LFP batteries to increase revenues, lower costs at Frontier’s Waroona project

Frontier’s final battery technology selection has increased the battery life for its Waroona renewable energy project. Pic: Getty Images

- Frontier Energy selected batteries have longer life, lower capex

- Longer battery life allows for more power to be sold during peak demand times, increasing revenue

- Selected LFP batteries are safer and longer lasting than other battery technologies considered

Special Report: Frontier Energy expects the economics of its Waroona renewable energy project to improve after its selected battery technology increased the battery duration up from 4 hours to 4.5 hours.

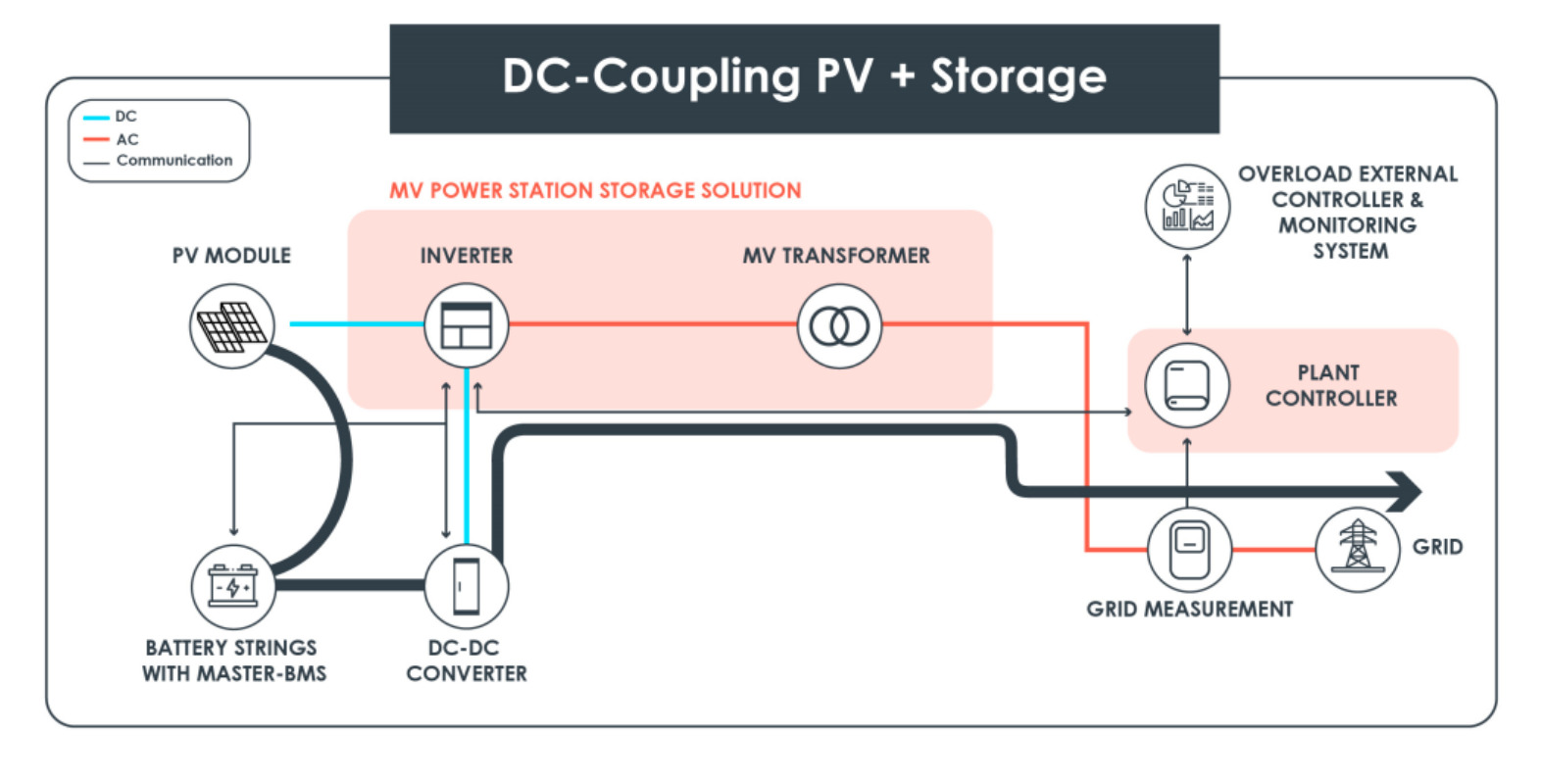

The Waroona project combines the construction of a 120MWdc (megawatts of direct current) solar facility with an integrated battery storage facility – originally expected to be a four hour 80MW battery – to help lessen the volatility in WA electricity prices.

A definitive feasibility study released by Frontier Energy (ASX:FHE) in late February estimated the project would have capex of $304m and deliver annual EBITDA of $68m over the first five years of operation and a post-tax IRR of 21.6%.

This was calculated using an average energy price of $143/MWh during peak periods, which is when the battery storage is likely to kick in, and $80MWh (solar price) over a 30-year operating period.

The DFS was attractive enough for the company to proceed with Phase 2 of its debt financing process for the project.

Selected batteries to enhance economics

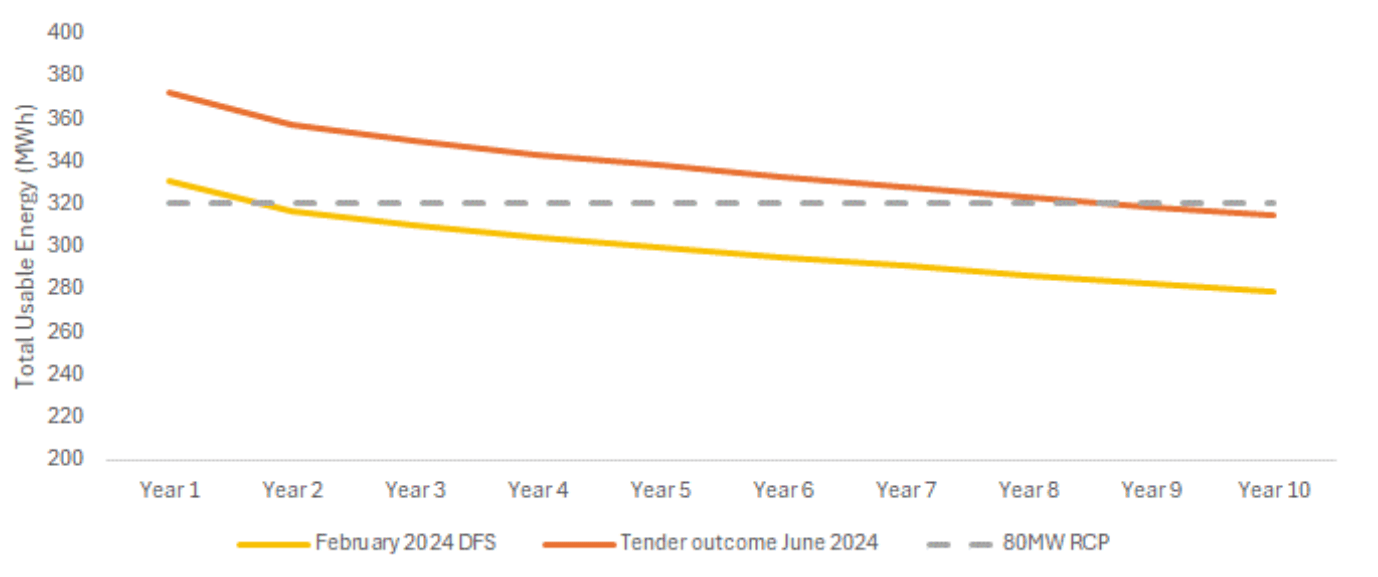

FHE notes that the final battery technology selection has increased the battery duration by 12% to 4.5 hours.

This is expected to increase project revenue compared to the DFS as more energy can be sold during peak electricity price periods. It will also increase the Reserve Capacity Payments (RCP).

If that wasn’t enough of an improvement, the selection of preferred battery partners to two Tier 1 manufacturers has also reduced the cost of the battery by ~5% compared to the DFS estimate of $118.5m.

Lithium-ion phosphate (LFP) batteries were selected due to their superior safety, longer cycle life, higher energy density, faster charging capabilities, wider operating temperature range, and lower environmental impact compared to other battery technologies.

“The company is in the fortunate position that the cost of the two largest capital items, solar panels and battery, have fallen significantly since the release of the DFS in February,” FHE chief executive officer Adam Kiley said.

“Battery prices have fallen due to a combination of factors, including falling raw materials prices, improvement in supply chain, and reportedly weaker than anticipated demand, resulting in an ample supply of batteries in the current market.

“This unique situation is to Frontier’s advantage, with improved battery capacity resulting in increased duration (approximately 4.5 hours compared to 4 hours in the DFS), increasing project revenue while at the same time achieving a lower capital cost.

“The company continues to progress its funding strategy, with both debt financing and strategic partnering processes well advanced.”

This article was developed in collaboration with Frontier Energy, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

SUBSCRIBE

Get the latest breaking news and stocks straight to your inbox.

It's free. Unsubscribe whenever you want.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.