FREE WHELAN: It’s hot. It’s sticky. It’s copper time

Copper or caramel. Both are sweet. Via Getty

In this Stockhead series, investment manager James Whelan from VFS Group offers his insights on the key investment themes and trends in domestic and global markets. From macro musings to the metaverse and everything in between, Whelan offers his distilled thoughts on the hot topic of the day, week, month or year, from the point of view of a professional money manager.

Aloha.

Webinar on Wednesday evening.

Location: The internet. Check your phone or computer for more details, by going on the internet.

Book a spot now, clicking here, which will take you to another part of the internet and catch all of my views in a little more detail. Won’t take long but will be a good overview of what’s behind and what’s ahead.

It’s a dry heat

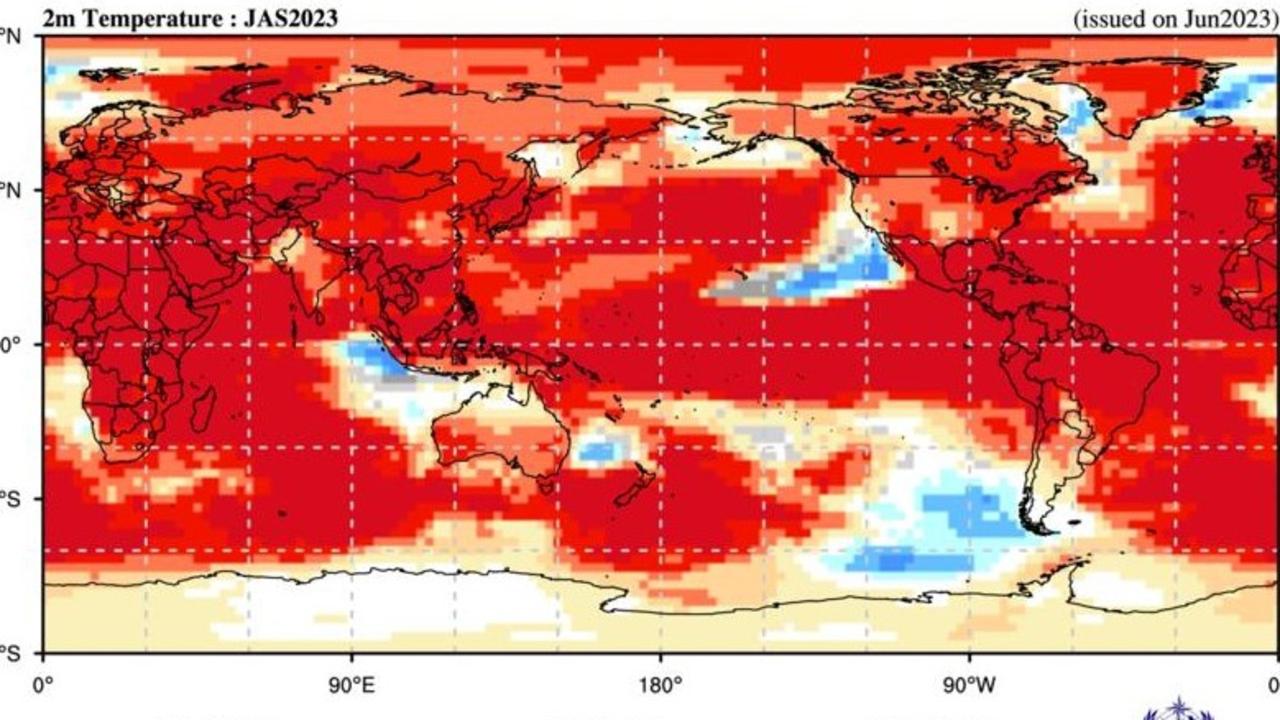

As we now look towards longer days and an impending summer, I’m doing that thing I do where I look out over any patch of dirt I happen to be standing on and all I can see is it getting dryer.

That’s natural for Australia, and for most things, but this will be dryer than usual.

A few people posted this over the weekend but it bears repeating that the planetary average temperature hit 17.23 degrees on Thursday, surpassing the record set on Wednesday which equalled Tuesday which beat Monday.

It was a hot week in the world.

Whilst I urge all clients and anyone reading to be sure to factor this phenomenon into all decisions I can tell you that there wasn’t much in the form of global warming sitting outside at Artemis wines on Sunday at 11am. Mittagong in 9 degrees really brings out character in the wine and the self.

I mention wine because I was reminded of my time driving to Mudgee a few years ago as the dams were at about 17%. It was dry, near impossible to make a go of the land and everything was for sale.

That was pre-Covid. We’re heading into that area again, however with a recession on our hands.

Not amazing

As I write this it’s difficult not to see more and more around me that fuels like more support for my thesis a few weeks ago that we are in troubled times.

Not to rehash it but looking at the Monday note from Shaw and Partners and they’re starting (continuing) to get the hang of how bad things are.

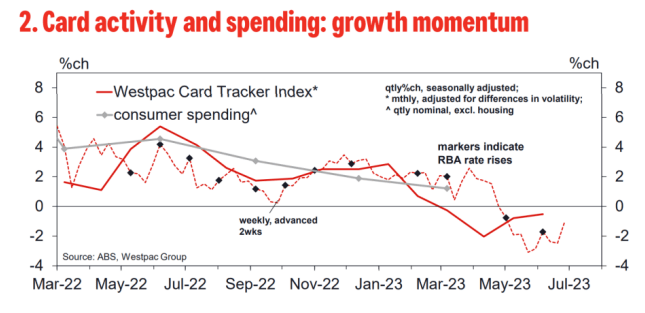

I need to make sure I give some reference to these charts so simply put if the RBA has done enough, spending will drop.

Grey line shows that spending is trending lower along with card spending (red line). So, we’re ok for now re RBA carrying on. Which means consumer discretionary is getting a kicking. Stay well clear.

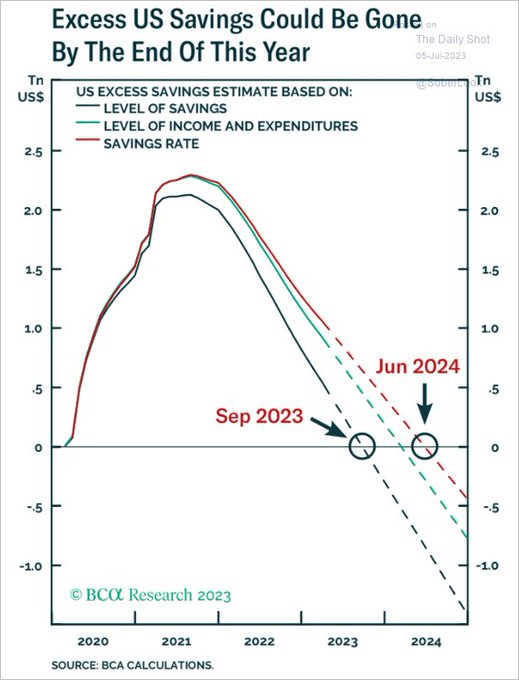

Over to the US and one of the key things that has been propping the whole show up is the excess savings rate of the all-powerful US consumer.

Households’ excess savings could run out as soon as September.

That surely is something to keep an eye on in the coming months and is a loud and clear message that we’re not out of the woods by any stretch.

However, remember that a decline in spending by US consumers assists inflation in continuing to decline which puts pause to the Fed continuation of rate hikes into a discontinuance.

I continue…

US consumer price inflation is expected to continue to slow but core inflation (sans food & energy) is stickier. I believe these all really speed up their decline over the back half of the year and we see the Fed proclaim “ job done” early in the 4th quarter.

The US earnings recession continues and apparently we will see another decline of over 5% year on year for US companies who commence reporting at the end of this week.

Some more things of interest:

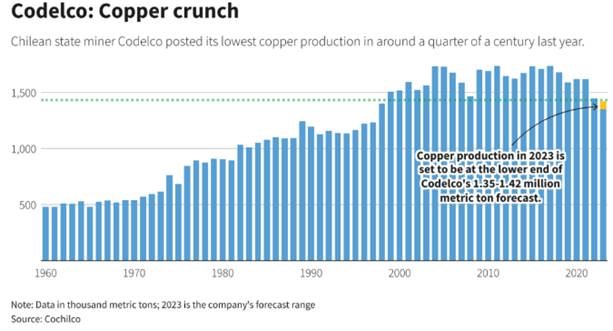

Copper production is quite low.

This from Chilean producer Codelco – showing a 14% decline year on year and we know that majority BHP owned Escondida mine production is down 21.5%.

So, if you want to tie together a few things then think “world in drought and an increased shift towards renewables” along with “copper production lowest in 25 years” and you can see why I maintain my core holding in copper miners.

Big risk to this is going to be global growth slowing demand, which quite frankly it’s possible we’re seeing the start of now.

No change to position to maintain cash levels here with an eye to put dividend payments to work in the bond market, await the yield drop in once the recessionary indicators are glowing and rotate balance into equities through year end.

However, if you’re looking for signs of global growth slowing don’t look below. The world set another record in air traffic.

A good reminder that all things are related.

Stay safe and all the best,

James

The views, information, or opinions expressed in the interview in this article are solely those of the writer and do not represent the views of Stockhead.

Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.