Trading Places: Which global bank is backing Myer and Cassius Mining has new, high profile substantial shareholder

Pic: Getty Images

- Japan’s UFG has bought into department store Myer, which has flagged strong results for FY22

- Magnus Energy Technologies chairman Frank Poullas has become a Cassius Mining substantial shareholder

- United Malt Group loses a substantial shareholder along with WA junior gold mine developer Kin Mining

Trading Places is Stockhead’s semi-regular, pretty damn fascinating recap of the latest red flag buying and selling of ASX stocks. It is here that the rubber really hits the road for fund managers, stakeholders, distant (and not-so-distant) relatives and other famous or infamous investors.

Specifically, Trading Places tracks substantial shareholder movements – namely when a trade in a company’s stock crosses or falls below the 5% threshold.

Substantial shareholders are usually directors, individual investors, institutional investors… or their distant (and not-so-distant) relatives, which they will refer to as listed related bodies corporate or something similar. You can see in detail these listed bodies on the company’s ASX announcement.

Shareholders are required by basic human decency (and the law) to publicly declare via the exchange when their personal stake goes below or above 5%, and from there, every movement in their holdings while owning above 5%.

The becoming and ceasing to be substantial shareholders are the ones we think are worth noting, where a trade takes an investor over the 5% threshold or has them drop back below.

Here’s the form to get you started, if reading this makes you twitchy.

Fortnight Overview

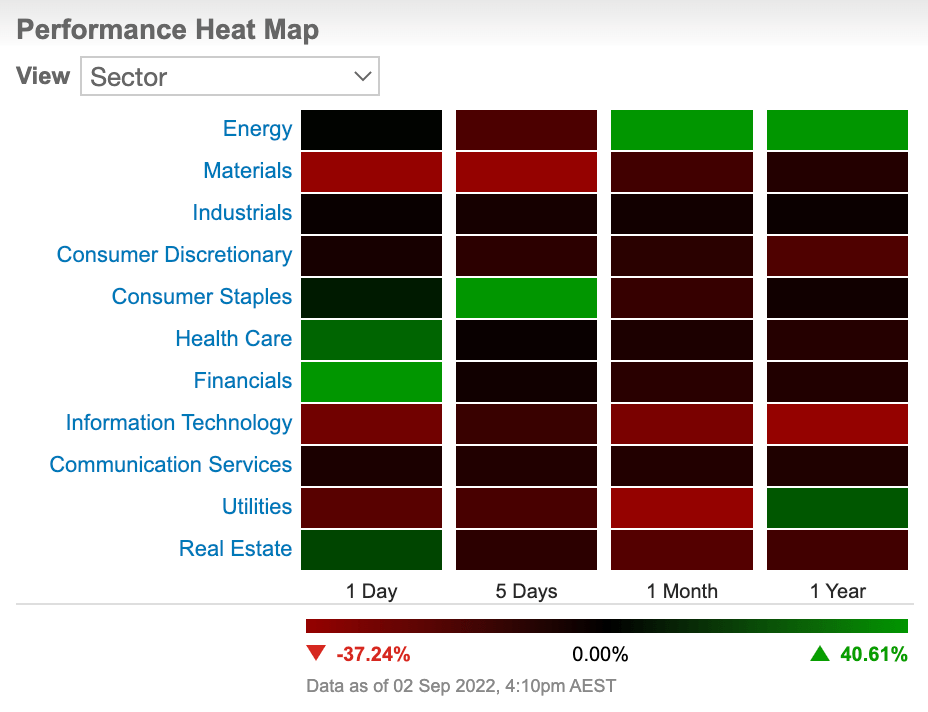

The ASX has continued its mercurial trend throughout 2022. Last week the benchmark ASX 200 index finished down almost 4%. Mining stocks dragged the broader index down as lithium and iron ore miners pulled back. Consumer staples were the only sector in the green.

Heading into the start of the week, the S&P/ASX200 lifted 0.34% on Monday. Today, all eyes will be on the RBA when the central bank holds its monthly rate-setting meeting. The RBA is expected to lift rates by another 0.5% taking the cash rate to 2.35% as it does “what is necessary” to bring inflation back to its 2-3% target.

There have been some large buys and sells on the ASX in the past fortnight.

Buyers

| Code | Company | Market cap | Date | Holder | Holding |

|---|---|---|---|---|---|

| OSX | Osteopore | $33.42M | Aug-22 | Irene Ng AI Chen | 6.89% |

| MYR | Myer Holdings | $414.75M | Aug-29 | Mitsubishi UFJ Financial Group, Inc. | 5.01% |

| LVT | Livetiles Ltd | $47.07M | Aug-31 | Regal Funds Management Pty Ltd and its associates ( | 6.78% |

| NTO | Nitro Software | $394.50M | Aug-30 | Potential Capital Management | 12.01% |

| CMD | Cassius Mining | $10.85M | Sep-01 | Frank Poullas | 5.05% |

| MOB | Mobilicom | $27.77M | Aug-29 | The Bank of New York Mellon Corporation and listed group entities | 73.34% |

| SPT | Splitit Payments | $63.64M | Sep-05 | Thorney Techologies | 6.63% |

In July Myer (ASX:MYR) flagged to the market strong profit results for FY22. It is due to release its results this month.

One of Japan’s biggest financial institutions Mitsubisi UFG isn’t waiting though, and bought into the famous department store. Rich-lister Solomon Lew’s Premier Investments lifted its stake in Myer from 19.88% to 22.87% in August.

The company’s share price is up more than 10% year to date, with Datt Group managing director Emanuel Ajay Datt having the company as one of its picks for the week.

New high profile Cassius Mining substantial shareholder

Cassius Mining (ASX:CMD) has a new substantial shareholder with high profile lithium battery manufacturer Magnis Energy Technologies (ASX:MNS) chairman Frank Poullas picking up ~5% stake.

CMD announced in July it was joining the lithium play after acquiring four contiguous prospecting licences in central Tanzania. The licences are located about 40km north of the capital city of Dodoma, and the company says the time’s right because of the ongoing worldwide interest in battery metals.

The CMD share price has risen 55% year to date.

Potentia Capital Management has become a shareholder in digital workflow company which specialises in PDF solutions and eSignatures Nitro Software (ASX:NTO). According to an ASX announcement Potentia and its associates currently hold combined relevant interests and economic interests of 16.95%, comprising of relevant interests of 12.097% and economic interests of 4.855%.

Nitro went into a trading halt last Tuesday night after a Potentia Capital Consortium decided its 41.4 million shares or 17% of total Nitro capital wasn’t going to cut it. Potentia Capital and co-investor HarbourVest Partners, lobbed a move to acquire 100% of the issued share capital of Nitro at $1.58/share. However, Nitro on Wednesday informed the market “the Nitro Board has concluded the indicative proposal significantly undervalues Nitro and unanimously rejects the indicative proposal as not being in the best interests of shareholders”.

Sellers

| Code | Company | Market Cap | Date of change | Holder |

|---|---|---|---|---|

| NTO | Nitro Software | $394.50M | Aug-30 | Copia Investment Partners |

| QAL | Qualitas Limited | $696.78M | Sep-01 | Ethical Partners Funds Management |

| CG! | Carbonxt Group | $28.78M | Aug-29 | Pie Funds Management |

| KIN | Kin Mining NL | $83.10M | Aug-26 | Credit Suisse Holdings (Australia) Limited |

| UMG | United Malt Group | $1.03B | Sep-01 | Ethical Partners Funds Management Pty Ltd |

| ZEO | Zeotech | $81.22M | Aug-31 | Credit Suisse Holdings (Australia) |

| APX | Appen | $438.23M | Aug-31 | Norges Bank |

Credit Suisse has sold out of WA junior gold mine developer Kin Mining (ASX:KIN). In late 2021, Kin Mining turned down a 16c/share takeover offer from miner and major shareholder St Barbara (ASX:SBM), and instead raised $7m to advance the flagship 1.28moz ‘Cardinia’ gold project on its own.

United Malt Group (ASX:UMG) saw Ethical Partners Funds Management cease to be a substantial shareholder. UMG, which supplies malt to beer and Scotch whisky makers, saw its share price plunge 12.5% on August 1 after revising its earnings downwards in August. However, members of the leadership team were quick to buy up during the downturn and the share price has picked up, rising more than 8% in the past month. Sláinte!

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.