Sino Gas & Energy benefits as polluted China moves from coal to gas

Sino Gas & Energy is ramping up gas production just as China’s switch from coal begins to gain pace.

In its quarterly report the China-focused producer said gas consumption in China jumped 26 per cent compared to the third quarter last year.

Consumption was up 18.4 per cent year-to-date due to “substantial coal to gas switching”, China’s National Development and Reform Commission reported.

China is using gas to mitigate its air pollution problems, as city dwellers across the country are submerged in record-breaking smogs each winter.

In January, its five-year plan stipulated a shift from coal to gas in industrial boilers in the greater Beijing region, northeast China, the Yangtze River Delta around Shanghai and the Pearl River Delta in Guangdong province.

That plan also set a mandatory target for reducing the use of coal in energy generation. It set a target of no more than 58 per cent of national energy consumption by 2020, or 6 per cent lower than in 2015.

Riding China’s gas wave

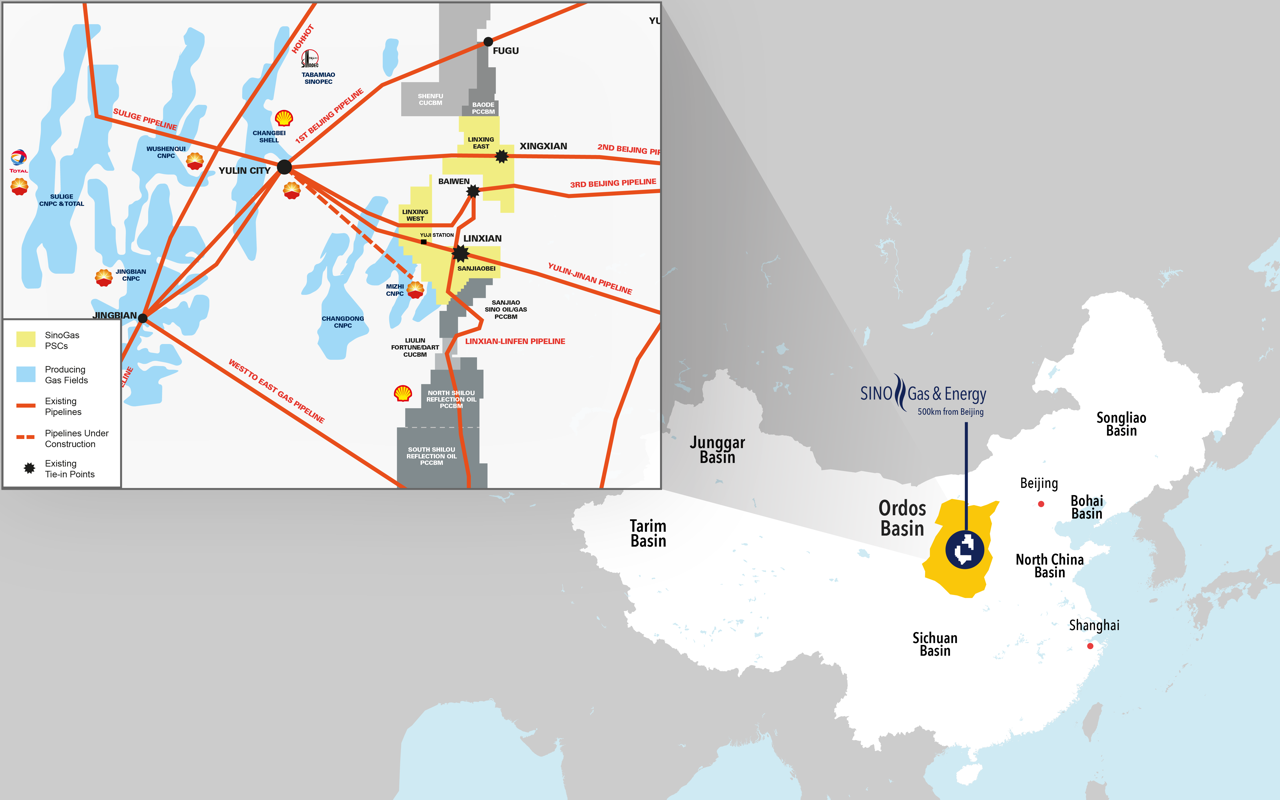

Sino Gas and Energy (ASX:SEH) operates three fields with coal-bed methane gas and tight gas in the Ordos Basin in central China.

It plans to extract 350 million to 550 million standard cubic feet per day by 2022.

Sino’s average production rate in the third quarter was about 13 million standard cubic feet/day) from the Sanjiaobei and Linxing West fields, as part of a pilot program. Full-year production was expected to be 16 million to 18 million.

A $US100 million ($130 million) loan from Macquarie Bank is set to fund development plans for the Sanjiaobei and two Linxing fields.

Gross revenue for the quarter was up year-on-year by 320 per cent to $US6.1 million — though it was down from the previous quarter.

The net realised price for the gas was up slightly on the last quarter and up 8 per cent year-on-year to $US5.1 million per thousand standard cubic feet. The company had $US30.5 million in cash.

Sino Gas and Energy shares were down 5 per cent to 9.9c on Monday morning — though they are up 25 per cent since last month, valuing the company at $222 million.

China breaks into unconventionals

Where shale gas is trapped in shale rock formations, tight gas is found in sandstones or limestones.

The same technique however can be used to extract them: hydraulic fracturing, which is when water mixed with lubricants and particles is flushed down a well to crack open fissures and allow the gas to escape.

Coalbed methane is found in coal seams.

All of the above are considered ‘unconventional gas’.

In August, China’s Ministry of Land and Resources said it was the third-biggest shale gas producer in the world after the US and Canada, but earlier said recoverable reserves had also fallen by 6 per cent in 2016.

It said China produced 7.9 billion cubic meters in 2016, or 76.3 percent more than in 2015.

In terms of the broader definition of unconventional gas, the International Energy Agency estimates that China’s total production of unconventional gas in 2014 was 32.6 billion cubic metres.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.