How Brookside Energy followed the money to a black gold mine

Special report: Brookside Energy hit on its Oklahoma oil play in 2015 by following the money.

That year saw the bottom of a price rout when crude oil sank below $US30 a barrel.

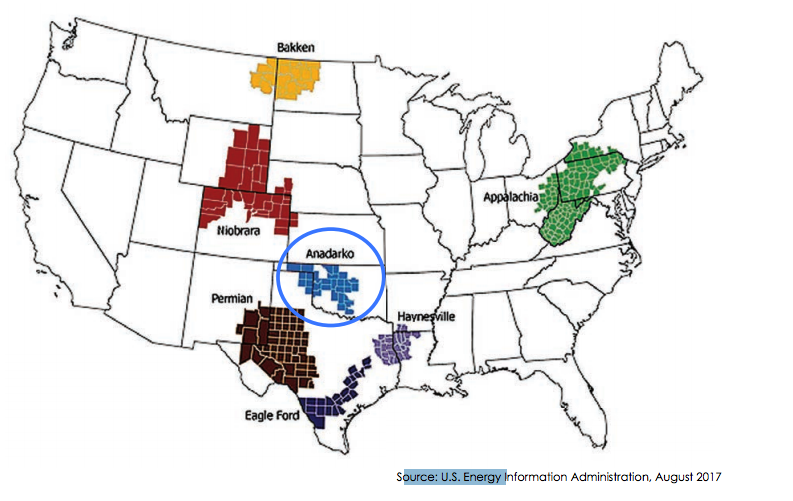

Brookside (ASX:BRK) managing director David Prentice looked for locations where operators were still drilling and making money: Oklahoma’s STACK and SCOOP plays in the Anadarko Basin, and the Permian Basin to the south, were the two best spots.

STACK and SCOOP have been described as two of the “hottest new areas” for oil development in the 130,000 sq km Anardarko Basin — one of the most productive oil and gas regions in the United States.

“If the operators there were still generating returns, those are the areas we should be looking at,” Mr Prentice told Stockhead. “We wanted to buy the very best real estate at the bottom of the cycle.”

The men at the helm of Brookside’s drilling partner Black Mesa were Oklahoma veterans — so the Anadarko Basin was where they ended up.

It’s a region that has been described by various operators as hosting world-class resource plays that generate superior rates of return in the current oil price environment.

Cheap deals

Brookside was able to pick up land cheaply for two reasons: they were happy to work with very small blocks and the technology to exploit those areas has only just started being used.

Mr Prentice says there are about 85 drilling rigs operating in the STACK and SCOOP areas now — and about $3.5 billion of capital deployed annually to drilling and completion by major independents like Marathon, Newfield, Continental Resources and Devon Energy.

The STACK and SCOOP are producing wells with record setting initial production rates.

NYSE-listed Continental drilled a well that achieved a 24-hour rate of 7442 barrels of oil equivalent.

New techniques, more oil

While drilling activity has been ongoing over the area for at least 100 years, only the use of horizontal drilling and “generation two” completion techniques have been able to get the best value out of them.

Horizontal drilling is a technique perfected in the shale oil and gas sector over the last 10 years and is now commonly used in both conventional and unconventional oil recovery.

Mr Prentice says generation two completion techniques have been used in only the last two years or so, and involves larger fracking-stimulation jobs.

Fracking, or hydraulic fracturing, is a process where fluid is pushed into a well and opens cracks in the rock. Proppants, or materials to keep the fractures open, are part of the fluid mix.

Small time stuff

Brookside has also been willing to do what Mr Prentice calls “kitchen table leasing”.

“We deal directly with small land-owners on the ground, doing the hard work on small pieces of land at a time,” he said.

“Bigger guys, if they’re going to deploy capital and manpower, they have to secure a big position quickly so as not to drive prices up — which is what is happening now as the region becomes more popular.”

Land in the STACK play is now going for as much as $US29,000 an acre, after a $3.8 billion deal in February between Silver Run and Alta Mesa

Brookside is now repeating its formula in the neighbouring SCOOP play, but getting in earlier and securing a larger position.

Brookside has already leased about 2100 acres and is currently working to expand that position to in excess of 9000 acres.

This special report is brought to you by Brookside Energy.

This advice has been prepared without taking into account your objectives, financial situation or needs. You should, therefore, consider the appropriateness of the advice, in light of your own objectives, financial situation or needs, before acting on the advice.

If this advice relates to the acquisition, or possible acquisition, of a particular financial product, the recipient should obtain a disclosure document, a Product Disclosure Statement or an offer document (PDS) relating to the product and consider the PDS before making any decision about whether to acquire the product.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.