Japan’s trading giants begin exiting Aussie oil, gas to meet zero carbon pledge; eye LNG

Pic: Vertigo3d / E+ via Getty Images

- Several Japanese trading giants announce shift away from investing in oil and gas assets

- ‘If 2020 was a year for the evaluation of future plans, then 2021 looks to be the year of implementation’ – Wood Mac

- ASX gas producers rise on booming Asian LNG market

There is some rethinking going on among Japan’s fabled trading giants about investment in oil and gas projects, including in Australia, as they look towards honouring Japan’s zero-carbon emissions pledge.

Japan’s trading houses like Mitsubishi and Sumitomo are household names and they play a key role in funnelling commodities such as oil and gas into the Asian nation’s economy.

“Japan is one of the great industrial economies, despite its extremely limited natural resources,” Wood Mackenzie Asia Pacific upstream research director, Angus Rodger, said.

“Energy of course is critical to this, with the country having invested hundreds of billions of dollars worldwide to ensure the secure supply of coal, oil and liquefied natural gas,” he said.

Trading houses based in Japan make up 30 per cent of Japan’s total investment in upstream oil and gas assets worldwide that are valued at around $US70bn and produce 1.6 million barrels of oil equivalent per day.

Now it seems Japan’s trading companies are having a change of heart, and some have already stated publicly their intention to withdraw investment in carbon heavy energy products like coal.

Cleaner and greener energy sources

Wood Mackenzie said strategic moves by Japanese trading companies to “de-risk” their upstream energy portfolios make sense in the context of Japan’s ongoing energy transition.

As they look to cleaner, greener fuels such as hydrogen, solar and wind, and energy storage systems they are re-jigging their investment plans for gas and oil production.

“If 2020 was a year for the evaluation of future plans, then 2021 looks to be the year of implementation,” said Wood Mackenzie.

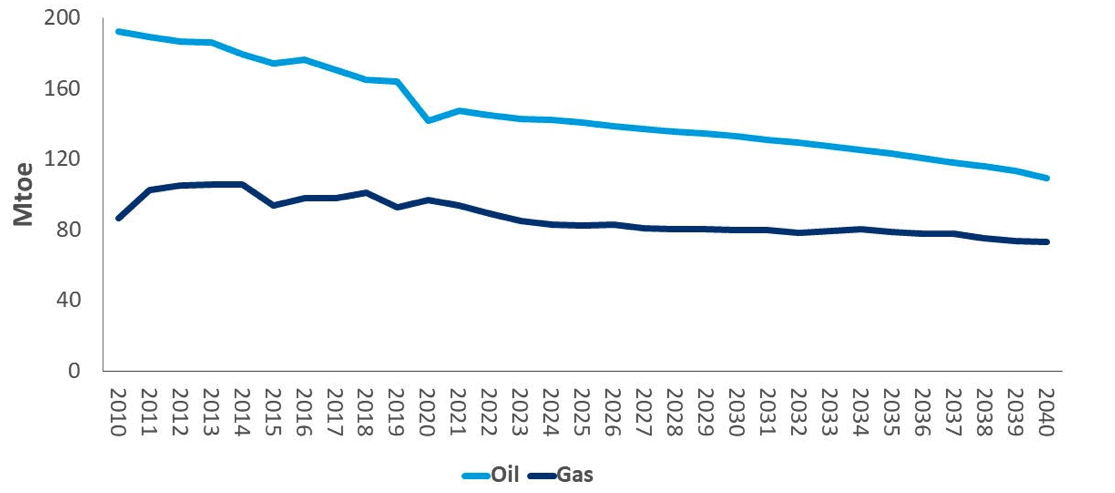

“Faced with falling domestic oil and gas demand and an accelerating energy transition, future exploration and production investment is far less certain,” the consultancy said.

The tendency for Japanese traders to own minority stakes in large, long-life and expensive oil and gas assets has also been problematic in some ways.

“This has created portfolios with longevity, but little control or operator experience and lacking exposure to key global growth themes, such as deepwater and unconventional,” Rodger said.

Action after strategic business reviews

Strategy reviews inside Japanese trading houses are concentrating on new energy sources and business lines as they try to prioritise investment capital in growth sectors.

“Regardless of size, all trading houses face challenging long-term growth outlooks due to mature portfolios, a lack of new development assets, and executive management teams increasingly reluctant to allocate precious capital to upstream investments,” said Rodger.

Two Japanese trading companies, Mitsui and Mitsubishi, account for 80 per cent of Japan’s upstream portfolio, and are involved in projects in a range of countries including, Canada, Russia and Mozambique.

Mitsui is understood to have closed the sale of its 35 per cent stake in Beach Energy’s (ASX:BPT) BassGas project in Australia’s Bass Strait off the coast of Victoria.

The company’s other oil and gas projects include a joint venture with Woodside Petroleum (ASX:WPL) off WA’s northwest coast, and the Casino gas project in the Otway Basin off Victoria with its operator Cooper Energy (ASX:COE).

Sumitomo has announced it will no longer participate in new oil projects, and at the same time revealed it is to shift its focus to renewable energy investment, said Rodger.

The trader has invested in OneH2, a hydrogen fuel company based in the US state of North Carolina.

“Globally, Sumitomo is engaged in several hydrogen projects and we look forward to our experience and collaborating with OneH2,” said Sumitomo.

Sojitz has announced a move away from upstream oil and gas production, and Marubeni has started to sell off some of its upstream assets including in the North Sea, said Wood Mackenzie.

ESG risks in some oil and gas plays

For some Japanese traders, upstream assets are already considered non-core to their business, and some are perceived to carry environmental, social and governance risks.

“Japanese upstream investment in oil sands, US lower 48 fracking and the Arctic will be scrutinised by investors and financial institutions, particularly European banks looking to limit exposure to companies and projects in these areas,” said Rodger.

Other Asian countries are following suit and like Japan are seeking to divert investment in oil and gas assets, such as South Korean firm KNOC which is selling its North Sea assets.

Not all Japanese companies are seeking to back out of the oil and gas sector. Inpex, a large player in Australia’s market, has ambitious production targets.

Tokyo Gas and Osaka Gas are looking at opportunities in the LNG market, and JXTG is focused on the CO2 sector.

“But there is no doubt that for all Japanese exploration and production players, the strategic choices look hard,” added Rodger.

He identifies a possible role for Japan’s government as a facilitator in asset swaps between Japanese companies, allowing some players to exit the sector and others to scale up.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.