Free Whelan: China simply HAS to reopen. The only questions are WHEN, HOW and WHAT will it look like?

Via Getty

In this legendary Stockhead series, investment manager James Whelan from VFS Group offers his insights on the key investment themes and trends in domestic and global markets. From macro musings to the metaverse and everything in between, Whelan offers his distilled thoughts on the hot topic of the day, week, month or year, from the point of view of a damn fine professional money manager.

Morning all,

We’re on multiple watches on multiple fronts this week.

Better start with the worst, because it’s now Day 254 of the Russian invasion of Ukraine.

(Ed: From our brothers at AJ):

Putin endorses evacuation of Ukraine’s Kherson region https://t.co/geC2MFfobP

— Al Jazeera English (@AJEnglish) November 6, 2022

Meanwhile there’s been the usual round-the-grounds condemnation of Russia reneging on the UN brokered Black Sea Grain initiative. The mid-term focused Americans getting out front there:

US President Joe Biden: A move “purely outrageous” and which will increase starvation.

US secretary of state, Antony Blinken: Russia is weaponising food.

But what are markets watching?

As it stands there are only three things driving markets: China, the Fed and US midterms.

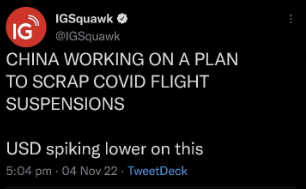

As everyone knows I’ve been banging the drum on China. If the furiously forbidden red gates ever do reopen, it’ll be a massively bullish trigger for the market. What we saw on Friday confirmed what will happen when that is actually announced.

Currently (and this may change by the time I finish the sentence) China hasn’t officially announced a reopening.

The internet financial channels have had wind of a special reopening committee being formed while at the same time running stories of Shanghai Disneyland getting shut, with the guests locked up and trapped inside like some kind of Disney nightmare because of a single positive Covid case discovery.

Markets popped and then dropped, then did it again on more legitimate news.

A Zero to Hero COVID-policy?

How it started…

How it’s going…

What we know is that markets ARE pre-gaming this news. Of that there is zero doubt. One can Xi it everywhere one turns.

China HAS no choice but to reopen. The question is only when and in what manner.

Or does that even matter?

The facts we have in front of us are that Chinese companies now have a higher level of “uninvestibility” than in times past.

The new guys running the show in the CCP are just a bit too much for me with regards to what little transparency there was in China. You’ll be safe and happy holding your little Shanghai Fudan Microelectronics Group Co. Ltd and then BANG one day it’s made property of the state.

I’m suggesting to people that the better way to gain access is via the second or third derivative of a China reopening.

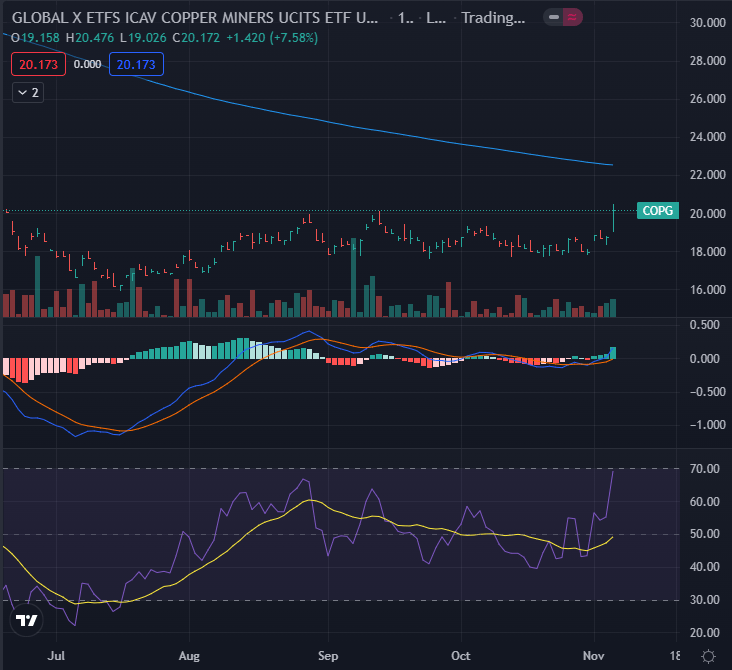

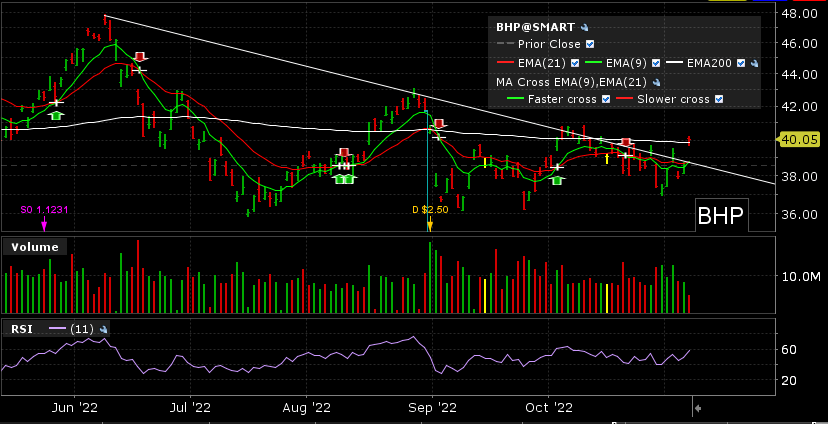

We saw what happened to copper on Friday on Chinese news and there’s a reason we hold COPA and BHP.

We’ve held the Copper ETF COPA for a while now in the face of retracting global growth but because it’s been in USD it’s held up okay.

Copper runs on China reopening news – fact.

An all JW Idea: Long Copper ETF (COPG.LSE)

It’s the Global X Copper Miners ETF so you’re buying companies still instead of the direct exposure to copper and it’s in GBP so any decline in USD on China rallying is mooted.

The theory being that while the AUD rallies on China popping back it should rally against the GBP less than the USD.

I wish there was a more pure play exposure to copper and iron ore listed locally but for the life of me I can’t think of one…

I mean… except The Big Australian.

Which just happened to be having a very big Monday as I wrote this.

If you really want to own Chinese companies then I prefer CNEW to KWEB.

CNEW provides access to actual Chinese listings instead of the offshore ones (HK & NYSE) and it’s listed here.

Red Wave

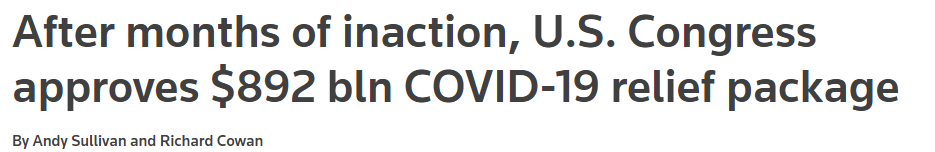

Aside from owning BHP we see that the midterms will consist of a Red Wave and usually that’s a good sign for markets. Republicans at least don’t blow billions of dollars on stimulus…

Fed Up?

Except… you know…

I won’t even go into the Fed.

The rug pull happened. Mum & Dad arrived back from dinner out and discovered us drunk on the couch after stealing too many swigs of scotch out of the liquor cabinet.

The beatings will continue until morale improves.

I go into it and more on the podcast recorded on Friday with David Sokulsky of Carrara Capital.

That’s all except for this.

The market is healing at least.

Stay safe and all the best,

James

The views, information, or opinions expressed in the interviews in this article are solely those of the interviewees and do not represent the views of Stockhead. Stockhead does not provide, endorse or otherwise assume responsibility for any financial product advice contained in this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.