Cashed-up oil and gas explorer Brookside Energy is ready for more US deals

Brookside Energy is awash with cash, calming any expectation that the US-focused oil and gas explorer might have to raise capital from the market.

Brookside (ASX:BRK) has increased a leasing facility to $US4 million ($5.2 million), giving it considerable financial wiggle room to buy more acreage.

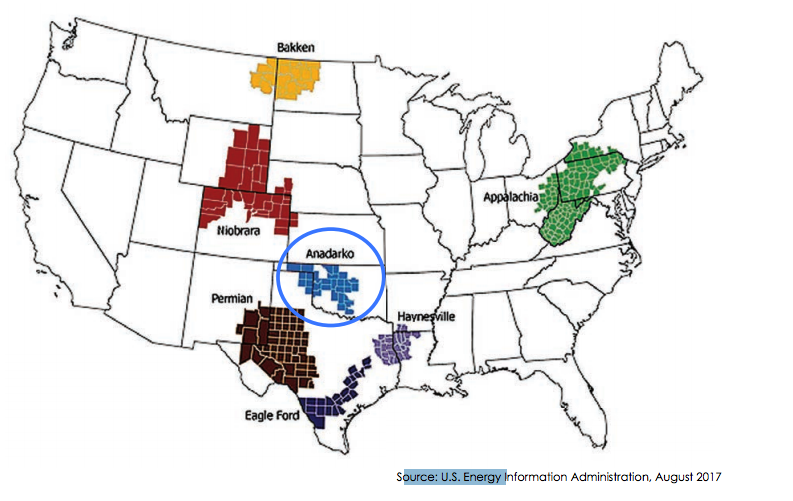

“This additional asset level funding will enable Brookside, together with its partner and manager of US operations Black Mesa Production, to continue to aggressively pursue its leasing and acquisition activities across the liquids-rich fairways of the Anadarko Basin in Oklahoma,” the company said last week.

A joint drilling fund of $US3.5 million means it can easily complete another 14 planned wells, and just in case, it has $US8.7 million of 2c options at its disposal.

Add that to the revenue-generating oil fields it is building in the Anardarko Basin in Oklahoma, and the company is in a strong financial position.

Oil production began in February and now stands at about 300 barrels of oil equivalent (boe).

That’s expected to generate $US2 million in revenue over the next 12 months, which will be reinvested in drilling.

Production is expected to reach about 1000 boe once it adds another 14 wells to its current 10.

Property play

Brookside can be thought of as a property investor, pursuing a buy low/sell high strategy that has traditionally had great success in the US.

It buys leases and brings in drilling partner Black Mesa to establish a resource, produce oil and increase the value of the land. Ultimately the partners sell the ‘renovated’ land for considerably more than they paid.

Managing director David Prentice told Stockhead in February they’d seen the value of land in the area rise from from $1000 an acre to $16,000 in just 12 months.

- Bookmark this link for small cap breaking news

- Discuss small cap news in our Facebook group

- Follow us on Facebook or Twitter

- Subscribe to our daily newsletter

Further, a $3.8 billion deal in February between Silver Run and Alta Mesa valued the land nearby at $US29,000 an acre.

Mr Prentice is hopeful they can sell for upwards of $50,000 an acre.

Brookside leases about 2100 acres.

The oil producer is currently on a roadshow around Australia and accompanied by its drilling partner Black Mesa.

This special report is brought to you by Brookside Energy.

This advice has been prepared without taking into account your objectives, financial situation or needs. You should, therefore, consider the appropriateness of the advice, in light of your own objectives, financial situation or needs, before acting on the advice.

If this advice relates to the acquisition, or possible acquisition, of a particular financial product, the recipient should obtain a Product Disclosure Statement (PDS) relating to the product and consider the PDS before making any decision about whether to acquire the product.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.