Oil and gas deal-making is on the up: US investor swoops on Sino Gas with $528m offer

Energy

An expected surge in oil and gas deals that could lift the sector from the doldrums appears to have started, with another US private equity investor jumping on an ASX-listed gas company.

This time it’s one of Lone Star’s funds with a 25c a share cash bid for all of Sino Gas & Energy.

Sino shares (ASX:SEH) put on more than 20 per cent to an intraday high of 25.5c in Thursday morning trade.

On Wednesday, Key Petroleum said a US investor had invested in one of its Queensland gas projects for a minimum of $5 million.

Earlier this week oil sector executives told Stockhead they were expecting a rash of deals to start. They said once that started, the whole sector would be re-rated upwards.

The Lone Star Fund X Acquisitions bid values Sino Gas at $528 million.

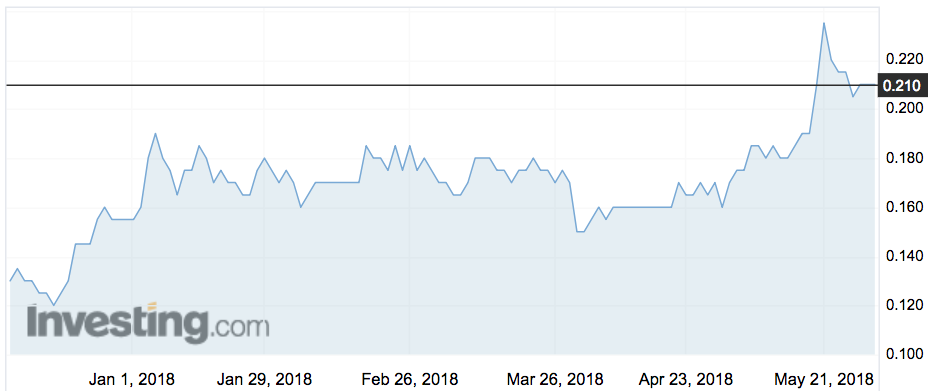

Its closing market cap on Wednesday was $447 million on shares valued at 21c.

Sino Gas is recommending shareholders take the deal.

Unlike the Key Petroleum deal, which is conditional on an investor finding the cash, Lone Star is flush with money. Its funding is coming from Bermuda and US affiliates who have $5.5 million to play with.

The takeover is being done via a scheme of arrangement, which is expected to be implemented by September.

Sino Gas’s assets are all in China, where it has a 49 per cent stake in the operator of contracts in the the country’s biggest gas basin, the Ordos.

The company’s shares were steady in early Thursday trade: