Emission Control: Rystad reckons we’re about to witness an Olympian US$60bn in low-carbon investments this year

Energy

Energy

Emission Control is Stockhead’s fortnightly take on all the big news surrounding developments in renewable energy.

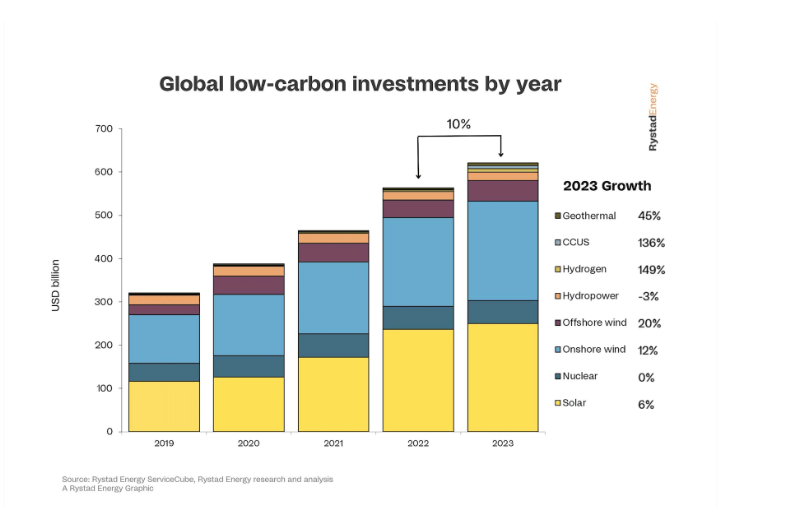

Low-carbon investments are going to vault, using a pole by US$60bn this year – some 10pc higher than 2022 – thanks to wind developments and a significant rise in funding for hydrogen and carbon capture, utilisation, and storage (CCUS) infrastructure.

This is one of the many striking findings from new research into the global low-carbon market out of Rystad Energy, an independent energy research and business consultancy headquartered in Norway.

According to the analysis, investments in the geothermal, carbon capture, utilisation and storage (CCUS), hydrogen, hydropower, offshore and onshore wind, nuclear and solar industries are set to hit US$620bn in 2023, up from about US$560bn last year.

Solar and onshore wind will contribute the most by a sizeable margin with solar totalling US$250bn in 2023, rising only 6pc from 2022.

But due to the falling cost of poly-silicon, the primary cost driver of solar PV cells, capacity growth will be more substantial than dollar investments suggest.

Meanwhile, spending growth will vary widely across industries.

Hydrogen and CCUS are expected to see the most significant annual increase, growing 149pc and 136pc, respectively.

Total hydrogen spending will approach US$7.8bn in 2023, while CCUS investments will total about $7.4bn.

“The weaker-than-expected growth is not a reason to panic for those in the low-carbon sector,” Rystad Energy’s head of supply chain research Audun Martinsen says.

“Rampant inflation typically triggers fiscal restraint across industries, and spending will likely bounce back in the coming years.

“The outlook for hydrogen and CCUS is especially rosy as technology advances, and the large-scale feasibility of these solutions improves.”

Low-carbon investments are more short-cycled than the fossil fuel industries, Rystad states, and are more sensitive to inflationary pressures.

Project plans, permitting activity and awards from companies and governments indicate this year’s expected investment growth.

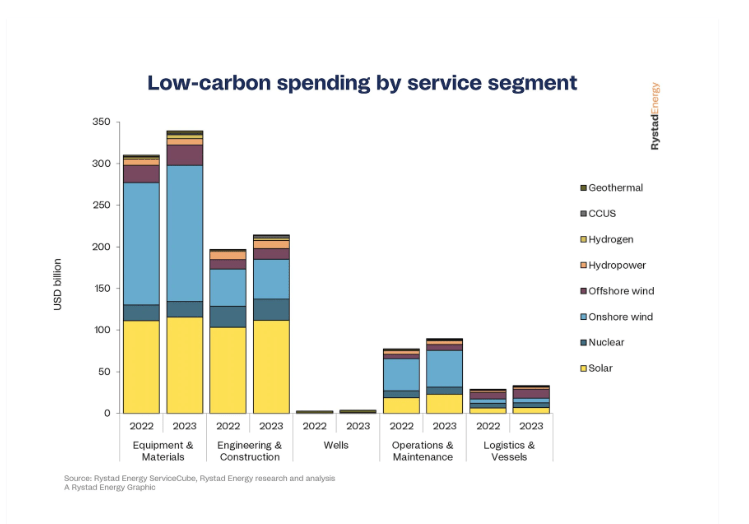

Sectors set to benefit the most include operations and maintenance companies who are most exposed to the overall installed operational capacity, which will grow this year at a similar pace to 2022, Rystad explains.

These companies are set to achieve 16pc growth while logistics and vessel companies, heavily weighted towards offshore projects and marine trade, are estimated to take in 15pc more this year.

It’s important to note, as well, that some suppliers prefer to focus on regional clients and projects rather than the global market.

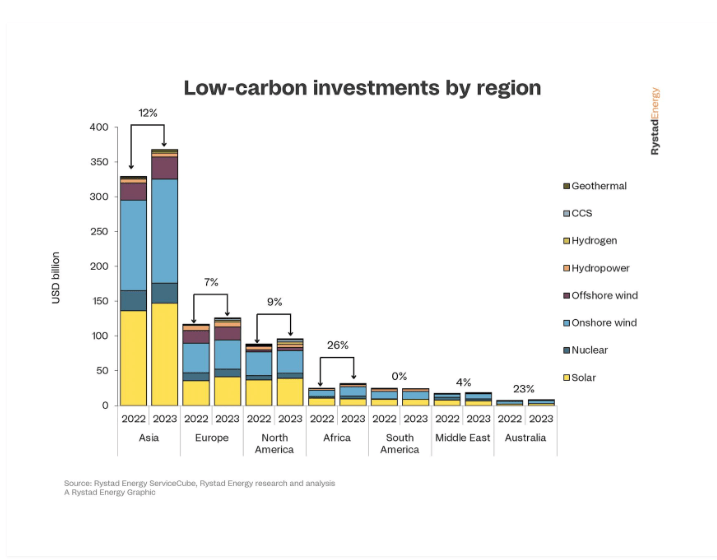

“The location of confirmed projects this year shows that Africa is set to attract the highest investment growth with a 26 per cent increase, mainly driven by onshore wind projects in Egypt,” Rystad says.

“Australia takes second place with 23 per cent growth with expansion across almost all sectors.

“Asian growth of 12 per cent is heavily impacted by China’s ambitions within solar and wind, while the US Inflation Reduction Act and a step-up in renewables and CCUS will help push North American investments up 9 per cent this year.”

| CODE | COMPANY | PRICE | % TODAY | % WEEK | % MONTH | % 6 MONTH | % YEAR | MARKET CAP |

|---|---|---|---|---|---|---|---|---|

| AVL | Aust Vanadium Ltd | 0.028 | 0% | -3% | 12% | -26% | -42% | $122,181,506 |

| BSX | Blackstone Ltd | 0.165 | 10% | 14% | 18% | -6% | -77% | $71,007,771 |

| DEL | Delorean Corporation | 0.08 | 0% | 8% | 5% | -36% | -65% | $17,257,673 |

| ECT | Env Clean Tech Ltd. | 0.012 | 0% | 9% | 0% | -20% | -60% | $20,595,020 |

| FMG | Fortescue Metals Grp | 22.58 | 2% | 1% | 12% | 34% | 9% | $68,353,021,180 |

| PV1 | Provaris Energy Ltd | 0.0525 | 1% | 19% | 9% | -13% | -52% | $28,510,584 |

| GNX | Genex Power Ltd | 0.15 | 3% | -6% | -12% | 15% | -21% | $200,850,685 |

| HXG | Hexagon Energy | 0.017 | -11% | 0% | 6% | -26% | -76% | $9,745,402 |

| HZR | Hazer Group Limited | 0.63 | 3% | 6% | -3% | -23% | -48% | $103,970,683 |

| IFT | Infratil Limited | 8.05 | 1% | 2% | -1% | 11% | 4% | $5,784,628,820 |

| IRD | Iron Road Ltd | 0.11 | -8% | -8% | -12% | -21% | -44% | $96,291,151 |

| LIO | Lion Energy Limited | 0.032 | -6% | -6% | -6% | -9% | -51% | $14,487,748 |

| MEZ | Meridian Energy | 4.89 | 2% | 0% | 1% | 14% | 11% | $6,039,599,009 |

| MPR | Mpower Group Limited | 0.018 | 0% | -5% | 0% | -31% | -58% | $5,286,659 |

| NEW | NEW Energy Solar | 0.2 | 3% | 0% | 8% | 45% | 48% | $62,514,657 |

| PGY | Pilot Energy Ltd | 0.015 | -6% | -6% | 0% | -6% | -72% | $12,501,505 |

| PH2 | Pure Hydrogen Corp | 0.2 | 0% | -5% | 11% | -25% | -61% | $71,030,761 |

| PRL | Province Resources | 0.065 | 0% | 2% | 8% | -24% | -55% | $76,797,054 |

| PRM | Prominence Energy | 0.002 | 33% | 33% | 33% | 0% | -80% | $3,636,913 |

| QEM | QEM Limited | 0.18 | 3% | -3% | 0% | 3% | -14% | $23,650,125 |

| RFX | Redflow Limited | 0.245 | 2% | 0% | 0% | -47% | -52% | $43,132,647 |

| SKI | Spark Infrastructure | 0 | 0% | -100% | -100% | -100% | -100% | $5,036,718,784 |

| VUL | Vulcan Energy | 6.97 | -1% | -2% | 3% | 18% | -29% | $1,008,350,166 |

| CXL | Calix Limited | 5.24 | 1% | 7% | 12% | -8% | -25% | $941,291,992 |

| KPO | Kalina Power Limited | 0.014 | 0% | -13% | -18% | -30% | -39% | $21,212,741 |

| RNE | Renu Energy Ltd | 0.062 | 5% | 9% | 29% | 48% | -35% | $25,965,042 |

| NRZ | Neurizer Ltd | 0.093 | -2% | -2% | -7% | -40% | -38% | $105,676,536 |

| LIT | Lithium Australia | 0.048 | 0% | -6% | 7% | -31% | -64% | $58,617,200 |

| TNG | TNG Limited | 0.089 | 0% | 10% | 16% | 31% | -4% | $123,569,222 |

| SRJ | SRJ Technologies | 0.13 | 8% | 30% | -70% | -70% | -70% | $10,701,030 |

| NMT | Neometals Ltd | 0.885 | 0% | -4% | -1% | -8% | -47% | $489,175,941 |

| MR1 | Montem Resources | 0.04 | 0% | 0% | 0% | 18% | -26% | $12,913,190 |

| FGR | First Graphene Ltd | 0.096 | -4% | -4% | -9% | -13% | -56% | $58,131,639 |

| EGR | Ecograf Limited | 0.22 | -2% | -4% | -2% | -14% | -66% | $101,325,028 |

| EDE | Eden Inv Ltd | 0.005 | -9% | 0% | -9% | -44% | -74% | $15,022,006 |

| CWY | Cleanaway Waste Ltd | 2.71 | -1% | 4% | 0% | 2% | -13% | $6,076,980,328 |

| CPV | Clearvue Technologie | 0.2225 | 6% | 24% | 27% | -7% | -44% | $45,582,884 |

| CNQ | Clean Teq Water | 0.4 | -6% | -13% | 7% | -20% | -42% | $24,526,877 |

| M8S | M8 Sustainable | 0.008 | 0% | 0% | 14% | 14% | -58% | $3,927,268 |

| EOL | Energy One Limited | 4.5 | -2% | 1% | 1% | -12% | -26% | $137,710,292 |

| LNR | Lanthanein Resources | 0.022 | 0% | 5% | -12% | 47% | -8% | $21,594,663 |

| FHE | Frontier Energy Ltd | 0.48 | 7% | 5% | 12% | 140% | 269% | $112,865,052 |

| LPE | Locality Planning | 0.054 | 0% | 8% | 4% | -4% | -64% | $9,620,439 |

The board of Australia’s biggest coal generator has appointed Damien Nicks to take on the role of managing director and CEO as the company transitions into a low carbon energy leader.

On the same day as Nicks appointment, AGL also announced a new chief financial officer (Gary Brown), completing the board and management renewal process with nine experienced non-executive directors set to lead the company’s exit from coal-fired generation.

Delta Group were awarded the demolition contract for the company’s Liddell Power Station on Wednesday, which is set to officially close in April 2023 with one of four units already retired in April 2022.

AGL chief operating officer Markus Brokhof says it will be the first of AGL’s thermal generation sites to be converted into an integrated, low-carbon industrial energy hub, which will support the energy market and regional economic development.

“After over 50 years of generating electricity for Australia, Liddell Power Station has reached the end of its operational life and will close in April 2023,” he says.

“It’s a significant piece of work – Liddell Power Station has been an important part of the Upper Hunter community for a long time now and it’s also the home of many great memories for thousands of people who’ve worked there over the years.”

The demolition process is expected to begin in early 2024 and will take roughly two years with work including the removal of all main structures (boilers, chimneys, turbine houses, coal plant) as well as ancillary buildings, and levelling of the site using recovered crushed concrete.

More than 90pc of the materials in the power station are expected to be recycled during demolition, including 70,000 tonnes of steel which is more than the total weight of steel works for the Sydney Harbour Bridge.

Critical infrastructure, such as transmission connections, will be retained to support the ongoing use of the site as an industrial energy hub, helping provide employment and essential economic activity for the region.

Planning approval has already been granted for a 500MW/2GWh grid-scale battery.

The $18.4bn takeover bid for Australian utility Origin Energy has been delayed as the ‘Consortium’ – otherwise known as Canada’s Brookfield and US private equity firm EIG Partners – advised that it is working to complete its due diligence and has requested additional time to do so.

This is the second time the Consortium has pushed back after putting forth a non-binding take offer valuing Origin shares at $9 each back in November – a level not seen since 2018.

The offer is a fair chunk higher than Brookfield’s previous indicative proposals, which valued the company for $7.95 per share in August and between $8.70 and $8.90 per share in mid-September.

Evion has every reason to proceed with developing a battery anode material plant in Europe after its Scoping Study confirmed that it would generate strong returns.

Under Evion Group’s (ASX:EVG) study into a plant that will process graphite concentrate from Maniry into uncoated spheronised purified graphite for use in batteries, five different process routes and two throughput rates were reviewed as a precursor to a Pre-Feasibility Study.

At a throughput of 30,000 tonnes per annum, the study found that the plant would generate pre-tax net present value (NPV) and internal rate of return (IRR) – both measures of a project’s profitability – of US$392m ($563m) and 39.5% respectively as well as pre-tax cashflow of US$2.8bn from an initial capital expenditure of US$117m.

Halving the throughput to 15,000tpa will reduce the initial Capex to US$74m but also reduce NPV to US$152m, IRR to 28.4% and cashflow to $1.4bn while increasing the payback period to 4.67 years.

Evion will now carry out comprehensive testwork on Maniry concentrate to better define the process flow sheet, optimise reagent selection and understand the characterisation of the waste stream.

On Tuesday Vulcan and Stellantis signed an agreement to support the decarbonisation of the Rüsselsheim auto manufacturing facility in the Upper Rhine Valley, Germany with geothermal energy.

In the northern area of the Upper Rhine Valley, Stellantis maintains a large manufacturing facility in which the DS 4 and Opel Astra models are produced, including the electrified variants.

This facility in the German state of Hesse is also the traditional home of the Opel brand and the German headquarters of Stellantis.

The new project will revolve around the development of geothermal renewable energy projects in Rüsselsheim as the first phase of the multiphase Project (Phase A).

Vulcan aims to carry out a pre-feasibility study for the construction of geothermal assets for Stellantis’ Rüsselsheim facility based on existing data.

The following phase, if the first phase is successful, will focus on drilling and more advanced studies and development.

ZEO has secured a $1.04 million R&D incentive payment for FY22 from the Australian Federal Government.

The rebate received relates to the company’s expenditure on the development of its proprietary mineral processing technology for the sustainable production of manufactured zeolites, together with advancing its dual stream agri-soil product development (including soil carbon protection and enhancement) and carbon utilisation technology.

“The R&D Tax Incentive Program is an important program that supports Australian innovation,” Zeotech MD Peter Zardo said.

“The funds received in conjunction with cash on hand, position the company well to continue progressing scaled up production and development of innovative applications for manufactured zeolites revolving around circularity and greenhouse gas mitigation.”

Frontier Energy has commenced several Sustainability, Environmental, Social and Governance (ESG) initiatives and plans to release its inaugural sustainability report mid-year.

The company says setting a high standard in all its ESG activities and reporting is the foundation for the sustainable and responsible development of its Bristol Springs Green Hydrogen Project in Western Australia.

To ensure standards are set and maintained at the highest level, the company has formed a sustainability committee, has in place a sustainability committee charter and has employed an ESG manager in Amy Sullivan, who has 20 years of environmental, approvals, community engagement and sustainability experience.

Frontier has also formalised a sustainability policy which empowers all directors, employees, contractors and relevant suppliers to implement continuous improvement and sustainable practices in everyday tasks and to establish the responsibilities for implementing sustainable systems.