2020 ‘got old fast’ – where money is moving next, and which ASX small caps could benefit

Pic: Stevica Mrdja / EyeEm / EyeEm via Getty Images

In post-COVID capital markets, “yesterday’s winners are today’s losers” says Randal Jenneke, head of Australian equities at global fund manager T.Rowe Price.

Yesterday’s winners include high-growth tech names and ecommerce plays that dominated the 2020 market rally.

But “2020 got old so fast”, Jenneke says.

Things changed in November, when the COVID-19 vaccine results were first announced.

So far in 2021, ‘Value’ has (finally) trumped ‘Growth’.

Why? “We know why (ahem…inflation),” Jenneke said.

Those inflation expectations fed into February’s bond market scare, as yields rose and the valuation models for companies with high growth and low profits (or losses) got tweaked.

Will ‘Value’ maintain its edge?

Looking ahead, Jenneke said nothing is that simple in what is “one of the strangest economic recoveries I’ve seen”.

Where to next?

The November vaccine news marked the first possibility of global economic activity returning to some kind of normal.

In that context, short-term demand for established Value stocks tied to the broader rebound makes sense.

However, “this is not a surprise as the market tends to be fixated on the short term”, Jenneke said.

‘Value’ stocks in Australia primarily means the big banks, given their weighting in the local index.

And in comments to Stockhead, Jenneke highlighted that financial stocks – a market laggard for years – got a boost from higher growth and inflation expectations.

“That’s partly as bad debt expectations have reduced, but primarily because higher inflation/interest rate expectations are resulting in stronger projections for Net Interest Margins,” he said.

However, there are a few reasons why the growth vs value debate could take more twists and turns as the ‘strangest recovery’ continues.

Fade the trade

Consulting their own crystal balls, central banks globally have taken pains to prepare markets for higher inflation through the middle of 2021.

The premise is that annual inflation growth will be transitory, given pandemic deflation took hold at the same time last year.

Low base effects are also a factor in what’s now expected to be a “dramatic economic expansion in 2021”, Jenneke said.

But by year-end, that’s where the “acceleration ends”, based on the economic growth projections of most major economies.

So for investors, “it’s critical to think about the inevitable fade of this inflation trade’,” he said.

Balancing act

For some extra layers around the inflation debate, a research note from UBS this week outlined the competing forces at play in the post-COVID recovery.

The UBS equities team (led by analyst Pieter Stoltz) maintains the view that “an inflation outbreak is unlikely”.

The rise flagged by central banks will see annualised inflation growth hit 3.5pc in the June quarter and then “moderate thereafter”.

“However, booming business conditions and an improving labour market suggests upside risk to CPI,” UBS said.

Inflation is a complex beast and investors are going to have to make a judgment call.

But if inflation proves to be more stubborn than transitory, UBS said these ASX small caps are well-placed to protect their pricing power:

| CODE | COMPANY | SECTOR | PRICING POWER | PE Ratio (12m-fwd) |

|---|---|---|---|---|

| AX1 | Accent Group | Discretionary retail | STRONG | 16.2 |

| ALU | Altium | Tech | STRONG | 56.7 |

| ARB | ARB Corporation | Discretionary retail | STRONG | 32.5 |

| CQR | Charter Hall Retail | REITs | STRONG | 14.0 |

| DHG | Domain Holdings | Media | STRONG | 57.7 |

| GOZ | Growthpoint Properties | REITs | STRONG | 15.5 |

| HUM | Humm Group Ltd | Fintech | STRONG | 6.9 |

| KGN | Kogan | Discretionary retail | STRONG | 22.25 |

| NAN | Nanosonics Ltd | Health care | STRONG | 123.50 |

| NEA | Nearmap Ltd | Technology | STRONG | -53.34 |

| SUL | Super Retail Group | Discretionary retail | STRONG | 12.2 |

| ALD | Ampol | Energy | WEAK | 17.58 |

| HVN | Harvey Norman | Discretionary retail | WEAK | 48.3 |

| FPH | Fisher & Paykel Healthcare | Health care | WEAK | 13.62 |

Growth vs Value – the BNPL debate

Will BNPL stocks – an early victim of the February shift into value – come under renewed pressure if higher inflation becomes more structural?

UBS added some extra context there too, noting the sector could benefit from the “higher volume of sales that accompanies an inflationary environment”.

“However, higher interest rates would mean the cost of funding would increase for these companies.”

On that front, Zip Co (ASX:Z1P) is “particularly exposed” because it relies heavily on debt funding, UBS said.

Conversely, “Afterpay (ASX:APT) is fully equity funded, and even if interest rates rise, interest costs are only a small component of their cost base”.

Afterpay has so far proved an interesting barometer for the inflation debate, as its shares dipped from almost $160 to less than $100 when yields began to rise.

Since then it’s rallied back to around $130 and is now eyeing off a US listing.

For Jenneke, the stock’s volatility is “partially a result of the oscillations we’re seeing between ‘themes’ in the market”.

However, he also attributed part of the rebound to fundamentals – a term that hasn’t always been synonymous with BNPL.

“They are the number one player in a very fast-growing segment with a huge addressable market,” Jenneke said.

“Data out of the US is confirming their growth there and we are seeing increasing foreign interest, as investors recognise the value of Afterpay’s leadership in the segment.”

Fiscal runway

More broadly, Jenneke said a key focus for investors looking to fade the inflation trade will centre around the extent of ongoing fiscal support.

The response from major governments globally is what first prevented COVID-19 turning into a calamity that froze markets entirely.

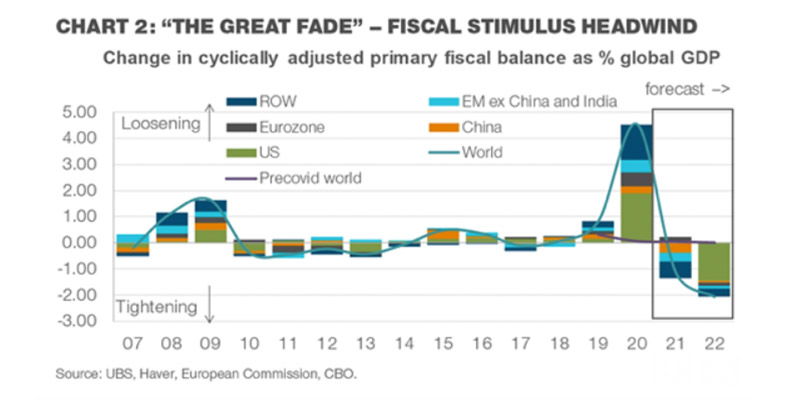

And this chart from T.Rowe Price illustrates the surge in fiscal support during the 2020 year:

Just as important in that chart is the projected outlook for 2021 and 2022, which indicates fiscal stimulus is due to tighten sharply as a percentage of global GDP.

In the absence of modern monetary theory — government spending financed by central bank purchases in the primary bond market – Jenneke believes there will still be a short spike in growth and inflation data for 2021.

“But the big question is, how much of this is already priced in?” he said.

“If the inflation trade is a 2021 story, beware the rush of money that will look for sustainable growth on the other side,” he added.

“What was a good trade in November (Value), may not be right now.”

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.