FREE WHELAN: Methinks a but small allocation to uranium for solace during the winter of our discontent

Via Getty

In this Stockhead series, investment manager James Whelan from VFS Group offers his insights on the key investment themes and trends in domestic and global markets. From macro musings to the metaverse and everything in between, Whelan offers his distilled thoughts on the hot topic of the day, week, month or year, from the point of view of a professional money manager.

Spring is here which for me personally means Father’s Day. Anniversary weekend. Blossoms on my fruit trees. And the impending realisation that we’re nearing Spring Carnival which means Melbourne Cup which means offices start to wind down.

The next month or two is effectively the last chance this year to start and project what you want finished this year. Even then it’s pushing it.

In the advice space the market doesn’t take many breaks. The market trades through Melbourne Cup and right up to Christmas and New Year. It’s exhausting but it’s worthwhile.

Anyone wondering about the pressure of this job may want to note that for my 16th wedding anniversary my wife and I booked a night in the city for Saturday, ordered room service, opened a bottle of wine, watched a movie and two episodes of Ozark, black out shutters down and we slept for 12 hours and felt like absolute gods. The whole of Woolloomooloo Bay on our doorstep and we choose a night in watching movies without interruptions? And are we happy?

Absolutely.

That’s the life at the moment.

CBA: data so good it’s like they’re in your house… (they are)

Speaking of stress, a wonderful note by CBA Head of Aussie Economics Gareth Aird clearly outlining where the Aussie consumer is at the moment, his inboxes everywhere on Monday morning. And here’s the crux, about delays between RBA doing things and things actually impacting mortgage market.

The good thing about Gareth (among many things) is that the CBA has THE best data on spending and on mortgages.

I’ve argued for a while that the ABS still gets its data via a phone call and a survey while CBA tracks data live. They’re in your house. Whilst that’s a bit of an exaggeration, they still get the good data and this is what they have now:

“CBA is Australia’s biggest mortgage lender. Our mortgage book is ~25% of the total mortgage market. There is on average a three month lag between an RBA rate hike and when CBA borrowers on standard variable rate mortgages experience an increase in their loans repayments. This means that the bulk of our borrowers have only felt the impact of one 25bp hike on their cash flow (or potentially as of this week the cumulative impact of the May 25bp rate hike and June 50bp rate increase).”

There is a lag and that lag is kicking in now.

I still think that the consumer discretionary stocks are best left alone and any fake in sentiment that consumers will tighten belts will be delayed to the end of the year. Christmas is the last hurrah and even then it’ll be cooler than forecast.

Meanwhile Europe is shifting slowly out of the realm of “Basket Case” into “Uninvestable” as Russia shut down Nord Stream 1 for an oil leak and Siemens (who built the turbines that are now shut down) claim that the reasons given by Russia for the shut down are absolutely not valid for a shut down. Apparently the US market, which had started to rally on the back of slightly weaker US jobs numbers on Friday, saw weakness on the news of the shut down.

So the market still feels these things have an impact on markets.

Personally I think we’re almost at the stage to stop concerning ourselves with Russia’s gas taps.

Germany have met the minimum 80% requirement set by EU regulations for gas storage so they’ll be “ok” (apparently) for the winter and there are these amazing headlines coming down the pipe every day:

This has since been denied by the Greens but the chat is still there and the rumours are coming from somewhere.

France is already on the right track:

A small allocation to uranium would not be the worst idea I’ve seen as the world continues to embrace a nuclear future.

Now to markets. We are very much in the next leg of the bear market and facing the realisation that nothing will stop central banks from ploughing ahead on rate hikes in the face of human misery.

Anyone who thinks this job is easy is asked to look at the results for what has been the “easiest” portfolio to own for millennia: The 60/40 portfolio.

I reiterate that at some point a huge allocation to bonds is basically mandatory.

That day is not yet here.

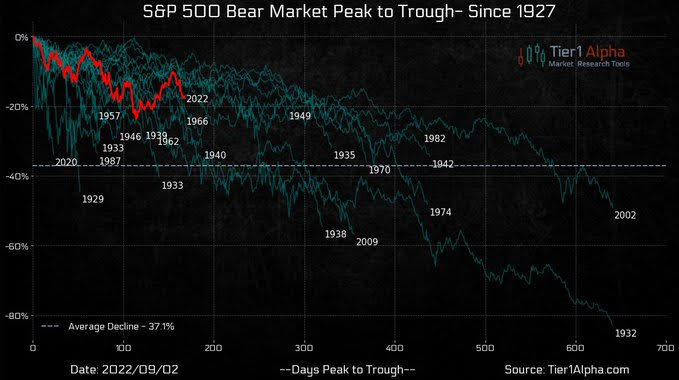

The day for an equities allocation is also a fair way away if you look at past bear markets. Red line is our current location and the dotted line is the average since 1927.

We’re about halfway there which sounds about right if you listen to what’s being said about company valuations in the US. They’re still a little high.

For reference, the S&P 500 is currently trading around 16.6x forward P/E.

The top 10 stocks in that index are trading at 24.7x.

The ratio of the remaining 490 stocks is 14.6x, which is reasonable. It’s the mega-caps providing the support. Same as it ever was, I guess.

Cash on the side

Last week was spent thinning out portfolios and bringing allocations down to be as sidelined as possible without being uninvested. Having this much cash on the sidelines isn’t something I do often and hasn’t been this large since the early pandemic days. At this stage I see nowhere immediately to allocate said funds.

Playing it prudent right now.

Do not forget that as we enter the Spring the US enters a kind of funk with the seasonality of the time really shining through.

Summer holidays are over and if the market struggles, the mood to save it is gone. Good friend Jonathan Pain describes it as “the Winter of Discontent” and rightly so.

Stay safe and all the best,

James

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.