FREE WHELAN: The universe is at a key inflection point, even if you are not

Via Getty

Rested and refreshed after a wonderful weekend in Katoomba with the family to celebrate my wedding anniversary and Father’s Day.

There’s still a quaint buzz around the mountains that echoes to the mid-1800s and it’s a part of Australia that should be supported as much as possible. In this economy, however, “as much as possible” is doing a LOT of heavy lifting.

Some have lots with a meaningful savings rate and some have little with a VERY meaningful mortgage rate.

Another great week in the land of “higher for longer” in which we see the US calmly gliding its way to the smoothest of landings.

Remembering that markets and economies are not the same we view the market as an ongoing buy opportunity and encourage the default to be invested where possible and appropriate.

The below is what happens when the US market is up +7% in the first quarter and what happens next.

The bulls seem like they won the day last week with continuing weak data assisting markets in a “bad news is good news” scenario.

As mentioned last week, we prefer reasons to buy instead of sell so this proved prudent and we used the opportunity to deploy some more capital to work in the lithium space.

Mixed Markets

One of the most generic things someone can say as a commentator and advisor (aside from my go to line “markets were mixed overnight”) is “markets are at a key decision point right now”.

Generally speaking, this is almost always the case.

That being said, we have a month ahead of us in which we will have something clear with regards to the intentions of the various central banks we care about.

In the US there’s a big look at how back to school sales for August will come in.

How goes the consumer is how goes America and how goes back to school is how goes the consumer. Weaker than usual data is expected and if it’s in line with expectations then we’re smooth sailing.

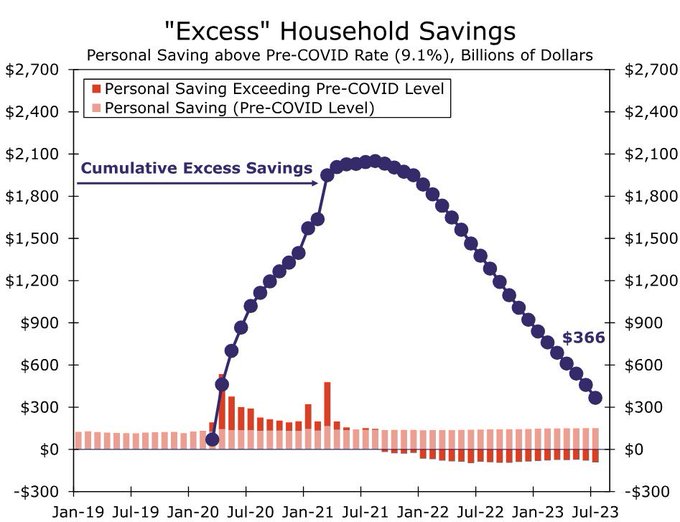

Note the below…

According to the above researcher:

“Consumers are heading for trouble. Under US$200 billion is left in excess savings, which is keeping households afloat 3 months ago, this number was at US$500 billion, At current rate, savings will be depleted by Oct 2023”

And this is backed up by the Kobeissi Letter (which is a perennial doomsayer but always interesting to read)…

“Excess household savings in the US have fallen for 23 STRAIGHT months. Since 2022, excess savings in the US have been falling by $100 billion per MONTH on average.

“The San Francisco Fed estimates that remaining household savings will be depleted this quarter. Just over 2 years ago, Americans had a record $2.1 TRILLION in excess savings. Current estimates put savings at a mere $190 billion. Debt will soon be the answer for many more people.”

How distressed should we be?

Late last week I was sent the deck for Invesco’s Small Cap Distressed Fund.

Whilst I can’t go into it because it’s restricted to certain investors, there were some scary looking charts outlining the true state of things in the US.

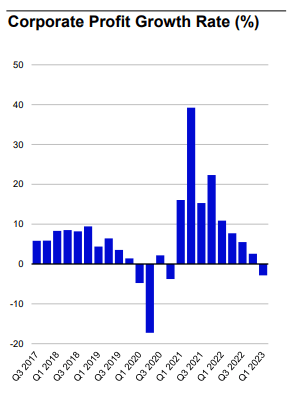

And we see this as well from the same Game of Trades research house.

So get the tissues out for all the commercial property owners about to hit the wall (again).

In summary, whilst the US market continues to show strength there are some real underlying signals of recession that should not be ignored.

Savings are running out and no one is in the office anymore.

In China we see that continuing sluggishness is being echoed around the Asian region even coming as close as Australia, which due to a range of factors we are actually seeing meaningful slow down in inflation growth, as seen in the weaker than expected CPI growth for July.

Hopefully, HOPEFULLY the RBA is done.

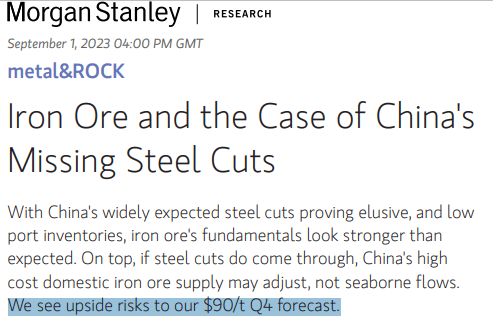

Note though the situation that we’re in where China’s slowdown is helping disinflation however a spark of stimulus may unwind this. Right now it’s balanced well with iron ore holding strong.

This headline from Morgan Stanley is all I’m authorised to send.

Good enough!

Finally I leave you with this perfect summary of the state of things on the surface.

Stay safe and all the best,

James

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.