Buru secures free ride with EnRes on the first two L20-1 exploration wells

Buru will be free carried on the first two exploration wells at L20-1. Pic: via Getty Images

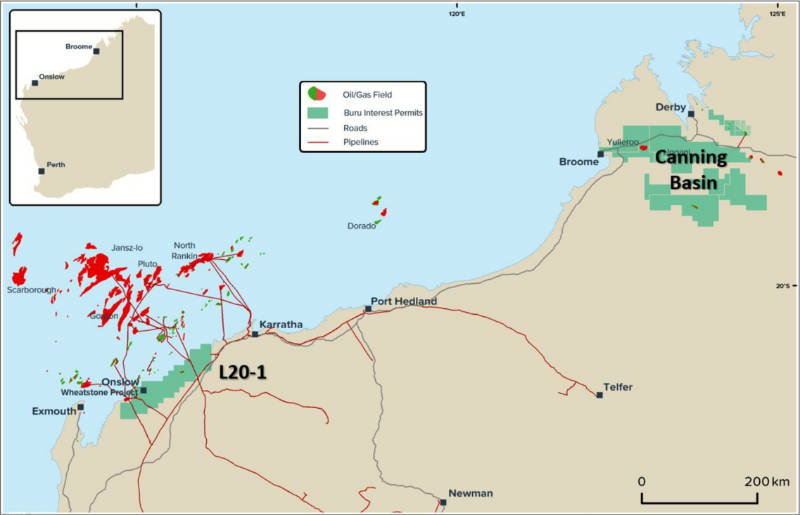

Buru is handing a further 25% interest and operatorship of permit L20-1 in the onshore Carnarvon Basin to its current partner Energy Resources (a subsidiary of Mineral Resources) in exchange for a free carry on the first two exploration wells.

Under the restructured farmout agreement, Energy Resources (EnRes) will now have a 75% stake in L20-1 once the permit is granted and the requisite regulatory approval for the transaction is received.

In return, Buru Energy (ASX:BRU) gets to enjoy the benefits of its partner paying for the two wells, which are expected to be drilled in 2023, along with other agreed exploration and overhead costs.

EnRes has also agreed to match the funding contribution under the recently announced Commonwealth Grant of up to $7m that was offered to Buru for a three-year carbon capture and storage feasibility study in the onshore Carnarvon Basin.

In return for this additional financial carry, the two companies have also agreed to enter into a joint venture for the CCS project that will align with the L20-1 JV, granting EnRes 75% as operator with Buru holding the remaining 25%.

“The farmout transaction will allow EnRes to bring the expertise of its highly successful Perth Basin operating team to the L20-1 area and allow Buru to focus on its very exciting Rafael gas condensate discovery in the Canning Basin and on its energy transition businesses,” Buru executive chairman Eric Streitberg says.

“The CCS activity will reflect the underlying permit equities with Buru and EnRes working together closely and applying and expanding their respective technical and commercial inhouse expertise in the CCS Feasibility Study with the support of the Commonwealth Grant.

“The CCS program will also assist Buru to more fully develop its technical and commercial expertise for its Canning Basin gas commercialisation activity, where CCS has the potential to be a significant project enabler by decarbonising its planned gas developments.”

L20-1 application

The joint venture had applied for block L20-1 under the Western Australian state government’s 2020 onshore petroleum acreage release.

It covers the onshore portion of the Peedamullah Shelf, a geological unit bordering the main oil and gas productive area of the Carnarvon Basin, and is located in close proximity to the Tubridgi gas storage field, the Wheatstone LNG gas processing plant and associated pipeline infrastructure and the gas pipelines from Varanus Island that cross the north of the block.

The block was granted in March 2021 and the JV recently concluded negotiations with the Thalanyji People who are the native title holders over parts of the application area that resulted in the recent execution of a heritage protection agreement.

Buru now expects the permit to be granted shortly with both companies holding an initial 50% before the JV agreement kicks in.

The two planned wells will target highly prospective Palaeozoic aged structures similar to Buru’s discoveries in the Canning Basin including the Rafael 1 conventional wet gas discovery that flowed high-quality gas at rates of about 7 million standard cubic feet per day during testing.

CCS Feasibility

Buru has been carrying out CCS technical and commercial activity through its Geovault subsidiary since early 2021.

This is focused on onshore geological greenhouse gas storage in the L20-1 area and the broader Carnarvon Basin.

Under the CCS JV terms, EnRes will match the Commonwealth Grant of up to $7 million with any costs in excess of the $14m in matched funding being split according to the participating interests.

This article was developed in collaboration with Buru Energy, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.