Wanted! Explorers to push the next great source of gas for Western Australia

Pic: Thana Prasongsin / Moment via Getty Images

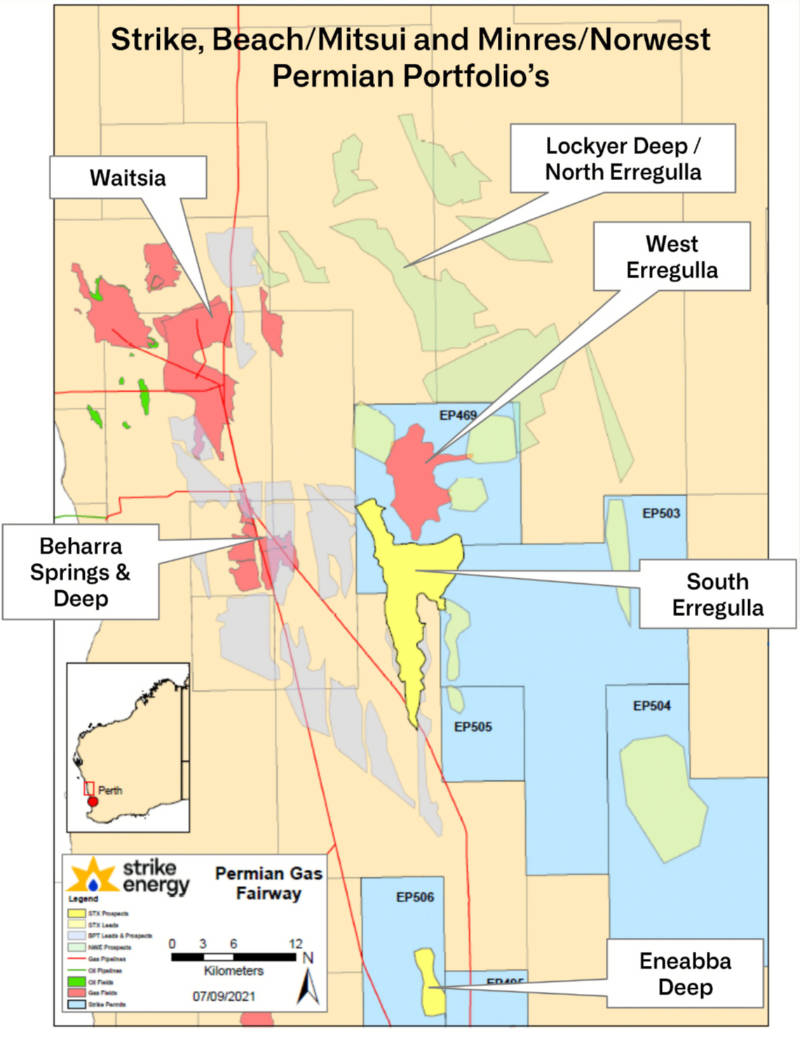

The northern Perth Basin is back in the limelight as the next great source of gas for Western Australia after Mineral Resources (ASX:MIN) and Norwest Energy (ASX:NWE) declared their Lockyer Deep 1 exploration well to be a significant gas discovery.

While the gas supply situation in the state isn’t quite as critical as it is over on Australia’s east coast, it has nonetheless been signalled that supplies could tighten as early as 2029, a future that has been highlighted by significant reserve write-downs at the Reindeer and Pluto fields earlier this year.

This makes the newest discovery especially important given that it essentially opens up vast swathes of acreage in the northern Perth Basin as potential locations for further discoveries.

Here’s why.

The Perth Basin – a (very) condensed history

Speaking before a packed crowd at the Good Oil & Gas Energy Conference in Perth on September 8, Basin Science director Darren Ferdinando outlined the history of the Perth Basin into four distinct phases.

Phase 1, which he characterised as low hanging fruit with hydrocarbons discovered in a new play and new place, went from 1963 through to 1979 and targeted very large, easily visible structures within the late Permian Dongara Sandstone play due to the low resolution of 2D seismic available at that time.

The next phase targeted the Wodgina formation that sits directly below the Dongara with exploration still testing large structures, albeit using 2D seismic with slightly better quality, with Ferdinando saying it was a new play in an old place.

Phase 3 was the ‘mopping-up’ stage with exploration split into two components.

“The first occurred onshore and was targeting smaller structures in the Dongara sandstone, which is the old play in the old place. This was helped by acquisition of 3D seismic over the area,” Ferdinando noted.

“The second part occurred at Cliff Head in the offshore area.

“A lot of work had gone on in the previous years and decades prior to that and when Cliff Head was drilled and discovered oil in the Irwin River Coal Measures, a much older play to the Dongara play that’s about 275 million years old.

“This opened up a new play in a new area, the led to oil discoveries like Dunsborough and Perseverance.”

This brings us to the current Phase 4 of exploration, which properly started in 2014 with the Senecio-3 well discovering the Waitsia gas field in what Ferdinando described as the intersection of opportunity and preparedness.

The discovery was made possible by previous work carried out by operators such as Arc Energy and AWE that led to the identification of this play in the deep Kingia Sandstone with high resolution 2D and 3D seismic unlocking the best locations for drilling.

There was also the element of opportunity as AWE was originally targeting a tight gas discovery and decided to test the Kingia after discovering it had more money in its drilling budget, the stereotypical new play in an old place.

“The idea was proven in Waitsia and now companies like Strike Energy in West Erregulla and MinRes and Norwest in Lockyer Deep are pushing where the area works further to the south and north,” Ferdinando told the conference.

Potential for more, a lot more

The trick for explorers is to find locations where a unique iron-rich clay coating has inhibited late stage quartz overgrowth, preserving the porosity of the Kingia Sandstone even at depths of about 5,000m.

This is not ubiquitous throughout the Kingia with Ferdinando noting that two recent offshore wells drilled by Murphy Oil had detected the clay coatings but found that they just weren’t effective as they were not close enough to river input.

“We expect to see these clay coated grains in marine sands close to estuaries, river mouths and delta fronts,” he noted.

“These areas will have the anomalous porosity preservation whereas other areas, which are just a straight beach and no river systems coming through, are unlikely to have this mechanism and be subject to this porosity degradation that occurs around 2,700m or deeper.”

Ferdinando added that the only questions were just how deep this mechanism works and where else it could be found in the Perth Basin.

He also noted the potential for other play types including the area east of the Perth Basin where the Dongara sandstones occur at depths less than 2,700m, the Jurassic formations that have not been systematically explored despite gas discoveries such as Gingin and Red Gully along with more conceptual plays like turbidite plays.

Speaking to Stockhead, Ferdinando said that while the majority of the prospects are currently around the Waitsia-West Erregulla belt, there were a number of other opportunities that go further out to the west towards the coastline and offshore as well as further to the south.

“There is still the opportunity to work out what the limits of this play are in terms of where this special mechanism for preserving porosity, this clay coating on the grains works, and where is too deep. We still don’t know where is too deep is,” he added.

“There is still a lot of scope going down into the south going down into what is known as the Dandaran Trough where the Kingia formation is deep but it may still be effective for getting gas out.”

He explained that the secret to unlocking the play is finding where the river systems of the Irwin River Coal Measures hit the coast and come out and that achieving this on a regional scale will happen when these systems are imaged as they were with the Mungaroo play in the North West Shelf.

“But it is much harder onshore than offshore because inherently, the seismic data quality is lesser because of problems we have with the surface limestone and things like that that take away the signal. It’s harder to get the seismic lines done and securing permitting,” he added.

“The Kingia is now a proven play, but it is still in its emergent phase. I think there are a lot more scope for new large discoveries before we then start going into the smaller discoveries.”

Reactions to the MinRes discovery from companies operating in the Perth Basin have also been positive with Talon Energy managing director David Casey telling Stockhead that it augers well for significantly more discoveries going forward.

“The Norwest results are very encouraging. It further supports the whole Permian deep gas play concept. You have Waitsia, West Erregulla, Beharra Springs Deep and now Lockyer Deep,” he noted.

“Having said that MinRes/Norwest still need to run logging and testing, but it’s an encouraging first set of results.”

Upcoming exploration

With the string of successes to date, it is no surprise that there is a flurry of activity planned in the Perth Basin.

Beach Energy (ASX:BPT) and its partner Mitsui are the proverbial 800lb gorilla in the Perth Basin who own and operate the most advanced Kingia Sandstone play, the play-opening Waitsia gas field.

Development is underway on the Waitsia Stage 2 project, which will see the duo start gas exports to the North West Shelf liquefied natural gas project.

This includes the drilling of up to six development wells from the second half of 2022.

Strike Energy (ASX:STX) is another frontrunner in the Perth Basin following its successful West Erregulla wells – that were drilled with Warrego Energy (ASX:WGO), which proved that the success of Waitsia was not a fluke.

The company noted recently that West Erregulla had broken open the Permian gas fairway and that the increased activity would benefit all operators by bringing down costs.

And it is not just the Kingia that’s on the menu. Strike appears keen to test the other plays mentioned earlier, starting with the Walyering-5 well with Talon that will test a Jurassic wet gas play.

Walyering is a known productive system with previous wells already establishing the ability to produce commercial quantities of hydrocarbons despite being let down by poor seismic control in the past.

It is also targeting the South Erregulla structure, where the company noted that separate imaging of the ‘tail’ by Beach and itself had returned nearly identical results.

Talon Energy (ASX:TPD) is also spreading its wings, negotiating a right of first refusal to negotiate an interest in the adjacent, Strike operated, exploration licence, EP495, which contains the Ocean Hill Jurassic gas discovery that could host up to 360 billion cubic feet of best estimate contingent resource.

Additionally, the company had executed an agreement in January to acquire two licence areas over the Condor Structure, which maps as a high relief structure with potential to host up to 10 times the prospective resources estimated for Walyering.

Condor also features Jurassic reservoirs that are much shallower than at either Walyering or Ocean Hill, which should result in improved reservoir quality and lower drilling costs.

On the oil front, Vintage Energy (ASX:VEN) and Metgasco (ASX:MEL) are currently planning to drill the Cervantes-1 exploration well targeting a lookalike of the Hovea oil field.

The Cervantes structure, which is adjacent to the Jingemia oil field that has produced over 4.6 million barrels of oil to date, has a best estimate prospective resource of 15.3 million barrels of oil.

Cervantes-1 is expected to spud in the first quarter of 2022.

Meanwhile, Cliff Head oil field operator Triangle Energy (ASX:TEG) is currently planning a series of development wells at its flagship asset to deliver target production of about 3,000 barrels of oil per day by the second half of 2023.

It is also looking to apply modern technology to the old Bookara Shelf/Mt Horner area that has been dormant for 20 years.

At Stockhead we tell it like it is. While Metgasco is a Stockhead advertiser, it did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.