Offshore oil exploration will return ‘with a vengeance’ after big discovery

Pic: Vertigo3d / E+ via Getty Images

Carnarvon Petroleum’s historic oil discovery in WA is creating a ‘nearology’ bounce for a handful of companies, and is highlighting an industry-wide return to offshore exploration.

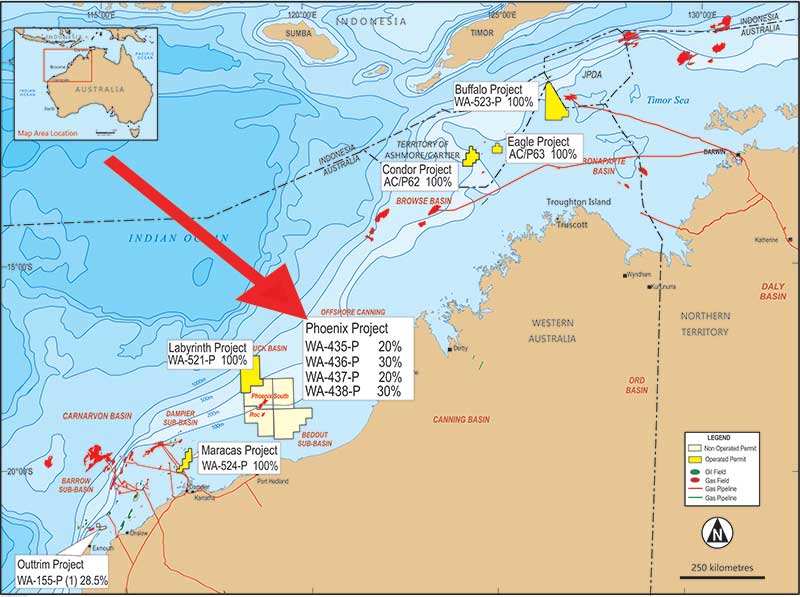

Carnarvon (ASX:CVN) saw its share price surge last month when it uncovered a major oil reservoir drilling its Dorado-1 well in the little explored Bedout Basin off the north-west coast of Western Australia.

Energy and mining consultancy Wood Mackenzie calls it “Australia’s biggest oil discovery this century” — and it’s been good news for other ASX oil stocks.

Pancontinental Oil (ASX:PCL), which says it could have the Namibian equivalent of Carnarvon’s Dorado discovery; Far (ASX:FAR), which Tim Treadgold says could be the next Carnarvon; IPB Petroleum (ASX:IPB) with its block in the nearby Browse Basin; and 3D Oil (ASX:TDO), which picked up a lease next door to Carnarvon last year, have all seen their share prices tick up in the last two months.

“What Carnarvon has done has been great for the sector and shows that small companies can still [find the big reservoirs] if they’re in a high quality drilling project,” said Pancon chief John Begg.

Wood Mackenzie analyst Daniel Toleman says the Dorado find has shown companies what the next big thing in Australia could be.

“We are anticipating exploration in the area to return with a vengeance. A key indicator will be the level of interest in nearby acreage releases W17-4 and W18-4 – the bidding on which is due to close in Q4 2018,” he wrote in a research note.

Back to the sea

Pacon’s Mr Begg says the oil majors are returning to offshore exploration to look for big reservoirs, which could be good news for investment-starved juniors.

Pancon pointed out on Monday that Exxon Mobil was moving in next door to them in Namibia, and they’re also installed off the coast of Mauritania, while Total and BP are looking in Senegalese waters.

Mr Begg says the majors are keen if they can get decent fiscal terms from government when they invest, if the prospects are big, the reservoirs are high quality and — importantly — are conventional (easily extracted).

He says drilling rigs cost up to a third less than what they were in 2013 and 2014, before the oil price crash, as the offshore industry has re-engineered its costs to stay viable in a shale-inspired price environment.

3D Oil boss Noel Newell says it’s crunch time as a big downturn in development spending over the last few years means many reserves are depleted just as demand in emerging nations is heating up.

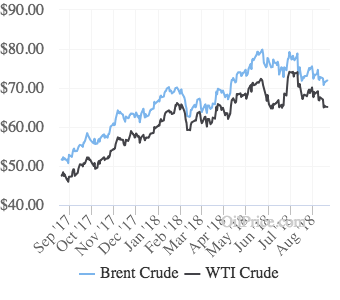

Ths US oil benchmark WTI crude and the European benchmark Brent have both come off six month highs.

But studies from EY and the International Energy Agency say the price rises have made offshore oil exploration and development viable again.

In Australia, where state governments have put considerable regulatory obstacles in the way of onshore drilling, offshore could be looking a little more attractive.

Onshore restrictions include Victoria’s moratorium on all drilling and while the Northern Territory has removed its ban on fracking, the process of cracking open shale rock to extract gases and oils held in small fissures, it hasn’t made it easy to actually do it.

Seabed stocks

There are about two dozen small and mid caps on the ASX with a toe in the waters of offshore exploration or production.

Half of those have watched their share prices move higher over the last six months:

— Otto Energy (ASX:OEL) and Petsec Energy (ASX:PSA) have interests in the Gulf of Mexico.

— In Africa there is Far (ASX:FAR) in the Gambia and Senegal, Global Petroleum (ASX:GBP) and Pancontinental are offshore Namibia.

— Tap Oil (ASX:TAP) is turning around its Manora reservoir but its share price movement is due to two competing takeover offers.

— Carnarvon and 3D Oil are in the Carnarvon Basin.

— IPB Petroleum has a promising block in the Browse Basin it’s trying to sell shares in.

— Key Petroleum (ASX:KEY) has an area near Triangle Energy’s (ASX:TEG) producing Xanadu field in the Perth Basin. Triangle, after a share price surge in 2017 when it announced the Xanadu results, has fallen back.

— High Peak Royalties (ASX:HPR) has a deal with Carnarvon partner Quadrant on a nearby permit but hasn’t felt a share price bounce from the ‘nearology’ factor of the Dorado well.

Other offshore oil explorers and producers that haven’t seen their share prices remain higher than they were six months ago are Sun Resources (ASX:SUR), Byron Energy (ASX:BYE) and Fitzroy River Corp (ASX:FZR) in the US.

ADX Energy (ASX:ADX) in Tunisia and Horizon Oil (ASX:HZN) in New Zealand and Chinese waters are flat.

While South Pacific Resources (ASX:SPB) in PNG, Enegex (ASX:ENX) and Octanex (ASX:OXX) in the Browse Basin, Pilot Energy (ASX:PGY) in the Perth Basin near Triangle, and Bounty Oil and Gas (ASX:BUY) in the Timor Sea are all lower than where they were six months ago.

- Subscribe to our daily newsletter

- Bookmark this link for small cap news

- Join our small cap Facebook group

- Follow us on Facebook or Twitter

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.