Emission Control: US DOE maps pathways to nuclear commercial lift-off

The idea that nuclear energy has an important role to play in the future energy mix is finally starting to catch on. Pic: Getty Images

Emission Control is Stockhead’s fortnightly take on all the big news surrounding developments in renewable energy.

As nations across the globe scramble for more low-carbon energy supplies with the climate crisis front of mind, the idea that nuclear energy has an important role to play in the future energy mix is finally starting to catch on.

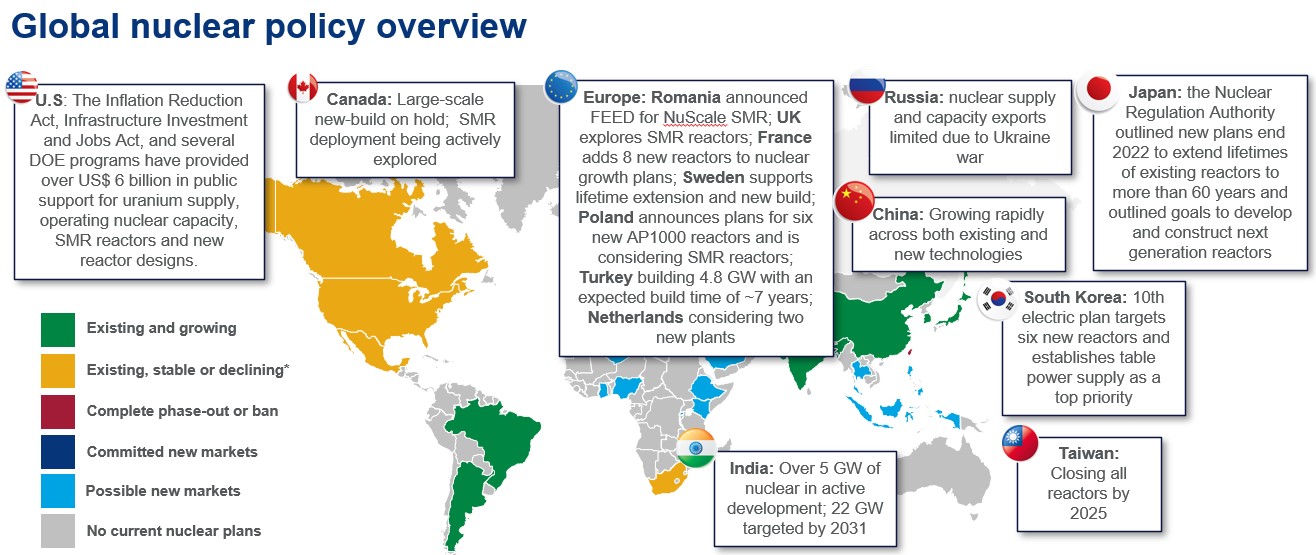

This can be seen by countries increasingly starting to adjust their policies in support of new nuclear projects with Japan announcing its plan to restart 17 nuclear power plants, the EU voting in favour of marketing nuclear power plants as sustainable investments, and the focus on nuclear energy at COP27 as a potential ‘low emission’ energy source.

But the most recent example of this comes out of the US, with the Department of Energy (DOE) releasing road maps for industries and policy makers about how to bring three key clean technologies into the country’s mainstream, advanced nuclear being one of them, along with clean hydrogen and long duration storage.

Thar she blows! US Dept of @Energy has published a Liftoff Report advocating a rapid #Nuclear build-out plan even more aggressive than #China of 13GW added annually⚛️ ️ deploying another 200GW of nuclear by 2050. Mind-blowing #Uranium demand! https://t.co/GWxMFj0b8o pic.twitter.com/iNuYDtTMBp

— John Quakes (@quakes99) March 22, 2023

Developed in part for private investors, the three reports lay out the barriers for the three technologies along with solutions and rough timelines for their emergence in the 2020s.

The report highlighted that advanced nuclear could become a major contributor to net-zero goals in 2050, accounting for around 200GW of the firm power capacity necessary to meet the mid-century target.

But for this to happen, at least one specific nuclear design needs to emerge as a clear leader by winning contracts to build between five to 10 reactors within the next few years.

“A committed order book is required to catalyse commercial liftoff in the US and given expressed utility risk tolerances, it is likely that the first design to reach a critical mass of orders may be a Gen III+ SMR, which could be followed in parallel or sequence by Gen IV reactors,” the report authors wrote.

New tech driving costs down to make nuclear competitive

Analysts at Wood Mackenzie believe investments in advanced nuclear, such as small modular reactors (SMR) and new reactor technologies, could lower costs, improve time to market and make nuclear a viable competitor with renewables.

“We project that by 2030, SMR costs can fall quickly to be competitive with abated thermal capacity,” David Brown, director, Energy Transition Service for Wood Mackenzie said.

“By 2050, SMR costs could fall even further to be competitive with thermal capacity.”

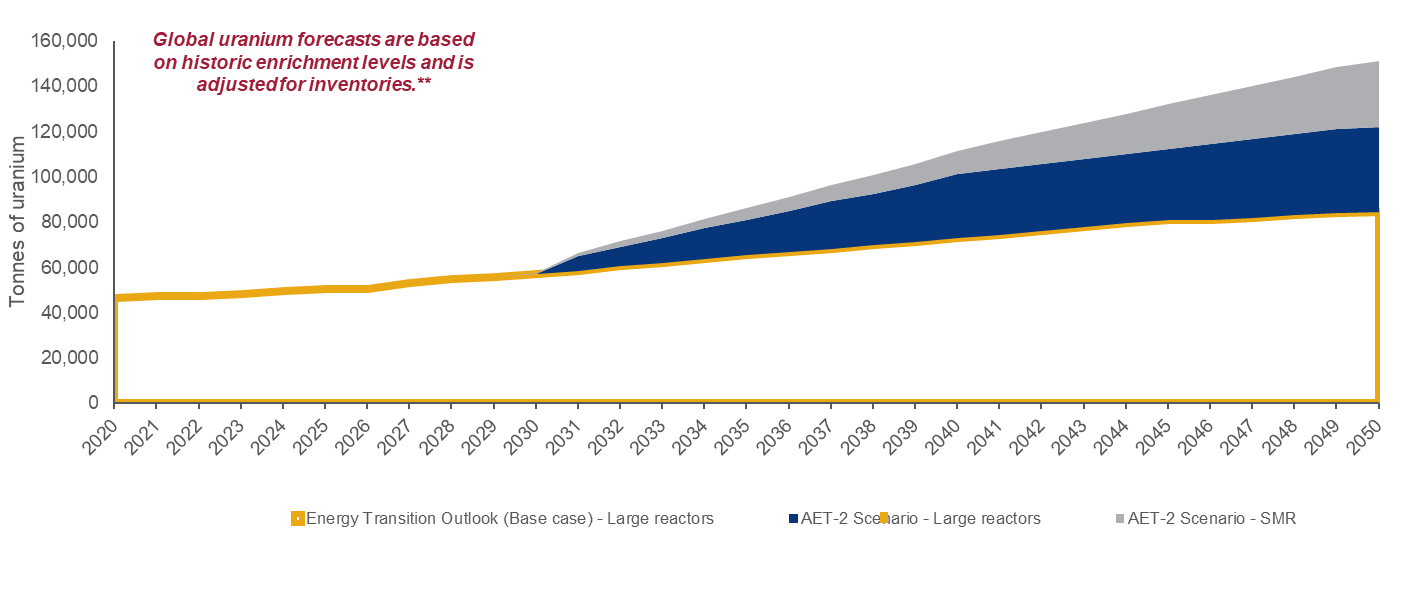

With growth in nuclear capacity will also come more demand for uranium.

Wood Mackenzie projects that demand will remain flat until 2030, but then nearly double to meet its energy transition outlook (ETO) outlook, and triple to meet its AET-2 scenario, which is consistent with a 2C warming trajectory by 2050.

There is enough uranium to meet this demand, but countries that rely on sources from Russia may find additional challenges.

In Australia, near-term uranium producers like Boss Energy (ASX:BOE), Deep Yellow (ASX:DYL), and Aura Energy (ASX:AEE) are perfectly placed to answer the call, while mining junior explorers like Kingsland Minerals (ASX:KNG), Uvre (ASX:UVA), and GTI Energy (ASX:GTR) work hard at proving up resources to meet demand.

NOW READ: Uranium stocks guide

IPCC calls for urgent climate action

The road maps come on the heels of the latest warning about the pace of global warming from the UN Intergovernmental Panel on Climate Change report, which highlighted the rapidly closing window for transformative climate action both here and around the world.

This latest IPCC report showed global warming has increased at an unprecedented rate over the past decade, resulting in more frequent and severe droughts and cyclones.

By the 2030s, every region in the world is expected to face increasing risks from climate change.

Minister for Climate Change and Energy Chris Bowen said the IPCC report highlighted the importance of getting on with the job of ambitious reforms in climate and energy.

“Ten years of denial and delay has increased the threat of climate change to our health, environment, economy and national security, the Government is acting rapidly to urgently turn this around,” Minister Bowen said.

“We’ve legislated Australia’s 43% emissions reduction target by 2030, along with net zero by 2050, supercharging a new offshore wind industry and delivering the $20 billion Rewiring the Nation investment to decarbonise our grid and take us to 82% renewables by 2030.

“If passed, our Safeguard reforms will come into effect in just 101 days from now. And with only 82 months left before 2030 – it is critical that we seize every possible day of the remaining decade to drive down emissions.”

Here’s how ASX renewable energy stocks are tracking:

| CODE | COMPANY | PRICE | % WEEK | % MONTH | % 6 MONTH | % YEAR | MARKET CAP |

|---|---|---|---|---|---|---|---|

| AVL | Aust Vanadium Ltd | 0.035 | 6% | 17% | -10% | -40% | $157,090,508 |

| BSX | Blackstone Ltd | 0.15 | -9% | -3% | -25% | -64% | $73,374,697 |

| DEL | Delorean Corporation | 0.04 | -11% | -37% | -50% | -81% | $8,628,837 |

| ECT | Env Clean Tech Ltd. | 0.009 | 13% | -14% | -53% | -70% | $22,289,495 |

| FMG | Fortescue Metals Grp | 20.33 | -6% | -11% | 23% | 7% | $64,750,632,226 |

| PV1 | Provaris Energy Ltd | 0.042 | -7% | -25% | -31% | -58% | $23,069,780 |

| GNX | Genex Power Ltd | 0.14 | -3% | -13% | -33% | -7% | $207,776,571 |

| HXG | Hexagon Energy | 0.011 | 0% | -35% | -35% | -80% | $5,642,075 |

| HZR | Hazer Group Limited | 0.49 | -3% | -13% | -22% | -47% | $83,517,434 |

| IFT | Infratil Limited | 8.19 | 1% | 4% | 0% | 9% | $5,784,628,820 |

| IRD | Iron Road Ltd | 0.11 | -8% | 5% | -21% | -42% | $88,378,000 |

| LIO | Lion Energy Limited | 0.037 | 9% | 6% | 16% | -24% | $16,618,299 |

| MEZ | Meridian Energy | 4.77 | 0% | -1% | 5% | 1% | $5,900,612,421 |

| MPR | Mpower Group Limited | 0.02 | 18% | -9% | -9% | -44% | $4,992,956 |

| NEW | NEW Energy Solar | 0 | -100% | -100% | -100% | -100% | $20,197,043 |

| PGY | Pilot Energy Ltd | 0.012 | -8% | -33% | -29% | -75% | $10,477,059 |

| PH2 | Pure Hydrogen Corp | 0.175 | 25% | -5% | -31% | -61% | $60,376,147 |

| PRL | Province Resources | 0.036 | -5% | -32% | -58% | -63% | $44,896,739 |

| PRM | Prominence Energy | 0.001 | -33% | -50% | -50% | -92% | $3,636,913 |

| QEM | QEM Limited | 0.2 | 0% | 5% | -5% | 11% | $27,028,714 |

| RFX | Redflow Limited | 0.18 | -5% | 0% | -56% | -57% | $33,248,082 |

| SKI | Spark Infrastructure | 0 | -100% | -100% | -100% | -100% | $5,036,718,784 |

| VUL | Vulcan Energy | 5.61 | -8% | -9% | -29% | -45% | $824,752,981 |

| CXL | Calix Limited | 4.31 | -11% | -21% | -39% | -38% | $792,944,040 |

| KPO | Kalina Power Limited | 0.01 | -9% | -29% | -50% | -60% | $16,667,154 |

| RNE | Renu Energy Ltd | 0.051 | 21% | 2% | 31% | -7% | $22,025,106 |

| NRZ | Neurizer Ltd | 0.07 | -4% | -14% | -50% | -52% | $79,107,017 |

| LIT | Lithium Australia | 0.033 | -11% | -20% | -44% | -70% | $41,520,517 |

| TVN | Tivan Limited | 0.072 | -9% | -19% | -20% | 6% | $105,519,785 |

| SRJ | SRJ Technologies | 0.08 | -4% | -27% | -81% | -81% | $8,422,530 |

| NMT | Neometals Ltd | 0.57 | -10% | -29% | -52% | -69% | $334,408,411 |

| MR1 | Montem Resources | 0.04 | 0% | 0% | 0% | 18% | $12,913,190 |

| FGR | First Graphene Ltd | 0.085 | -4% | -13% | -26% | -51% | $50,184,320 |

| EGR | Ecograf Limited | 0.18 | -12% | -16% | -50% | -69% | $81,060,023 |

| EDE | Eden Inv Ltd | 0.0055 | 10% | 0% | -50% | -68% | $17,588,666 |

| CWY | Cleanaway Waste Ltd | 2.42 | -3% | -9% | -12% | -19% | $5,409,180,292 |

| CPV | Clearvue Technologie | 0.17 | 6% | -6% | -21% | -51% | $39,071,043 |

| CNQ | Clean Teq Water | 0.3425 | -9% | -9% | -35% | -44% | $19,332,950 |

| M8S | M8 Sustainable | 0.009 | 0% | 0% | 29% | -50% | $4,418,176 |

| EOL | Energy One Limited | 3.4 | 4% | -18% | -33% | -50% | $101,785,868 |

| FHE | Frontier Energy Ltd | 0.43 | 1% | -1% | 23% | 83% | $106,609,057 |

| LPE | Locality Planning | 0.055 | 4% | 2% | 0% | -24% | $9,798,595 |

| GHY | Gold Hydrogen | 0.345 | -4% | -28% | 0% | 0% | $18,615,000 |

Who’s got news out?

ORIGIN ENERGY (ASX:ORG)

Aussie renewable gas retailer, Origin Energy, has signed an agreement with $11.5 billion company, Jemena, for the sale and purchase of renewable gas produced at the Malabar bio-methane demonstration project – a $16 million partnership between ARENA, Sydney Water and Jemena.

Jemena managing director Frank Tudor says the deal will enable biomethane to be blended into Jemena’s gas distribution network which delivers gas to more than 1.5 million users across Sydney and parts of regional NSW.

“We received broad interest from a number of retailers when we initially approached the market with an offer to purchase biomethane, and we are thrilled to have agreed to sell the renewable gas to Origin,” he explains.

“This is proof that renewable gasses, such as bio-methane, are commercially viable and that there is significant appetite from the market for it as part of the future energy mix.”

The project, which is scheduled to begin operating imminently, is expected to initially produce around 95 terajoules of gas per year, a volume equivalent to the gas usage of roughly 6,300 homes.

Jemena anticipates that, over the demonstration project’s four-year trial period, production can be scaled up to produce around 200TJs of biomethane each year – equivalent to the usage of approximately 13,300 homes if put to use in the residential network.

MPOWER (ASX:MPR)

Shares in this renewable energy and battery storage development shot up Thursday morning after establishing a project funding relationship with global renewable energy investment firm, AMPYR Energy.

The agreement will fund MPR’s national ‘Build Own Operate’ portfolio of solar power and battery storage projects which are being rolled out across Australia.

It will also allow a flexible funding solution for expansion on a project-by-project basis, in alignment with its strategy to build a national network of regional clean energy supply hubs.

An agreement has been executed for the first $10 million in funding, which will go towards the company’s clean energy project in Narromine, NSW – expected to be fully operational during summer 2023/2024.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.