Carnarvon soothes investors with promises of ‘highly profitable’ oil after Monday’s freak out

Energy

Energy

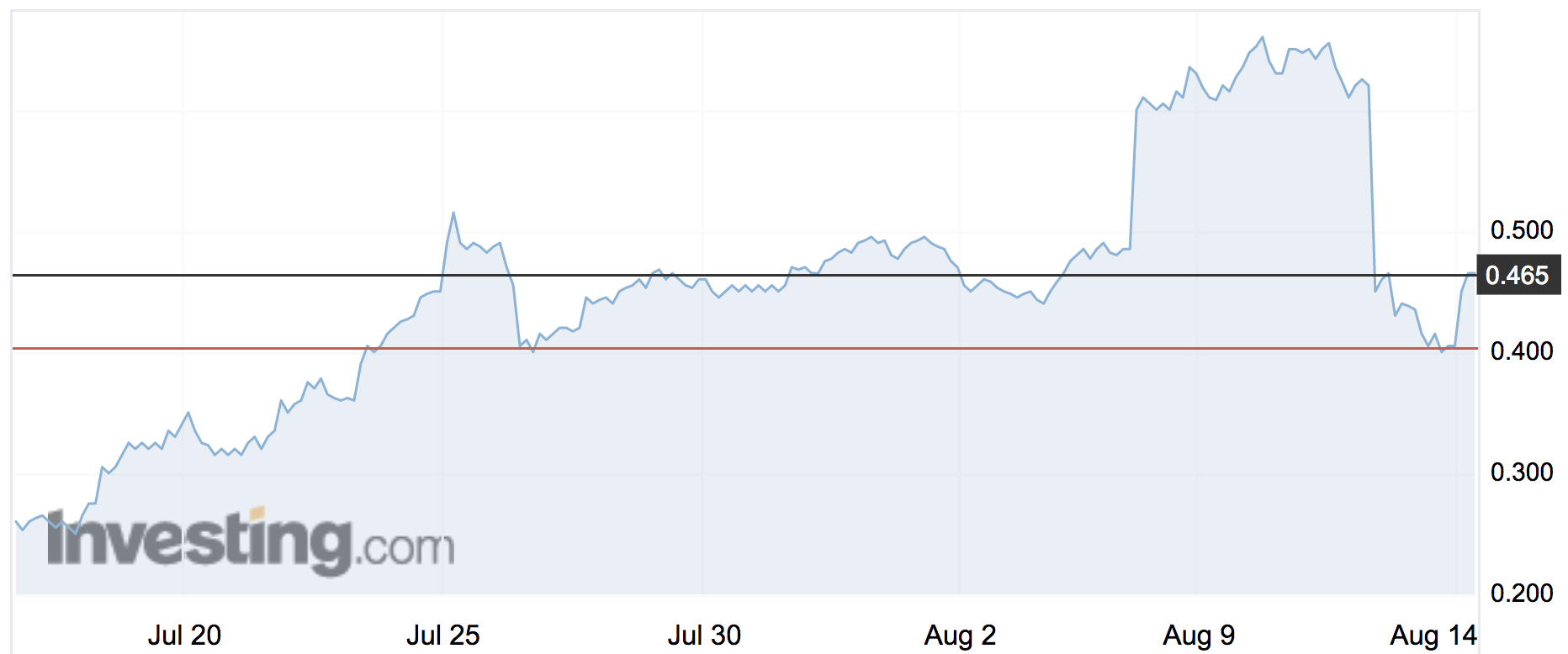

Disappointing gas drilling results decimated Carnarvon on Monday — but the stock resumed an upward march after the company said its main oil target would be “highly profitable for shareholders in due course”.

Carnarvon (ASX:CVN) said on Monday that its Phoenix South-3 well had located a hydrocarbon reservoir, but that the rock might not be permeable enough to actually extract anything.

They weren’t able to extract anything to determine if the reservoir held oil or gas.

The shares plunged 33 per cent.

But on Tuesday, the company’s shares were back up 14 per cent at 46c after a note saying Carnarvon’s Phoenix wells have already confirmed that there is a “significant gas condensate resource” there.

Furthermore, it’s the oil in the Dorado field next door — the one that sent Carnarvon’s shares skyrocketing earlier in August — that it’s truly interested in.

“That will now become our immediate focus. And we expect this to be highly profitable for shareholders in due course,” managing director Adrian Cook told shareholders.

The big exciting well

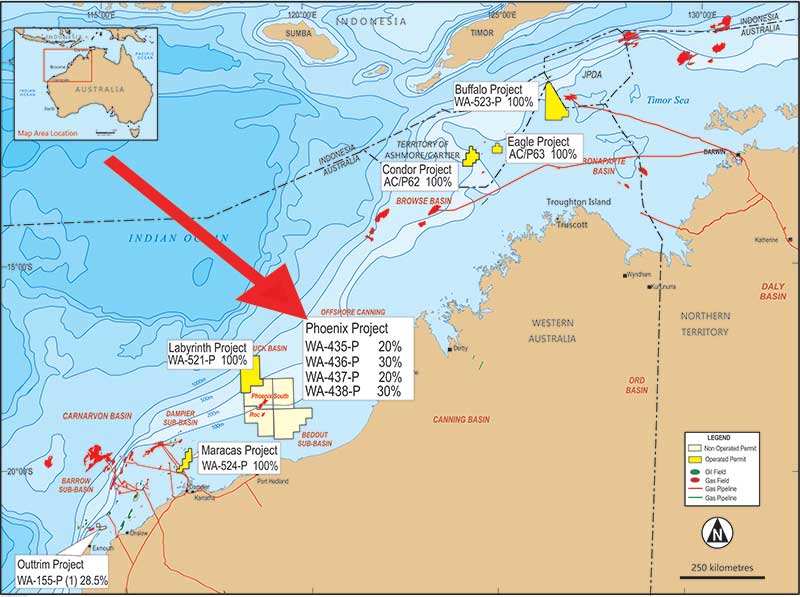

Dorado is part of Carnarvon’s broader Phoenix project which is about 250km north of Port Hedland on WA’s north-west coast.

On August 8, it confirmed new oil discoveries at the “Crespin” and “Milne” sites of the Dorado-1 well.

Analyst David Low from Wood Mackenzie called the deal “a real win”, though he said there would be “significant upfront capex required to drill the wells, purchase subsea equipment and obtain an FPSO”.

An FPSO or “Floating Production Storage and Offloading” vessel is a ship that houses processing equipment and storage for oil.

Carnarvon “could attract interest from established Australian oil and gas operators or an international E&P [exploration and production company] looking for exposure to the Australian upstream sector.

“Longer-term, it opens up a new oil play in the region, which could prove a real boost to Australian exploration after a number of very lean years.”

Tim Treadgold wrote in May that the big opportunity for Carnarvon is a proposed trans-continental gas pipeline that could get its oil and gas to Sydney and Melbourne, rather than being stuck in over supplied WA.

He also picks Carnarvon as a possible takeover target, as larger companies seek to buy already-producing oil assets, as happened with AWE.

The new project

Mr Cook also directed shareholders to Carnarvon’s other project, Buffalo in the Timor-Leste national waters.

“BHP produced oil for several years at Buffalo before the field was successfully abandoned in 2004. It’s important to note that the field was still producing some 4,000 barrels per day when it was abandoned,” he said.

“Carnarvon’s technical team, convinced that there could be a quantum of oil left behind that was material for a junior and commercially recoverable, set about applying modern seismic data technology to answer this question.”

They found a recoverable volume of about 31 million barrels, with project costs of around $20 a barrel.

Mr Cook said they are having “constructive” discussions with the government in Dili to get the process moving towards production.