Director Trades: Sláinte! UMG execs double down after tough year for brewery suppliers

Pic: Getty Images

- Director trades see UMG directors bullish on stock despite the maltster revising its FY22 earnings downward

- Reporting season continues to dominate August on the ASX with few director on-market buys and no sells

- TerraCom directors buy up in the resource explorer which has a range of coal assets in Australia and South Africa

Director trades are often considered a good indicator of a company’s future prospects. Our fortnightly Director Trades column informs you who is buying in and who is selling down.Often referred to as insider buying or selling, directors are legally permitted to buy and sell shares of the company and any subsidiaries. However, these transactions must be properly registered and divulged.

Insider buying or selling is not to be confused with insider trading, which is buying shares based on non-public information, a big no-no and illegal.

We troll through the ASX company announcements looking at director trades of interest over the past fortnight. It’s usually the big ones that stand out or those coinciding with company news.

Directors may get shares as part of employee incentive schemes, share purchase plans, rights issues, participate in dividend reinvestment plans or purchase on-market. It’s the on-market trades we think are worth noting, where directors directly or indirectly through entities they are associated either put up cash or cash in a stake.

When a director buys shares on-market, it can signify confidence the share price will rise in the future and if multiple directors are buying, especially at larger amounts, that is even more of an indication. Of course, it’s not a sure win that the share price will rise, so it’s always worth further research on a company.

Directors will often buy company shares after a sharp price decrease. Directors may think the stock has been oversold and represents good value, sometimes they want to show confidence in their company’s prospects, other times they’ve just got another good reason to buy or sell a stock which will be divulged, like paying the good ol’ taxman.

Fortnight overview – Reporting season continues

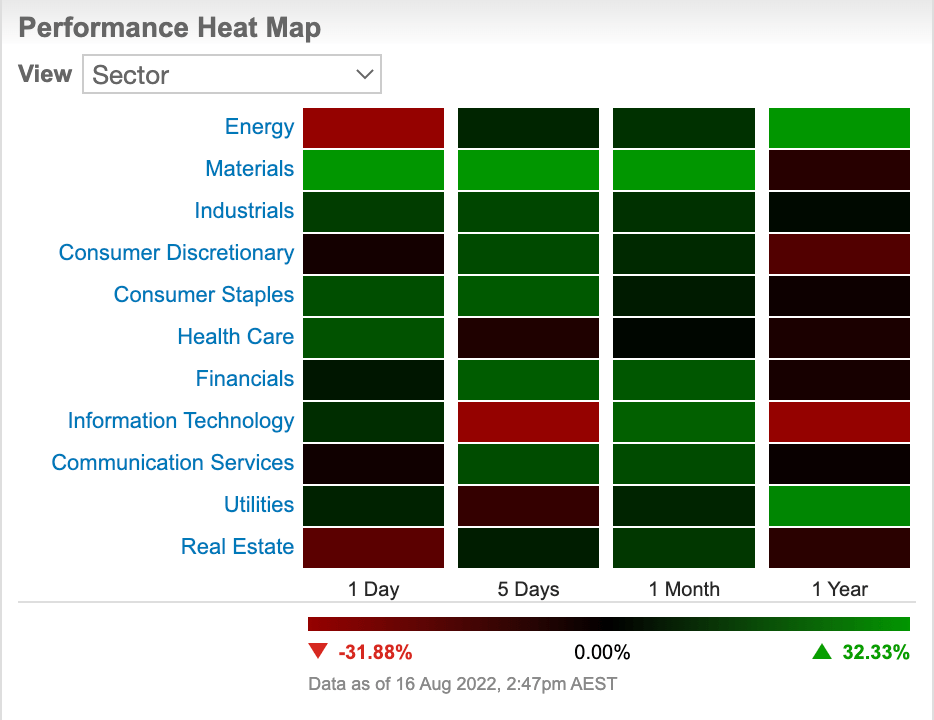

The much needed mid-year rally is continuing on the ASX along with reporting season. The S&P ASX 200 (XJO) was up 6.25% in the past with all sectors in the green. Leading the winners has been the Materials sector, up 14.45% in the past month, followed by Information Technology which has risen 9.40% and Financials up 8.47%.

While new options have been issued, and options exercised along and transactions relating to performance rights, there remains few director on-market buys and again no sells in the past fortnight.

Recent large director buys

| Code | Company | Director | Direct or Indirect | Date | Volume | $ | Nature of change |

|---|---|---|---|---|---|---|---|

| APE | Eagers Automotice | Nicholas George Politis | Direct & Indirect | Aug 2-12 | 90,000 | $1,166,954 | On-market |

| LSF | L1 Long Short Fund | Raphael Lamm | Direct & Indirect | July 29, Aug 9-15 | 210,750 | $532,898.74 | On-market |

| PYC | PYC Therapeutics | Alan William Tribe | Indirect | Jul 29 – Aug 3 | 1,683,537 | $103,369.17 | On-market |

| TER | TerraCom | Danny McCarthy | Direct & Indirect | Aug-02 | 350,000 | $274,645 | On-market |

| TER | TerraCom | Graeme Campbell | Indirect | Aug-04 | 200,000 | $164,000.00 | On-market |

| TER | TerraCom | Glen Lewis | Indirect | Aug-02 | 113,240 | $89,051.94 | On-market |

| UMG | United Malt Group | Graham John Bradley AM | Direct | Aug 3-8 | 75,000 | $227,994.66 | On-market |

| UMG | United Malt Group | Mark Palmquist | Direct | Aug-04 | 50,000 | $147,625 | On-market |

| UMG | United Malt Group | Gary W Mize | Direct | Aug-04 | 17,317 | $49,353.45 | On-market |

Director Trades – Here’s cheers for UMG recovery

United Malt Group (ASX:UMG), which provides malt to beer brewers and Scotch whisky makers, has seen members of its leadership boost their holdings, including managing director and chief executive Mark Palmquist, non-executive chairman Graham Bradley and independent non-executive Gary Mize.

As Stockhead’s Gregor Stronach noted, UMG saw its shares plummet 12.5% on August 1 after revising its earnings downward, sending shockwaves through the market as investors feared for the safety of their precious beer and whisky supplies.

In an ASX announcement, UMG said underlying EBITDA (before SaaS costs) for FY22 will be in the range of $100-108 million, below previous guidance.

“The Processing segment in North America was adversely impacted by a number of external events, including the significant deterioration of the North American barley crop, supply chain disruptions, increased costs of imported barley which could not be fully passed on to customers and general cost inflation,” UMG said.

UMG was part of GrainCorp (ASX:GRN) until it got de-merged in 2020. The maltster has operations in Canada, the UK, US, and Australia with strong market shares in those countries in the craft brewing and Scotch whisky sectors.

The UMG share price has fallen ~25% YTD.

TerraCom directors buy up

Directors of TerraCom (ASX:TER) have been buying up shares in the company during the past fortnight. Formerly Guildford Coal, TER counts the Blair Athol coal mine in central Queensland as its main asset. Other assets include the Springsure project, the Northern Galilee Project and Clyde Park Coal Project along with operations in South Africa.

The buy up comes after major shareholder OCP sold its stake in the company on August 1, worth more than $30 million. Shares in TER have risen more than 430% in the past year and ~12% in the past month to 85 cents/share.

Rich-lister continues buy up in Eagers

Car dealer Eagers Automotive (ASX:APE) has seen rich-lister, director and the company’s largest shareholder Nicholas Politis continue to increase his holding in what seems to be his trademark series of buying – 10,000 lot purchases over a sustained period.

On July 15 Eagers shareholders approved the acquisition of WFM’s Group ACT dealerships and associated properties, which Politis majority owns and controls. He now hold 70,455,321 ordinary shares in Eagers.

Shares in Eagers have risen ~13% in the past month to $13.19.

Recent large director sells

We’ve been doing our job here at Stockhead but haven’t seen any director sells this fortnight in what could be interpreted as a positive sign of a strengthening market overall.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.