Guy on Rocks: Battery metals are on the move thanks to China’s stockpiling

Experts

Guy on Rocks’ is a Stockhead series looking at the significant happenings of the resources market each week.

Former geologist and experienced stockbroker Guy Le Page, director and responsible executive at Perth-based financial services provider RM Corporate Finance, shares his high conviction views on the market and his “hot stocks to watch”.

While iron ore has taken most of our attention in recent months, late 2020 also saw a significant move in battery metal prices in China with lithium, cobalt, and nickel (premiums) surging in recent months and battery grade lithium carbonate lifting 60 per cent to $US8,000 ($10,289) a tonne since the lows of August 2020.

This is clearly driven by significant stocking as China ramps up EV production, with China’s automotive output rising to 16.4 million units by 2030 up from previous estimates of 14 million. This is likely to see a significant lift in cobalt/lithium demand in 2021 respectively.

We see further upside in lithium prices during 2021 as demand continues to improve and prices remain low relative to marginal lithium production costs, with $US9,000 seemingly a figure that will see much of the spare brine capacity come back online.

I remain sceptical about the ability to substitute cobalt in lithium-ion batteries which has a stabilising effect and prevents cathode corrosion that can lead to a battery fire.

With many cobalt-rich (mostly laterite) projects requiring cobalt prices in excess of $US70,000 I remain reasonably confident of a run in one of the more opaque LME traded metals possibly mid to late CY 2021.

Cobalt is set to remain a metal that is hard to forecast, volatile with very limited long term supply options outside of the DRC. No wonder there has been considerable interest from China in stockpiling cobalt.

Nickel has also been caught up in this battery stocking drive but also remains heavily tied to stainless steel use and has room to move to +$US22,000 before nickel pig iron becomes a viable alternative.

Estrella Resources (ASX:ESR) this week announced the restart of diamond drilling along strike from its T5 nickel-copper discovery at Carr-Boyd, where hole CBDD030 drilled in late 2020 showed mineralisation could be interpreted over a 450m strike length.

At a fully diluted market capitalisation of around $117m the stock isn’t cheap but is off from highs over 20c, so it is getting close to buying territory.

Given the paucity of quality nickel plays in Australia and the positive near-term outlook for nickel, investor interest is likely to remain high.

Auroch Minerals (ASX:AOU) continues to impress with results from its maiden diamond drill program at the Horn Prospect (near Leinster, WA).

Hole HNDD002 intersected high-grade nickel-copper-PGE sulphide mineralisation including 7.3m at 2.20 per cent nickel, 0.53 per cent copper and 0.64 grams per tonne (g/t) palladium from 143m downhole.

The company also announced last week the start of a 3,500m reverse circulation (RC) program at the recently acquired Nepean nickel project (past production 32,303 tonnes at 2.99 per cent nickel).

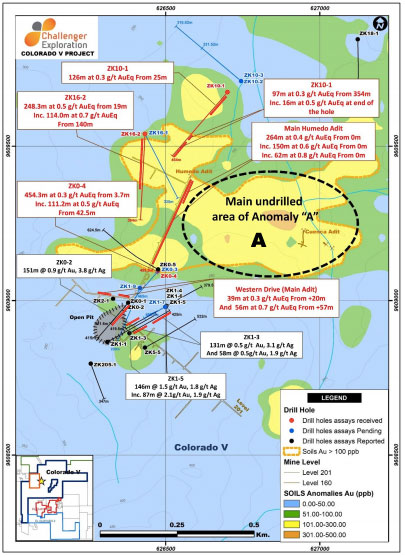

Challenger Exploration (ASX:CEL) has regained some momentum with some impressive intersections at the Colorado V project in Ecuador.

RC drilling on a number of soil anomalies returned what looks to be porphyry intersections, including 112m at 0.70g/t gold (equivalent) and 114m at 0.70g/t gold (equivalent) from surface.

Grades appear to increase towards the centre of the anomalies (coincident with underlying magnetic anomalies).

The hope is that CEL could find something akin to the Cangejos gold project (Lumina Gold Corp, TSX-V:LUM) situated 5km northeast containing JORC indicated resources of 468.8 million tonnes at 0.59g/t gold and 0.12 per cent copper for 8.9 million oz of gold and 1,220 tonnes of copper.

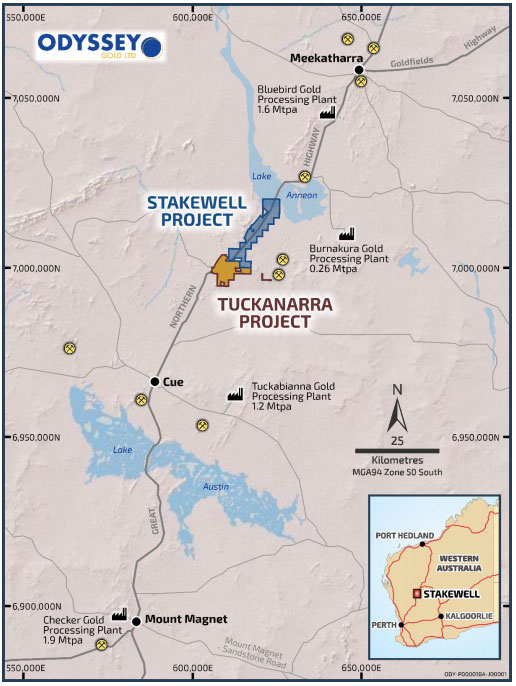

Odyssey Gold (ASX:ODY) has recently come back on the boards (14/1/2021) following its acquisition of an 80 per cent interest in the Tuckanarra and Stakewell gold projects from Monument Mining (TSX-V:MMY).

The projects cover a 30km strike length between Cue and Meekatharra in WA, with historical production of 27,000oz at 49g/t gold from the early 1900s and 95,000oz at 2.8g/t gold from 1988-1994 (Metana Minerals).

The 14/1/2021 announcement is well worth a read and demonstrates the high-grade gold potential beneath four historical pits (Bottle Dump, Maybelle, Cable and Bollard) in addition to a number of untested shafts that are likely to be the target of their initial exploration efforts.

At RM Corporate Finance, Guy Le Page is involved in a range of corporate initiatives from mergers and acquisitions, initial public offerings to valuations, consulting and corporate advisory roles.

He was head of research at Morgan Stockbroking Limited (Perth) prior to joining Tolhurst Noall as a Corporate Advisor in July 1998. Prior to entering the stockbroking industry, he spent 10 years as an exploration and mining geologist in Australia, Canada and the United States.

The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in this article.