Emission Control: Goldman Sachs estimates hydrogen generation could become a $1tn per year market

Pic: Getty Images

- Goldman Sachs says hydrogen generation could become a $1 trillion per year market

- Queensland Government announces $3,000 rebate for EV purchases under $58k

- Billionaire backed Sun Cable raises $210mn

Yep, you heard that right.

Green hydrogen, the ultimate de-carbonisation solution, and its market share has the potential to reach US$1tn by 2050, according to Goldman Sachs latest report Carbonomics: The Clean Hydrogen Revolution.

As policy support continues to gain pace around the world, with roughly 30 national hydrogen strategies and roadmaps pledging a >400-fold increase in clean hydrogen installed capacity this decade compared with 2020, the American multinational investment banking firm says policy, affordability and scalability seem to be converging to create “unprecedented momentum for the clean hydrogen economy.”

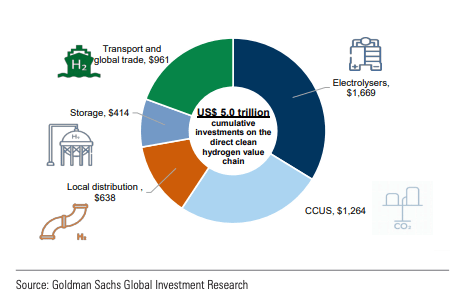

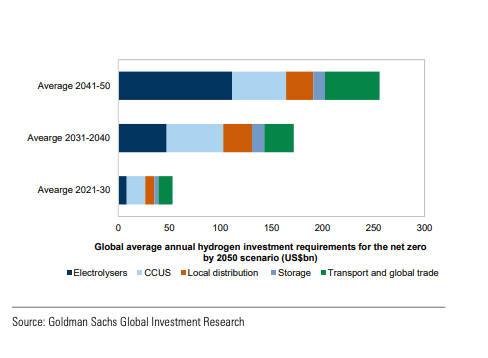

It says green hydrogen’s total addressable market (TAM) has the potential to double to US$250bn by 2030 and reach US$1tn by 2050, on top of a net zero by 2050 scenario calling for US$5tn of cumulative investments.

These investments would be focused on the direct supply chain of clean hydrogen, it said, specifically the investments required for its production, storage, distribution, transmission, and global trade.

“We view these as solely capex investments (not including opex or other costs) in the direct supply chain of clean hydrogen and not including capex associated with end markets (industry, transport, buildings) or upstream capex associated with the power generation plants required for electricity generation for green hydrogen,” Goldman Sach highlighted.

“This corresponds to an annual average of US$55/165 bn per annum required to 2030/50E, respectively.”

(US$bn).

Goldman Sachs states four interconnected technologies are emerging as “transformational” in the path to net zero and have a key role to play in the next frontier of clean tech – renewable power, clean hydrogen, battery energy storage, and carbon capture technologies.

The total installed electrolyser capacity for green hydrogen production was only around 0.3 GW by the end of 2020 but the industry is moving at a remarkable pace, Goldman Sach notes, with the current projects pipeline suggesting an installed electrolysis capacity of close to 80 GW by end-2030.

This includes projects currently under construction, having undertaken FID (final investment decision) and pre-FID (feasibility study), and assuming projects meet the guided start-up timeline.

“If we were to consider projects in earlier stages of development (pre-feasibility study stage, ‘concept’ projects), then this figure would go close to 120 GW,” the authors explained.

Under all three of the firms’ global hydrogen demand paths – the bull, base, and bear – global hydrogen demand increases at least 2-fold on the path to net zero.

Queensland supercharges the future of electric vehicles

This week, the Queensland State Government announced a $3,000 subsidy for drivers who choose to switch to an electric vehicle as part of a new package to help reach the state’s goal of net-zero emissions by 2032.

Premier Annastacia Palaszczuk revealed on Wednesday the government will spend $45mn on subsidies for upfront car purchases over the next three years and another $10 mn spent building more charging stations.

The $3,000 subsidy will be available for anyone buying an electric vehicle worth a total of $58,000.

While the move marks a positive step in the right direction, Electric Vehicle Council head of policy Jake Whitehead says Australia needs federal leadership to get the level of support required to drive uptake, attract more EV models into the Australian market, drive down prices through increasing competition, and ultimately align uptake with Net Zero by 2050 while reducing the cost of transport and energy for Australian households and businesses.

“The key barrier is getting more vehicles supplied to our market and as long we don’t have a fuel efficiency standard, or some kind of sales mandate, combined with significant incentives, we are just going to be an afterthought for manufacturers of electric vehicles around the world,” he said.

“At the moment we don’t have the settings to encourage those vehicles to be sent here.”

Aussie EV sales accounted for a 1.95% market share of new vehicles in 2021, up from 0.87% in 2020, and although it demonstrates a clear improvement, it is clear there is still a serious amount of work that needs to be done.

“EV sales need to be over 50% by 2030 to be on a trajectory to net zero – we are at 2% now, we have eight years to get to 50%.

“Even though there has been a vocal voicing of this need to have a fuel efficiency standard, we haven’t seen any policy to introduce a zero-emission sales mandate where we would see more electric vehicles encouraged into the Australian market,” he said.

Location to be a key driver in green hydrogen economics

In January this year, British oil giant BP and the Ministry of Energy and Minerals in Oman signed a strategic framework agreement and Renewables Data Collection Agreement, outlining the potential development of a multiple, gigawatt, world-class renewable energy and green hydrogen facility by 2030.

As part of the agreement, BP will capture and evaluate solar and wind data from 8,000km of land – an area more than five times the size of Greater London – which will be used to approve the future developments of renewable energy hubs at suitable locations within this area to take advantage of these resources.

The renewable energy resources could also supply renewable power for the development of green hydrogen, targeting both domestic and global export markets.

BP’s CEO said at the time the company is not “just investing in energy” but investing in Oman to create and develop infrastructure and support local supply chains needed to users in “this next generation of energy leaders.”

Global energy, renewables, and mining research consultancy group WoodMac says the agreement highlights how location will be critical to green hydrogen project economics.

“With the entire green hydrogen value chain being nascent, getting access to the best location for consistent renewable power has a significant impact on project values,” it said.

“The importance of capturing and analysing the renewables data on a large scale is analogous to geological surveys aimed at identifying technically and commercially visible hydrocarbon reserves.

“The 8000km in the BP/Oman project aims to map the best spots and locations for renewable development.

“Our analysis indicates that Oman’s green hydrogen levelised costs could reach US$2/kg by 2030, which positions Oman very favourably.”

Cannon-Brookes and Twiggy lead Sun Cable raising

Billionaire backed Sun Cable, the proponents of a subsea cable that will transfer Australian solar power 4200km from Darwin to Singapore has completed a $210mn Series B capital raise this week led by Mike Cannon-Brookes’ Grok Ventures and Twiggy Forrest’s Squadron Energy.

Sun Cable says funds will support its +$30bn Australia-Asia PowerLink (AAP) project, which will include a 17-20GW solar array, the world’s biggest battery at a scale of 36-42GWh and the world’s longest subsea cable.

Once fully developed, the project will be seven times the size of the largest solar generation sites of Bhadla Solar Park (2.7 GW) of 160km2 in India and the Golmud Desert Solar Park 2.8 (GWAC) in China and 25 times the size of the largest existing battery storage system of 1.6GWh in Moss Landing, California.

Grok Ventures principal Cannon-Brookes, one of the two bidders rejected by AGL to take over its coal assets, said Sun Cable’s project brings Australia one step closer to realising its renewables exporting potential.

“We can power the world with clean energy and Sun Cable is harnessing that at scale,” he said.

“It’s a blueprint for how we export energy across the world, we fully back this vision.”

ASX green energy stocks

Swipe or scroll to reveal full table. Click headings to sort:

| CODE | COMPANY | PRICE | 1 WEEK RETURN % | 1 MONTH RETURN % | 6 MONTH RETURN % | 1 YEAR RETURN % | MARKET CAP |

|---|---|---|---|---|---|---|---|

| AST | AusNet Services Ltd | 0 | -100% | -100% | -100% | -100% | $9,919,608,018.74 |

| AVL | Aust Vanadium Ltd | 0.05 | 39% | 39% | 100% | 108% | $161,710,285.84 |

| BSX | Blackstone Ltd | 0.4275 | -5% | -14% | -22% | -7% | $195,574,940.78 |

| DEL | Delorean Corporation | 0.215 | 5% | -12% | 10% | 0% | $39,529,221.60 |

| ECT | Env Clean Tech Ltd. | 0.022 | 5% | -4% | 120% | 47% | $32,541,285.23 |

| FMG | Fortescue Metals Grp | 18.105 | -4% | -14% | 5% | -12% | $53,573,989,573.20 |

| GEV | Global Ene Ven Ltd | 0.095 | 4% | -5% | 14% | -2% | $51,725,644.18 |

| GNX | Genex Power Ltd | 0.145 | 4% | -17% | -36% | -41% | $200,485,006.80 |

| HXG | Hexagon Energy | 0.051 | -7% | -7% | -39% | -49% | $22,320,961.65 |

| HZR | Hazer Group Limited | 0.89 | -1% | -12% | -8% | -34% | $141,720,558.78 |

| IFT | Infratil Limited | 7.33 | -4% | 2% | -5% | 7% | $5,344,535,143.75 |

| IRD | Iron Road Ltd | 0.18 | 3% | 0% | -14% | -33% | $143,409,633.48 |

| LIO | Lion Energy Limited | 0.05 | 0% | -7% | 9% | 79% | $20,453,290.70 |

| MEZ | Meridian Energy | 4.73 | -3% | 2% | -6% | -14% | $6,177,298,043.00 |

| MPR | Mpower Group Limited | 0.036 | -5% | -12% | -39% | -76% | $8,440,557.95 |

| NEW | NEW Energy Solar | 0.915 | 1% | 1% | 14% | 19% | $293,338,007.19 |

| PGY | Pilot Energy Ltd | 0.045 | -4% | -17% | -25% | -45% | $24,210,734.98 |

| PH2 | Pure Hydrogen Corp | 0.41 | 3% | 3% | 58% | 14% | $134,657,119.11 |

| PRL | Province Resources | 0.09 | -2% | -28% | -44% | -22% | $103,046,556.45 |

| PRM | Prominence Energy | 0.0115 | -12% | -18% | -4% | -4% | $15,475,305.83 |

| QEM | QEM Limited | 0.175 | -3% | 3% | 3% | 13% | $19,849,083.28 |

| RFX | Redflow Limited | 0.046 | 15% | 10% | -28% | -42% | $65,525,785.09 |

| SKI | Spark Infrastructure | 0 | -100% | -100% | -100% | -100% | $5,036,718,783.60 |

| VUL | Vulcan Energy | 9.51 | 7% | 2% | -35% | 46% | $1,178,223,555.50 |

| CXL | Calix Limited | 6.93 | 8% | 28% | 29% | 208% | $1,131,707,242.32 |

| KPO | Kalina Power Limited | 0.024 | 20% | 20% | -23% | -48% | $34,770,893.66 |

| RNE | Renu Energy Ltd | 0.055 | 6% | -26% | 6% | -39% | $17,224,819.95 |

| LCK | Leigh Crk Energy Ltd | 0.1425 | -2% | -5% | 19% | -14% | $125,783,456.54 |

| LIT | Lithium Australia NL | 0.105 | -5% | -9% | -16% | -16% | $108,419,912.58 |

| TNG | TNG Limited | 0.069 | 10% | 3% | -22% | -34% | $90,247,184.43 |

| SRJ | SRJ Technologies | 0.43 | 0% | 0% | 69% | 59% | $31,927,138.80 |

| NMT | Neometals Ltd | 1.59 | 16% | 22% | 67% | 319% | $828,048,357.96 |

| MR1 | Montem Resources | 0.038 | -10% | -16% | -10% | -75% | $9,420,935.93 |

| FGR | First Graphene Ltd | 0.175 | 6% | -5% | -5% | -33% | $91,321,256.73 |

| EGR | Ecograf Limited | 0.56 | 6% | -6% | -30% | -23% | $231,921,731.39 |

| EDE | Eden Inv Ltd | 0.016 | -6% | -6% | -24% | -52% | $37,031,055.54 |

| CWY | Cleanaway Waste Ltd | 2.925 | 5% | 2% | 12% | 25% | $5,855,026,695.12 |

| CPV | Clearvue Technologie | 0.315 | -2% | -21% | -7% | -27% | $63,522,103.20 |

| CNQ | Clean Teq Water | 0.645 | -1% | 4% | -9% | 0% | $28,586,351.36 |

| M8S | M8 Sustainable | 0.018 | -5% | 6% | -40% | -51% | $7,550,639.28 |

| EOL | Energy One Limited | 6.57 | 1% | -6% | 15% | -6% | $169,871,654.40 |

On the ASX, shares in Australian Vanadium (ASX:AVL) continue to climb following the announcement of a $49m government grant which will be used in the development of the Australian Vanadium Project, near Meekatharra and Geraldton to create an Australian green-fuelled vanadium industry.

Neometals (ASX:NMT) was another winner this week after news broke about its partnership with Mercedes-Benz for the design and construction of a battery recycling plant in southern Germany. The two entities and their subsidiary’s plan to build a two-stage 2,500 tonne a year lithium-ion battery recycling and waste disposal plant with first stage commencing production in 2023.

And Redflow (ASX:RFX) shares rocketed following its plans to work with US sustainable energy developer, Anaergia, on a new fully wrapped solar and 5.5–6.0MWh Redflow battery storage solution with Anaergia’s subsidiary, SoCal Biomethane, at its Victor Valley plant in California.

“If it proceeds, at up to 6MWh, the Victor Valley Project will be our largest deployment to date, involving the supply of up to 600 Generation 3 batteries,” Redflow CEO Tim Harris said.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.