Free Whelan: Same merde, different month; Long China this week in every way; and Meta’s still the best short in town

Via Getty

In this legendary Stockhead series, investment manager James Whelan from VFS Group offers his insights on the key investment themes and trends in domestic and global markets. From macro musings to the metaverse and everything in between, Whelan offers his distilled thoughts on the hot topic of the day, week, month or year, from the point of view of a damn fine professional money manager.

Last week: A string of weaker data, a massive short squeeze, Fed speakers who not for one second hinted at any pivot but a financial media hinting a pivot from a hawkish stance.

Enter stronger non-farm payrolls and the market gets the rug pulled from under it… again.

Same thing happened last month and from memory has happened before that too.

The weirdest thing of the week that happened was the 25bps rise from the RBA (instead of 50- great call CBA’s Gareth Aird, he was right across it) which set the tone for the world’s markets to rally… because… the RBA was taking a less hawkish stance?

I was interviewed on Ausbiz on Wednesday arvo and had to really emphasise just how foolish it was for the world to be following this lead. I was struggling for an appropriate Australian “trend gone bad” like budgie smugglers or shrimps on the barbie but those things are actually amazing.

The best I could come up with was “I’m reminded of the Australian Crawl song ‘Reckless’”.

And so we spend another week waiting, safe in the knowledge that the Fed won’t change its path until:

- They actually say they’re changing their path or;

- They actually change their path

Until then it’s higher for longer re rates in the world’s biggest economy. Something has to break or inflation needs to rapidly decrease. Act accordingly.

Things could only get better, at Meta

Meta – Sell.

The best short in the market.

I’m loud and proud on this. I spent some time over the weekend really drilling into just how bad things are for Facebook (META).

Great piece on it in the FT (paywalled) outlining the current status of the move. Complete with chilling/amazing quotes like this from inside the company:

It’s been about a year since Zuckerberg hoisted the pivot to the metaverse up the flagpole and there can be no argument it’s not been as amazing as he’d hoped.

Morale is down, losses continue, product for the Facebook Metaverse is rushed and buggy.

A different metaverse called Decentraland (which runs on the Ethereum network) only had 20 people on it in the last 24 hours to midnight Monday morning.

That’s just really, terribly bad.

Yes the economy is cactus for this type of thing at the moment (remember people were spending millions for virtual space in the metaverse a few months ago).

Facebook doesn’t have that excuse. They have quarterly reports and shareholders and a massive amount of money spent on this thing that is absolutely getting flushed.

Local property… for local people

Speaking of rate rises is seems the Aussie property market isn’t as bad as certain folks are hammering for headlines. Property is finding a base and rents look set to continue going up.

Good news for property investors… apparently.

Also we go into how REA differentiates on who is a real searcher and who is just a tyre-kicker.

I had a terrific chat with the terrifically intelligent Eleanor Creagh on the BIP Show podcast a few days back and yes, fascinating stuff.

REA group are going to talk things up a bit. However, I reckon they’ve arguably the best data for search preferences and what buyers are looking for (sellers too). Importantly, we go into how REA differentiates on who is a real searcher and who is just a tyre-kicker. It’s worth a listen:

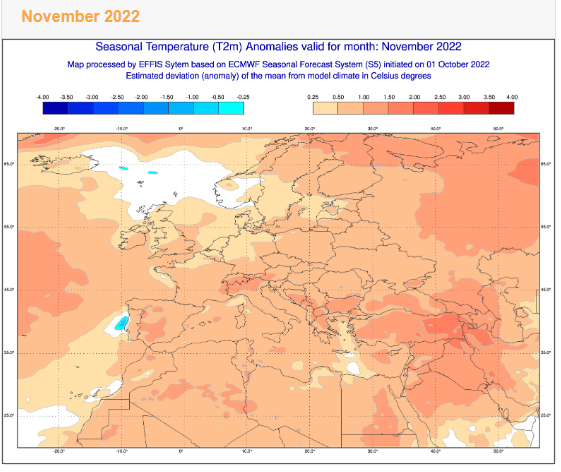

The weather in Europe

We check in with the European Centre for Medium-Range Weather Forecasts and it’s looking like a mild winter is coming. If so, Europe won’t burn through as much gas which means Russia loses another card to play in this game of geopolitical poker. A long Europe trade could be the way to go but then again, the weaker Russia looks the more chance there is of nuclear bombs being tested in the area.

Natural gas prices might ease but then again I don’t hate money that much to take a position, it was just an observation.

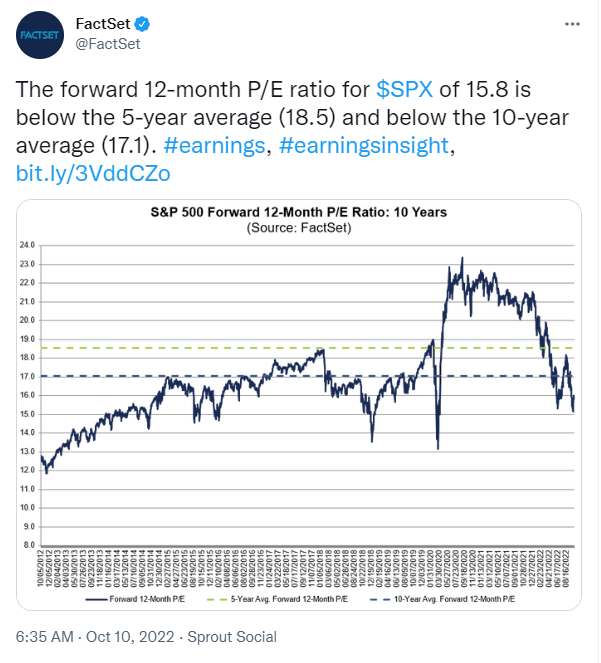

Earnings

The lag effect of the market is about to be shown in company earnings. We hit the first of two potential “earnings recessions” in US quarterlies. This will, provided my crystal ball is not glitching, set a good base to be fully invested by year’s end.

Of note…

I still believe the “E” in this equation is too high. Stay tuned for things to start moving in that regard.

Until then, risk is to the downside overseas.

Long China this week.

Funny also you come back from Term 3 holidays and completely forget that the 20th National Congress of the Chinese Communist Party starts this week.

Remember the game plan on that is for Xi to be made Chairman for life (or at least consolidated as a long termer) and immediately after to unwind the Covid Zero policy that is trapping China in the past and overcompensate for missed growth.

Long China this week in its various manifestations.

All the best and stay safe,

James

The views, information, or opinions expressed in the interviews in this article are solely those of the interviewees and do not represent the views of Stockhead. Stockhead does not provide, endorse or otherwise assume responsibility for any financial product advice contained in this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.