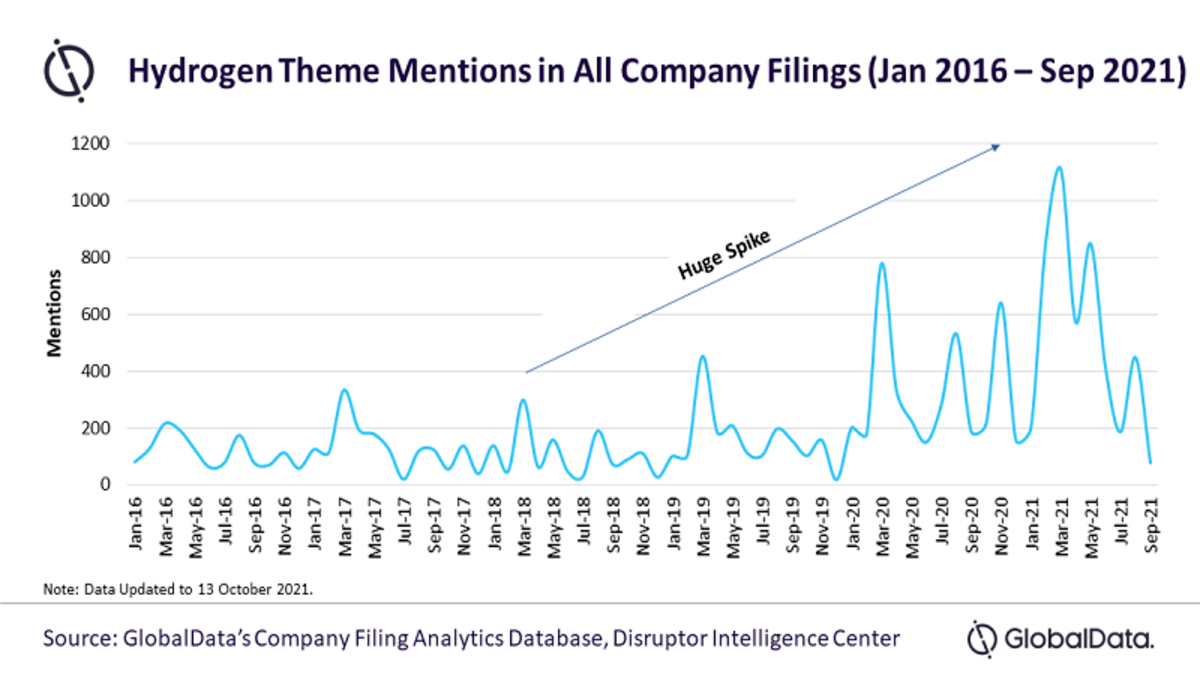

Emission Control: ‘ Hydrogen’ mentions in company announcements are up 21% in 2021

Pic: Matthias Kulka / The Image Bank via Getty Images

If you think you’ve been hearing the word ‘hydrogen’ being thrown around a lot, you’re not wrong.

New research out of GlobalData has shown that mentions of the word ‘hydrogen’ in company filings this year has increased by 21% compared to 2020.

In the power industry, data shows companies have accounted for 64% of hydrogen mentions between 2016 and 2021 while companies in the oil and gas and automotive sectors attributed for 28% and 8%, respectively.

Globaldata business fundamentals analyst Rinaldo Pereira said companies consider hydrogen to be the next step in renewable energy, with themes such as ‘carbon emissions’, ‘emission reduction’, and ‘climate change’ also regularly thrown into the mix when discussing hydrogen.

“There have multiple peaks in the mentions of ‘hydrogen’ during March and May,” he said.

“In terms of other related keywords, ‘fuel cell’ is the top technology that companies are focusing on to achieve carbon neutrality.

Globaldata senior automotive consulting analyst Bakar Sadik Agwan suggests that turning hydrogen into a mass commercial success in the automotive sector is easier said than done, as companies are already struggling with electric vehicle adoption for commercial vehicles.

Projections are not enough to make Australia a green investment world leader

But while the nation listened, it soon became clear that the ‘plan’ we had all been waiting for in the lead up to the UN Climate Change Conference (COP26) in Glasgow on Sunday was actually ‘based on existing policies’ and more importantly, featured no change to the 2030 target.

Although it has been projected that Australia is on track to cut emissions by 30 to 35 per cent by 2030, the formal target of a 26 to 28 per cent reduction below 2005 levels will remain unchanged.

Responsible Investment Association Australia executive for policy and standards Nicolette Boele said Australia’s near-term 2030 target of achieving emissions by 26 – 28% is not aligned with the Paris Agreement’s interim targets of 35 – 55% and is “insufficient” for readying the Australian economy for the transition needed.

“We need stronger targets, those targets for 2030 should be up between 35, 55 and 60% so that we can be in step with our international key trading partners – that’s really important because the Australian economy has to remain internationally competitive now and into the future.

“Without those policy signals for the near term, there is a real risk that our economy is going to lag.

“Projections do not offer business and investors sufficient policy certainty.”

Money could be flying into clean-tech right now

Boele highlighted that Australia should be lifting the bar and adopting scientifically relevant emissions reduction targets for 2030 in step with the global investment marketplace.

“The nationals don’t believe in climate change; Barnaby Joyce has been in a field looking up into the hot sun with the drought saying its gods will.

“And we have seen recently that Australia is among the least attractive countries for green investment, alongside Argentina, India, Indonesia, Mexico, Russia and Saudi Arabia.

“The announcement does little to set the Australian finance sector onto a different path and towards a net zero future in the short term.”

Climate change is at the front of mind for investment managers, she said.

“They are already acting on market signals, and they understand that as Australia’s trading partners follow through on their commitments to reduce emissions, fossil fuel heavy investments will only deliver reduced returns over time.

“There are tens of billions of dollars ready to go from investment funds and into the marketplace and into clean tech and they are not flying because of the uncertainty.”

Billionaire backed Sun Cable welcomes Singapore commitment to net zero

The company behind the world’s biggest solar and battery project, Sun Cable, welcomed Singapore’s Minister for Trade and Industry Gan Kim Yong’s announcement that the country will import up to 4 GW of electricity by 2035.

Sun Cable said this announcement by Singapore recognises its demand for net zero electricity and comes as Sun Cable looks to expressions of interest from customers in Singapore that desire net zero electricity.

Sun Cable’s landmark AAPowerLink is a USD23 billion project harnessing Australia’s massive solar energy and delivering it to Singapore via the world’s largest renewable electricity transmission network.

It has the potential to reduce carbon emissions by 6 million tonnes per year in Singapore, which would contribute towards meeting Singapore’s 2030 carbon abatement target of peaking emissions at 65 MtCO2.

Sun Cable co-founder Dr Fraser Thompson said Asia Pacific is significantly behind Europe when it comes to renewables and grid interconnectivity.

In Europe, around 11.5% of electricity generated is traded among member states, while this is only around 0.3% in Asia.

With energy demand rising faster in Asia than other parts of the world, major investment is needed to ensure that growing Asian economies can meet their energy needs.

“Greater grid connectivity is crucial to the energy transition in the Asia Pacific,” Thompson said.

“By 2040, greater grid connectivity in the Asia Pacific could create up to 870,000 jobs and reduce emissions by roughly 3 times Japan’s total current carbon emissions.”

ASX green energy stocks

| CODE | COMPANY | PRICE | 1 WEEK RETURN % | 1 MONTH RETURN % | SIX MONTH RETURN % | 1 YEAR RETURN % | MARKET CAP |

|---|---|---|---|---|---|---|---|

| ECT | Env Clean Tech Ltd. | 0.017 | 21 | 89 | -15 | 70 | $ 19,922,008.40 |

| BSX | Blackstone Ltd | 0.695 | 21 | 49 | 90 | 99 | $ 237,990,372.05 |

| GEV | Global Ene Ven Ltd | 0.13 | 18 | 57 | 24 | 43 | $ 61,717,932.05 |

| LIO | Lion Energy Limited | 0.072 | 16 | 71 | 13 | 414 | $ 24,974,994.28 |

| PH2 | Pure Hydrogen Corp | 0.335 | 16 | 26 | 24 | 319 | $ 109,856,552.05 |

| VUL | Vulcan Energy | 14.99 | 10 | 12 | 82 | 1170 | $ 1,856,280,848.87 |

| QEM | QEM Limited | 0.19 | 9 | 31 | -25 | 92 | $ 22,684,666.60 |

| MPR | Mpower Group Limited | 0.07 | 8 | 17 | -39 | 94 | $ 15,415,526.19 |

| DEL | Delorean Corporation | 0.21 | 8 | 8 | -19 | $ 34,024,873.20 | |

| AVL | Aust Vanadium Ltd | 0.0245 | 2 | 2 | 11 | 104 | $ 82,020,637.03 |

| MEZ | Meridian Energy | 4.78 | 2 | -3 | -7 | -6 | $ 6,040,628,064.66 |

| PGY | Pilot Energy Ltd | 0.068 | 1 | 17 | -17 | 106 | $ 36,115,322.47 |

| IFT | Infratil Limited | 7.93 | 1 | 3 | 21 | 51 | $ 5,785,905,174.74 |

| GNX | Genex Power Ltd | 0.225 | 0 | -2 | 7 | 38 | $ 246,077,010.35 |

| SKI | Spark Infrastructure | 2.835 | 0 | 1 | 31 | 39 | $ 4,966,520,612.40 |

| AST | AusNet Services Ltd | 2.49 | -1 | -3 | 32 | 23 | $ 9,460,012,280.42 |

| CXL | Calix Limited | 5.19 | -2 | 0 | 121 | 549 | $ 835,665,079.60 |

| FMG | Fortescue Metals Grp | 14.06 | -3 | -11 | -39 | -13 | $ 43,105,508,852.00 |

| RFX | Redflow Limited | 0.06 | -3 | -2 | -13 | 124 | $ 82,420,072.24 |

| NEW | NEW Energy Solar | 0.805 | -4 | -2 | 2 | 2 | $ 289,508,904.81 |

| HXG | Hexagon Energy | 0.089 | -4 | 13 | -41 | 65 | $ 39,249,216.78 |

| HZR | Hazer Group Limited | 1.35 | -5 | 39 | -2 | 121 | $ 223,970,310.63 |

| PRL | Province Resources | 0.155 | -6 | 0 | -24 | 1153 | $ 175,097,270.71 |

| IRD | Iron Road Ltd | 0.195 | -7 | 3 | -33 | 16 | $ 154,945,107.33 |

| KPO | Kalina Power Limited | 0.027 | -18 | -7 | -37 | -16 | $ 38,066,005.49 |

| PRM | Prominence Energy | 0.0075 | -56 | -35 | -64 | 25 | $ 10,936,037.87 |

It has been a big month for Environmental Clean Technologies (ASX:ECT) with shares up 89%.

It’s share price jumped 12.5% off the back of the news, with ECT also intending to complete its Coldry demonstration plant at Bacchus Marsh in Victoria in early 2022 (Phase One).

Once ready, the plant will demonstrate to industry participants its unique, low cost, zero emission Coldry lignite drying technology at a commercial scale.

WA-based nickel explorer Blackstone Minerals (ASX:BSX) also made massive gains this month with shares up 49% on the back of announcing is partnership with UK headquartered Circulor Ltd to establish a full nickel and cathode precursor traceability system for its Vietnam Ta Khoa assets.

The company says the partnership will enable it to demonstrate compliance with sustainability metrics for mining through to the Ta Khoa Refinery (TKR) finished product.

Dynamic ESG metrics such as CO2 intensity, biodiversity impact, water use and energy mix, will be digitised from project samples and made available for potential downstream markets.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.