FREE WHELAN: Wake up to China, don’t sleep on Gold

Via Getty

In this Stockhead series, investment manager James Whelan, managing director Barclay Pearce Capital Asset Management, offers his insights on the key investment themes and trends in domestic and global markets. From macro musings to the metaverse and everything in between, Whelan offers his distilled thoughts on the hot topic of the day, week, month or year, from the point of view of a professional money manager.

Good morning and congratulations, we have now been a part of the longest consecutive streak of trading days with the US 10/2s curve in an inverted pattern.

Keep in mind this is one of those Nostradamian (new word) signals that predicts a recession. It even predicted a recession before the Covid recession, which was weird.

It’s been predicting a recession now since the middle of June 2022, and with a very springy US economy and accommodative Fed it’s difficult to see where it’s going to come from.

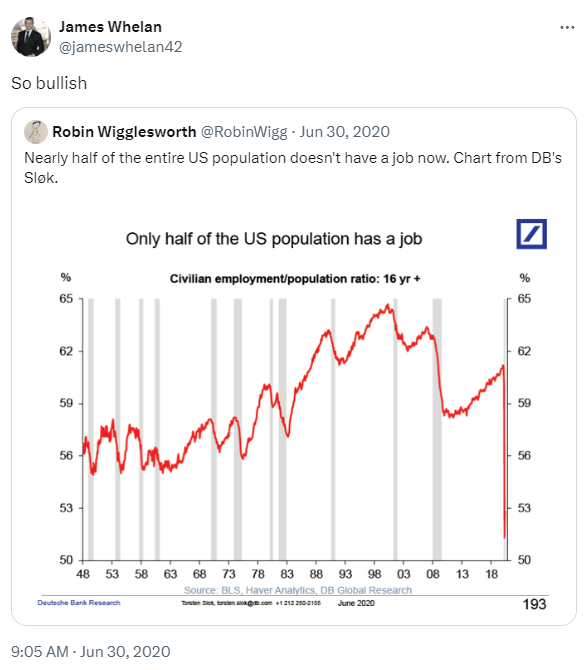

Speaking of things not making sense, I was reminded of a response to a comment from the FT’s global finance correspondent when Covid was at its absolute June 2020 craziness.

Strange to think that the impact of half the US population over 16 not having a job was what, indirectly, drove markets higher.

Now, with about the most robust labour market in a few generations, the market is still plowing ahead.

Not many other ways to say “remain invested” than that.

Europe

With the attention mostly on the US and the Magnificent 7 (NVDA, META, TSLA et al) hogging all the spotlight many have missed what’s going on in Europe.

Absolute carnage over there.

No. Just kidding, the main Index is tracking 11 straight weeks of gains.

I’m trying to minimise the number of graphics I use in these notes but imagine an ETF called ESTX which is the Eurostoxx50 managed by my buddies at Global X which is tracking straight up and there you have it.

Specifically if you’re still searching for value then European Financials might be the way forward.

The latest podcast by Morgan Stanley taking the best parts of the recent European Financials Conference by their Euro guys on the ground.

They say this on wealth:

“Wealth may not recover already in Q1. But as the confidence builds up, we definitely expect inflows to pick up in the second half, both in quantity and margin… We continue to be positive the sector. Look, the valuation is depressed. The multiples, the PE multiples on six times. Historically it’s been much closer to double-digit. We think recovering PMIs should help re-rate that multiple.”

So if it’s European Financials ETF you’re after then you need to travel overseas for iShares MSCI Europe Financials ETF EUFN.

And yes it’s trading on a lower P/E than usual with a dividend to keep you warm at night waiting on those PMIs.

Gold

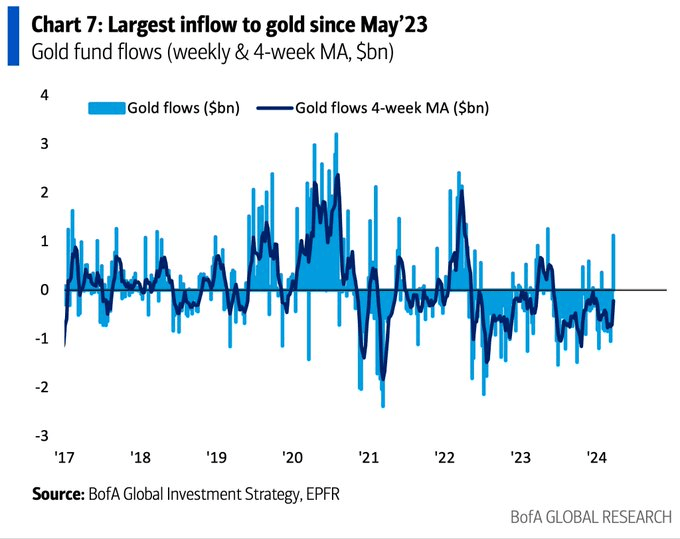

Don’t sleep on gold. Biggest fund inflows since May last year.

That’s not nothing.

There’s some lovely little gold miners out there just waiting for some love – and having just spent two days at a mining conference last week – I can tell you there’s some micro caps that have some decent gold holdings.

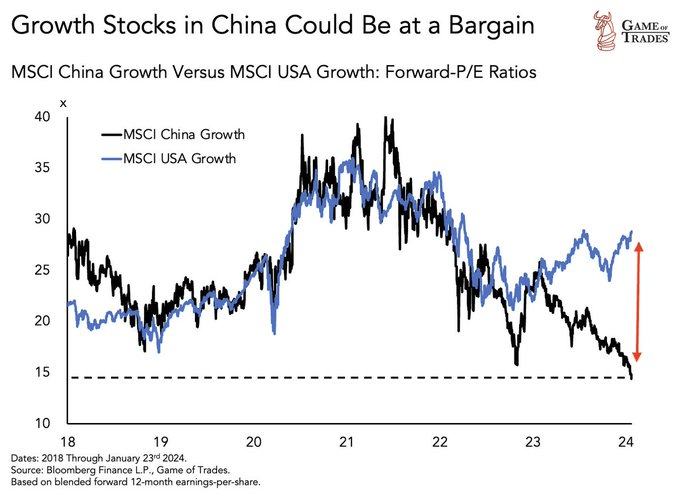

China

I continue to push the barrow on China and for those looking to diversify out of the US (which should be everyone if you believe in diversification) then China is now ultra-cheap on a relative basis.

We continue to favour VanEck Vectors FTSE China A50 ETF (ASX:CETF) as the best way to gain exposure locally to China.

We had Pepperstone’s Chris Weston on the pod this week and it’s a lot of fun.

So many central banks out with directions last week and we pick it right apart. Some chatter around commodities too. He’s very smart and I love having him on the show. Please enjoy!

Stay safe and all the best, our thoughts are with Princess Kate and her family,

James

The views, information, or opinions expressed in the interview in this article are solely those of the writer and do not represent the views of Stockhead.

Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in this article.

SUBSCRIBE

Get the latest breaking news and stocks straight to your inbox.

It's free. Unsubscribe whenever you want.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.