FREE WHELAN: Usually buying on a pause would be a smart idea…

Experts

In this Stockhead series, investment manager James Whelan from VFS Group offers his insights on the key investment themes and trends in domestic and global markets. From macro musings to the metaverse and everything in between, Whelan offers his distilled thoughts on the hot topic of the day, week, month or year, from the point of view of a professional money manager.

An absolutely wild few days in the rear view mirror with a weekend in Our Nation’s Capital for the State Rope Skipping Championships…

That’s coming off the back of “interesting” jobs data from the US off the back of a Fed hitting pause on their rate hikes.

This off the back of CALLING IT that the RBA would raise again, one last time.

Summary of each:

Rope Skipping Championships…

My youngest is now back to back to back State Champ.

She has a gift and I’m so proud of her.

Driving back from Canberra on a Sunday evening through snow, actual snow, was an experience too.

For anyone wondering what Mid-May snow looks like on the hills beside Lake George, taken by a 10 year old through the window of a car travelling at 100kph with the heat at 25 degrees Celsius, then please look no further.

Magical.

The weather is doing some very odd things and should not be ignored.

Ignored was my little one who suggested we pull over to have a look at the snow. I’m not sure what sort of Winter Wonderland she was hoping for in the impromptu 1.5 degree toboggan fields next to the Federal Highway but it was an idea quickly dismissed.

…came in strong in the US but who am I do speak.

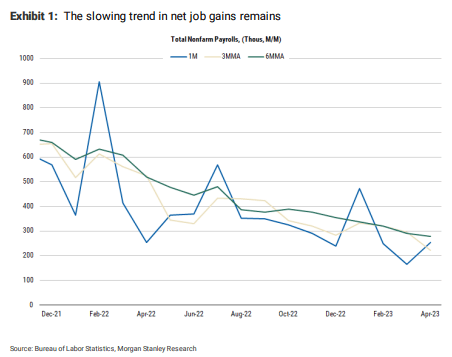

Here’s the Morgan Stanley Chief Economist with an easy summary:

“The April employment report surprised to the upside, all the way around, with a stronger-than-expected net jobs gain of 253k, a stronger-than-expected wage increase, and a lower-than-expected unemployment rate. The strength should be weighed against significant downward revisions of prior data, which keeps the slowing trend in place.”

So there’s a slowing trend in jobs and the market likes that.

Especially when…

…is very much now the next phase we go into.

Anything pointing to a raise from here would be massively unexpected. Soft landing recession is now the most baked in part of the cake and the next steps for the Fed is a cut on the back of it.

What can I say? We were right. We followed the right guy. The CBA has the best data and quality economists and they held firm to one more raise even though the market saw it as impossible. Stick with the best.

So that’s the wrap. Of the week. Winners all. Markets great.

Usually buying on a pause would be a smart idea… however Morgan Stanley again urge caution because the environment now is not the same as it’s been on previous occasions. The key point of fact that they point to is that the yield curve wasn’t this inverted in prior pausing scenarios.

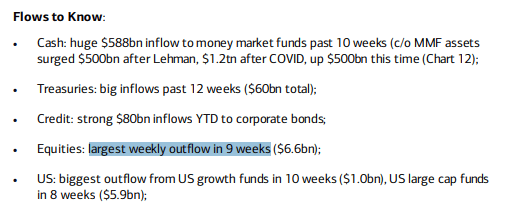

There is still an outflow in play re equities and an inflow re bonds and cash, as per BofA:

So that’s something. Credit to The Flow Show by the BofA Strategy Team.

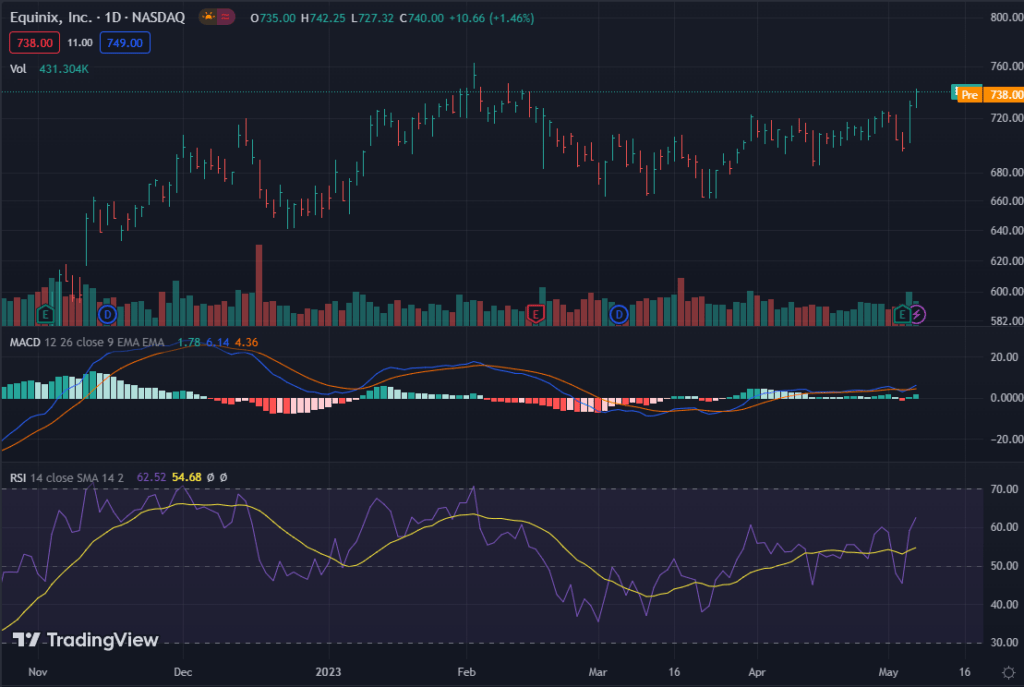

Whilst I agree with this I also think we caught a great opportunity on Data Centres. We did the rare thing and stayed away from the ETF this time, seeing too much obstruction from the US property downside. We held a focus on the biggest name in the ETF and Equinix was the answer.

Continual growth and a great report at the back end of the week.

That’s a fine looking chart in a bit of a fuzzy week.

Unfortunately that’s all I have for you for the moment.

I’m still urging a small switch from equities in general to bonds and will continue to seek that switch out where possible.

For more information please tune into the latest episode of the podcast Theory of Thing (formerly BIP Show)

We had a chance to watch the Coronation from our little Canberra hotel room and it’s easy to get caught up in the spectacle of it all.

New guy in there rattling a few cages, too…

All the best and stay safe.

James

The views, information, or opinions expressed in the interview in this article are solely those of the writer and do not represent the views of Stockhead.

Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in this article.