Conrad signs binding key domestic gas sales deal

Energy

Energy

Special Report: Development of Conrad Asia Energy’s Mako gas field in the West Natuna Sea offshore Indonesia has reached a major milestone with the signing of a binding domestic gas sales agreement.

The agreement with PT Perusahaan Gas Negara (PGN) – the gas subsidiary of Indonesian national oil company PT Pertamina and Indonesia’s largest gas company – paves the way for a binding export sales agreement with Singapore to be reached.

Key terms for the domestic agreement were reached in March this year.

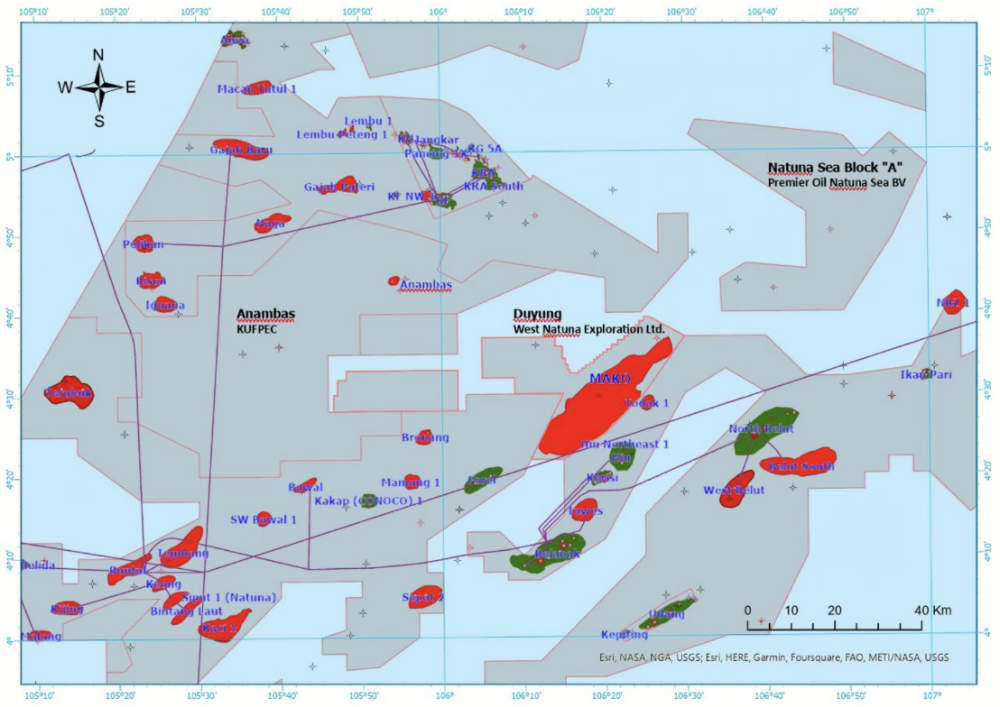

Conrad Asia Energy (ASX:CRD) currently has a best estimate (2C) contingent resource of 413 billion cubic feet (Bcf)of gas at Mako, which sits within its 76.5% owned Duyung production sharing contract.

This can be quickly brought into production through the existing West Natuna pipeline which carries gas from three third-party production facilities in the South Natuna Sea to an onshore receiving facility in Singapore.

Singapore relies on gas for 95% of its power needs and is scheduled to build four new gas-fired power stations over the next two years, ensuring that there will be a market for selling Mako gas.

The company has already been awarded a plan of development, completed front end engineering design, and agreed to key terms for a gas sales agreement with Sembcorp Gas and SKK Migas – the Indonesian upstream regulator.

The binding gas sales agreement with PGN covers a total 122.77 trillion British Thermal Units (BTU) – or 118.5Bcf – with estimated plateau production rates of 35 billion BTU per day.

It is subject to the construction of a pipeline connecting the West Natuna Transportation System (WNTS) to the domestic gas market in Batam and forms part of the company’s domestic market obligation.

PGN is proceeding with planning this tie-in across the Malacca Straight.

The remaining gas will be sold to Singapore as set out under the non-binding term sheet signed in 3Q 2023.

“As shared during our recent AGM, our focus has been finalising the underwriting gas sales agreements between the Mako joint venture, the Indonesian government and regulator and a Singapore-based customer,” managing director Miltos Xynogalas said.

“These agreements are the essential documents that demonstrate financial viability of the project, which in turn underwrite value and financial sustainability. This announcement is therefore an important step for Conrad in commercialising the Mako gas field and building its gas business in Indonesia.

“Conrad has been working closely with PGN for the commercialisation of Mako gas and is delighted to have progressed this to a formal GSA.

“This GSA is a significant milestone on the road to FID which is targeted for Q4 of the current year.

“Conrad also signed an MOU with PGN in February this year for its other gas discoveries in offshore Aceh which further strengthens Conrad’s alliance with PGN.

“Conrad has four gas discoveries in its Aceh portfolio and planned 3D seismic surveys later this year aim to continue delineating the size of these discoveries as well as add to its prospective resources which already total 15 trillion cubic feet (“Tcf”) of which 11 Tcf (P50) is net attributable to Conrad.”

Indonesia is the fourth most populous country on earth and has amongst the fastest GDP growth rates in the world with rapidly growing energy demand. It has a stated objective of doubling its current gas production by 2030 and Conrads’s gas resources will be important in helping Indonesia achieve its objectives.

CRD is moving towards finalising a GSA for the Mako export gas to Singapore over the coming few weeks.

This will in turn place the project firmly on the path towards a final investment decision in Q4 2024.

This article was developed in collaboration with Conrad Asia Energy, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.