UBS: A ‘wave of capital’ is about to flow into renewable energy

(Pic: Getty)

Australia’s wholesale electricity prices are falling as more renewable energy sources enter the mix, UBS says.

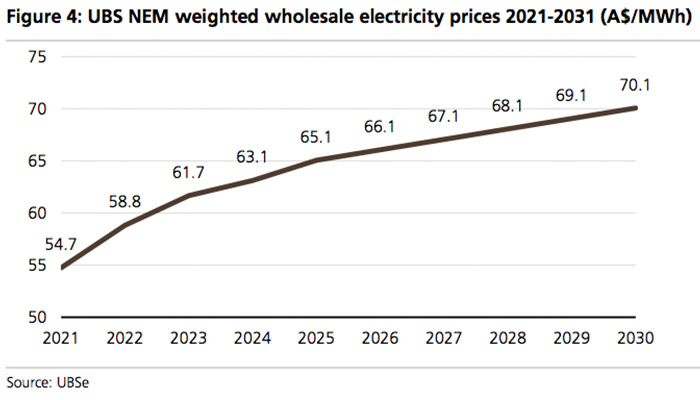

And over the next decade, the ongoing renewables rollout will help cap the cost of electricity below $70 per megawatt hour (MWh) by 2030.

While the policy stance around renewables remains a source of debate, UBS said the reality on the ground is that government support will drive “further significant penetration from renewables” over the next two to three years.

“State government policies supporting net-zero emissions will attract a wave of new capital into renewables over the next 10 years in our view,” analyst Tom Allen and his team said.

For example, thy highlighted the NSW Electricity Infrastructure roadmap, which has forecast around $32bn of private investment in renewables and storage capacity through to 2030.

In the nearer term, around four gigawatts (GW) worth of wind and solar projects are scheduled to enter the National Electricity Market (NEM) between now and 2023.

Those gains will be offset in part by grid constraints, particularly in western Victoria and western NSW, until new transmission pathways are set up. Gas prices are also expected to rise until 2024.

But beyond 2025, UBS expects electricity prices to decline in real terms (effectively, rise slower than the rate of inflation) “due to a strong increase in renewable penetration”.

In terms of ASX stocks, UBS’ focus is geared towards the big end of town where it said lower electricity prices will drag on margins for AGL (ASX:AGL) and Origin Energy (ASX:ORG).

However, with government policy helping drive major capital flows into the sector, it will be a space worth keeping an eye on for smaller ASX players looking to capitalise on new opportunities.

In last week’s edition of MoneyTalks, Niv Dagan from Peak Asset Management highlighted two small caps – energy trading firm Tymlez Group (ASX:TYM) and Countrywide Renewable Energy, a hydrogen play with plans to IPO in 2021.

Looking at the recent data, the UBS team highlighted that the rise of renewables has resulted in a material decrease in national power costs over the second half of 2020.

Over the last six months, wholesale power costs averaged between $30-41/MWH – an amount which is “36-51 per cent lower than the average prices over the previous 3 years”, UBS said.

More than 3 GW of renewable energy capacity has entered the NEM over the last 12 months, bringing its share to 12 per cent of total energy supply.

That’s up from 10 per cent in 2019 and five per cent in 2016.

In addition, this interesting chart shows how renewable energy’s capacity to generate energy at zero marginal cost has resulted in a sharp spike in the number of instances where energy trades at negative spot prices:

In addition to the 4MW of renewable energy generation that will come on board by 2023, UBS now expects that number to triple by 2030 – a trend which is creating “strong downward pressure on average wholesale prices, relative to prior forecasts”, the analysts said.

For now, coal-fired power sources continue to make up the biggest component of Australia’s energy mix.

But with grid bottlenecks scheduled to be addressed by 2025, renewable sources will continue to take market share from coal-fired generation, “sounding the alarm for incumbent owners of coalfired plants”, UBS said.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.