MCF could be the right partner to realise ADX’s big gas ambitions

MCF could be the right partner to help ADX explore and develop the Welchau gas prospect. Pic: Supplied

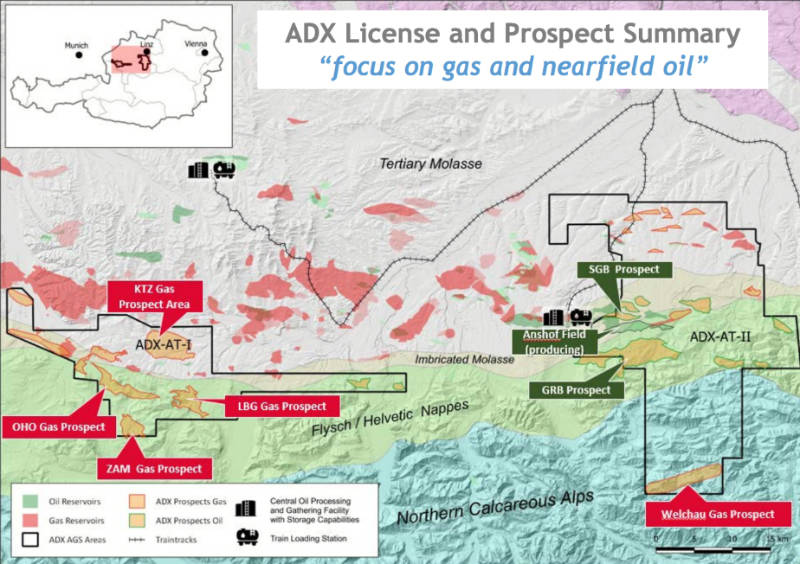

ADX is gearing up for the drilling of a potentially transformational gas prospect in Austria and where the recent entry of TSXV-listed MCF Energy could increase the international profile of its exploration efforts.

MCF Energy Ltd (MCF), which recently commenced trading on the TSX Venture Exchange and raised C$8.5m through a private placement, was assigned Kepis & Pobe Financial Group’s (KPFG) right to earn a 20% interest in the Welchau farm-in area by funding 50% of the Welchau-1 well cost.

The Canadian company, which was co-founded by KPFG’s managing principal Ford Nicholson, is focused on becoming an active explorer and developer of new natural gas discoveries in Western Europe.

As such, it shouldn’t come as any surprise at all that the relatively shallow Welchau prospect in Austria ticks all the right boxes with its best estimate technical prospective resource of 807 billion cubic feet of gas, proximity to a historic gas discovery, proximity to the national gas pipeline system , and location right smack in the middle of gas-starved Europe.

ADX Energy (ASX:ADX) managing director Ian Tchacos told Stockhead that MCF’ backing of the asset into a listed entity brought a bigger balance sheet with more liquidity into the drilling and potential development of Welchau.

“Secondly, I think it starts to bring a greater profile to what we’re doing because ADX basically was the only international listed entity which had a substantial position in Austria prior to MCF’s entry,” he added.

“Many investors would not realise that Austria is a significant oil and gas province because the oil and gas business in Austria has been dominated by two large, Austrian companies for over 75 years, until we purchased our oil field in the Vienna basin, secured an experienced team on the ground and commenced exploration in Upper Austria..

“We’re a new player but we’re also very active despite being the smallest operator in the country. In 2022 we made the Ansfof oil discovery in Upper Austria and 2023 is shaping up to be much more active with up to 4 wells on the cards. We’re probably the most active exploration player at the moment.”

Tchacos added that while a lot of larger companies have tended to withdraw from exploration in Europe, ADX had embraced it – an opinion it shares with MCF.

“I think MCF will bring greater visibility to what we’re doing. The people behind it have a track record of building substantial asset bases and being successful in building companies in Europe and elsewhere,” he noted.

“It’s going to be a good collaboration on Welchau, they like the prospect and we’ll see whether they want to deploy more funds on it with the option to increase their interest at the end of February.”

Should MCF exercise its option, it can earn a further 20% in the Welchau farm-in area by funding a further 50% of the Welchau-1 drill costs. If that is the case they will fund 100% of the well while leaving ADX with still a large 60% interest in the prospect.

Growth-focused

While Welchau is certainly the most exciting play – not unreasonable as European gas prices are expected to stay elevated for years to come, it is not the only piece that ADX has in the oil and gas game.

Tchacos said that while the company is focused on planning for drilling at Welchau, which is expected to spud in the middle of the year, it has also received lots of interest in the rest of its portfolio.

“We believe that we’re going to have additional farm-in deals,” he added.

ADX is also planning to drill two additional development wells at its Anshof oil field discovered in early 2022 following the strong contribution that the Anshof-3 well has made to its oil production rates and sales revenue since commencing production during October 2022.

“The first will be drilled in the third quarter of next year, following Welchau and then another well after that,” Tchacos said.

“That gives us the opportunity to substantially increase production rates from Anshof and potentially further increase reserves given we have only just started developing this large 25 km2 structure”

He added that while the company had all the approvals needed to drill the Anshof wells as they would be drilled from the same well pad as Anshof-3, their timing was due to the need to secure long-lead items such as packers, tubing and casings as it took time to secure them due to the impact of COVID-19.

“We also trying to squeeze in another another gas exploration well in between the two oil wells.

We are looking to step up activity now because we really expect the gas situation in Europe to be a lot worse in the second half of this year,” Tchacos explained.

“So we’re trying to get gas online as quickly as we can to respond to Austria’s demand for gas supply.”

“We are doing other things, our existing field production in the Vienna Basin, we’re doing further workovers to increase production.”

Not just oil and gas

Tchachos also touched on the company’s plan to build a solar plant at its Vienna Basin project, saying that the generated power could be used to meet the field’s requirements and reduce its operating costs.

ADX will also look to potentially expand this solar park, which could provide power to produce green hydrogen.

“Our Vienna basin fields have the potential to become like an energy park for producing hydrogen, storing hydrogen underground in some of its depleted reservoirs and generating electricity for our own consumption as well as for hydrogen production,” he added.

“A lot of this is possible because we own quite a bit of the land and there’s already lot of green power around us that we can use.

“We are trying to make our existing production operations as carbon efficient as possible. It is also good to enhance our existing assets through upcycling rather than creating new ones , as it is likely to be more profiteable and you will take on less risk.”

This article was developed in collaboration with ADX Energy, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.