Emission Control: Tough day for AGL as new path to renewables proves tricky… and costly

Pic: Getty Images

Emission Control is Stockhead’s fortnightly take on all the big news surrounding developments in renewable energy.

Shares in Australia’s biggest polluter and coal generator, AGL Energy (ASX:AGL), dropped 10% yesterday after reporting an interim bottom line loss of more than $1 billion while core profit halved to $87 million.

In what was the stock’s worst day since 2007, new AGL MD and CEO Damien Nicks said the losses reflect the impact of plant outages during challenging energy market conditions in July, the prolonged Loy Yang Unit 2 major outage caused by a generator rotor defect, and the closure of its Liddell Unit 3 power station in April 2022.

“Importantly, as units have returned to service, we’ve seen a significant improvement in portfolio performance at the end of the first half,” Nicks explained.

“We expect to have higher earnings in the second half of FY23, in line with guidance, and continued positive momentum into FY24.”

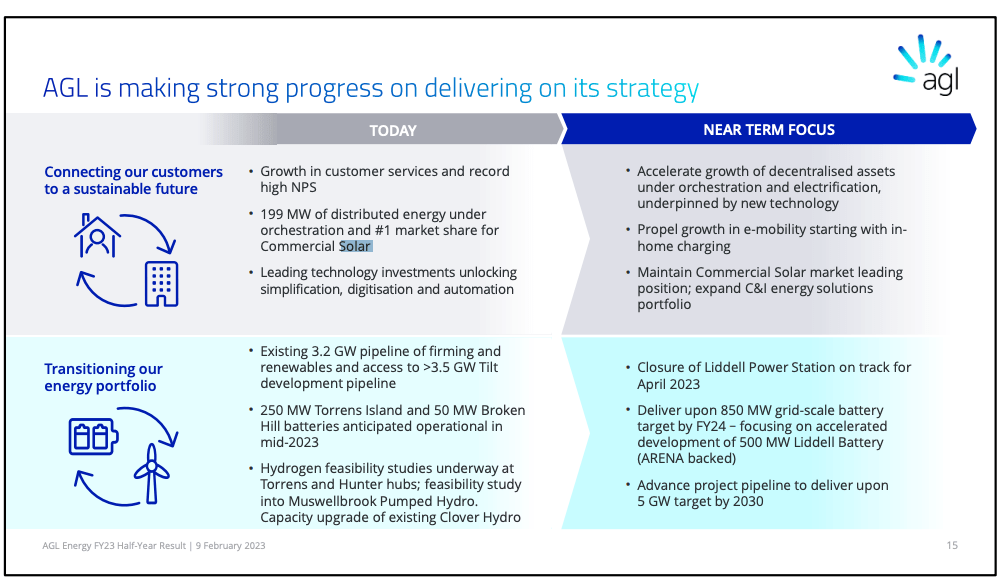

AGL has accelerated its decarbonisation plan as part of a ‘refreshed’ strategy, bringing forward dates for the closure of its major coal power stations with NSW’s Liddell generator set to shut down in April 2023.

Nicks said the closure of Liddell, which will cut 8 million tonnes a year of CO2 emissions, represents “one of the most significant decarbonisation initiatives in Australia in 2023.”

While the market reacted strongly to a big miss in underlying profit, the company remained upbeat on its pivot into renewables.

AGL plans to supply up to 12 gigawatts of new generation (wind, solar, battery, and pumped hydro) and firming capacity by the end of 2035, and intends to build big batteries at Torrens Island, Broken Hill, and Liddell.

AGL’s new generation and capacity

Interestingly, Nicks said up to one third of ‘new capacity’ will come from decentralised assets such as home batteries, EV charging, and orchestrated solar – meaning AGL can partially control the output and load of house and business assets.

“We will drive electrification through the propositions we offer and propel growth in e-mobility, starting with in-home charging,” he explained.

“We will continue to accelerate growth in decentralised assets, helping our customers electrify and decarbonise, and positioning AGL as leading in energy solutions.

“Our market leading position in Commercial Solar is evidence of the strong progress achieved in this area.”

Feasibility studies are underway at AGL’s Torrens and Hunter hubs and Muswellbrook Pumped Hydro project as it works towards meeting its 5-gigawatt interim target of new renewable generation and firming in place by the end of 2030.

Having raised more than A$3.5 billion in equity and debt funding into renewable assets since 2008, AGL chief financial officer Gary Brown said the company is confident in its ability to access a growing pool of global capital dedicated to fund the energy transition.

WA scores top place for wind farm performance

In other renewable energy news, January data from Rystad Energy finds Western Australia and South Australia as the nation’s top two wind performing states.

Wind projects between both Western Australia and South Australia accounted for the entire top 10 list.

Rystad Energy’s senior renewables analyst David Dixon said in a LinkedIn Post on Wednesday January 2023 was the second highest month on record for utility PV generation in Australia at 1463 GWh, just shy of the record set in December of 1509 GWh.

“January 2023 ends with all Australian utility PV and wind assets generating 3885 GWh, up from 3628 GWh (+7%) in January 2022,” he said.

“The best performing utility PV assets for the month were SUN Energy Merredin solar farm (42.2% AC CF) in Western Australia, Amp Energy’s Hillston solar farm in New South Wales (38.8 % AC CF) and DIF Capital Partners/Cbus Super Fund/Synergy (Electricity Generation and Retail Corporation)’s Greenough River solar farm (37.4% AC CF) in Western Australia.”

Aussie solar company wins micro-grid contract for lithium mine

Australian solar company, 5B, has been appointed by Zenith Energy as the tech provider for a 16MW solar system, set to form part of a 95MW hybrid power station for Liontown Resources’ Kathleen Valley Lithium Project.

It is expected to become the largest off-grid renewable energy hybrid power station in Australia, with 5B awarded the contract based on the rapid rollout and safety advantages of its system.

Zenith Energy will begin deploying the 342 5B Maverick array systems in June 2023.

When complete, the solar farm will occupy a land area equivalent to 17 NRL football fields and generate enough to power 4,000 homes.

Here’s how ASX renewable stocks are tracking:

| CODE | COMPANY | PRICE | 1 WEEK RETURN % | 1 MONTH RETURN % | 6 MONTH RETURN % | 1 YEAR RETURN % | MARKET CAP |

|---|---|---|---|---|---|---|---|

| AVL | Aust Vanadium Ltd | 0.033 | 14% | 14% | -30% | -21% | $148,363,257 |

| BSX | Blackstone Ltd | 0.155 | -3% | 7% | -35% | -75% | $71,007,771 |

| DEL | Delorean Corporation | 0.065 | -7% | -21% | -48% | -72% | $14,021,859 |

| ECT | Env Clean Tech Ltd. | 0.0115 | 5% | 5% | -48% | -57% | $19,736,894 |

| FMG | Fortescue Metals Grp | 22.52 | 1% | 3% | 19% | 1% | $69,215,131,357 |

| PV1 | Provaris Energy Ltd | 0.063 | -5% | 40% | -5% | -37% | $35,089,950 |

| GNX | Genex Power Ltd | 0.16 | 14% | 14% | -27% | -11% | $221,628,342 |

| HXG | Hexagon Energy | 0.018 | 13% | 13% | 13% | -68% | $9,232,486 |

| HZR | Hazer Group Limited | 0.6 | 3% | 3% | -19% | -37% | $98,857,371 |

| IFT | Infratil Limited | 8.2 | 4% | 1% | -1% | 13% | $5,885,986,522 |

| IRD | Iron Road Ltd | 0.105 | -9% | -13% | -25% | -45% | $84,360,818 |

| LIO | Lion Energy Limited | 0.036 | -5% | 20% | -10% | -32% | $16,192,188 |

| MEZ | Meridian Energy | 4.91 | 0% | 2% | 4% | 8% | $6,279,666,752 |

| MPR | Mpower Group Limited | 0.02 | 18% | 11% | -17% | -51% | $6,167,769 |

| NEW | NEW Energy Solar | 0.065 | -3% | 0% | 48% | 48% | $20,838,219 |

| PGY | Pilot Energy Ltd | 0.018 | -14% | -5% | 6% | -65% | $13,282,849 |

| PH2 | Pure Hydrogen Corp | 0.195 | 5% | 0% | -32% | -55% | $65,703,454 |

| PRL | Province Resources | 0.055 | -10% | -20% | -59% | -58% | $66,163,616 |

| PRM | Prominence Energy | 0.0015 | 0% | 0% | -25% | -88% | $3,636,913 |

| QEM | QEM Limited | 0.215 | 0% | 19% | -10% | 23% | $29,731,585 |

| RFX | Redflow Limited | 0.205 | -11% | -11% | -62% | -52% | $39,538,260 |

| SKI | Spark Infrastructure | 0 | -100% | -100% | -100% | -100% | $5,036,718,784 |

| VUL | Vulcan Energy | 7.37 | 4% | 9% | -12% | -19% | $1,059,986,874 |

| CXL | Calix Limited | 5.13 | -6% | 9% | -28% | -4% | $971,832,711 |

| KPO | Kalina Power Limited | 0.014 | 8% | -7% | -30% | -42% | $21,212,741 |

| RNE | Renu Energy Ltd | 0.057 | -3% | 8% | 0% | -32% | $25,108,621 |

| NRZ | Neurizer Ltd | 0.084 | -3% | -13% | -44% | -42% | $95,278,058 |

| LIT | Lithium Australia | 0.047 | 2% | -4% | -45% | -61% | $56,174,817 |

| TVN | Tivan Limited | 0.078 | -1% | 5% | -26% | 10% | $109,685,040 |

| SRJ | SRJ Technologies | 0.14 | -7% | 27% | -67% | -67% | $10,701,030 |

| NMT | Neometals Ltd | 0.82 | -5% | -6% | -41% | -42% | $442,192,941 |

| MR1 | Montem Resources | 0.04 | 0% | 0% | 0% | -7% | $12,913,190 |

| FGR | First Graphene Ltd | 0.105 | 7% | 0% | -22% | -43% | $58,131,639 |

| EGR | Ecograf Limited | 0.25 | 14% | 2% | -44% | -59% | $112,583,365 |

| EDE | Eden Inv Ltd | 0.005 | 0% | 0% | -50% | -71% | $14,657,135 |

| CWY | Cleanaway Waste Ltd | 2.75 | 0% | 5% | 3% | -5% | $6,054,720,326 |

| CPV | Clearvue Technologie | 0.21 | 8% | 17% | -25% | -49% | $44,497,577 |

| CNQ | Clean Teq Water | 0.41 | -2% | 11% | -30% | -38% | $21,929,913 |

| M8S | M8 Sustainable | 0.009 | -10% | 13% | 13% | -50% | $4,418,176 |

| EOL | Energy One Limited | 4.37 | 0% | -3% | -20% | -34% | $131,124,148 |

| FHE | Frontier Energy Ltd | 0.44 | -1% | -6% | 49% | 238% | $107,848,827 |

| LPE | Locality Planning | 0.052 | -4% | 2% | -25% | -50% | $9,264,126 |

| GHY | Gold Hydrogen | 50 | -1150% | $25,500,000 |

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.