Sicily Channel permit a potential gas feast for ADX

ADX is looking to enjoy the good life with its Sicily Channel gas permit now formally awarded. Pic: Getty Images

- ADX awarded highly prospective Sicily Channel gas exploration permit

- Permit benefits from shallow waters, stacked pay zones, access to gas pipelines and nearby third-party success

- Any gas discovery will find no shortage of customers in Italy

- A significant new growth pathway in Europe for the company

Special Report: ADX Energy is breaking out the bubblies following the much anticipated formal award of the C.R150.AU exploration permit in the Sicily Channel offshore Italy that’s highly prospective for natural gas.

The company’s history with the permit stretches back to 2018 when it first made its application but was left hanging when the then socialist-led government placed a moratorium on the award of new exploration licences.

This all changed when Ms Giorgia Meloni swept to power in October 2022 at the head of a centre-right coalition, a development that led to ADX Energy (ASX:ASX) being offered the 346km2 permit at the beginning of 2025.

Executive chairman Ian Tchacos said the company was delighted by the formal award, which added the Sicily Channel permit to its portfolio at a time when energy security and the demand for gas in Europe was at a premium.

“As is the case for the shallow gas play we are pursuing in Upper Austria, the availability of historic, high-quality 2D seismic data and production well data has strengthened our confidence in the potential of the Sicily Channel permit,” he added.

“The availability of data also reduces the exploration timeline significantly for this proven gas play.

“The permit, which was previously the focus of oil production, is totally under explored for gas but is ideally located in terms of water depth, distance from shore and availability of gas export infrastructure.

“The recent, nearby shallow gas discoveries and field developments by ENI have opened up the Sicily Channel for gas exploration.”

Tchacos added that ADX was now considered to be a qualified operator in Italy after demonstrating its financial capacity and technical competency in a pro-development jurisdiction. This will readily enable further investment in gas starved Italy.

Gas potential

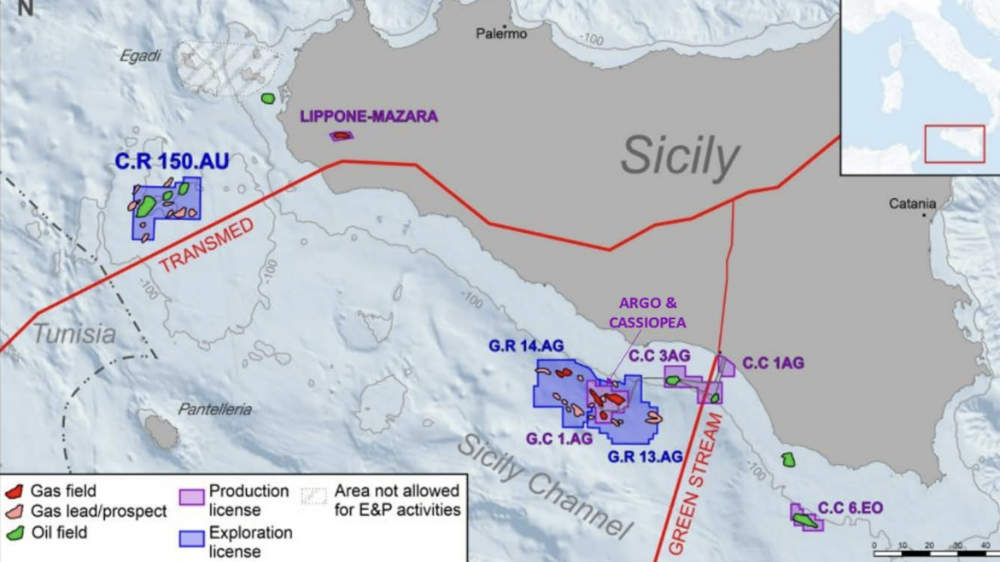

The availability of historical data including offshore seismic and drilling results for deeper oil has allowed the company to identify prospects similar to recently developed and producing gas fields such as nearby Argo-Cassiopea (offshore) and analogous to Lippone-Mazara (onshore).

Both fields feature stacked pays that result in large gas resource potential within a relatively small area.

While further work will be required to unlock its secrets, ADX had previously estimated the Sicily Channel permit could host best technical prospective resources of 369 billion cubic feet of gas within five high graded prospects.

ADX added the economic viability of the permit was enhanced by the shallow water depths of ~100m and expected drill depths between 700m and less than 2000m .

The water depths means that drilling can be carried out using a jack-up drilling rig, which is significantly less expensive to hire compared to semi-submersible drill rigs.

There is also proximity to infrastructure including a tie-in point onshore at Mazara for the TRANSMED pipeline – a major import route for gas into Italy, while the stacked pay and productive sands could yield peak well production rates of 20-30 million standard cubic feet per day as seen at the Argo-Cassiopea fields.

Sweet gas (99% methane with low levels of contaminant gasses) is also likely based on gas recovered from the historical Nilde-2 well in the permit and the analogous Lippone-Mazara field.

Italy also offers favourable fiscal terms such as a 10% royalty rate and 28% corporate tax along with gas prices of about €34.2 per megawatt hour (or about US$11.70 per thousand cubic feet).

This compares very favourably with the Henry Hub spot price of US$2.87 ($4.40) per thousand cubic feet (Mcf) in the US and the $13.26 per gigajoule (948.82 cubic feet) average wholesale gas price on Australia’s east coast.

ADX also benefits from the regional knowledge it previously developed from exploration in Tunisia to the south of the permit.

Next steps

“We now look forward to further studies utilising additional seismic and drilling data which will be purchased to further evaluate the prospectivity of the Sicily Channel Permit and provide further updates to our shareholders,” Tchachos said.

Acquiring this additional data will enable ADX to immediately commence exploration activities.

This is aimed at demonstrating the potential of the permit for gas exploration and high grading exploration targets for further seismic processing, new 3D seismic acquisition and drilling.

It will also commission an independent expert’s report to further validate and demonstrate the potential of the permit.

This article was developed in collaboration with ADX Energy, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.