Oil play Brookside taps into hot demand for STACK and SCOOP property

Pic: Matthias Kulka / The Image Bank via Getty Images

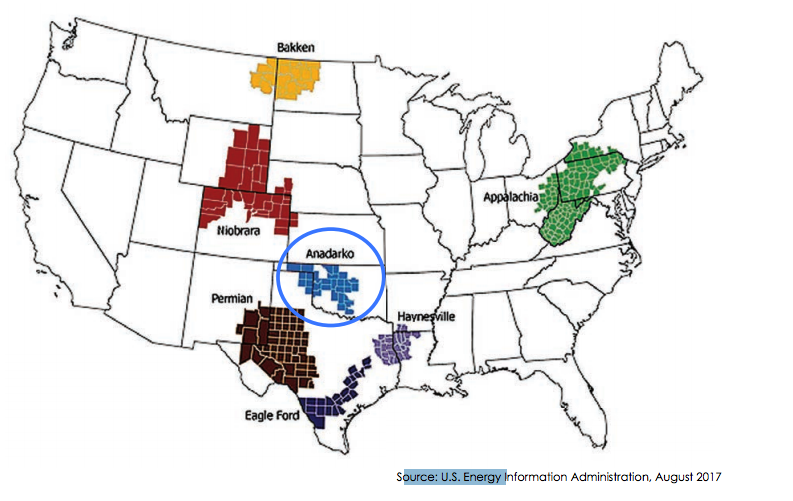

Special report: Oil and gas leases in Oklamhoma’s Anadarko Basin are increasing in value with a number of US publicly traded independents drilling and completing wells in the region.

While these big companies are bringing record breaking wells online and beginning to move to “full field development” a few companies are benefiting from this activity with a wait and see approach.

The utilisation rate of permits is sitting around 82 per cent and producers in the prolific STACK/SCOOP plays are continuing to buy up leases faster than they drill wells, says Platts senior energy analyst Sami Yahya.

STACK and SCOOP have been described as two of the “hottest new areas” for oil development in the 130,000 sq km Anardarko Basin — one of the most productive oil and gas regions in the United States.

Aussie small cap Brookside Energy (ASX:BRK) owns acreage in the SCOOP, STACK and the newly dubbed SWISH areas of the Oklahoma section of the Anardarko Basin.

Their business plan is built around being on the ground before it becomes as overheated as other oil and gas basins such as the Permian in West Texas — and selling up once it does.

Simple: buy then sell for a profit

Smack-bang among the big guys like Marathon Oil and Devon, Brookside buys up leases over small blocks of land, put a few oil wells on to realise what’s down there, increase the valuation, package it into larger parcels and then sell it off to a bigger oil company.

The theory is working.

In May they sold a lease in the STACK play for for an average of $US28,600 ($38,000) per acre — more than 10 times what they paid in 2016.

Then in July they did it again, selling another STACK lease for $1.5m, or nearly double what they paid for it.

The Company is now working to “scale-up” its activity with lease acquisitions in the SWISH area of the SCOOP Play – taking much larger positions in this new area with the opportunity to be operator over a significant block before packaging it up for sale.

Significantly the Company recently announced some outstanding initial production results (1,479 barrels of oil equivalent per day for thirty days) from a Woodford Shale (the main target for drillers in this area) well that was just 5 miles form the SWISH area.

Merger and acquisition activity over the last two years has meant leases have gone from $US2500 an acre to as high as almost $US30,000 an acre — indicating how fast prices have been moving upwards.

Ultimately Brookside wants to sell for upwards of $50,000 an acre.

Mr Yehya told Stockhead that deals in the Anadarko Basin have been moderate so far — when compared with the hugely popular Permian and Eagle Ford — but he has seen a number in the STACK and SCOOP plays.

Proving Brookside’s business case from 2016 the big money is starting to sniff around.

In early October LongPoint Minerals II, a company that also buys, proves and sells oil leases, raised $US846 million for acquisitions in the SCOOP and STACK plays, and in the Permian.

Why is Brookside in the Anadarko?

The opportunity in the Anadarko Basin for early movers is high, as Platts is forecasting gas production in the basin to rise by 75 per cent over the next five years.

“While the SCOOP/STACK continues to break its own records on many fronts, whether through the number of active rigs or sample and total production volumes, there is still room for growth, evident in the number of un-utilized approved drilling permits,” Platts researchers said in a report in May.

Energy Information Agency (EIA) data shows rig counts in the Anadarko — a number that indicates the health of an oil and gas industry — have been rising since mid-2016.

Legacy oil and gas production have dropped away fast but total production in the region but that is more than being made up for by new wells.

The EIA says Anadarko oil production is at an all-time high of almost 600,000 barrels a day in September while gas is also at record highs of over 7200 million cubic feet a day.

Break even prices in the two plays are between $US29-43 a barrel.

Brookside Energy is a Stockhead advertiser.

This advice has been prepared without taking into account your objectives, financial situation or needs. You should, therefore, consider the appropriateness of the advice, in light of your own objectives, financial situation or needs, before acting on the advice. If this advice relates to the acquisition, or possible acquisition, of a particular financial product, the recipient should obtain a disclosure document, a Product Disclosure Statement or an offer document (PDS) relating to the product and consider the PDS before making any decision about whether to acquire the product.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.