FREE WHELAN: And that is why Woolies is short strawberries and no one is ever short Meta

Via Getty

In this Stockhead series, investment manager James Whelan, managing director Barclay Pearce Capital Asset Management, offers his insights on the key investment themes and trends in domestic and global markets. From macro musings to the metaverse and everything in between, Whelan offers his distilled thoughts on the hot topic of the day, week, month or year, from the point of view of a professional money manager.

Good afternoon,

It was over the weekend that I was informed by my amazing wife that Woolies was short on strawberries.

Zero strawberries.

I was thinking that, after all the hullabaloo around price gouging by people who don’t understand seasonality or margins that “what if it was possible that Woolies literally decides NOT to put things on the shelves simply because the price has to be too high and they don’t want the negative publicity?”

An interesting thought, that the pearl clutching about the amount Woolies charges for food is actually meaning less food hits the shelves.

An hour later I was informed that strawberries were in fact back in prime position for ~$3.50 a punnet. So no.

But I think we all had fun entertaining the idea in the Whelan house on a busy Saturday morning. Also if you think (as I do) that the Australian economy is weaker at a personal level than it’s currently perceived, then supermarkets usually do ok in those environments.

Inflation easing, not reversing

Regarding inflation, there’s something I need to remind people often is that as we all slap each other on the back crediting that we’ve beaten inflation as the rate comes down back towards the holy 2% mark.

That doesn’t mean prices are coming off. It just means they’re rising less higher than what we’ve seen.

I think that in the self-congratulatory applause we have lost the audio screaming at us that “2% inflation is still inflation!”

Which isn’t all that bad… but just don’t ask the question too loudly why prices for many things aren’t going backwards.

A little note from Goldman Sachs research that a $10 rise in Brent crude equates to around 20-25bps worth of consumer inflation in the US (PCE to be exact). Oil rally is not good for the hip pocket, which isn’t exactly new news.

Now on to the fun stuff.

New month, new stats…

And we’re emboldened by the fact that every past market instance in the US when the S&P was up in January it’s just about always a bullish year.

We cover this in the latest iteration and return for 2024 of the Theory of Thing podcast.

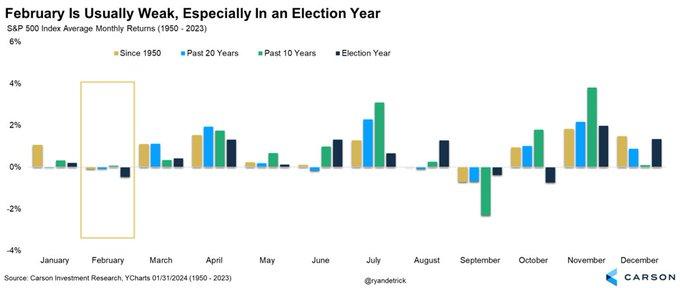

February is the relax month.

And Frankie says Relax.

Keep in mind that tech continues to drag the US market northward and nothing else really matters. However maybe without the tailwind of seasonality you should pay attention to the flashing lights.

Earnings & Valuations…

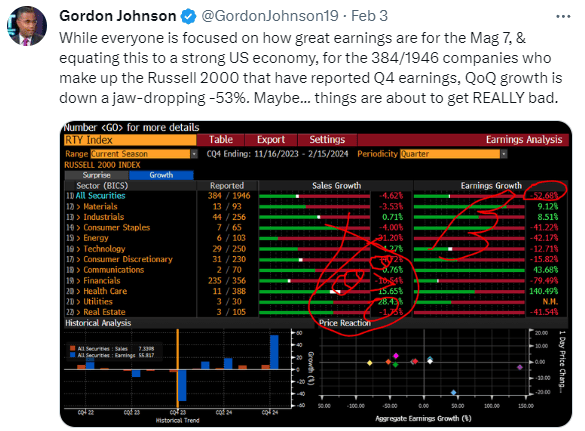

Look past the “Magnificent 7” (the Mag 7 as it’s being known) and you get a picture. The Russell 2000 is notoriously ordinary for earnings but 52% is a significant Quarter on Quarter decline.

That’s real companies that are, allegedly, the backbone of the US economy.

The messy boom

The US Economy is booming however, and I’m cutting this right out of our morning report which you can sub for here:

“The government reported the U.S. economy added 353,000 jobs in January, well above the Dow Jones estimate from economists of 185,000. The report also included inflationary data in the form of greater-than-expected wage growth. Wages expanded by 4.5% year over year, more than a 4.1% forecast.”

The US unemployment rate remained at 3.7%, lower than forecasts which were looking for a slight increase to 3.8%.

That is an economy that’s booming, with the big (and small) tech stocks letting people go, while small cap earnings are woeful.

You put that together and you have a bit of a messy picture.

Minus the Mag 7

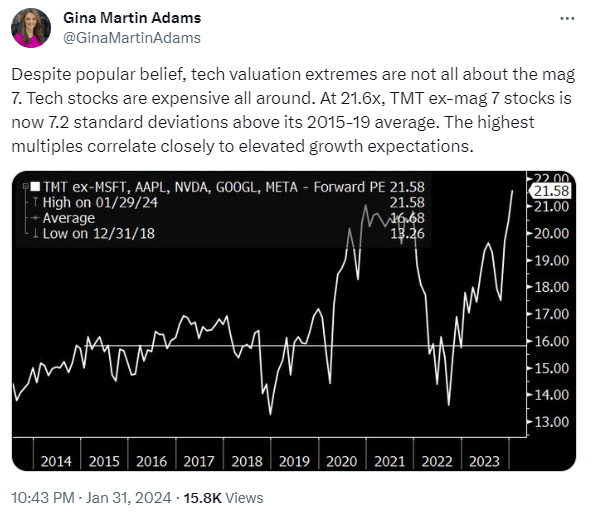

Bloomberg’s chief equity strategist had this the other day on the Tech, Media and Telecoms sub sector valuations EX the Mag 7.

That’s a long way off averages and requiring a LOT of growth to make the other side of the equation catch up.

J Powell’s smoking gun

And Powell shot down any chance of a sooner rather than later rate cut expectation last week, along with those jobs numbers…

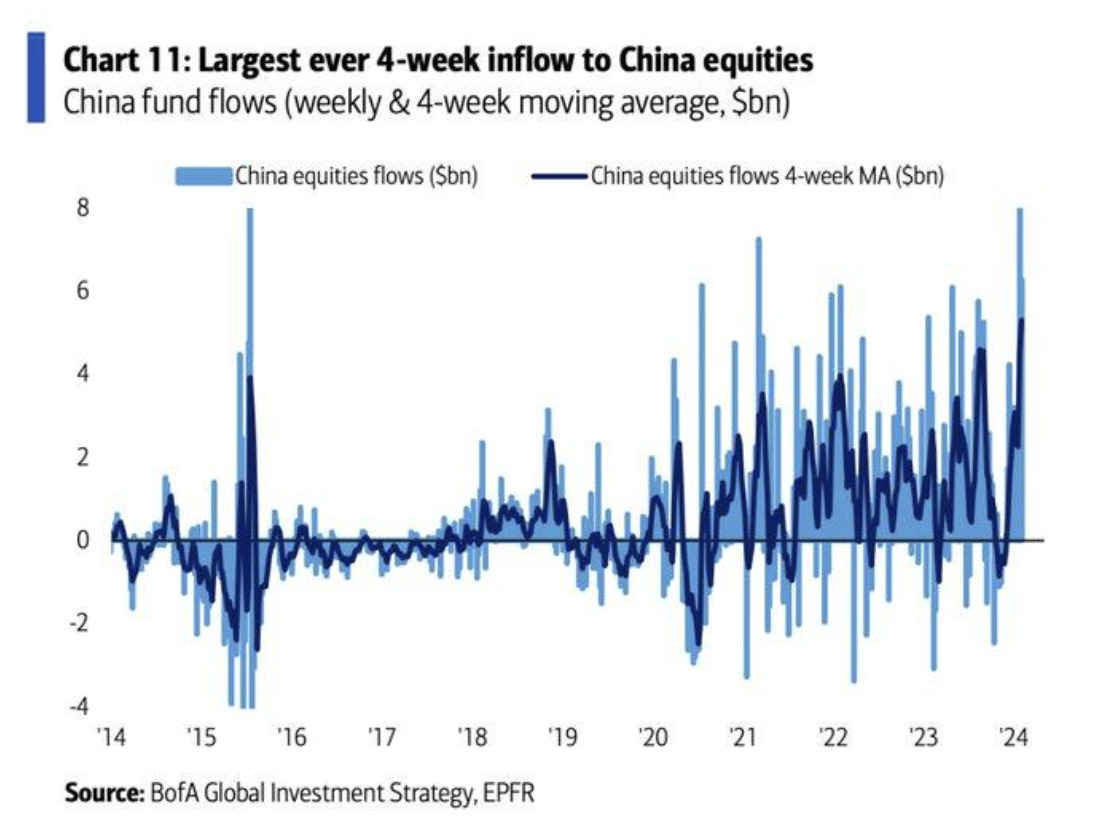

And if you want somewhere to take small profit to (because it’s all about staying invested) then you can join the absolute mess of the China market, which is not only seeing record inflows…

But is also seeing record flows OUT of China into foreign ETFs at the largest monthly amount since late 2020.

Money going in, money coming out..

I still like China in smalls as a deep value play.

Close your eyes.

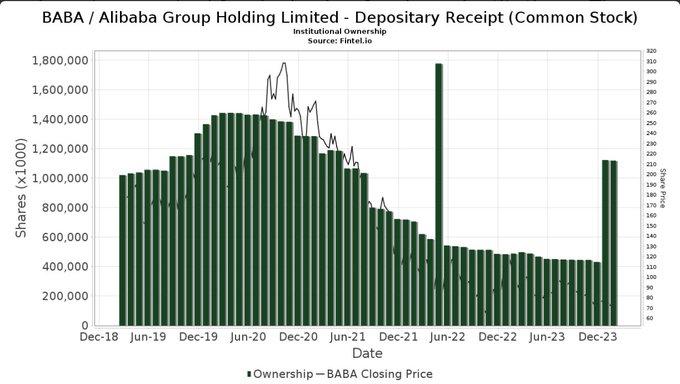

That in mind, insto ownership of Alibaba has been increasing rapidly leading into earnings on Wednesday (US time).

Pay attention.

Last things… almost

Zuck was absolutely slammed last week by Congress.

You know I’ve been following this and I feel that Meta and it’s related platforms are about as close to evil as you can get (says me, who just figured out how to monetise his Insta account…)

But here’s Ted Cruz tearing them apart nicely…

Just wow, Instagram. This is the most important exchange and despicable evidence I’ve seen today. Zuckerberg and his leadership need to be fired. Sandberg held accountable for fleeing after years. It’s really hard to shock me. /11 pic.twitter.com/JhZhnzSsCd

— Jason Kint (@jason_kint) January 31, 2024

Meta goes… Meta

And here’s what happened to Meta stock last week with the announcement of earnings, buyback and a new divvy.

That’s why you don’t short the big names.

#Idiots and Vision Pro

Finally a collection of idiots with the new Apple Vision Pro…

The future…

And my favourite…

Stay safe and all the best,

James

The views, information, or opinions expressed in the interview in this article are solely those of the writer and do not represent the views of Stockhead.

Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.