Finder Energy levels up to become a petroleum project developer

Pic via Getty Images

Finder Energy has agreed to make a low-cost but bold move to upgrade its status from explorer to petroleum project developer.

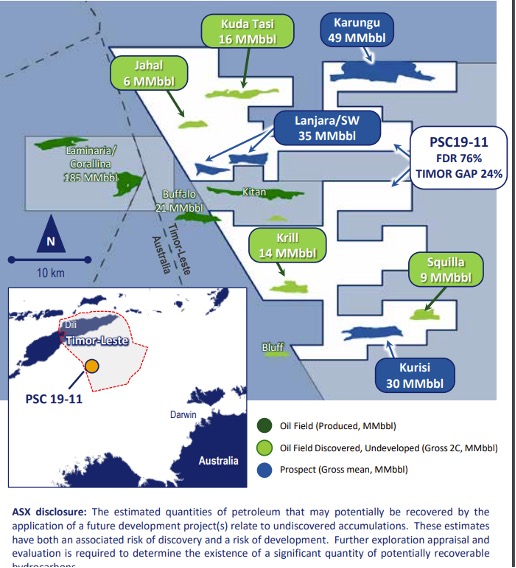

Finder Energy Holdings (ASX:FDR), which has a market capitalisation of $9.3 million and cash of around $6 million, will add to its North Sea oil and gas prospects via purchase of a 76% interest in offshore Timor Leste permit PSC TL-SO-T 19-11.

The permit contains four discovered oilfields holding estimated Gross Contingent oil Resources totalling 45 million barrels (MMbbls) in four separate discoveries plus low-risk, near-field exploration potential for an estimated Gross 118 MMbbls of Mean Prospective oil Resources.

On completion of the transaction and rights issue, Finder will have a nominal market capitalisation of approximately US$0.29 per barrel of 2C oil Resources.

The Deal

Vendors Eni and Inpex have agreed a purchase price of US$2 million, plus up to US$6.5 million, contingent on reaching a Final Investment Decision (FID) for development, plus a 5% royalty on production.

On these metrics, Finder makes a nominal upfront payment, equivalent to US$0.06 per barrel of net 2C Contingent oil Resources of 34.2 MMbbls, which rises to US$0.25 per barrel at FID. Assuming oil sales at US$80/bbl, a 5% royalty would lift estimated, all-up acquisition cost at the time of first production to around US$4.25 per barrel of estimated net 2C oil Resources.

By comparison, Carnarvon Energy’s (ASX:CVN) 2023 sale of a 10% interest in its share of 467 MMBOE of gross 2C Resources of oil and gas at the Dorado, Roc and Pavo discoveries delivered it an up-front payment of US$1.20/BOE (50% gas) plus development carry that would lift total sale proceeds to US$3.13/BOE to Carnarvon.

These metrics imply potential for a significant value uplift to Finder, upon a partial divestment and/or as the project reaches key project milestones over the coming year.

Finder has a strong history of farming down to industry partners to secure funding for exploration wells. The company’s management believes that its modest entry cost for this acquisition, combined with a record of achieving value-accretive deals, place it in a strong position to deliver the significant value uplift as the project develops financial feasibility work.

Strong commercial drivers for oil production

Candidates for early development in Permit PSC 19-11 include the appraised and adjacent Kuda Tasi and Jahal oil oilfields, holding estimated Gross Contingent Resources of 15.6 MMbbls and 6.3 MMbbls respectively.

The entire permit is well defined by seismic data from the Ikan 3D survey, undertaken in 2005.

As a matter of urgency, Finder will reprocess this seismic data, applying modern technology that it believes will improve sub-surface imaging quality, enabling further appraisal of up-dip potential from the Krill and Squilla oilfields.

Development targets are situated adjacent and to the Northeast of the depleted Buffalo and Laminaria/Coralina oilfields that produced 21 MMbbls and 185 MMbbls of oil respectively from Elang Formation reservoirs.

Excellent reservoir quality across the region results in high flow rates and recovery factors of up to 65%, when recoveries of 30% to 50% of in-situ oil are considered common at many other oilfields.

This capacity was comprehensively demonstrated by the first two production wells at the Buffalo field, which commenced production at a combined rate of 50,000 barrels of oil per day, while Eni’s Kitan oilfield delivered 45,000 BOPD from three production wells.

Electric log data from six oil discovery wells at PSC 19-11 plus core analysis from Jahal, indicate similar reservoir characteristics that should support high oil production flow rates, enhancing commerciality for development.

Flow testing at the Kuda Tasi-2 well indicates potential for an unconstrained flow rate of more than 20,000 BOPD is likely. Capital and operating costs per barrel can be kept low when small fields are developed with leased equipment using just one or two wells to deliver recoverable oil in under 4-5 years.

Project design and feasibility plus exploration appeal

By late 2025 Finder aims to have selected and designed a preferred development option, incorporating technical studies of subsurface and drill data.

This work will inform a Front End Engineering and Design (FEED) phase through 2026, leading to development in early 2027.

Developing the project’s financial case will run in tandem with activity to attract development partners over the medium term. A transaction would deliver a look-through market value for Finder’s retained interest.

Further exploration appeal in Australia and North Sea

Nearby, in AC-P-61 over the Vulcan Sub-Basin, Finder is farming out its 100% interest in the Gem Prospect. Here, a Prospective oil Resource of 137 MMbbls is assigned a 32% chance of success, aligning with an exploration success rate of 60% for the province.

Finder is actively seeking joint venture funding support across its North Sea permits. The company is in discussion to farm down its 60% interest to drill an estimated Prospective oil Resource of 150 MMbbls at its Whitsun stratigraphic Prospect, located to the west of the plus 1-billion-barrel Buzzard oilfield in the South Halibut Basin.

In the South Viking Graben, on the Norwegian Median Line, Finder has a 50% interest in the Boaz Prospect, which has an estimated Prospective Resource of 748 Bcf of gas plus 81 MMbbls of condensate, located close to an existing gas project run by Equinor, which is seeking tie-in opportunities.

Funding initiatives ahead of final investment decision in late 2025

Finder has embarked on a non-renounceable rights issue priced at 4.8 cents per share, representing a 15.6% discount to its 15-day VWAP.

The company’s major shareholder, Longreach Capital, has committed $3.2 million to the offer, designed to support early works required to establish a development proposal, ahead of attracting joint venture funding.

At Stockhead we tell it like it is. While Finder Energy is a Stockhead advertiser at the time of publishing, it did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.