Emission Control: Hydrogen cost reductions are crucial to speed energy transition, WoodMac says

Pic: Vertigo3d / E+ via Getty Images

The hydrogen boom is well underway but the real game changer for the energy transition will come when low-carbon green hydrogen costs become competitive in major markets, Wood Mackenzie research analyst Bridget van Dorsten says.

New research out of the NASDAQ listed research firm explores the economics of green, grey, brown, and blue hydrogen and finds that while green hydrogen has some catching up to do, the pipeline is in fact gaining pace.

Van Dorsten said: “Green hydrogen – hydrogen created from the electrolysis of water using renewable energy – has a tiny share of the global energy market today.

“It is still largely uncompetitive against fossil-fuelled alternatives. However, the momentum behind net zero ambitions means that investors are betting on its long term potential.”

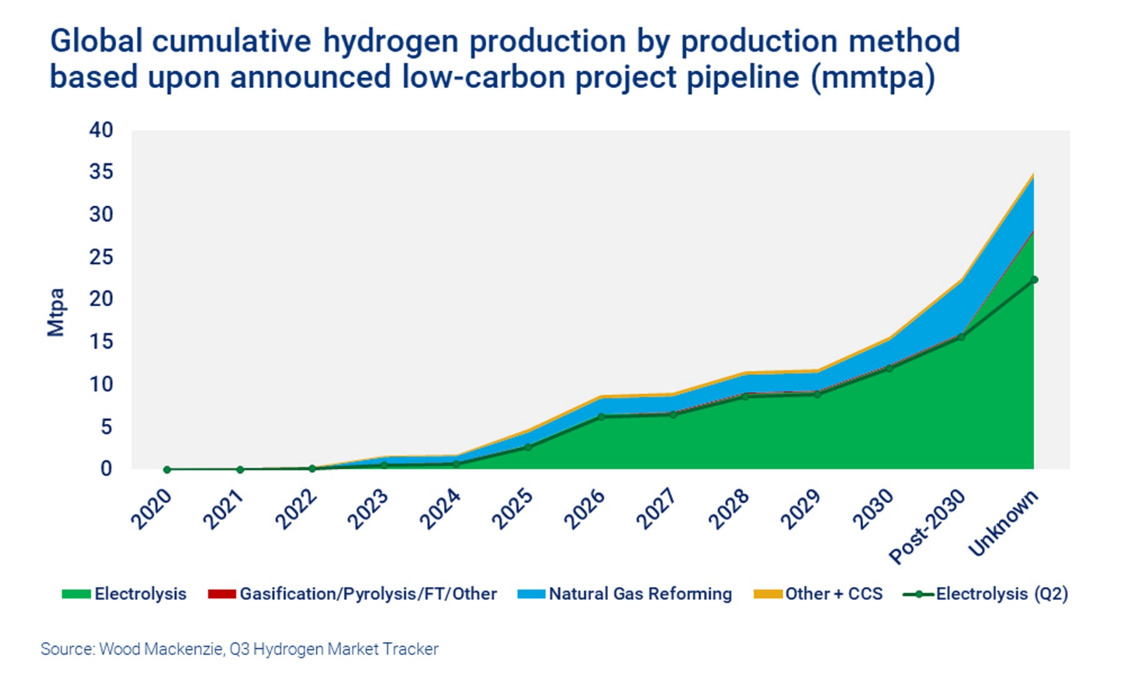

Since December 2020, van Dorsten says the hydrogen project pipeline has grown seven-fold.

Wood Mackenzie is tracking more than 560 low-carbon projects with a minimum of 180 GW total electrolyser capacity designation.

Most projects remain at early development stage, with the bulk of new projects advanced through Q2 this year.

Van Dorsten said: “Until 2019, global estimated electrolyser manufacturing capacity was just 200 MW but by midway point of 2021 that had jumped to 6.3 GW of announced capacity, with 1.3 GW added in quarter one alone.

“Now, as we reach the end of Q4, electrolyser manufacturers are dramatically expanding plans for gigawatt-scale factories.

“In recent weeks, Ohmium, Clean Power Hydrogen, Green Hydrogen Systems, Sunfire and FFI have all announced large-scale factories, joining Cummins, Haldor Topsoe, ITM, Nel, McPhy, Siemens, Thyssenkrupp and Plug Power.”

Van Dorsten expects a significant drop in electrolyser capex by 2025 due to a range of factors, including economies of scale, new entrants to the market, greater automation, and increased modularity.

Reductions for solid oxide electrolysers are set to be the most dramatic in the next six to eight years; but alkaline and polymer electrolyser membrane costs are forecast to fall between 35% and 50% by 2025.

“Capex reduction will help drive down the levelised cost of hydrogen production. Combined with cheap renewable PPAs and good renewable utilisation in many markets, the potential for competitive green electrolysis-based hydrogen really starts to grow,” she added.

At the same time, as the world adjusts to high commodity prices while demand bounces back from Covid-19 lows, the economics of blue, grey and brown hydrogen have become less favourable than they were a year ago.

However, van Dorsten pointed out that blue hydrogen – which pairs natural gas reforming with carbon capture and storage (CCS) – is expanding on the back of a rapidly increasing project pipeline for CCS projects linked to hydrogen.

“This combination of forces means that we believe green hydrogen will be competitive in 12 markets – those with the highest utilisation rates and lowest renewable electricity prices – by 2030,” she said.

“Brazil and Chile are amongst the front-runners of harnessing cheap renewables to produce green hydrogen off-grid. And by 2050, 20 of the 24 countries in our analysis see very competitive green hydrogen costs.”

You can read more about the ‘fuel of the future’ by checking out Stockhead’s Hydrogen Stock Guide.

Repurposed coal plants – the next green hydrogen hub?

Repurposing coal-fired power plant sites to generate green hydrogen is the new item on Fortescue Future Industries’ list and represents only one of many announcements made this year in its goal to turn Australia into a global hydrogen superpower.

After announcing plans to collaborate with three indigenous nations in Canada earlier this week to determine the viability of building green hydrogen projects, the ‘green arm’ of mining giant Fortescue Metals Group – backed by Andrew Forrest – has now signed an MOU with AGL Energy to undertake a feasibility study at the Hunter Valley’s Liddel and Bayswater power stations.

Pending feasibility outcomes, FFI said initial renewable electricity through new wind and solar “could produce 250MW, generating 30,000 tonnes of green hydrogen per year or enough for a hydrogen fuelled truck to drive to the moon and back five times.”

“Power for the electrolyser will come from new wind, solar, and supported by new pumped hydro and batteries, generated by FFI, AGL and other parties,” the company said.

The feasibility study will also assess whether green hydrogen can be used to fuel co-located industries, in addition to export options.

FFI CEO Julie Shutterworth said the study will take place over the next 12 months and aims to identify key operational and commercial projections for the project and allow for the development of a production timeline.

Alinta Energy investigates 1000 MW offshore wind farm

Earlier this week Alinta flagged the possibility of establishing a 1000 MW wind farm off the coast of Portland in southwestern Victoria, which would supply Alcoa’s Portland Aluminum Smelter and east coast electricity grid.

Named the ‘Spinifex Offshore Wind Farm’, it would connect to the grid via the smelter and make the site among Australia’s first smelters to be powered by up to 100% renewables.

Alinta’s head of project development Kris Lynch said the next steps would include wind monitoring, site surveys, and kick off consultation in the new year.

“Existing data suggest Portland Bay has an excellent wind resource that would be suitable to power offshore wind turbines,” she said.

“What we’re doing now is deploying monitoring equipment to ensure that’s also the case across the investigation area.

“The area we’re investigating is around 500sqkm and about 10 kilometres from the shoreline, and the great thing about this proposal is that we can connect to the grid via the smelter and won’t need to build new powerlines on private land.”

Green hydrogen project planned for SA’s Port Pirie

One of the world’s largest commodity trading companies, Trafigura Group Pte Ltd, a global multi-metals manufacturing business (Nyrstar), and the South Australian government have announced plans to construct a commercial scale green hydrogen manufacturing facility in Port Pirie, north of Adelaide within the Spencer Gulf region.

The two companies have launched an $5m front end engineering design study for the Port Pirie Green Hydrogen Project, which will begin imminently.

A final investment decision is expected to be made by the end of 2022 and if approved, construction will follow in 2023.

We’re partnering with global commodity trading company @Trafigura & Nyrstar to progress plans for a $750m green hydrogen manufacturing facility at Port Pirie.

✅ create #SAJobs

✅ another example of how we’re working with the private sector to get major projects off the ground pic.twitter.com/Wnidz3tSow— Steven Marshall, MP (@marshall_steven) December 8, 2021

At a cost of $750m, the development will go ahead in two stages – initially producing 20 tonnes per day of green hydrogen for export in the form of ‘green ammonia’.

This will then lead to a full-scale production of 100tpd of green hydrogen at full capacity from a 440MW electrolyser, enabling it to meet both export and domestic supply needs.

As it stands, the project will be integrated into Nyrstar Australia’s metals recovery smelter using existing infrastructure to accelerate production of green hydrogen as compared to developing a project on a new greenfield site.

This will form the cornerstone of a new hydrogen precinct in the coastal South Australian town and both companies hope it will benefit local business and support the decarbonisation of transport and industry.

ASX green energy stocks

Scroll or swipe to reveal table. Click headings to sort.

| CODE | COMPANY | PRICE | 1 WEEK RETURN % | 1 MONTH RETURN % | 6 MONTH RETURN % | 1 YEAR RETURN % | MARKET CAP |

|---|---|---|---|---|---|---|---|

| CCE | Carnegie Cln Energy | 0.0025 | 25 | -17 | -17 | 67 | $ 37,256,434.28 |

| LCK | Leigh Crk Energy Ltd | 0.1625 | 20 | 35 | -29 | -10 | $ 145,513,838.40 |

| PH2 | Pure Hydrogen Corp | 0.525 | 9 | -5 | 133 | 533 | $ 175,988,499.96 |

| GNX | Genex Power Ltd | 0.205 | 8 | 3 | -15 | 13 | $ 203,281,008.55 |

| FMG | Fortescue Metals Grp | 18.34 | 6 | 28 | -18 | -15 | $ 55,359,789,225.64 |

| VUL | Vulcan Energy | 11.25 | 5 | 2 | 47 | 414 | $ 1,208,739,513.24 |

| IRD | Iron Road Ltd | 0.21 | 5 | 11 | -34 | 40 | $ 166,863,961.74 |

| MPR | Mpower Group Limited | 0.044 | 2 | -37 | -49 | -27 | $ 9,621,037.62 |

| IFT | Infratil Limited | 7.74 | 0 | -3 | 6 | 14 | $ 5,575,903,610.20 |

| SKI | Spark Infrastructure | 2.87 | 0 | 1 | 30 | 35 | $ 5,036,718,783.60 |

| NEW | NEW Energy Solar | 0.81 | 0 | -4 | -8 | -4 | $ 261,279,208.59 |

| MEZ | Meridian Energy | 4.5 | 0 | -6 | -11 | -36 | $ 5,773,882,660.60 |

| AST | AusNet Services Ltd | 2.52 | 0 | -2 | 42 | 35 | $ 9,651,510,504.72 |

| LIO | Lion Energy Limited | 0.072 | -1 | -12 | 16 | 350 | $ 27,529,936.06 |

| HZR | Hazer Group Limited | 1.265 | -2 | -19 | 21 | 55 | $ 199,202,520.56 |

| HXG | Hexagon Energy | 0.079 | -2 | -28 | -10 | 20 | $ 34,343,064.68 |

| CXL | Calix Limited | 6.43 | -4 | 9 | 145 | 518 | $ 1,059,846,954.39 |

| BSX | Blackstone Ltd | 0.545 | -4 | -8 | 49 | 45 | $ 219,074,678.48 |

| PRL | Province Resources | 0.145 | -6 | -3 | -3 | 1015 | $ 163,800,672.60 |

| DEL | Delorean Corporation | 0.21 | -7 | 5 | -2 | $ 37,732,438.80 | |

| RFX | Redflow Limited | 0.048 | -8 | -17 | -23 | 86 | $ 67,460,397.74 |

| QEM | QEM Limited | 0.175 | -8 | -24 | 3 | 130 | $ 20,132,641.61 |

| RNE | Renu Energy Ltd | 0.088 | -9 | 21 | 22 | 151 | $ 11,815,900.15 |

| AVL | Aust Vanadium Ltd | 0.027 | -10 | 23 | 13 | 93 | $ 91,879,454.97 |

| GEV | Global Ene Ven Ltd | 0.1025 | -11 | -34 | 35 | 28 | $ 53,966,986.70 |

| ECT | Env Clean Tech Ltd. | 0.0465 | -12 | 133 | 133 | 210 | $ 57,275,866.15 |

| PGY | Pilot Energy Ltd | 0.062 | -13 | 11 | -24 | 121 | $ 30,096,102.06 |

| PRM | Prominence Energy | 0.009 | -18 | 13 | -40 | -10 | $ 9,304,729.37 |

| KPO | Kalina Power Limited | 0.021 | -19 | -28 | -45 | -48 | $ 28,197,041.10 |

Carnegie Clean Energy (ASX:CCE) is the biggest winner this fortnight with shares up 25% after announcing yesterday it had been selected alongside six other companies to deliver Phase 1 activities under the EuropeWave Pre-Commercial Procurement (PCP) program.

EuropeWave’s objective is to accelerate the development of cost-effective wave energy converter systems that can survive in the harsh ocean environment and will contract three of the Phase 1 contractors to deploy their prototypes in Basque Country or Scotland during Phase 3.

Phase 1 activities will kick off on January 3, 2022, for a period of seven months.

Not too far behind is Leigh Creek Energy (ASX:LCK) up 20% on no news – although on November 30 the company revealed it had signed an offtake heads of agreement with Daelim of 500,000 metric tonnes of granular urea per year for a minimum of five years.

Pure Hydrogen (ASX:PH2) comes in third place on a 9% rise and Genex Power (ASX:GNX) is up 8% after announcing a deal yesterday with Tesla Motors in relation to the 50MW/100MWh Bouldercombe Battery Project (BPP) near Rockhampton in Central Queensland.

The agreement paves the way for Tesla to operate the BBP using its proprietary algorithm-based bidding system, Autobidder, to maximise revenues in each given year.

Autobidder is a real-time trading and control platform that employs a machine learning algorithm to optimise dispatch behaviour whilst adapting to new markets and services and has been deployed on more than 1GWh of of Tesla projects globally.

As a key part of the agreement, Tesla will provide a minimum level of contracted revenues to support project financing for the development of BBP, marking a significant step towards achieving financial close of the project.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.