Frontier Energy leaps into Phase 2 debt financing for its 258GWh Waroona solar project

Frontier is jumping into the future with the next phase of financing for its Waroona solar project. Pic: Getty Images.

- Phase 2 includes debt financing of $200-$225m

- DFS has outlined a 5.8yr payback for the $304m initial project cost

- FHE is shortlisting financiers as it completes project due diligence

Special Report: Frontier has kicked off Phase 2 of the debt financing process for Stage 1 of its Waroona renewable energy project in WA, eyeing between $200-$225 million based on a recently completed definitive feasibility study.

Frontier Energy’s (ASX:FHE) 258GWh Waroona solar project is the construction of a 120MWdc (megawatts of direct current) solar facility with an integrated four-hour 80MW battery to help lessen the volatility in WA electricity prices.

The DFS released in late February outlined the attractive economics for the $304m project which include annual EBITDA of $68m over the first five years of operation and a post-tax IRR of 21.6%.

The metrics were evaluated based on using an average energy price of $143/MWh4 (peak periods) and $80MWh4 (solar price) over a 30 year operating period.

Debt funding Phase 2

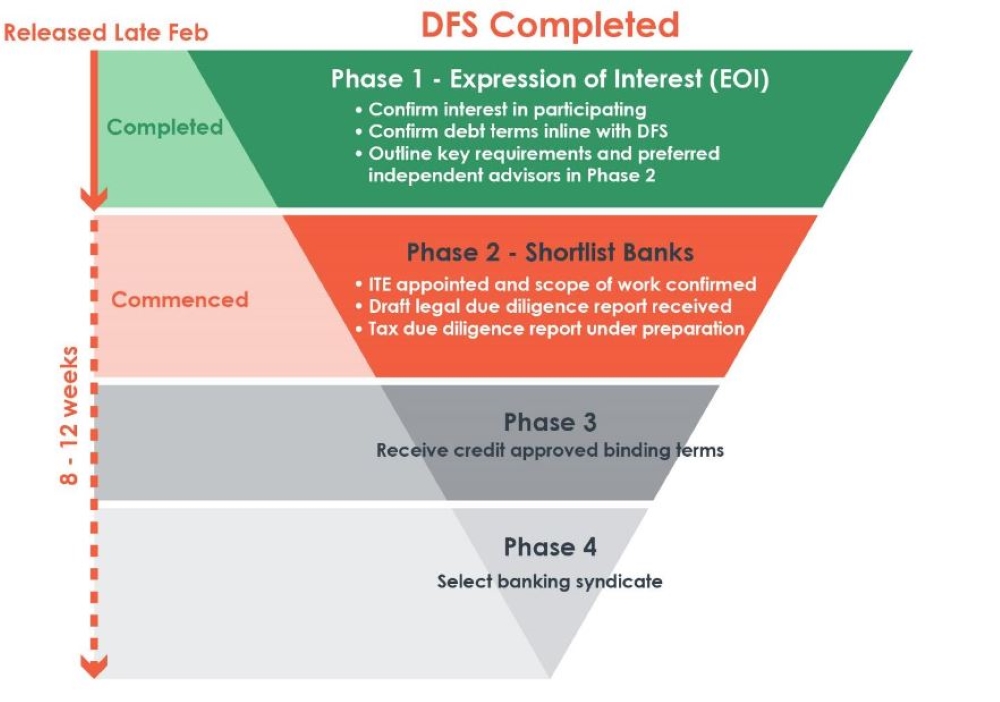

FHE is now in the process of shortlisting preferred banks ahead of further due diligence to enable submission of binding, credit approved terms after confirming expressions of interest from lenders.

In the coming days and weeks, the company expects to appoint an independent technical engineer, assess and choose an engineering, procurement and construction contractor and sign off on the procurement of long lead items such as the battery storage unit, photovoltaic panels and inverters for Waroona.

“Key to the initial phase of the debt financing process was confirmation of our major funding assumptions, which assumed gearing levels of between 65-70%, equating to between $200-$225 million, equipment selection, due diligence requirements and the funding timetable,” FHE CEO Adam Kiley says.

“Confirmation of these key assumptions in such a short time frame is testament to the key attributes of the Waroona project being well understood by financiers, predominately due to its simplicity and its executability as well the strong returns it delivers.

“We have now moved into the second phase of the debt financing process and will be working closely with shortlisted banks towards credit-approved terms and complete due diligence requirements in a timely manner.”

FHE anticipates the credit-approved terms for the development of Waroona to be provided during the next 8-12 weeks.

This article was developed in collaboration with Frontier Energy, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.