Talon is all gassed up for Perth Basin exploration

Pic: Vertigo3d / E+ via Getty Images

Western Australia’s Perth Basin is becoming one of Australia’s leading gas provinces thanks to recent exploration success like the ultra-deep West Erregulla-2 well and the more recent Beharra Springs Deep-1 well.

The region’s rise to fame began with the discovery of the deep but prolific Waitsia gas field by AWE in 2014.

That was followed up by Strike Energy’s (ASX:STX) highly successful West Erregulla-2 well that flowed a very respectable 69 million standard cubic feet per day (MMscfd) of gas during testing in October 2019.

Further evidence of the Perth Basin’s prospectivity – particularly in the north – came after Beach Energy (ASX:BPT) successfully flowed up to 46MMscfd from its Beharra Springs Deep-1 well.

And it is this prospectivity along with how Strike has leveraged its knowledge from West Erregulla-2 towards de-risking the Walyering play that led Talon Petroleum (ASX:TPD) to take up a 45 per cent interest.

“I think what we have been able to do with Walyering is farm into a project that has got an excellent operator in Strike with a proven track record of success in the Perth Basin,” Talon managing director David Casey told Stockhead.

He noted that while Walyering wasn’t analogous at the reservoir level with West Erregulla, Strike had used what it learned there to process and interpret the new 3D seismic data it acquired at the end of 2019.

“The 3D data is the key to unlocking the North Perth Basin. That data and the analysis and processing that Strike do is what really enables you to identify targets and significantly lower the risk,” Casey added.

Previous exploration confirms gas charge and production capability

The other factor that played a key role in Talon’s decision is that historical exploration has already proven that Walyering hosts liquids-rich gas – about 25 barrels of condensate per MMscf of gas – and that reservoir is porous and permeable enough to flow gas without assistance.

Walyering-1 was drilled in 1971 and flowed gas at a rate of 13.5MMcfsd during testing, which indicates that there is flow potential.

“Unfortunately it came on production at 3.5MMscfd, which was probably the initial sign that this was going to be problematic and it watered out pretty quickly and didn’t produce much gas at all,” Casey noted.

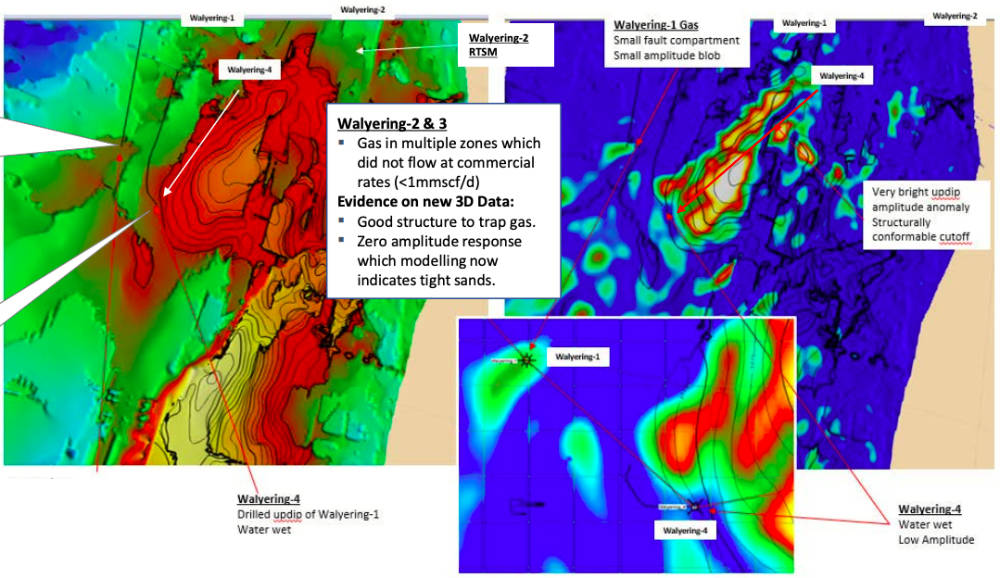

This was followed by the Walyering 2 and 3 wells that encountered multiple zones of gas that did not flow at commercial rates while Walyering-4 was water wet.

What’s important to Casey and Talon is the Strike technical team’s ability to reconcile the 3D data set and the amplitude bloom analysis with the results of all four Walyering wells to explain why they performed the way they did.

“I could see that that there were much better areas of what we believe are porous, permeable gas-charged reservoirs,” Casey explained.

“It gave me confidence that targeting these ‘bright spots’ would yield results.

“We believe Walyering 5 is an appraisal well, it is not an exploration well. Walyering-1 confirmed the presence of hydrocarbons — 13.5MMscfd is a very good result when you look at comparable wells in the same formation and sequence.”

Walyering 5 will be drilled after Strike and Warrego Energy (ASX:WGO) complete the drilling of two firm wells and possibly one contingent well at their West Erregulla project.

Western Australian gas market

With the recent Beach and Mitsui deal that allows gas from their Waitsia field to be exported via the North West Shelf liquefied natural gas (LNG) facilities, Casey believes that it will open up the domestic market for other players such as Strike, Warrego and Talon.

“I am not saying we are going to see East Coast prices here but I think what you are seeing is potentially extended delays to the likes of Browse and a few other projects,” he explained.

“You will see demand outstrip supply and that’s why you are seeing the WA gas thematic changing.”

Gas prices in Western Australia have trailed behind other Australian states due to the state’s gas reservation policy, which requires LNG project developers to reserve 15 per cent of their gas for domestic use.

North Sea oil assets have real value

While Talon’s attention is currently focused on Walyering, Casey says the upcoming drilling in Western Australia buys the company time to consider and review its North Sea assets.

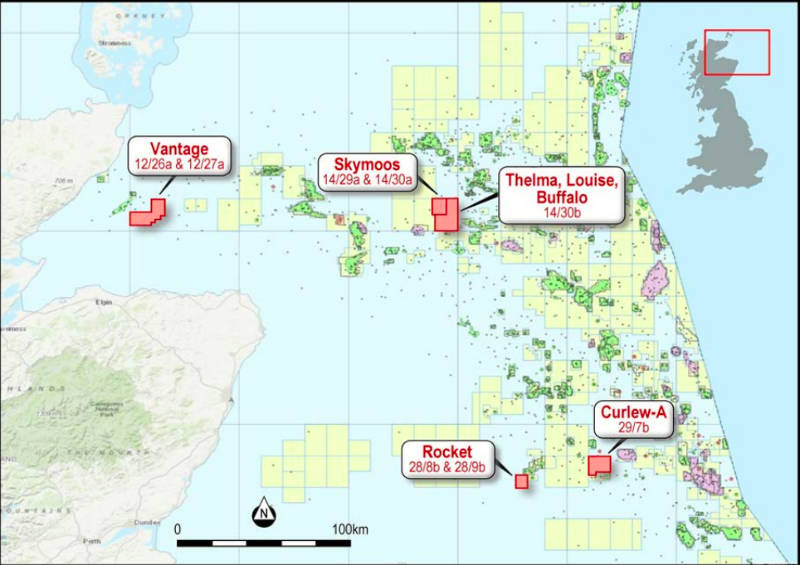

He said Talon’s North Sea assets had real value, highlighting the Skymoos prospect which has the potential to host 100 million barrels of oil.

That would be one of the larger fields in the UK North Sea.

However, the company does not intend to take point in the North Sea.

“We are not looking to be an operator at this particular point of time in the North Sea, we are looking to farm out and end up with somewhere near a 20 per cent non-operated carry or thereabouts,” Casey explained.

Talon Petroleum (ASX:TPD) share price chart

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.