FREE WHELAN: In these troubled financial times comes a troubled but heroic financial advisor in a boat

Via Getty

In this Stockhead series, investment manager James Whelan from VFS Group offers his insights on the key investment themes and trends in domestic and global markets. From macro musings to the metaverse and everything in between, Whelan offers his distilled thoughts on the hot topic of the day, week, month or year, from the point of view of a professional money manager.

There’s been some conversation about the Australian Economy potentially heading for troubled waters. I’d like to expand on that this week, hopefully bringing some light to the areas to be aware of and help guide portfolios through what could be a rough time.

As an opening gambit, I strongly believe that Tuesday the 6th June was the day when most of the Australian psyche capitulated.

Phil Lowe isn’t joking and the impact of that rate hike was felt deep in the stomachs of mortgage holders. However we base decisions on more than feelings, hence the following.

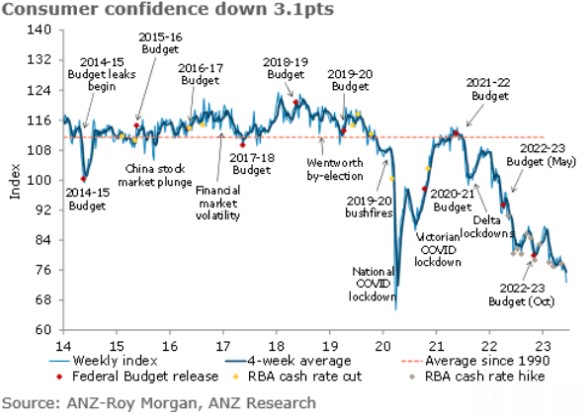

Confidence

Firstly, let’s take a look at confidence. ANZ are always good with this chart and it’s easy to understand. We’ve been closely watching confidence since late last year. Senior ANZ Economist Adelaide Timbrell was on the podcast near Christmas where we discussed the phenomenon that was taking place of “Sydney restaurants full of people complaining about how bad the economy is.”

Because as the confidence index declined to near COVID-lows we still saw spending continue to show resilience.

Think Phil Lowe standing at the Smiggle register shaking his head disapprovingly as you buy another overpriced pencil case for the kids.

Not anymore

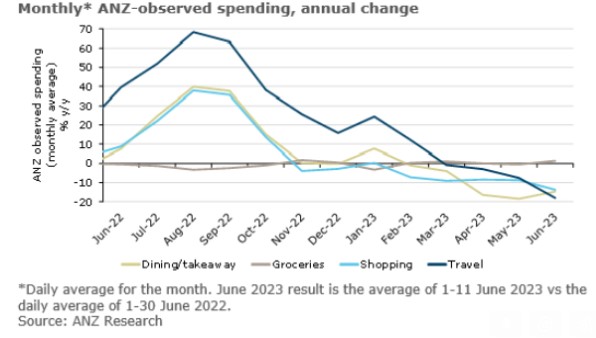

Now we have some fresh numbers, again from ANZ.

Remember that we’re wanting spending down to stop the rate hikes…

This seems like it’s back on the right path. The right path being downwards. Bad news is good news and this is bad news…for companies that rely on discretionary spending.

I believe that the latest RBA hike in the first week of June was the straw that broke the dromedary. As mentioned in my Tuesday note there are levels that families go through with regards to discretionary spending habits. Going out for pizza gets downgraded to eating in which becomes nothing. Whatever you can do to keep paying the mortgage is the right choice.

This is concerning…

Even with the cuts people are making you see a chart like the above and you have to be concerned.

Mortgage delinquencies are up and that’s bad. The RBA is continuing to squeeze families in the face of an economy a few days behind on their payments. Emotions aside the labour market is not helping the case for the RBA to pause, with 75900 roles added in May, over four times the forecast gain.

Are we there yet, yet?

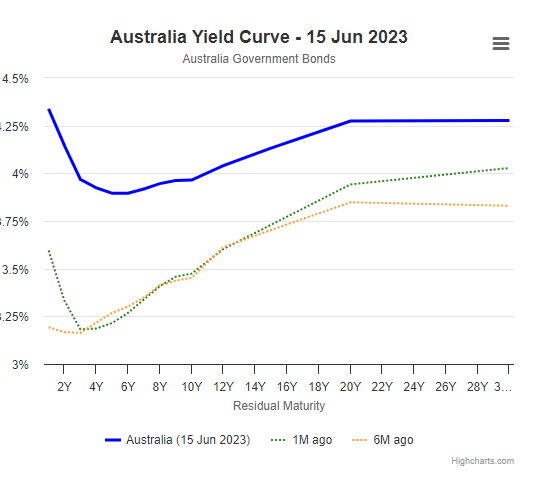

The local bond market has, finally, inverted in the 2 year vs 10 year yield. There’s pages of work on various points of the yield curve flashing different signals but keeping it simple enough it’s a clear indication that markets are pricing the risk of recession.

New Zealand has been a few steps ahead of the world with regards to their cycle, tightening harder and earlier so no surprises when this week saw them officially move into a technical recession.

Again, nothing is guaranteed, but I’m happy to commit to the thesis that outside of sport, art, music and cinema… where NZ goes so too does Australia.

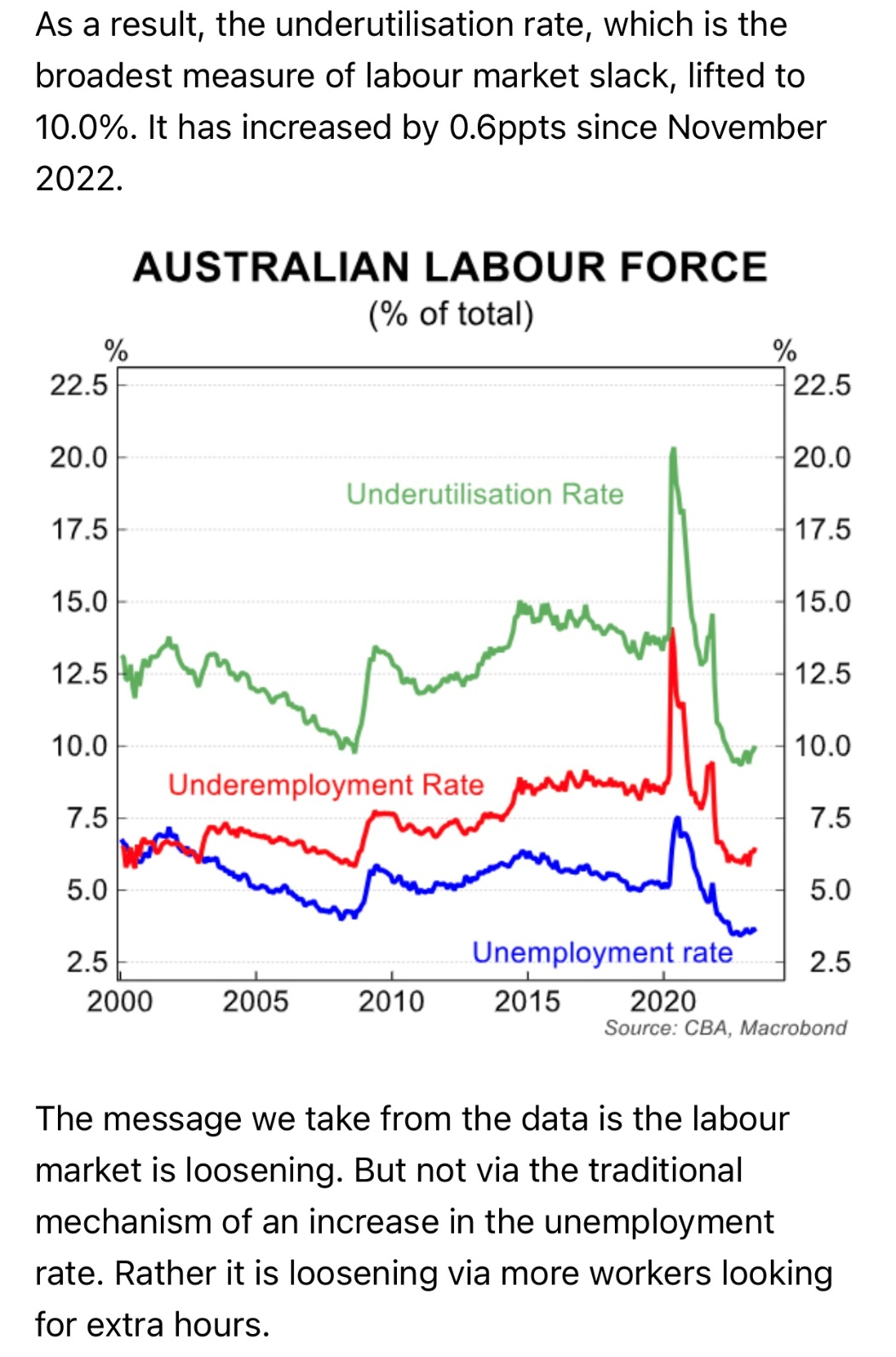

What about employment?

If you think the labour market is still too strong don’t be too sure. Head of Australian Economics at the CBA, Gareth Aird dropped this paragraph in to a recent note.

The market is loosening because folks are out needing the hours. Interesting.

So, we’re in a recession? What happens now?

It’s been a long time since we’ve felt a true recession.

I don’t count Covid as a recession because we all went out and bought two monitors and a laptop and booked Uber Eats. The irony that those days are now causing these days is not lost on me.

What to own?

In a recession cash is king, which is great if you’re able to time the market perfectly. I cannot do that and I’ve been doing this a while. I can’t possibly advise anyone to do it either. Best I can do is have a larger than usual allocation to cash awaiting discounts to present themselves.

I’m reminded of the interview we did with Emma Fisher of Airlie Funds Management who reminded me that Australia doesn’t go “Boom to Bust” but more likely Australia goes “boom to muddle through” and I’ll stand by that this time around too.

Keep in mind, however, that the great China reopening we all pinned hopes on has pretty much run its course. They’re needing to stimulate to try and find the spark again, but that’s a whole other note on its own.

At these levels I’m continuing to recommend a long bond position on portfolios. Overallocation preferred for me.

Steer clear of discretionary, it doesn’t look healthy here or into the future.

I prefer staples obviously, basing this on the pizza theory that people may not eat out but they still need to eat. Cheaper is better.

Emerging Markets

If you require an equities exposure to be maintained, which we recommend, then India is still a great way to have this exposure.

I’ve written athletically in this outstanding publication before about the closed market of India being a natural buy.

I can’t have the same conviction for commodities that I once did… however I reiterate that copper and oil are underestimated.

For more information please send me a note and I’d be more than happy to discuss the path ahead.

All the best,

James

The views, information, or opinions expressed in the interview in this article are solely those of the writer and do not represent the views of Stockhead.

Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.