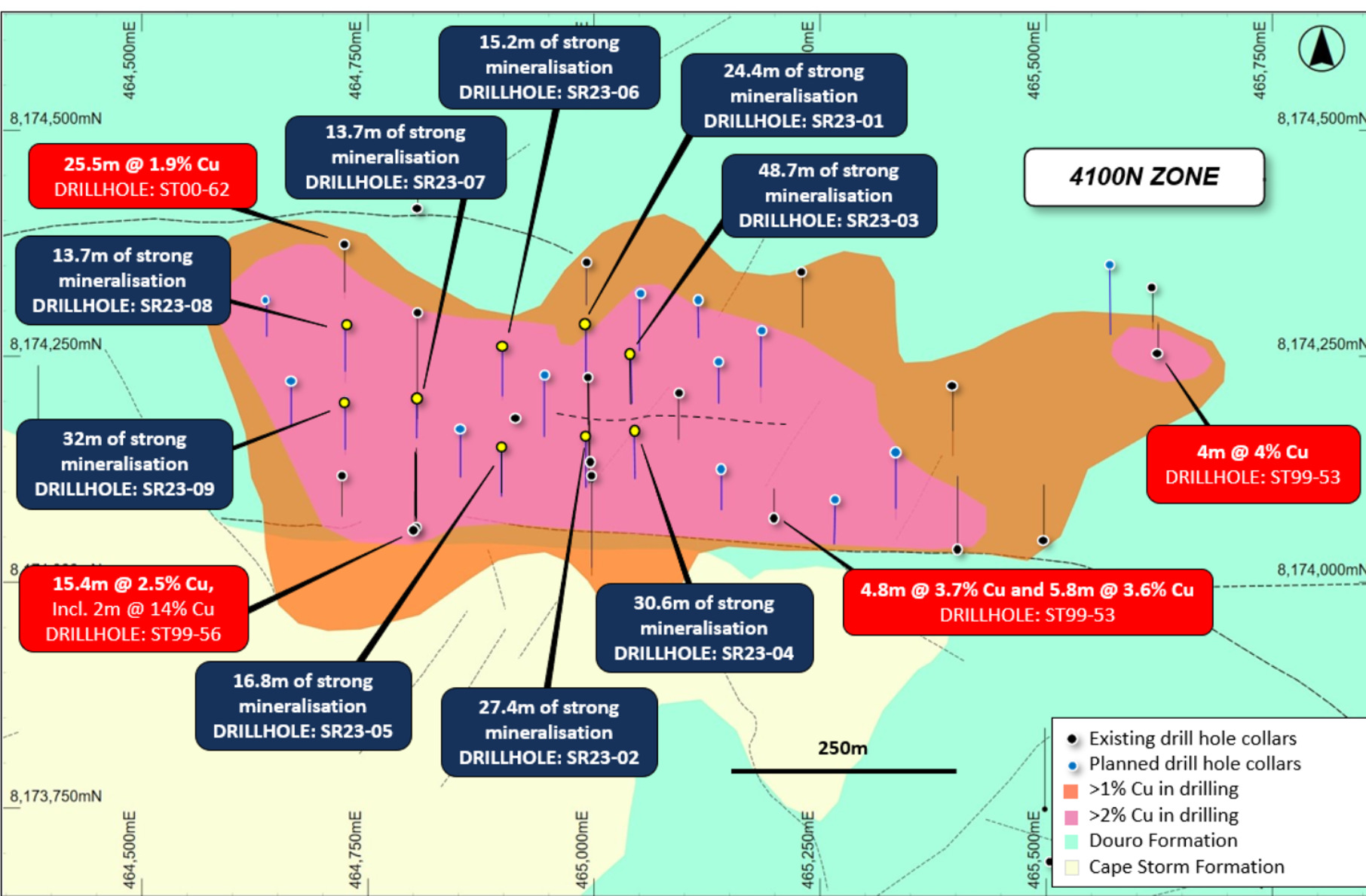

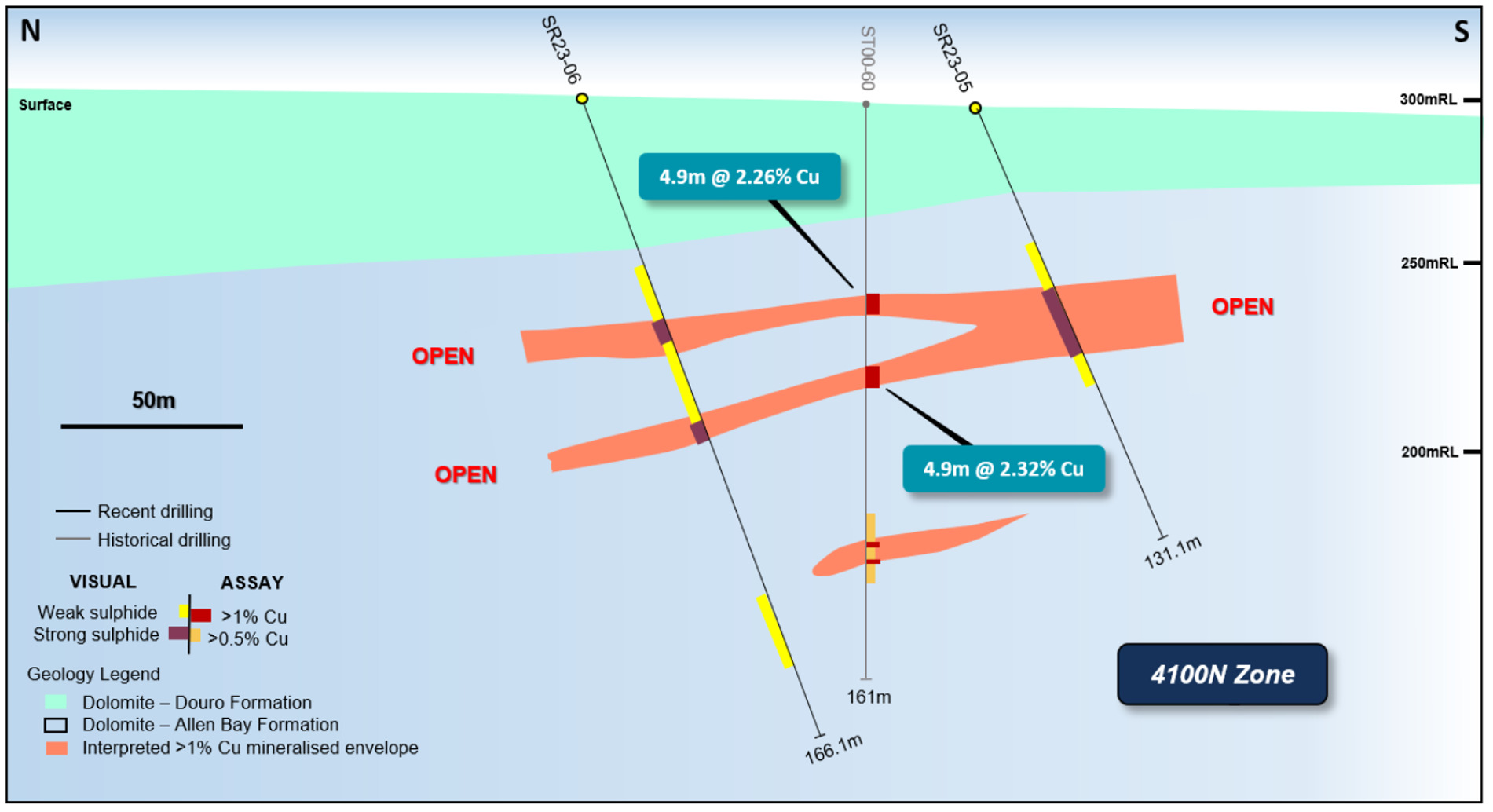

The company report visuals on a further five RC drill holes (figure 8, 9) on the highly prospective 4100N Zone with better intersections including:

o 16.7m of strong visual copper sulphides from 42.7m in SR23-05

o 15.2m of strong visual copper sulphides from 54.9m in SR23-06

o 13.7m of strong visual copper sulphides from 48.8m in SR23-07

o 13.7m of strong visual copper sulphides from 68.6m in SR23-08

o 32m of strong visual copper sulphides from 56.4m in SR23-09

AW1 remain on track for a maiden JORC Resource late in CY 2023 at the 4100N zone with a further 10-12 drill holes planned.

Moving Loop Electromagnetic (MLEM) is also near completion at this prospect and will soon move on to the Tempest Prospect (40km south of Storm) where a 250m long copper gossan has been identified.

A ground gravity survey testing deeper sedimentary hosted copper targets has also been completed with follow up drilling highly likely.

Cu) and recent drill hole visual observations (Source: AW1 ASX Announcement, 9 May 2023).

As mentioned previously, leverage into ASX listed copper plays is relatively thin on the ground when compared to the gold sector.

While there is a bit of stock to wash through from the recent placement and rights issue at 5 cents, I think 10-15 cents is more than achievable in the near term, particularly given 10 cents would equate to a market capitalisation of around $32 million with an excellent chance of a high-grade near-surface copper resource with direct shipping ore (DSO) potential.

The directors of TSX listed Fortuna Silver Mines Inc have obviously been reading this column and think that West African gold stocks represent good value with the board of Chesser Resources (ASX: CHZ) agreeing to a 14.2 cent scrip deal that was announced yesterday (9 May 2023).

The stock had drifted from 12 cents when I first covered the company two years ago to just under 7 cents last November with the bid by Fortuna representing a healthy 95% premium to the last closing price of 7.30 cents.

Expect more M&A activity in West Africa…

At RM Corporate Finance, Guy Le Page is involved in a range of corporate initiatives from mergers and acquisitions, initial public offerings to valuations, consulting, and corporate advisory roles.

He was head of research at Morgan Stockbroking Limited (Perth) prior to joining Tolhurst Noall as a Corporate Advisor in July 1998. Prior to entering the stockbroking industry, he spent 10 years as an exploration and mining geologist in Australia, Canada, and the United States. The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed, or otherwise assumed responsibility for any financial product advice contained in this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.