FREE WHELAN: Three easy ways to ride the China reopening wave in 2023

Experts

In this legendary Stockhead series, investment manager James Whelan from VFS Group offers his insights on the key investment themes and trends in domestic and global markets. From macro musings to the metaverse and everything in between, Whelan offers his distilled thoughts on the hot topic of the day, week, month or year, from the point of view of a damn fine professional money manager.

We’re almost there.

Counting down the days until I’ll be waking up to the sound of the sea breeze snapping the Aussie flag, fresh prawns off the back of the boat for lunch, walks on the beach and checking in for a few hours a day on the market while I plot the year ahead.

However they don’t just give you the end, you have to earn it, and we still are a long way from stability.

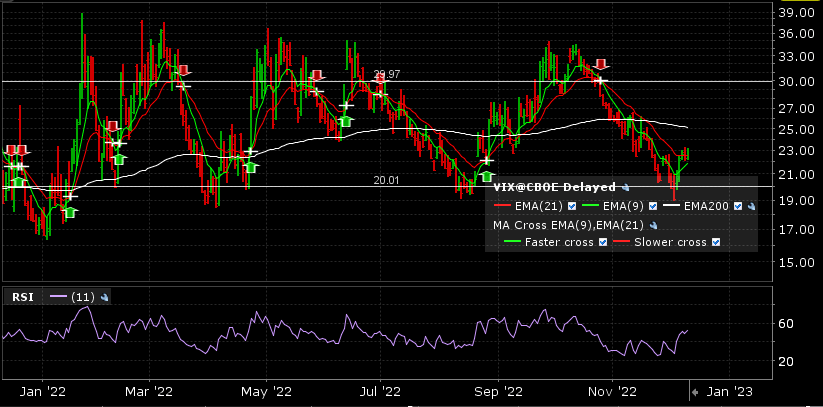

Starting this week I’ll be posting a shot of the Volatility Index in order to easily see if we should be leaning on the “buy” or “sell” side of the market this week. Currently it’s showing a lightening of holdings last week and we don’t look back at it until volatility peeks back above 30.

This proved quite prescient last week with the market taking a breather. I really do believe we will see a market that moves miles in either direction just to wind up back where we are right now.

China’s reopening is:

a) Not going to happen in a straight line, and,

b) Inflationary.

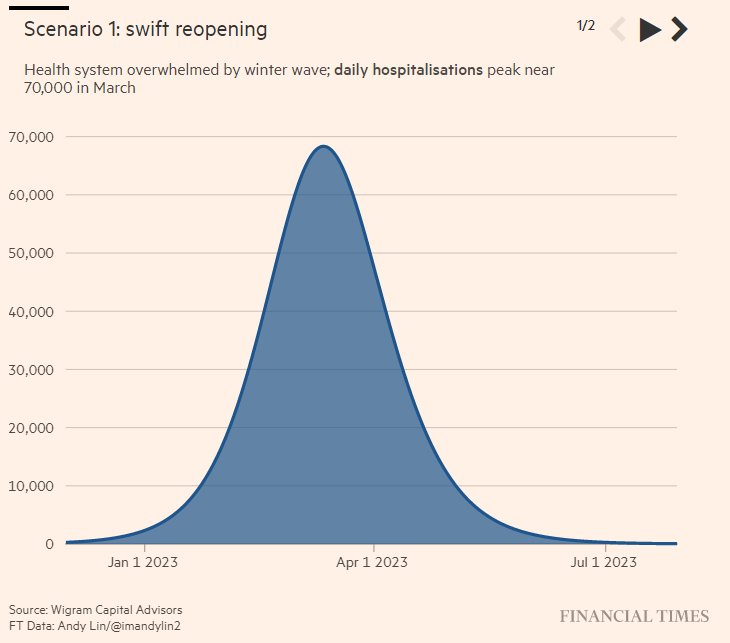

So everything that’s been done to knock inflation on the head comes back into the picture. Unless Xi gets chilly feet over the number of fatalities ahead. Here’s a stat:

They (Wigram Advisers) did some modelling and came up with the above chart.

These have been reviewed and seem legitimate. On its current trajectory China reopens into ~20k deaths a day and that’s going into Lunar New Year early in 2023.

Anyone who’s followed me for a while knows that it was Lunar New Year in 2020 that was my call to get out of equity markets because there was some sort of asymptomatic illness in a little place no one had heard about called Wuhan, which sat right at the intersection of China’s high speed rail network.

Fun fact: Lunar New Year is the biggest annual human migration on Earth.

It’s things like that which may give Xi pause. Or it may not.

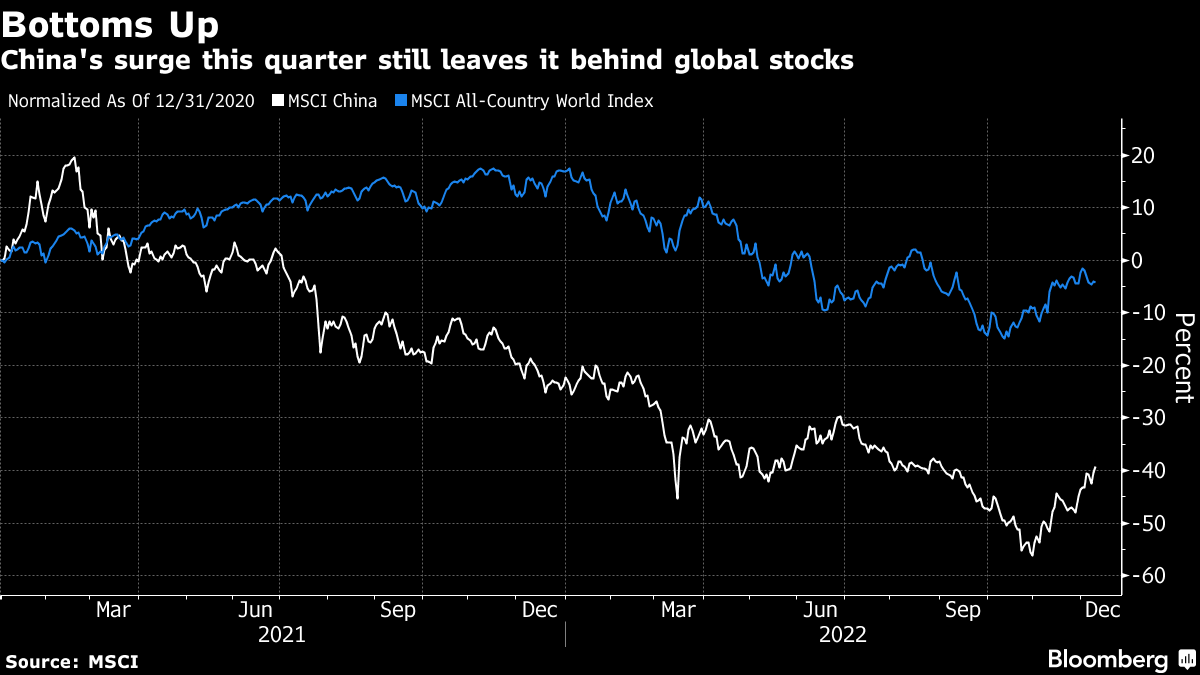

The reopening has been linked to Chinese stocks’ success so trade that as you see fit.

China still shows relative value to the rest of the world.

I personally think that a direct investment in China isn’t the best risk/reward possible. You wake up one day and some CCP committee you’ve never heard of that is suddenly the most important thing in the world had decided to nationalise Alibaba and your holding is toast.

With that in mind the three ways to get access to China stocks are:

This is your way to directly invest in China companies listed in China. It’s a little more expensive (because China) but it’s a select list of names that have the best Growth at Reasonable Price.

It’s trading on 17x earnings looking back and has a P/B over 3x. it does have the sort of Food & Beverage names you’d want in a China consumption society. It’s listed here on the ASX.

Also provides this direct China access but is a bit cheaper and has a different weighting, more towards Financials. It’s trading at ~15x 2022 earnings and has a P/B below 2x. Listed on the LSE or in New York.

Finally there’s:

It’s giving you access to the Chinese Internet companies you know and love. Tencent, Alibaba, JD. The ones that are listed in New York or In Hong Kong.

It’s received the most love in the reopening chatter but it’s listed in the States so currency hedging is an issue.

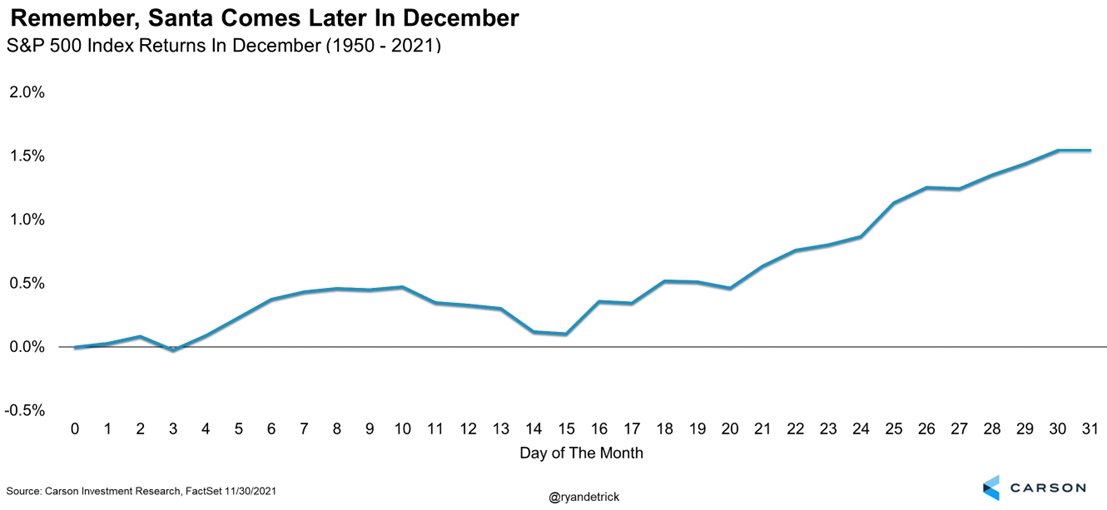

As mentioned though I’m not buying it and if I am doing any buying it’s not until late in the month. Seasonality is the word of the… season. Sorry.

Massive week of data ahead and the Fed raising by another 50bps. Don’t take it easy.

All the best and stay safe,

James

The views, information, or opinions expressed in the interviews in this article are solely those of the interviewees and do not represent the views of Stockhead. Stockhead does not provide, endorse or otherwise assume responsibility for any financial product advice contained in this article.