FREE WHELAN: When the charts are screaming of Facebook, Fear and The Fed

Experts

Experts

In this Stockhead series, investment manager James Whelan from VFS Group offers his insights on the key investment themes and trends in domestic and global markets. From macro musings to the metaverse and everything in between, Whelan offers his distilled thoughts on the hot topic of the day, week, month or year, from the point of view of a damn fine professional money manager.

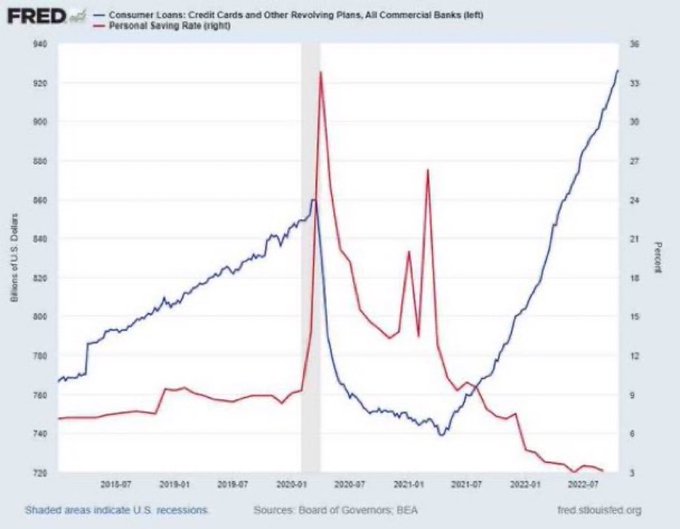

FOMC on Thursday, US mid terms next week, a market that’s had a good rally, China being a dismal uninvestable cesspool until further notice and charts that scare you a little like this one…

That’s card lending in the US.

Will the Fed care about this?

If not, when will they?

Not today because the Melbourne Cup is on which means things start to slow down across the board locally.

The reason things slow down is based purely on the fact that things slow down. It’s an odd self-fulfilling prophecy that I’ve always hated… but then that’s Australia for you?

Who’s going to win the Cup? First glance let’s have a crack at the bottom weight Realm of Flowers. Good luck and enjoy the day. Bet with your head not over it.

Or hey. Don’t bet at all.

That could also be the Australian way.

In my view the biggest punt you can have this week is being fully exposed to a Fed meeting, the outcome of which we don’t know.

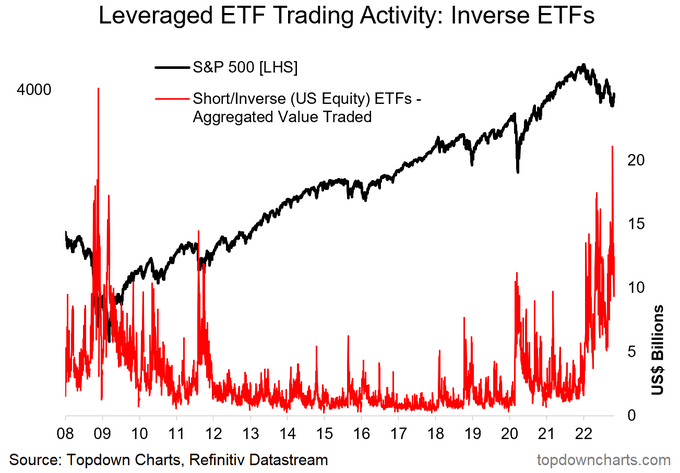

But retail are super short the market. Have a look at this one:

Look at the red line, that’s aggregate value traded on short and inverse ETFs. Every time the red line gets high it signals a bottom in the market.

If Powell et al even hint at a dovish (or less hawkish) tone the market will slingshot 10% in a week.

That’s their plan.

However, we don’t know. Nobody does. Anything you read last week was speculation.

The last week and a half of Fed blackout has been like mum & dad are out for the night and we’ve been sneaking swigs from the liquor cabinet.

The car is pulling into the driveway now so put down the chainsaw, quickly top the bottles back up with tea, lock the cabinet back up and put the key back in the hiding spot. We’ve had our fun now, let’s hope they don’t notice.

I’d be sneaking a little profit off the table here and making sure we have some powder dry whilst staying invested for the possible slingshot.

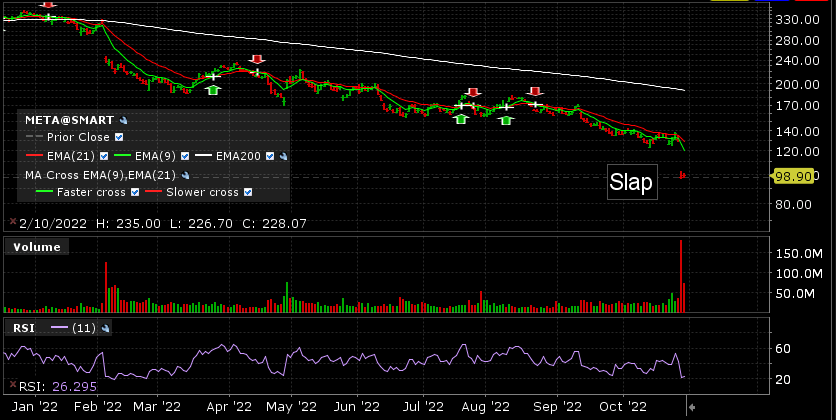

There’s no counting the number of times I said Facebook (Meta) was untouchable.

“The best short around” I believe I said.*

(Ed: Actually James you said Short Facebook or die.)

They announced their quarterly numbers last week and Mark “it’s my bat and ball and I’ll do what I like” Zuckerberg – who controls so much stock that shareholders can’t say boo about how bad an idea it is – is going to Captain Oates his way boldly into burning billions on the Metaverse pipedream.

I think there is value there at some stage based purely on the fact there is a very sticky world of Facebook users that won’t change.

Anyone who’s moved to TikTok isn’t worthwhile anyway. It’s almost certainly Chinese spyware.

Which sparked a run of memes on the internet that just got better and better…

Also never forget Jim Cramer of CNBC continued to bang the table as hard as possible on buying Meta even in the face of all this obvious nonsense.

That’s why you shouldn’t listen to pundits on the TV. (Ahem.)

In the absence of any fresh ideas I’ll leave you with the idea of taking some money off the table and enjoying not punting on the Fed.

All the best and stay safe,

James

The views, information, or opinions expressed in the interviews in this article are solely those of the interviewees and do not represent the views of Stockhead. Stockhead does not provide, endorse or otherwise assume responsibility for any financial product advice contained in this article.