FREE WHELAN: China, America or India… pick a market to park it before Christmas

Via Getty

In this Stockhead series, investment manager James Whelan from VFS Group offers his insights on the key investment themes and trends in domestic and global markets. From macro musings to the metaverse and everything in between, Whelan offers his distilled thoughts on the hot topic of the day, week, month or year, from the point of view of a professional money manager.

I’m back in action and ready to write again. Having recovered from the weekend hosting trivia (we raised about $13,000 on the night for the kids’ jump rope team) I am surrounded by charts screaming mostly doom and gloom.

If we take a look at the S&P 500 on a weekly basis we see a few ordinary looking weeks in a row.

The 4400 number is significant with many points of contact.

The market is digesting the reality of “higher for longer” re: rates and so the wild rally we saw to start the year is taking a breather.

Remember we look for places to add instead of selling at the first sign of panic. Staying invested is the key.

That being said… if I was looking for a way to summarise the mood in July vs August then I think I found it…

Along with concerns about the largest economy in the world having to keep rates at or around these levels for longer than expected there is also trouble out of China in the form of slower than expected growth.

Falling exports, weak retail sales and property sector that’s politely described a “sluggish” and you have your reasons.

Companies are doing business in China and seeing downturns as a result. So not only is the valuation of future cash getting revalued downwards but one of the biggest markets in the world is acting very “recession-ish.”

Remember that we look for buying opportunities so once proper news comes through of meaningful stimulus, this could turn around.

Also remember that stock markets and economies are separate things and don’t always correlate (except India, but that’s a different story).

Just over the weekend the Chinese Ministry of Finance cut stamp duty on securities trading which has driven the stock market higher this morning.

Remember though, the market isn’t the economy.

Charts like the one below annoy me too, and they get people worked up for nothing.

It was posted by Larry Summers (former Treasury Secretary) and its intention is to lead the reader to the point of view that what happened to inflation in the ‘70s will happen again.

Greg Jericho gives the perfect response.

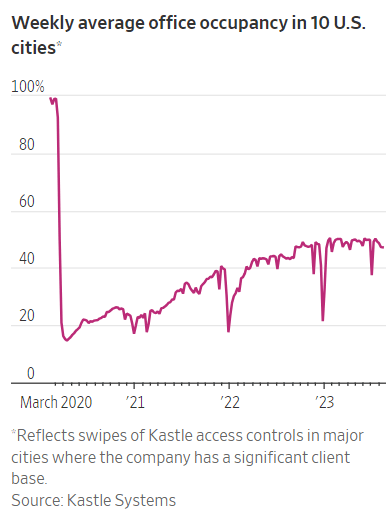

But this is one that’s really busted in the US and almost certainly here too.

It’s a chart of swipe card usage in US offices. It’s a great way to see what occupancy actually is and according to the chart it’s still ordinary.

People aren’t going back to the office in the numbers many predicted.

Office occupancy in 10 major US cities remains below 50% of pre-Covid levels.

Now this…

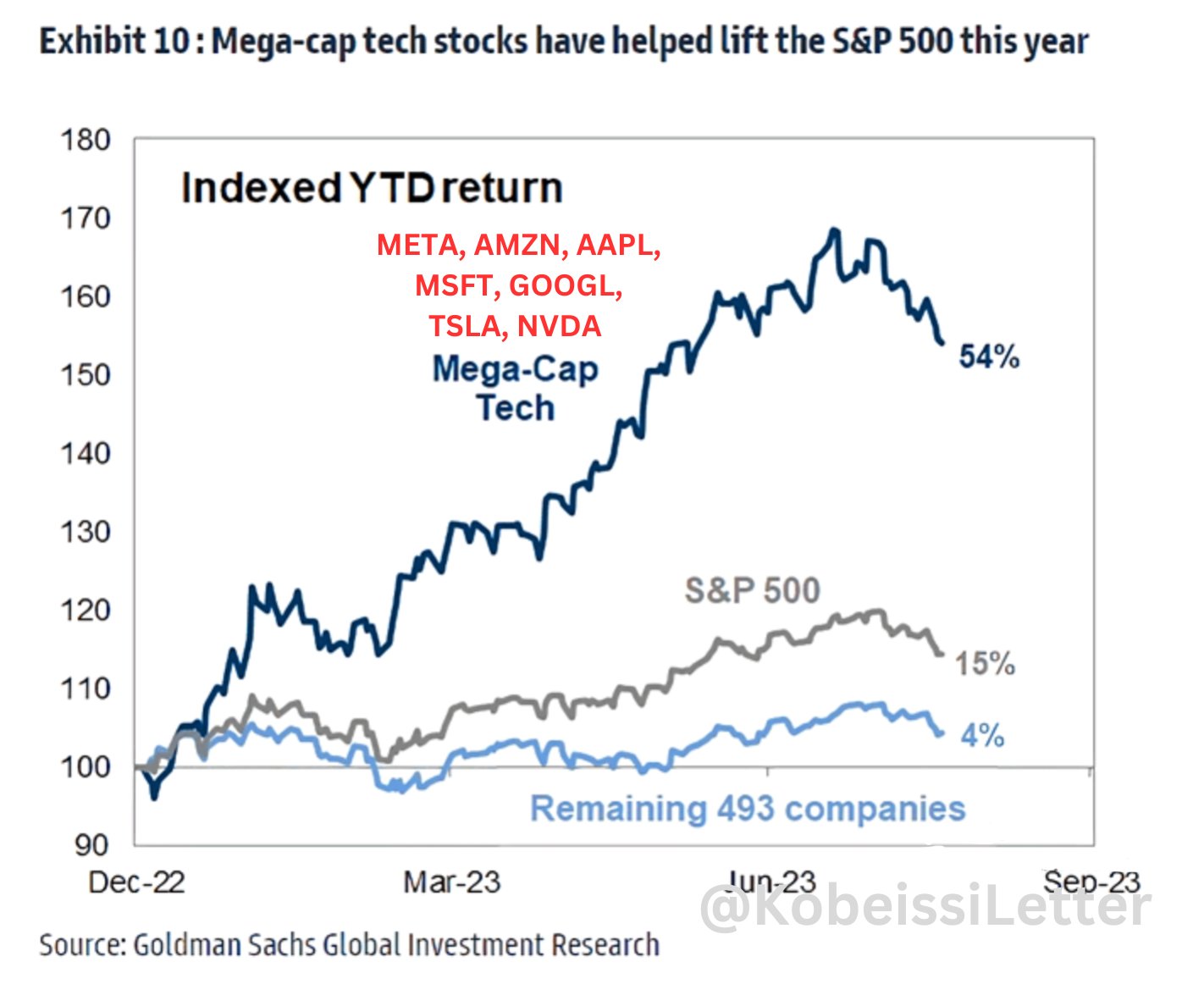

I do not like a market with so much dependence on such a small handful of names keeping it motivated. It’s mostly based on AI which as you know I prefer the “pipes and plumbing” access to AI rather than “the next big builder of it” (although I’m always bullish Google).

Speaking of which…

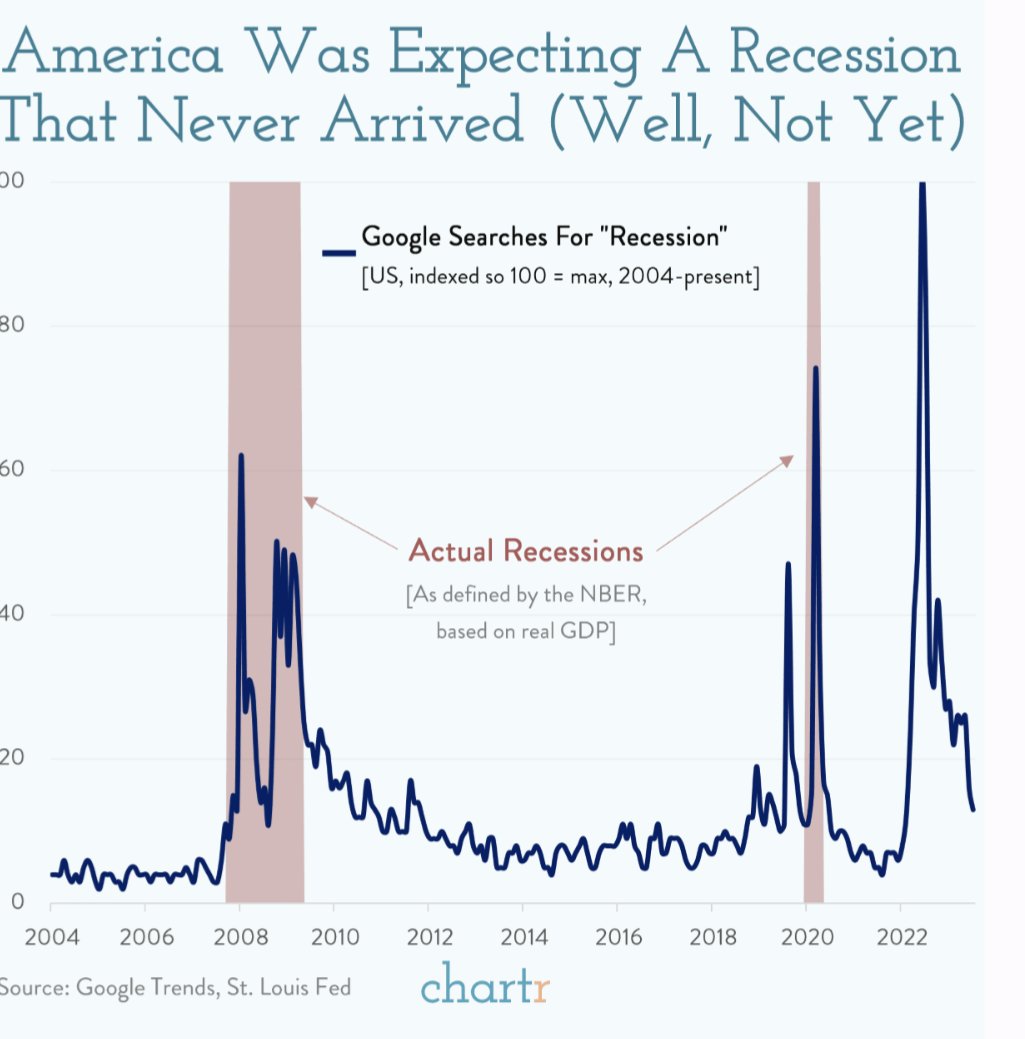

Finally something a little fun with Google searches for “recession” showing the most anticipated recession in history yet to come.

Take the time to listen to Heath Moss and I talk about this and lots of other things on the podcast.

Also. India landed a craft on the moon in the same week that Russia failed to keep something in orbit around the moon.

Show me a better metaphor for the transition of power.

Bullish India

Bearish Developed markets for now

Long bonds

All the best,

James

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.