Emission Control: Biden injects over US$9bn into clean hydrogen capacity and a prosperous clean energy economy

Pic: Getty

The US Department of Energy (DOE) announced a series of actions on Tuesday to advance climate action in the industrial sector, including the allocation of more than US$9 billion to develop clean hydrogen capacity in the US.

“Clean hydrogen is key to cleaning up American manufacturing and slashing emissions from carbon-intensive materials like steel and cement while creating good-paying jobs for American workers,” said US Secretary of Energy Jennifer Granholm.

The hydrogen technology investments from the Bipartisan Infrastructure Law are a major component of President Biden’s plan to decarbonise the industrial sector, which accounts for a third of domestic carbon emissions and form a crucial part of the administration’s strategy for achieving a 100% clean electrical grid by 2035 and net-zero carbon emissions by 2050.

The Bipartisan Infrastructure Law includes:

-

- $8 billion for Regional Clean Hydrogen Hubs

- $1 billion for a clean hydrogen electrolysis program

- And $500 million clean hydrogen manufacturing and recycling initiatives to support equipment manufacturing and strong domestic supply chains.

Climate change is a code red for our nation — and we have no time to waste. That’s why today, my Administration is announcing new actions that will reduce emissions across the industrial sector and create good-paying, union jobs. https://t.co/y49ZVVqaxl

— President Biden (@POTUS) February 15, 2022

Today, the US produces about 10 million metric tons of hydrogen annually, compared to the 90 million tonnes produced per year globally, but most of it is produced from natural gas through steam methane reforming.

Electrolysis technology however, which uses electricity to produce hydrogen from water is an emerging pathway with dozens of installations across the US and could allow for the production of hydrogen using clean electricity from renewable energy including solar, wind, and nuclear power.

Another major part of the announcement included new commitments to advance the low-carbon production of steel and aluminium needed for electric vehicles, wind turbines, and solar panels, as well as clean concrete for upgrading transportation infrastructure.

The Administration said it was working to implement carbon-based trade policies to reward American manufacturers of clean steel and aluminium and plans to establish the “first ever” Buy Clean Task Force to support low-carbon material made in American Factories.

Partners shortlisted for world’s largest green hydrogen project in NZ

Four potential development partners have been shortlisted for the Southern Green Hydrogen Project, a joint venture between Meridian Energy and Contact.

The shortlist comprises Fortescue Future Industries, Woodside Energy, BOC, and a Japanese consortium of Mitsui & Co, one of Japan’s largest trading and investment companies, and ENEOS, one of Japan’s leading integrated energy companies.

The counterparties are now engaged in a request for proposal (RFP) process to identify ‘early stage’ business plans and cases for a 600MW production facility in Southland, New Zealand.

Ongoing discussions and workshops are under way and final RFP responses are due by mid-April.

Southern Green Hydrogen is aiming to announce a partnership and/or consortium by the middle of 2022, so development activities can commence in the second half of the year.

The New Zealand based Meridian recently divested itself its Australian assets, which included selling electricity retailer Powershop Australia to Shell.

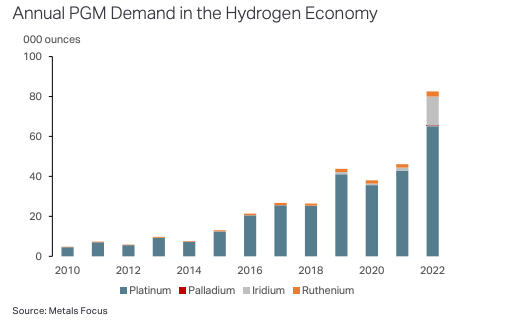

PGM’s role in unlocking hydrogen zero emissions potential

PGMs, otherwise known as platinum group metals, are a family of six similar elements that are highly durable, often recycled, and naturally occur in the same ore bodies.

These include iridium, osmium, palladium, platinum, rhodium, and ruthenium and are often further divided into sub-groups – the iridium group platinum group elements (IPGEs), and the palladium-group platinum group elements (PPGEs).

For many years now, water electrolysis and fuel cell technology have been developing to enable the production of hydrogen, but one technology involving PGMs has been flying under the radar.

The Proton Exchange Membrane Electrolyser (PEMWE) technology uses iridium on the anode and platinum on the cathode, which could see demand for both elements grow from a few thousand ounces to several hundreds of thousands of ounces by the end of this decade.

Another area where PGMs could play a crucial role involves hydrogen storage and transport.

According to the Metals Focus, “the hydrogenation and dehydrogenation process in liquid organic hydrogen medium uses either a combination of platinum and palladium or, given the current price deferential, increasingly only platinum.”

The use of green ammonia as storage and transport medium for hydrogen could see greater use of a ruthenium-based decomposition catalyst combined with palladium-based purification solutions.

But the transport sector is where PGM-based fuel cell technology could really take off, Metals Focus says, considering decarbonising transport requires the mass adoption and deployment Zero-Emission Vehicles (ZEVs), where Fuel Cell Electric Vehicles (FCEVs) are better equipped for the heavy-duty market as they offer extended ranges closer to that seen in internal combustion engines.

WA becomes second state to authorise turning solar power off

Earlier this week, Western Australia officially became the second state after South Australia to allow the network operator to order residential rooftop solar systems to be switched off remotely.

The Labour McGowan government said the new measure would be used for emergencies to keep the grid stable.

This means all new and upgraded solar photovoltaic (PV) systems with an inverter capacity of 5kW or less will need to be capable of being remotely turned down or off.

New and upgraded solar systems with an inverter capacity above 5kW will need to be export limited to either 1.5kW or 5% of inverter capacity (whichever is the greater of the two).

‘A reasonable emergency backstop’

Monash Energy Institute director and professor Ariel Liebman says giving the Australian Energy Market Operator (AEMO) power to turn off household solar systems is a reasonable ‘emergency backstop’ response to unprecedented situations.

“No other continental grid has ever had our per-capita of rooftop solar capacity,” Liebman explains.

“There is currently no way of diverting or storing the excess renewable energy at scale to deal with the potential risk to grid stability.

“Curtailing solar and wind power is the only immediate and reliable option.”

This situation could have been avoided if Australian policy makers had not been missing in action on grid reform for more than 10 years as renewables started to grow strongly, Liebman says.

“We urgently need coordinated policy, and the funding of research and development.

“Unfortunately, we can’t use international solutions on this as we are leading the charge.

“We therefore need homegrown innovation to address these issues.”

Industry: Put sustainable aviation fuel and biomethane on agenda

More than 80 Australian organisations are calling for urgent action to deliver decarbonisation results now – not in the future – with the inclusion of Sustainable Aviation Fuel (SAF) and biomethane technologies in the Government’s Low Emissions Technology Statement (LETS).

Bio Energy Australia chief executive officer Shahana McKenzie said in a letter delivered to Angus Taylor MP and Prime Minister Scott Morrison during the week that Australia risks meeting its 2050 net zero targets if SAF and biomethane technologies are not key investment areas.

“Putting SAF and renewable gas on the agenda sends a clear message to the Australian industry – who are both suppliers and drive demand in these technologies – that this is the future and it’s time to get onboard so we can build strong domestic supplies,” McKenzie said.

Today’s aircrafts are already operating on SAF, MckKenzie says, with up to a 50/50 split in fuel between petroleum and sustainable fuel approved, and over 180 SAF-fuelled flights recently departed Brisbane airport without any changes to the aircraft.

“Much like biomethane, which is also ready to operate in Australia’s pipelines.

“Green gas is a proven sustainable energy source in Australia, and more technological investments will help to expand supply and make it price competitive.”

Signatories of the letter are already engaged in a nation-leading project to capture biogas from wastewater treatment plants and convert it into biomethane ready to be injected back into the state gas supply.

ASX green energy stocks

Scroll or swipe to reveal table. Click headings to sort.

| CODE | COMPANY | PRICE | 1 WEEK RETURN % | 1 MONTH RETURN % | 6 MONTH RETURN % | 1 YEAR RETURN % | MARKET CAP |

|---|---|---|---|---|---|---|---|

| MR1 | Montem Resources | 0.049 | 17% | 2% | 17% | -76% | $11,457,895.05 |

| NEW | NEW Energy Solar | 0.9 | 10% | 11% | 8% | 7% | $291,735,067.26 |

| HZR | Hazer Group Limited | 1.01 | 6% | -17% | -5% | -28% | $164,526,165.94 |

| PGY | Pilot Energy Ltd | 0.052 | 4% | -12% | -25% | -37% | $27,237,076.85 |

| MPR | Mpower Group Limited | 0.0415 | 4% | 6% | -46% | -59% | $9,106,917.79 |

| MEZ | Meridian Energy | 4.71 | 3% | 5% | -4% | -13% | $5,836,916,314.10 |

| CWY | Cleanaway Waste Ltd | 2.99 | 2% | -2% | 19% | 25% | $5,916,875,568.66 |

| CNQ | Clean Teq Water | 0.64 | 2% | -4% | -12% | 0% | $27,693,027.88 |

| IFT | Infratil Limited | 7.41 | 2% | -3% | 4% | 7% | $5,235,758,987.50 |

| CXL | Calix Limited | 5.45 | 1% | -15% | 72% | 221% | $871,107,085.80 |

| AST | AusNet Services Ltd | 2.59 | 0% | 2% | 34% | 52% | $9,919,608,018.74 |

| DEL | Delorean Corporation | 0.24 | 0% | 4% | -2% | 0% | $44,919,570.00 |

| GEV | Global Ene Ven Ltd | 0.1 | 0% | 0% | 25% | -20% | $54,448,046.50 |

| HXG | Hexagon Energy | 0.055 | 0% | -29% | -29% | -36% | $24,553,057.82 |

| PRM | Prominence Energy | 0.013 | 0% | 30% | 8% | 8% | $17,984,523.47 |

| LCK | Leigh Crk Energy Ltd | 0.15 | 0% | 0% | 3% | 7% | $130,006,953.75 |

| LIT | Lithium Australia NL | 0.12 | 0% | -4% | -14% | -14% | $118,745,618.54 |

| SRJ | SRJ Technologies | 0.43 | 0% | 0% | 26% | 21% | $31,927,138.80 |

| EDE | Eden Inv Ltd | 0.018 | 0% | -10% | -22% | -57% | $39,345,496.51 |

| LIO | Lion Energy Limited | 0.053 | -2% | -23% | 26% | 96% | $23,009,952.04 |

| IRD | Iron Road Ltd | 0.185 | -3% | 3% | -8% | -38% | $143,191,451.70 |

| GNX | Genex Power Ltd | 0.175 | -3% | -8% | -26% | -30% | $187,232,507.88 |

| QEM | QEM Limited | 0.17 | -3% | -21% | 0% | 70% | $19,281,966.61 |

| PRL | Province Resources | 0.125 | -4% | -11% | -22% | 381% | $141,207,476.38 |

| FMG | Fortescue Metals Grp | 20.5 | -4% | -4% | -6% | -14% | $65,120,108,015.70 |

| FGR | First Graphene Ltd | 0.175 | -5% | -13% | -20% | -42% | $102,390,499.97 |

| VUL | Vulcan Energy | 9.3 | -5% | -7% | -33% | 25% | $1,228,248,689.70 |

| M8S | M8 Sustainable | 0.017 | -6% | -6% | -19% | -68% | $7,131,159.32 |

| RFX | Redflow Limited | 0.04 | -7% | -22% | -33% | -58% | $59,827,890.74 |

| TNG | TNG Limited | 0.066 | -8% | -20% | -26% | -31% | $93,024,020.87 |

| KPO | Kalina Power Limited | 0.021 | -9% | -13% | -36% | -57% | $30,235,559.70 |

| PH2 | Pure Hydrogen Corp | 0.395 | -9% | -25% | 114% | 80% | $135,497,516.40 |

| NMT | Neometals Ltd | 1.27 | -13% | -23% | 57% | 239% | $715,631,196.78 |

| EGR | Ecograf Limited | 0.58 | -13% | -13% | -39% | -42% | $267,948,408.11 |

| ECT | Env Clean Tech Ltd. | 0.024 | -14% | -25% | 118% | 60% | $35,510,940.05 |

| AVL | Aust Vanadium Ltd | 0.035 | -15% | -5% | 21% | 35% | $118,588,676.51 |

| RNE | Renu Energy Ltd | 0.071 | -15% | -21% | 20% | 13% | $24,467,587.99 |

| CPV | Clearvue Technologie | 0.39 | -16% | -19% | 26% | 22% | $84,696,137.60 |

| BSX | Blackstone Ltd | 0.485 | -26% | -34% | 13% | -10% | $222,550,794.68 |

| SKI | Spark Infrastructure | 0 | -100% | -100% | -100% | -100% | $5,036,718,783.60 |

Companies operating in the renewable energy and hydrogen space have taken a back seat in recent weeks, but a handful have performed well.

Up 17% this fortnight is Montem Resources (ASX:MR1) with no news.

Australia’s first ASX-listed solar infrastructure business, New Energy Solar (ASX:NEW) gained 10% after announcing performance data across its 14 solar power plants, all located in the United States.

NEW said its remediation of the fire-damaged Stanford and TID solar plants at Rosamond, California “progressed steadily throughout 2021” and at year end, both sites were operating at or above 98% capacity.

Hazer Group (ASX:HZR) saw a 6% rise following news of its latest deal with Suncor Energy and FortisBC Energy to develop a 2,500 tpa low-carbon emission hydrogen production facility based on the Hazer Technology in Canada.

The proposed Hydrogen Project will process natural gas feedstock to produce 2,500 tpa low-carbon emission hydrogen and approximately 9,000 tonnes of synthetic graphite by-product.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.