And now for the Top 10 Geopolitical Nightmares 2024 may never wake up from

Premeditated Morning Raccoon Attack: not even in this year's Top 10) Via Getty

I’ve long been an advocate of the old school journo’s aphorism: “If it bleeds, it leads.”

That’s why I make sure to punch Reuben on the nose, every time one of his rock operas steals the Stockhead front page.

But in these woke days of digital listicles and viral ejecta, I am learning to adhere to the new schools of thunk.

In particular I’m now liking: “If it offends or heart rends, then it trends.”

On that sparkling note, here’s something out of the Lazard Geopolitical Advisory: Top 10 geopolitical trends in 2024.

“The current geopolitical landscape is fundamentally more volatile and (is) reshaping global financial markets, dramatically impacting corporate decision making,” according to the head of LGA, Theodore Bunzel.

Certainly 2024 looks like being another year of extraordinary geopolitical volatility.

We have a lot of war, (two stellar ongoing conflicts,) what appears to be the resurgence of great-power competition, and a fraught global electoral cycle all which will ensure that geopolitics remains front, centre above, below and all over what businesses need to know in the coming 12 months.

“Two active wars provide a backdrop to this year’s geopolitical outlook. In the Middle East, 2024 will see the conflict enter its next phase,” Bunzel’s team notes.

“While Israel’s operations inside Gaza may wind down, the regional struggle pitting the US and Israel against Iran’s ‘axis of resistance’ will continue, posing significant escalation risks and resurrecting the threat of global terrorism.”

So, really, good luck ‘fighting the Fed’ this year, if you’re not taking into account the shipping disruptions in the Red Sea, friction over Iran’s advancing nuclear program, not to mention a spillover and escalation of the Israeli war into the West Bank or Lebanon – any of which could upend oil markets, draw in outside actors and do all sorts to commodity prices and trade.

“Although the critical players — Israel, Iran, the US, Saudi Arabia et al — seek to avoid a major widening of the conflict, the situation is trending towards greater risk of escalation,” according to the LGA team.

In Ukraine, Lazard says the “lines of control will likely stay stalemated throughout the year as Vladimir Putin waits out Western support (and the US election) and Ukraine rebuilds its offensive potential after a failed summer counteroffensive.”

But, stalemate doesn’t mean static.

“Russia may launch another offensive this year, while the Ukrainian military has promised operational ‘surprises’ as it seeks to shake up the battlefield.”

But at least on that front, LGA believes the risks of a major escalation in 2024 ‘appear limited.’

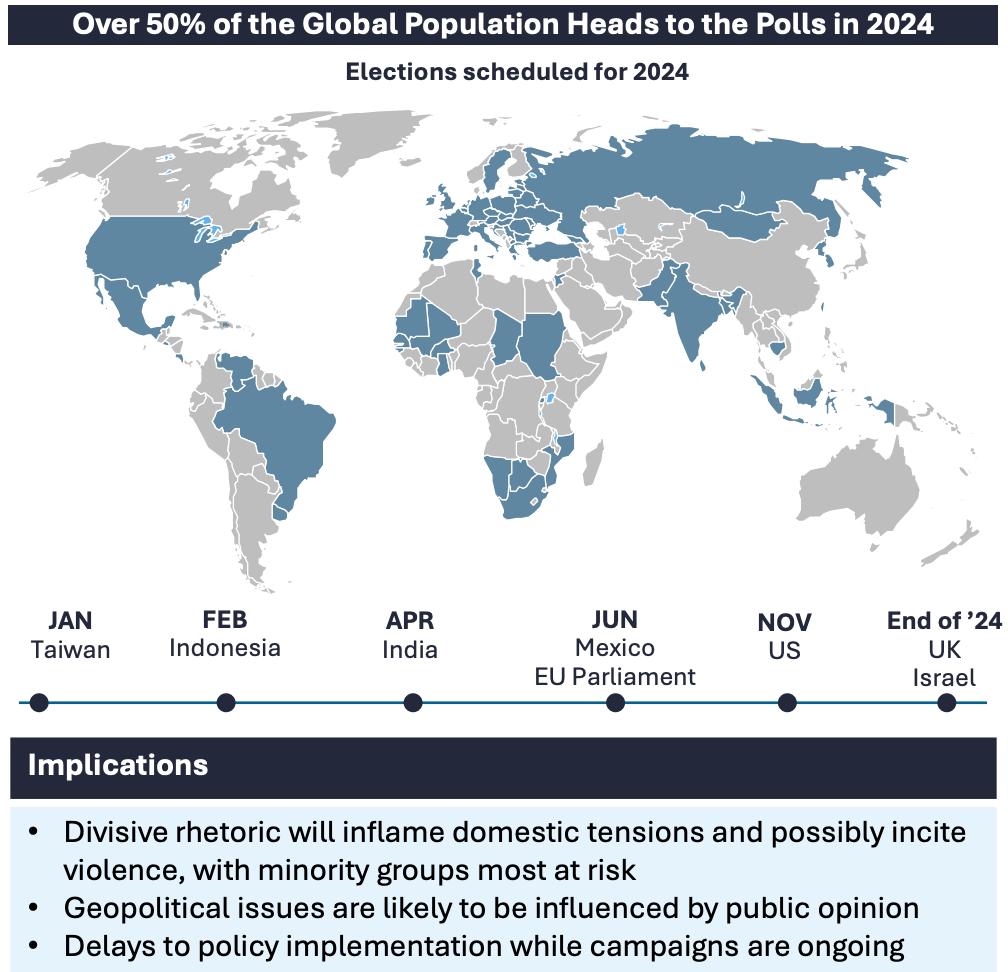

However, against this uncertain backdrop, over half of the world’s entire population will head to the polls in 2024.

The US election is most consequential, but the elections in Taiwan, India, the UK, Mexico, and elsewhere will be globally and ideallogically significant.

At the same time, structural shifts in the global economy will accelerate in the next 12 months, Bunzel warns.

“China is settling into a ‘new normal’ of slower growth while continuing its strategic competition with the West.”

This poses challenges for Australia as a major Chinese supplier and for the global economy… ‘while creating tailwinds for new investments in places like Latin America and Southeast Asia.’

Lazard Geopolitical Advisory: Top 10 geopolitical trends in 2024

The world chooses (electoral cycle)

In 2024, Lazard says an unprecedented number of voters will head to the polls.

“An estimated 76 countries are scheduled to hold elections, including some of the world’s most populous — Bangladesh, Brazil, India, Indonesia, Mexico, Pakistan, and the US — making 2024 a year of political upheaval.”

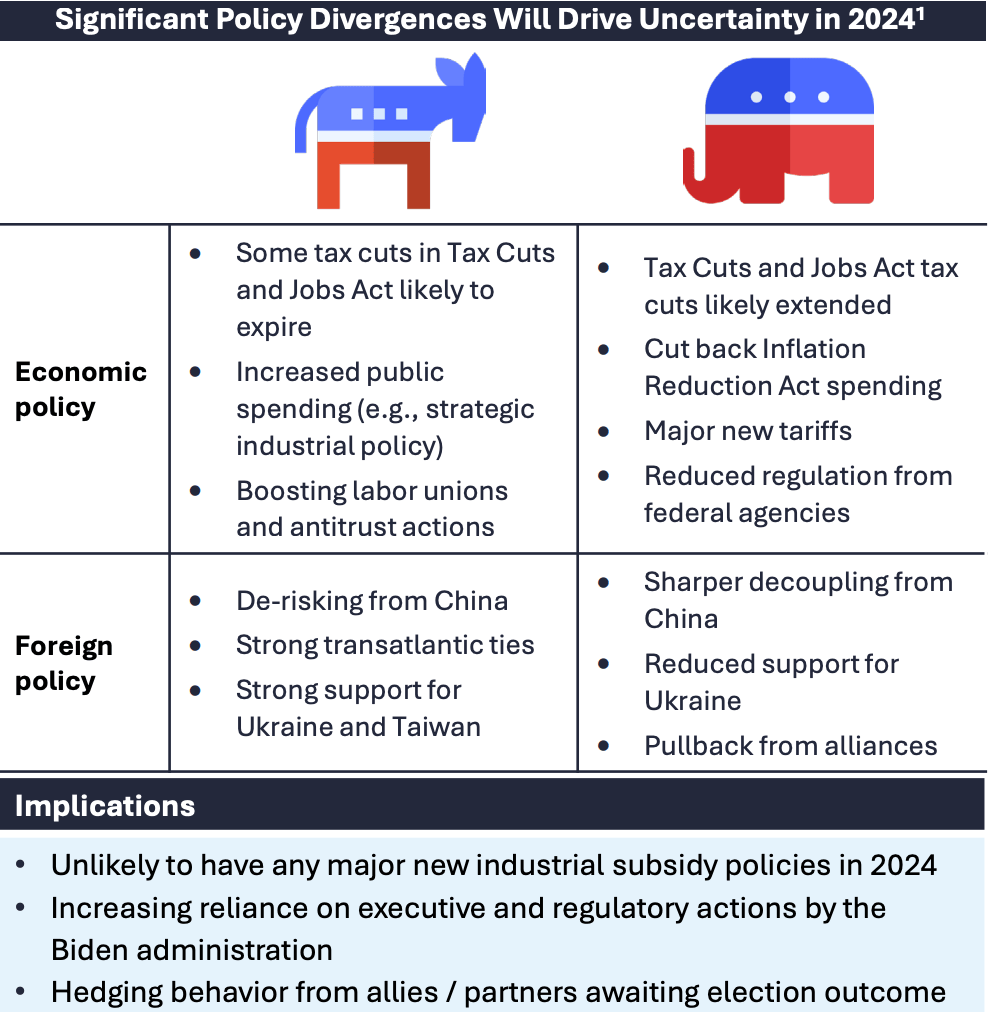

America’s reluctant rematch: The 2024 Presidential Election

Lazuras says that most significantly, the return of Donald Trump in the US would upend US foreign policy once again. A Trump victory would portend changes on major issues, including support for NATO and Ukraine, the outlook for conflict in the Middle East, and the direction of global trade.

“A record share of Americans hold unfavourable opinions of both major parties and their respective frontrunners. Low voter enthusiasm and divisive partisan rhetoric will cement stalwart bases of support while further eroding the middle ground.”

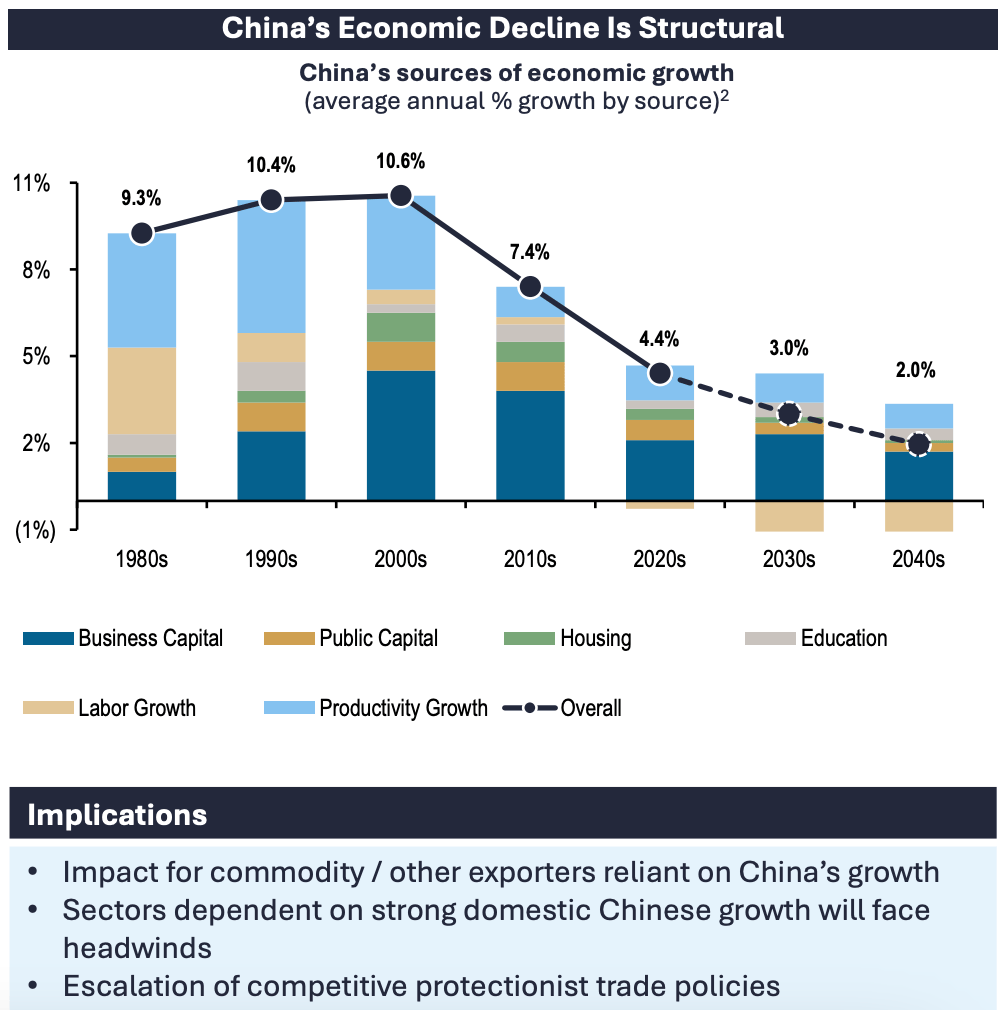

China’s miracle fades: A secular slowdown

The scope and scale of China’s economic miracle over the past 40 years was great. Terrific even.

But the days of China ‘captur(ing) the world’s imagination as the engine of the global economy’ won’t be seen again this year.

Today, Lazarus reckons, China’s economy is facing a gearshift — the era of rapid growth is over, and the probability of economic stagnation in the medium-to-long term is rising.

This secular shift in China’s economy and, by extension, the global economy will be a significant factor in 2024. The “new normal” will predominantly impact countries like our own whose own growth has relied on China’s manufacturing role in the global economy.

“Specific industries, including chemicals, electronics, automation equipment and machinery, and manufacturing, will face slower demand globally.

“China’s own reaction to its slowdown will be determinative in the long run. In the short term, Beijing is likely to lean on exports in 2024 to drive growth, driving down prices and putting pressure on producers elsewhere. Europe has indicated it will react strongly to any attempts to dump Chinese products in the EU single market, while the US will likely also respond in kind. Trade tensions could lead to an increase in protectionist policies and greater market volatility in the near term.”

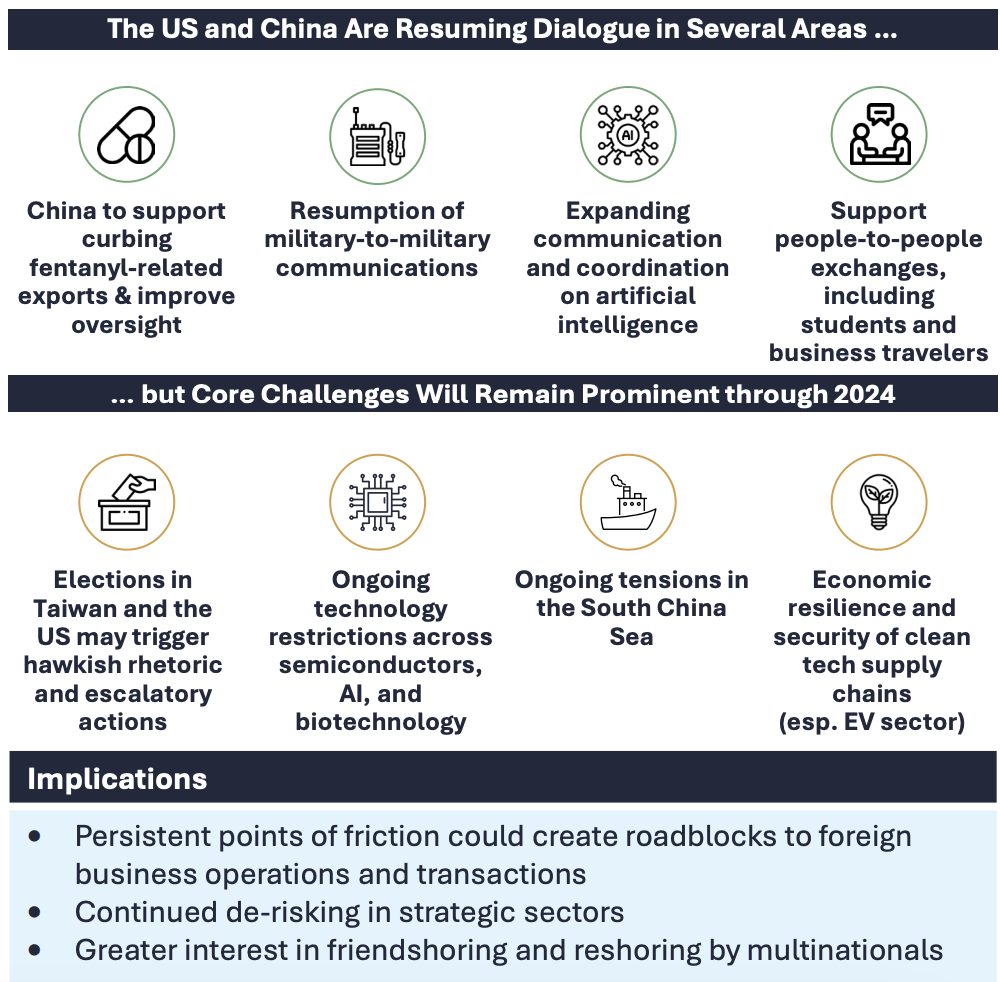

Fragile US-China détente put to the test

US-China relations actually ended 2023 on some relatively positive notes like the face-to-face meetings between Presidents Xi and Biden, as well as other senior officials.

Both governments sought to improve the state of deteriorating bilateral relations, with the US especially focused on setting a “floor” for the relationship.

The actual strength of this “floor” in the new year begins with Taiwan’s presidential election this weekend.

On January 13, a victory for the Democratic Progressive Party (DPP) will solidify Taiwanese desire for autonomy, test Xi’s image as a strongman and very likely trigger an ugly response from the direction of Beijing to be sure.

Other flashpoints, according to Lazarus, will include US plans to implement additional restrictions on outbound investments, exports, and trade; provocative rhetoric regarding China during the 2024 election cycle; and ongoing tensions in the South China Sea.

“As a result, corporations and investors will need to think strategically about how they will navigate the ups and downs of a relationship defined by strategic competition. ‘Friendshoring’ destinations, such as Southeast Asia, will also continue to benefit in the year ahead.”

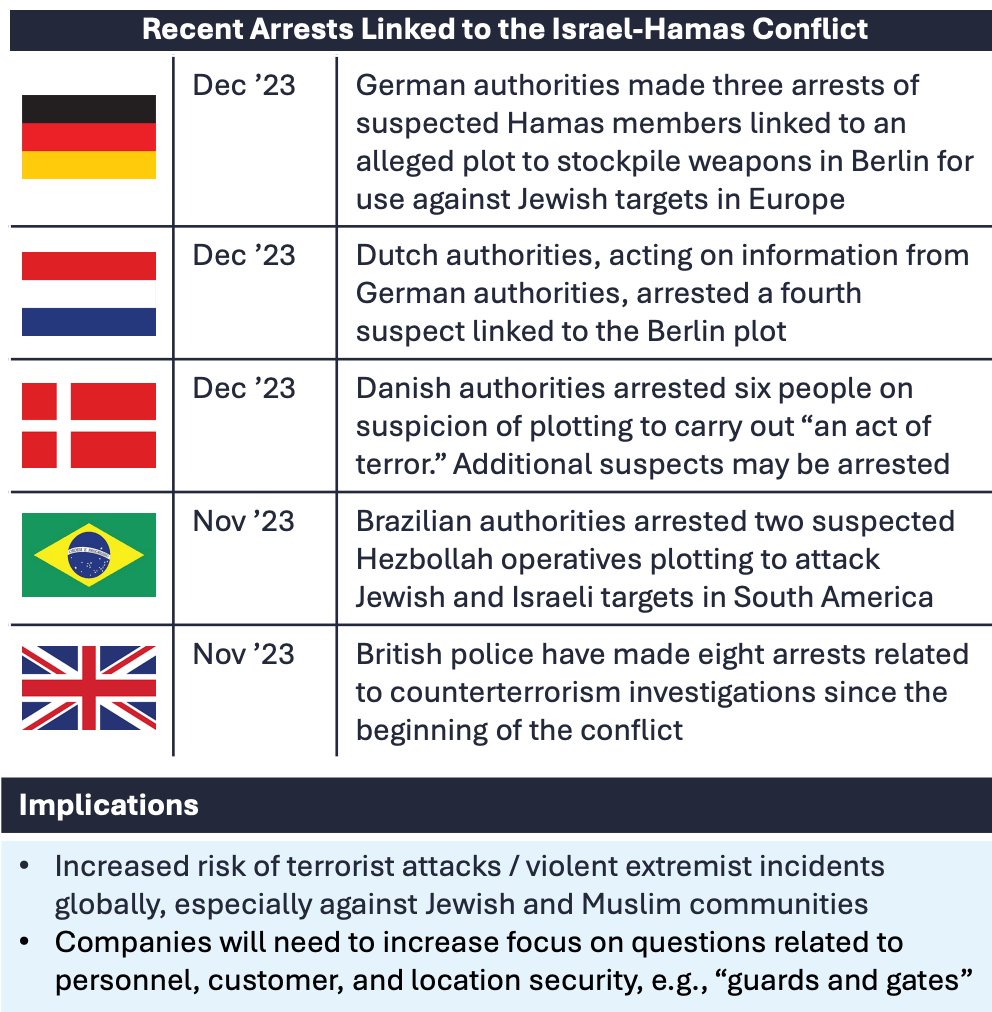

Resurgence of global terrorism threat

As with past conflicts in the Middle East, the current fighting in Gaza is changing the nature of the global terrorism threat.

The highly charged conflict is creating incentives for terrorism globally, “the likes of which we haven’t seen since ISIS,” according to FBI director Christopher Wray.

“Hamas’ political wing is also explicitly encouraging such attacks, calling for ‘violent acts against American and British interests everywhere’ and other countries supporting Israel,” Lazard says.

“Recent arrests in Denmark, Germany, and the Netherlands were based on suspected plans to carry out attacks on Jewish institutions. The Israel-Hamas conflict has also reinvigorated white supremacist groups and domestic extremist threats. Increased kidnapping by terrorist groups is another possibility.”

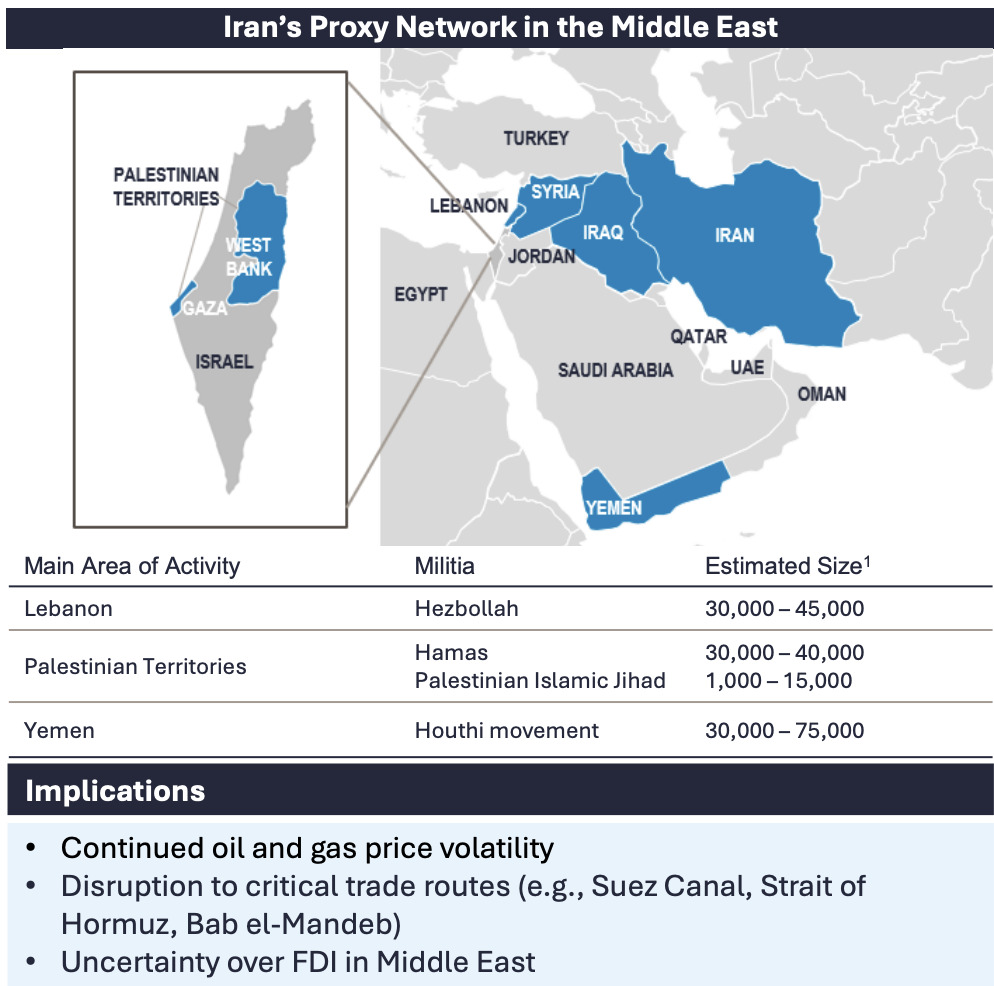

Edging towards escalation in the Middle East

“Israel’s operations in Gaza have emboldened Iran and its proxies, who are bringing the region closer to more direct conflict between Iran and the US & Israel.”

The ongoing conflict in the Middle East has brought those ever-simmering-not-so-latent tensions to the fore between Iran and its proxies on one side and the US and Israel on the other, rekindling concerns about a possible regional escalation of violence.

Since October 7, Iranian proxies have intensified attacks across the region — and while Tehran may not be directing individual actions, it does appear to be encouraging escalation by its proxy groups.

Attacks by Houthi rebels in Yemen have so far had the greatest economic impact.

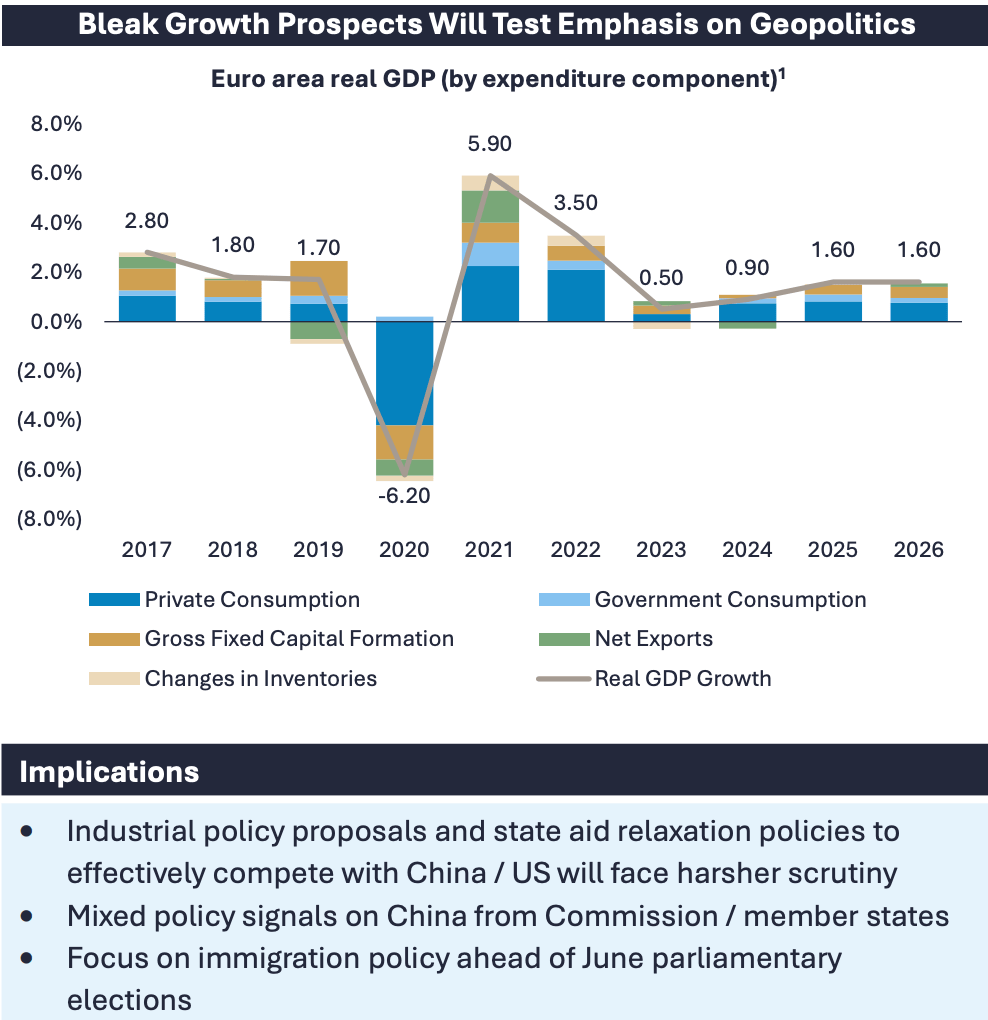

Europe’s conundrum: Is unity a bridge too far?

Big, comparatively brave European steps to deal with COVID, support Ukraine and try to ‘de-risk’ from China, marked the birth of what the Dutch EU Commission president, Ursula von der Leyen, coined the “Geopolitical Union.”

Since then, the EU has framed many of its flagship policies in security terms: the green transition = energy security.

But the key moves are closer alignment with the US against a rising China, and unflinching support for Ukraine in the face of a revanchist Russia.

Lazarus points out that while EU support for a more hawkish approach to China continues to grow, a challenging economic outlook and the possible return of a less transAtlantically inclined US are setting the stage for a slower rollout of

the EU’s economic security package.

“Member states are deeply concerned about Europe’s economic competitiveness and the state of the single market. Recent downgrades to the EU and eurozone’s growth prospects in 2024 highlight the pressures facing European governments and the EU in the year ahead. Germany, in particular, is at odds with many of the economic security goals now being pursued in Brussels.”

Tech war’s next front: AI and biotechnology in the crosshairs

Lazarus says that security considerations will translate into stricter rules for investment in, and global commercialisation of, AI and biotechnology

Semiconductors dominated the headlines in 2023 as the industry started to manage evolving Western government concerns regarding exporting the most advanced technology to China.

“In 2024, governments will zero in on the risks artificial intelligence (AI) and biotechnology pose to national security and the economic resilience of their supply chains… Ongoing strategic competition between China and the US will continue to play out on the tech front as innovation and technological advancement are seen as key barometers of economic competitiveness, military capability, and global influence.”

The EU is similarly animated by its emerging economic security agenda and the importance of “derisking” from China.

Meanwhile the firms says that the explosive emergence of generative AI and the rise of synthetic biology have cemented AI and biotechnologies as the next frontiers of innovation.

A recognition of the vast possible gains and possible catastrophic risks made possible by AI and biotechnology is motivating regulators’ interest. Where biotechnology can vastly improve lives and cure problems, for instance, it can also be leveraged for biowarfare applications or genetically modified diseases targeting specific populations, which has serious national security implications.

As a result, states are increasingly classifying biotech and AI as “strategic sectors.”

In 2024, the AI agenda will move from policy formulation to implementation as the now-finalised EU AI Act moves forward and US agencies begin executing President Biden’s AI executive order. Other countries will also be rushing to put forward their own AI policy frameworks with likely be more prescriptive rules by governments around the world.

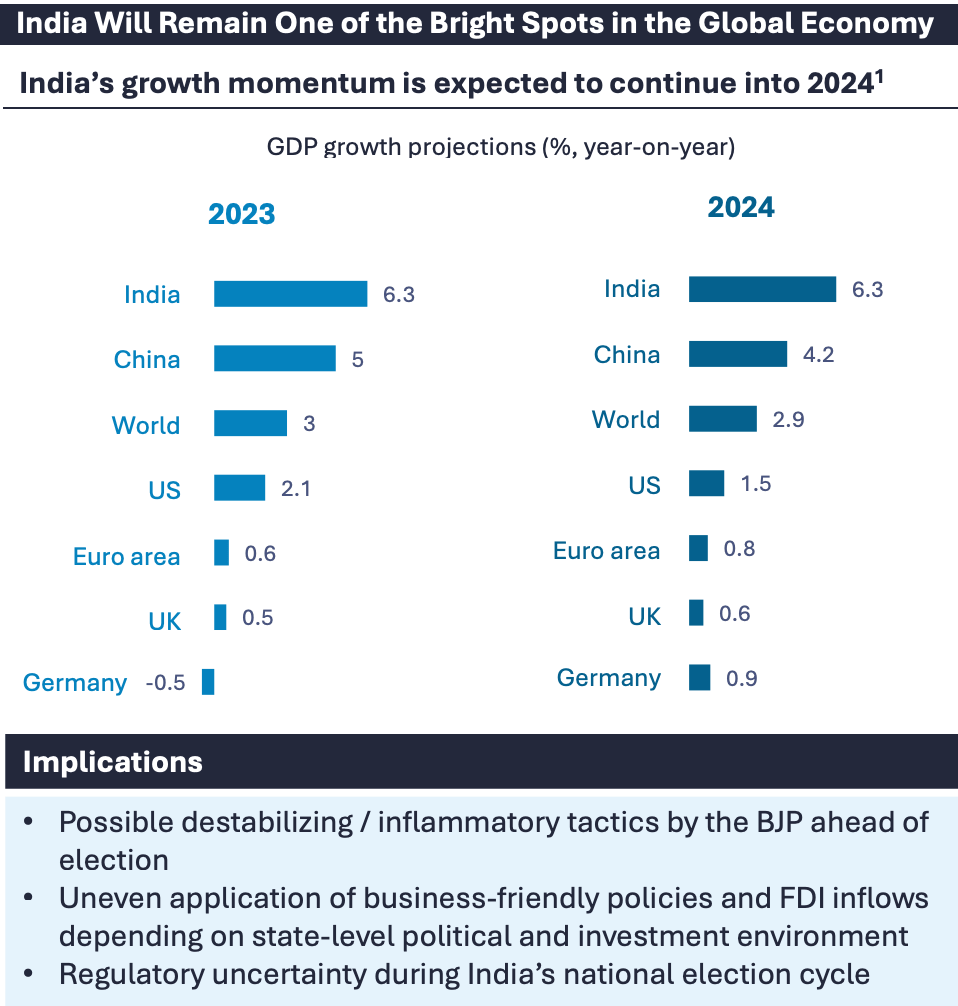

Modi’s India at a crossroads

In 2024, India is expected to maintain its position as a top-performing emerging market, benefiting from the shifting geopolitical environment and its role as a counterweight to China in the Indo-Pacific region.

Record stock-market valuations and surging foreign inflows in 2023 have set the stage for continued growth in 2024, with the World Bank recognising India as one of the few bright spots in an otherwise challenging global landscape.

The 2024 elections will be a crucial test for Prime Minister Narendra Modi, his nationalism and his economic policies. With projected 6% GDP growth and recent Bharatiya Janata Party (BJP) successes in state elections, Modi’s position appears

strong heading into the 2024 elections.

Under Modi, India has made significant progress in streamlining the economy and promoting national integration. But, the BJP risks undermining recent tailwinds with inflammatory Hindu-nationalist rhetoric which could easily lead to sectarian violence as it has in the past and stimie India’s best-on-field investor confidence.

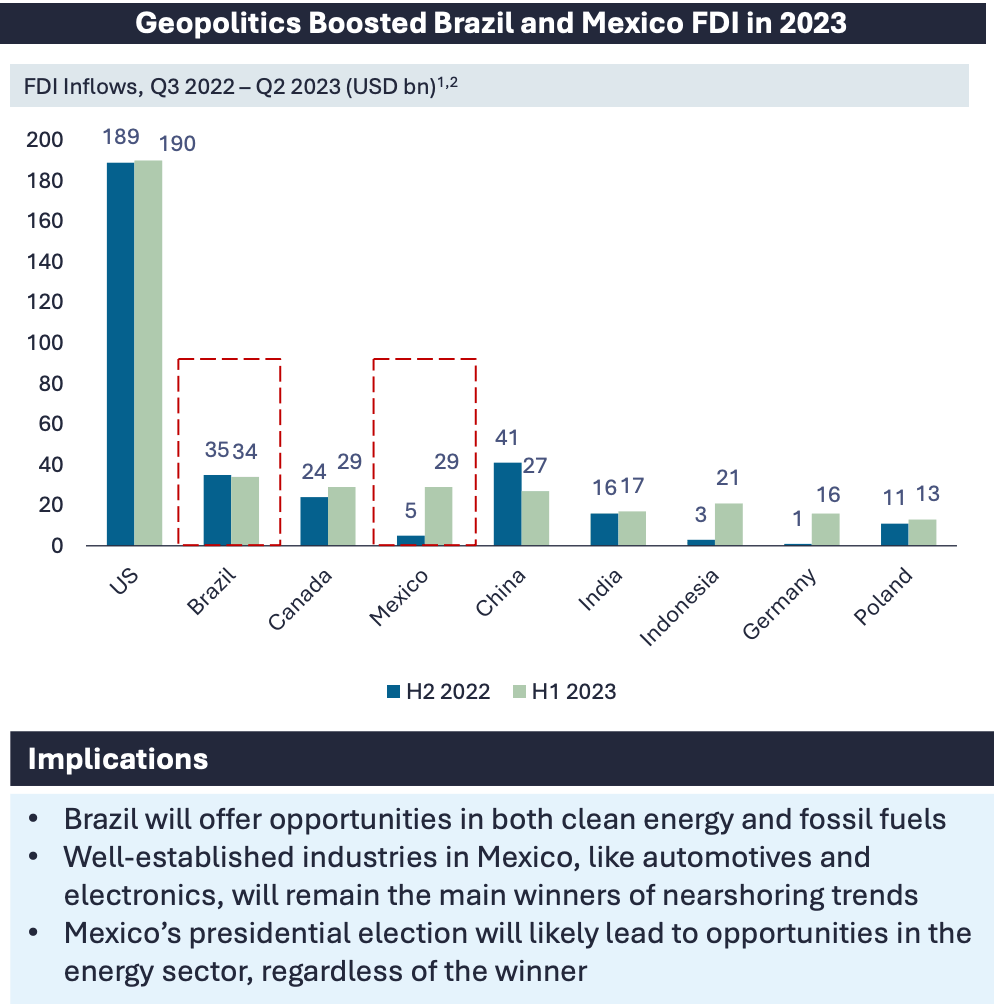

Latin America’s giants: Brazil and Mexico in the spotlight

Brazil and Mexico have benefited — and continue to benefit — from the geopolitical “new normal” defined by US-China strategic competition and global economic fragmentation. Both countries are winners in a challenging geopolitical landscape, capitalising on reconfigurations in global supply chains and commodity markets.

Challenges in 2024, however, will test this momentum, according to Lazarus.

Toppy commodity prices, bolstered by wars in Ukraine and the Middle East, will likely continue to represent a major economic win for Brazil and Mexico has similarly benefited.

Mexico surpassed China as the US’s top trading partner as the promise of nearshoring has started to materialise, though the US remains sensitive to ensuring that China does not access US technology via Mexico.

Brazil’s lefty President Luiz Inácio Lula da Silva is expected to take on a more controversial, international profile in 2024. With Brazil assuming the G20 Presidency in 2024 and hosting COP30 in 2025, President Lula will benefit from the spotlight of various international platforms to espouse his proto-Marxist views challenging the Western-dominated world order.

“He may choose to push for policies such as an end to US-dollar dominance or support for some Russian claims in Ukraine, generating political headwinds as investors evaluate Brazil’s economic attractiveness,” Lazarus notes.

But then elections in June may revive some uncertainty.

However, Lazarus reckons the ruling party candidate Claudia Sheinbaum is expected to win and will represent policy continuity, along with some potentially new favorable policies in sectors such as energy.

“Inflammatory rhetoric regarding Mexico in the US election, especially on immigration and border security, may cause distractions, but ultimately Mexico’s attractiveness for near shoring will continue to draw investment.”

This will pose challenges for the global economy while creating tailwinds for new investments in places like Latin America and Southeast Asia.

In short, this year is likely to be a bumpy ride.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.