Corporate: Carnegie is still into wave energy, but it’s back to the (digital) drawing board

Pic: Vertigo3d / E+ via Getty Images

Nearly five months after the McGowan government pulled the plug on a $16 million contract to fund its wind farms, Carnegie Clean Energy (ASX: CCE) has launched its recapitalisation offer.

And if the offer is successful, Carnegie will subsequently be a little different. It will retreat from building physical prototypes, to developing its technology digitally. For the next couple of years it will be in the research and development phase.

Scroll down for more ASX small cap corporate news>>>>

The company’s core technology is CETO – an ‘ocean wave conversion system’ which helps convert waves into electricity.

“Carnegie has now addressed the previous problems in the company which stemmed from the failed EMC business,” said chairman Terry Stinson.

“The new and more focused Carnegie business will have a much smaller footprint, reduced head count and significantly reduced operating cost.”

The company wants to raise between $5.5 million and $11.5 million. It will use the proceeds to extinguish past debts and develop its technology, with the help of universities.

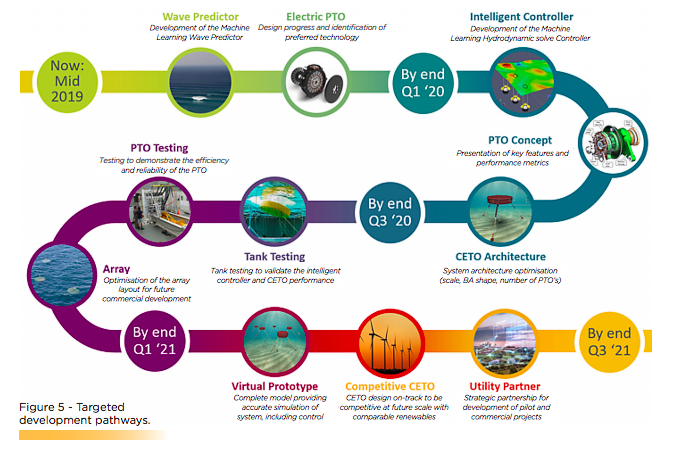

Carnegie has promised to apply machine learning to development, thus reducing design cycle time and cost. It will apply the same electrical subsystems used in EVs to its own wave power generation.

The company has indicated it expects to complete the offer this month and relist on September 12. By Q3 of 2021 the company aims for a preliminary design of the optimised commercial version of CETO.

By then, Carnegie said it wants CETO, “capable of being competitive with offshore wind energy when deployed at large scale”.

In other ASX small cap corporate news today…

PointsBet (ASX: PBH) signed a deal with NASDAQ-listed Penn gaming for PointsBet to enter five US states. These states were Ohio, Indiana, Missouri, West Virginia and Louisiana and Penn’s licenses will be used under PointsBet’s brand. The stock rose another 14 per cent this morning and is now up 66 per cent since its IPO.

Is Smiles Inclusive (ASX: SIL) turning around? It lost $537,000 from its operations and $7.1 million in the last 12 months. But the company sent a letter to shareholders last night saying the worst was behind it. The letter noted it is is overhauling its marketing initiatives, increase fees and reactivating its mobile dentistry business.

Chairman David Usasz and CEO Tony McCormack admitted the performance to date was disappointing but argued things would get better. “Investors can be assured with the support of our JVPs, staff, bankers and suppliers, every effort is being made to stabilise, consolidate and turn around the business in FY20 and return it to acceptable levels of performance,” they said.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.