FREE WHELAN: Don’t have a cow, man. Just hold the line

Energy

In this legendary Stockhead series, investment manager James Whelan from VFS Group offers his insights on the key investment themes and trends in domestic and global markets. From macro musings to the metaverse and everything in between, Whelan offers his distilled thoughts on the hot topic of the day, week, month or year, from the point of view of a damn fine professional money manager.

Firstly a note that I’m hosting a webinar on February 15th with some great guests, including Stockhead, talking about the year ahead and how to navigate it. Should be a great evening so please RSVP via this link and I’ll see you there.

Back at the Milsons Point HQ from my time working offsite, refreshed and full of ideas.

One great yarn from the time away was doing an evening run around the farms checking on calving and finding a distressed mother standing on one side of the fence and her newborn calf standing on the other. As confusing as that was to piece together we had to act quickly and be very careful. I went down one side of the fence and jumped and the manager of the farm went down the other and did the same.

We grabbed the little one and, with me holding the barbed wire up, managed to get it back under the fence to the correct side. As with most simple jobs, it was made all the harder with a distressed cow mum standing next to you mooing loudly as barbed wire slices into your forearm.

However, we managed to reunite them and all was well.

The question remains of how it managed to get to the other side of the fence to begin with, but some things are best kept as a mystery.

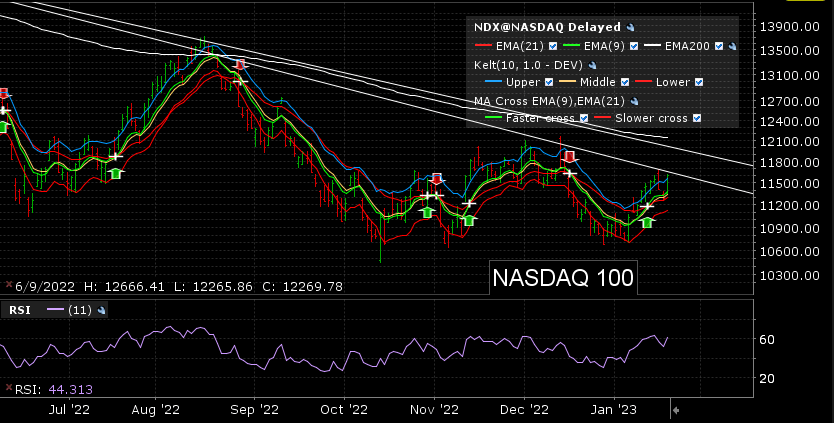

What remains a mystery to many is that if the world is on the brink of an earnings and economic recession with mass layoffs happening in tech why then does the market do this?

We have a few stories going on at the moment with the debate raging as to whether bad news is bad news or if it’s still good news? Bad data was met with a market selloff at one point last week and then massive tech layoffs were met with buying in the space. Investing is fun.

Fact is that every time we hear “stay the course” by central bankers the market will come off.

Last week we heard it twice: President of the ECB Christine Lagarde at the WEF- “We shall stay the course until . . . we can return inflation to 2 per cent in a timely manner.” And Fed Vice Chair Brainard- “it will take time and resolve” to get “high” inflation back down to the US central bank’s target of 2 per cent.

“We are determined to stay the course,” Brainard said at an event hosted by the University of Chicago’s Booth School of Business.

It’s clear central banks still have control of the markets because these statements had negative impacts on the US market.

We cover this in the latest episode of The BIP Show with some great guests. It’s good to be back on the air.

And we have finally hit the wall on the cycle. “Bad news is bad news” again, said Charlie McElligott, a strategist at Nomura.

If Charlie says it, it’s true.

Barclays adding to the pile on with this line from a recent note:

“But the ‘bad data is good news for equities’ mantra seems over now in the US.”

So how to defend the line whilst staying invested? Tough to do.

Firstly the focus on the US market is shifting. The earnings recession is focussed there. China and the US are currently at a massive disconnect and those leveraged to each will be at the whim of their fortune.

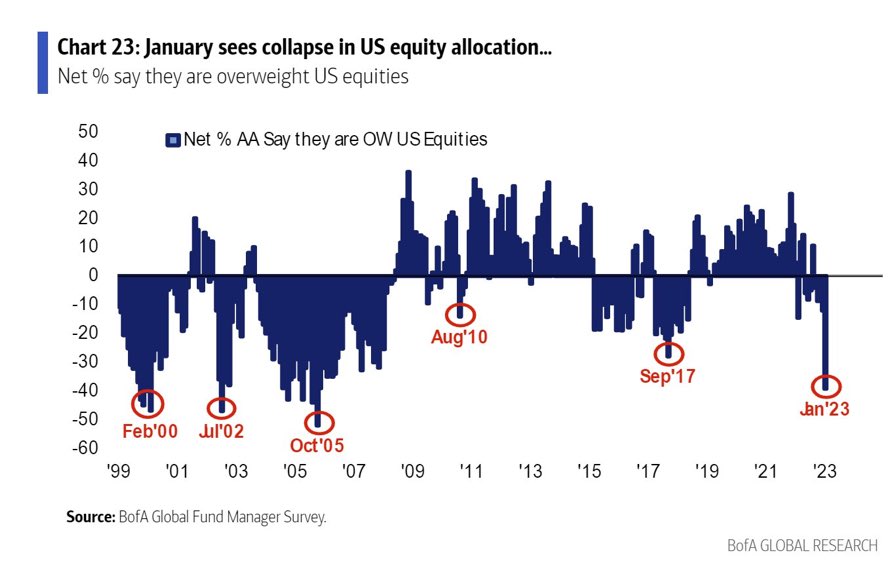

Note – two things from the BofA Fund manager Survey out last week:

And Europe catching a bid.

Still not a massive fan of being overweight the US market now. Continue to look at the allocation to Australia backed by the China reopening trade as well.

As for Europe here’s something to think about.

Locally listed, European exposure WITH luxury goods (to capture the China reopening and buying nice things trade). ESTX is the code, buy Global X Euro Stoxx top 50 stocks.

This may just be the best way to ensure you still have point-scoring players on the field.

I’ll be keeping an eye on it for entries.

Finally we’re really going to find out if the US is in an earnings recession this week. Lots going on.

Stay safe and all the best,

James

The views, information, or opinions expressed in the interviews in this article are solely those of the interviewees and do not represent the views of Stockhead. Stockhead does not provide, endorse or otherwise assume responsibility for any financial product advice contained in this article.