Suitor reckons Stanmore won’t get a better offer, slams buyback

Pic: Vertigo3d / E+ via Getty Images

Indonesian company Golden Investments says it is “highly unlikely” a competing suitor will emerge for junior coal producer Stanmore Coal.

Golden Investments said in its fifth supplementary bidder’s statement released to the ASX late on Friday that “the prospect of a competing offer or proposal emerging at this time is remote”.

“Golden Investments considers that the proposed corporate actions indirectly support this view.

“In effect, Stanmore Coal is using the shareholders’ own funds to fund the only alternate proposal that the board has been able to make available for shareholders.”

Stanmore (ASX:SMR) revealed on Friday it would pay shareholders 3c per share back in the form of a dividend, which equates to a total return of about $7.6m.

It is also undertaking a buyback of up to 10 per cent or 25.3 million of its shares.

But Stanmore boss Dan Clifford told Stockhead following the announcement on Friday that the company had received interest from other potential suitors.

“This is the rough and tumble world of the capital markets and we’ve had a spotlight put on us from interest from one company that has elicited, as you can imagine, by default a lot of other interest in the business as well,” he said.

“I think as time unfolds, logically we will remain in one way, shape or form attractive to someone at some point.

“Our view here is whether we’re a target or not doesn’t matter, what we are doing is acting on behalf of all our shareholders and the only way we can act properly in that regard is maximising the outcome for our shareholders at any point in time.”

Golden Investments questioned the timing of the announcement three days before the offer was due to close.

“The timing of the proposed on-market buy-back raises obvious questions,” Golden Investments said.

“Why was it necessary for the board of Stanmore Coal to announce this buy-back just days before the end of the offer period?”

- Subscribe to our daily newsletter

- Bookmark this link for small cap news

- Join our small cap Facebook group

- Follow us on Facebook or Twitter

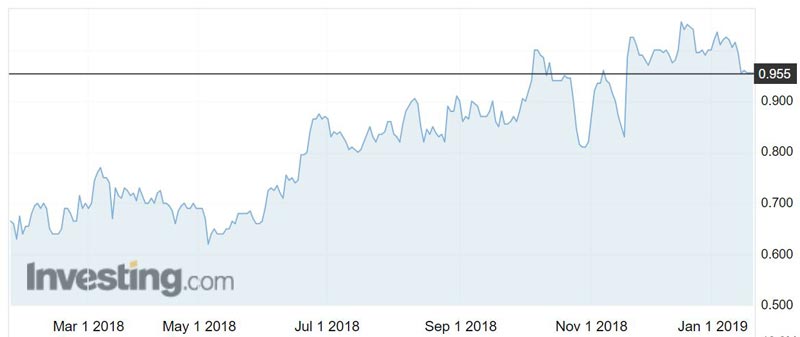

In November, Golden Investments launched a 95c cash per share offer for Stanmore, which the cashed-up coal junior urged shareholders to reject.

Stanmore says the offer seriously undervalues the business on a range of measures including earnings multiple, control premium and comparison to broker forecasts.

The offer was initially due to close on January 3 but in late December was extended to January 22.

Golden Investments says the cash Stanmore is using for its share buyback could be applied to development and exploration.

The suitor also raised the issue of the buyback only being for 10 per cent, saying there is no certainty that shareholders’ holdings will be bought either at all or in their entirety.

“There is also no certainty that the on-market buy-back will continue to be available (or if so, for how long) beyond its proposed start of 4 February 2019,” Golden Investments said.

“Stanmore Coal has reserved the right to suspend or terminate the buy-back at any time and for any reason.”

Golden Investments has so far only increased its stake in Stanmore to 24.3 per cent from just under 22 per cent previously, but has not yet announced another extension to its offer.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.